In this class, we continued our discussion of the cost of capital approach to deriving an optimal financing mix: the optimal one is the debt ratio that minimizes the cost of capital. To estimate the cost of capital at different debt ratios, we estimated the levered beta/ cost of equity at each debt ratio first and then the interest coverage ratio/synthetic rating/cost of debt at each debt ratio, taking care to ensure that if the interest expenses exceeded the operating income, tax benefits would be lost. The optimal debt ratio is the point at which your cost of capital is minimized. Using this approach, we estimated optimal debt ratios for Disney (40%), Tata Motors (20%), Vale (30% with actual earnings, 50% with normalized earnings). Disney was underlevered and Tata Motors was over levered.

Slides: http://www.stern.nyu.edu/

Session 18: The Cost Of Capital Approach To Optimizing Financing Mix

Transcript

This is a children’s book called The little red head. And it’s about a little redhead obviously. And this summer the Little Red Hen collects all the grain she makes cakes she makes food she stores it for the winter and all her friends are out there partying and winter comes along.

And the little red it pulls all the stuff she’s prepared over the summer and she eats and the friends want to join in and she says you didn’t work while I was working your play. So you kind of put the moral of the story is those who work hard and keep up with stuff. We get rewarded and those who don’t will get punished. I’m going to violate that principle. I know some of you have not been working on your projects some of you don’t even remember what project.

What are you talking about. So it’s completely natural. You’re not unusual. This happens in every class. And yesterday I gave you a chance to catch up if you didn’t take the chance you can still take it. Where I said Hey I know you’ve not even looked at the project since the very beginning. But this spreadsheet I’m attaching to this e-mail review go in and spend 15 minutes on your company. You’d be pretty much caught up. Get any easier than that. Right. So if you did take advantage of it. Great if you have and it’s still out there. But today I’m going to take you through what that spreadsheet does. So last session I said one way to find the right financing mix for your company is to look see it look to see what mix of debt and equity minimizes your cost of capital and laid out what we need to do to get there. I said it every day that ratio I need to estimate what my cost of equity will be. And I said I’m going to do that by computing the levered beta at every Deatherage. Then they said that every debt ratio I’ve estimated cost of debt and as I borrow more money my cost of that will go up and if I can estimate that I’m going to end up with a table that looks just like the X Y Z widget company table. And I laid the groundwork for Disney if you remember that existing caustic Apple is based on about 88 percent equity 12 percent debt.

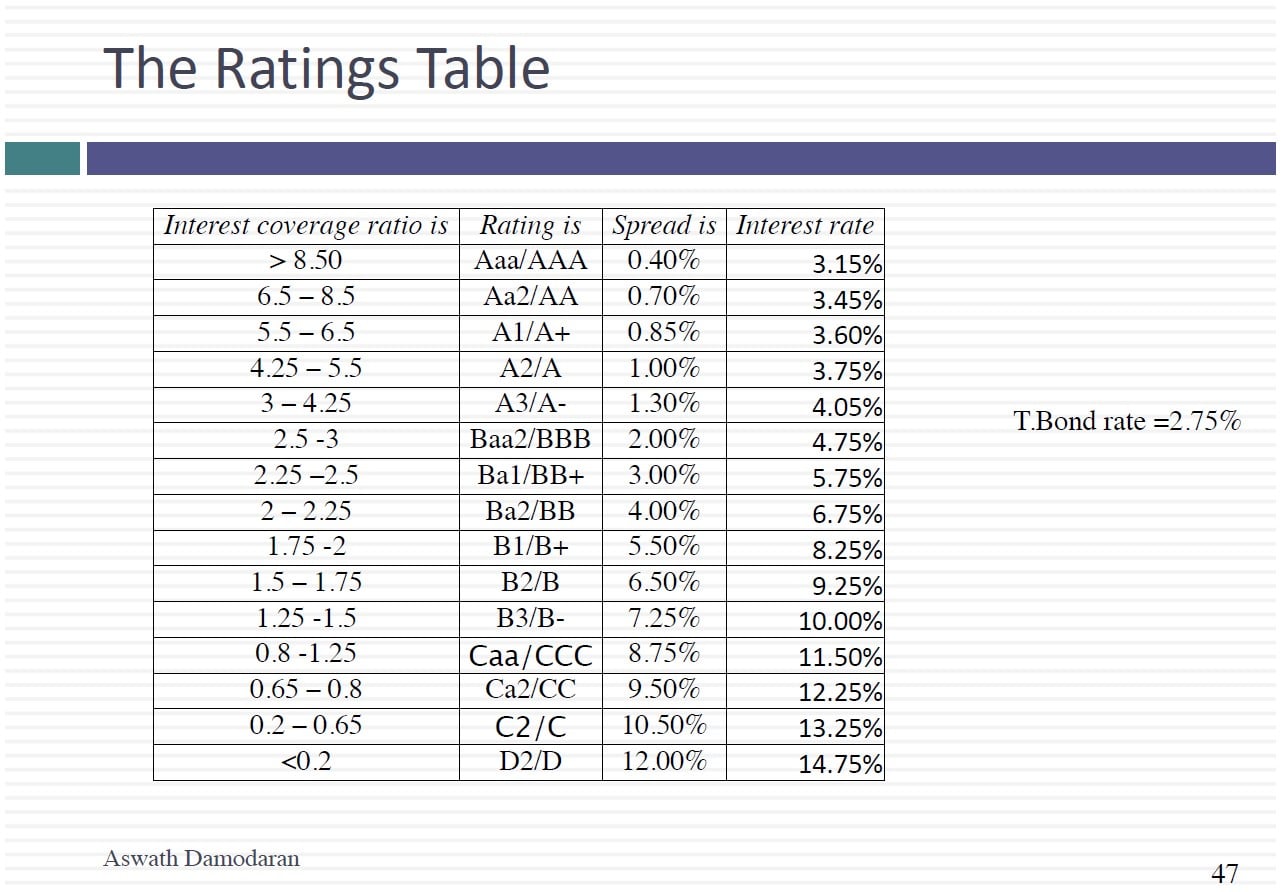

And you come up with a seven point eighty one percent cost. If I can my estimate the cost of care for Disney at 20 30 40 50 60 70 80 90 percent dead. Then you should be able to tell me what the right mix of debt and equity view companies. So let’s start on estimating the cost of equity and every debt ratio beyond levered beta that I came up with for Disney based on the four businesses that are in the bottom of beta was point ninety nine point nine to 3 9. So that’s what the beta will be if they have no debt. So the first thing I did was let me start easy. I know what the beta will be at no dead point 9 2 3 9 and using that beta. With the risk free rate in equity risk windows don’t change as my debt ratio changes Madras credit is still two point seventy five percent. My equity risk premium still reflects the parts of the world. Disney operated. I come up with the cost of equity of eight point seven. I’ve got my cost of equity with no debt. And if I lived in a Mella Modigliani world. Where do the rest of the stable look like. Mamilla to Modigliani anyway. What happens the cost of capital as you change your debt ratio. Absolutely nothing. You’d get eight point seven percent all the way through. Think how much how much easier our lives would be if we lived in the Mulumba to go the world but we don’t we have taxes and default risk. So here’s what I’m going to do I’m going to go to 10 percent ratio. 10 percent debt of 10 percent debt 90 percent equity. Ten divided by 9 to give me a debt to equity ratio of eleven point eleven percent. I plug it into the Levit bayed equation and the one that that you’ve done in both quizzes and you take the undelivered bait Lebert. You come up with the Levit beta point ninety nine cost of equity a point four five percent. And 20 percent 30 percent 40 percent 50 percent and noticed by the time I get to 90 percent debt my Batres sky high and my cost of equities also sky high. I’ve got one half of my table done. And this is the advantage again of building up debater’s and the bottom up because all I had was a regression back that couldn’t do the stable right. I can go to Bloomberg to tell me what the regression would look like if I had no debt. It doesn’t work that way but I’ve debated every different every day. Let me turn to the cost of debt. You remember how estimated the cost of debt for Disney at its existing debt trishaw.

I cheated I Cheated in what sense. I looked at the actual rating. And I actually estimated the default spread their rating came up with the cost of debt of three point seventy percent. I’m sorry FairPoint 0 5 percent I think. So. If I have that cost the cost of debt then I can get an aftertax cost of debt but I cannot do that or the other debt ratios I could send S&P a blank sheet and say can you send me the ratings you would give Disney and every debt ratio. But they’re not going to do it. But I’m going to also give you the second approach we’ve got to get to get a cost rate for companies that had no ratings. What do we say we’re going to do to get a cost of debt. We basically started.