Ashva Capital Management letter to investors for the first quarter ended March 31, 2019, titled. “Is The Inverted Yield Curve Signaling Recession?”

Dear Limited Partner

Pointillism is a type of painting in which an artist uses small dots of color to form larger patterns and shapes. If you were to stand very close to the canvas you would only see small strokes and patterns of color. However, only by stepping away from the painting do you get an idea of the subject matter of the painting. Vincent van Gogh’s Self Portrait is probably one of the most famous examples of a painting done in the pointillist technique. Essentially by stepping away from the painting, you get a broader perspective, which allows your eyes to make sense of the image as a whole. Similarly, annualized returns in the stock market are essentially random. Over the long-term (years) stock market returns are much more easily explainable. Returns from the stock market are driven by the following three factors: earnings growth, changes in the valuation level and dividend yields. Jeremy Siegel in his book Stocks for the Long Run states the following: “Over the past 210 years, the compound annual real return on a diversified portfolio of common stock has been between 6 and 7 percent in the United States, and it has displayed remarkable constancy over time.” If we assume an average inflation rate of 3%, nominal annualized returns have been approximately 10% for over two centuries. I know that this data applies to a sample size of one, but long-term returns from equities have been relatively consistent across the developed economies of the West. My point in highlighting this data is to show that in the short-run equity returns look random but if we take a longer-term perspective the overall trend becomes readily apparent.

Q1 hedge fund letters, conference, scoops etc

Our Performance

In March 2019 Ashva Capital LP (the “Fund”) gained 9.4% net of expenses. It was our best monthly performance since launching the fund in 2017. As of March 31, 2019, the Fund is up 4.27% year-to-date. In comparison, our benchmark the iShares MSCI India ETF was up 5.73% year-to-date. Our top five positions were largely unchanged in comparison to the end of 2018. Our biggest positions at the end of 1Q19 listed in terms of size were the following: Vinati Organics, Britannia Industries, Bajaj Finance, City Union Bank and Asian Paints. Please see our 2018 annual letter for a more detailed investment thesis for each position, excluding Asian Paints. The latter is India’s largest paint company and reported solid volume growth for the quarter ending December 31, 2018 (3QFY19). Although the valuation isn’t cheap the company’s revenue growth outlook remains strong due to a combination of higher pricing and volume growth.

The Inverted Yield Curve

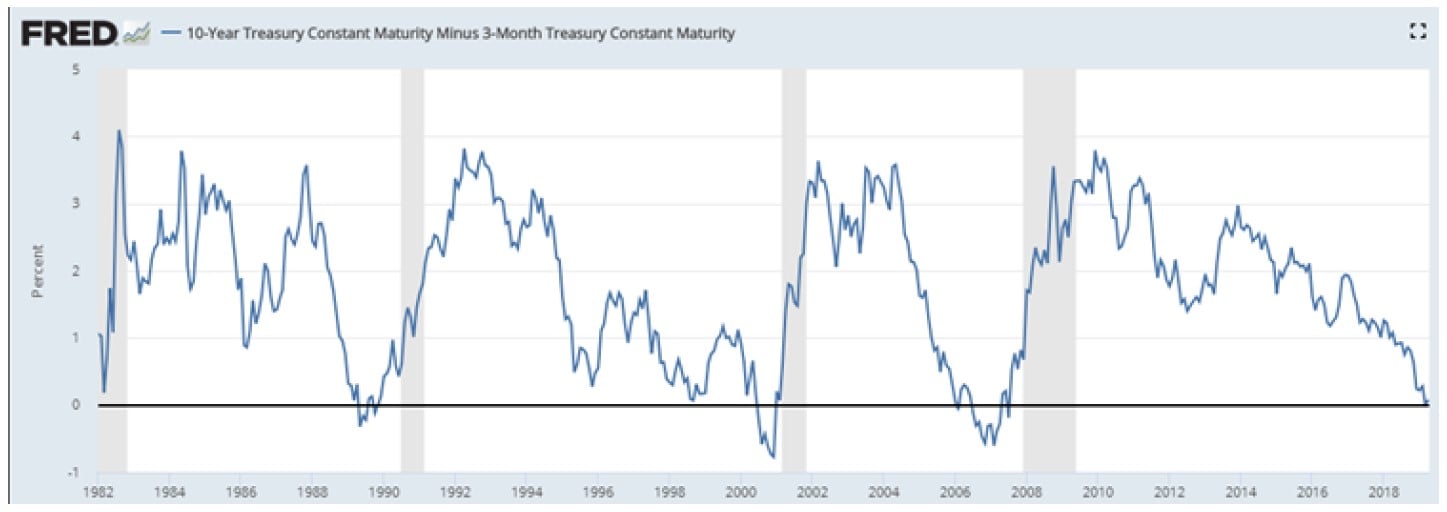

In the 2018 annual investor letter, I also discussed the use of the yield curve as a long leading indicator of recession. Additionally, I highlighted the use of the 10-year minus 3-month curve because it roughly estimates the Net Interest Margin (NIM) that banks earn. We can see from the chart below that an inverted yield curve has preceded every recession in the US since the early 90s. Despite being an excellent predictor of recession, it’s a horrible market timing tool. The yield curve went negative in mid-2006 but the US stock market didn’t peak until October 2007. The Indian equity market peaked a few months later in January 2008. Although you can’t tell from the chart, the 10-year minus 3-month yield curve finally inverted on March 22, 2019. However, the inversion must be both pronounced and prolonged for it to be a valid signal of an oncoming recession. A few days after inverting, the yield curve subsequently turned positive. A similar occurrence happened in 1998 when the yield curve briefly inverted during the Asian financial crisis. Alan Greenspan quickly cut rates by 75 bps and essentially provided the fuel for the dot-com bubble. As you can see from the chart below the US economy ultimately entered into a recession a few years later in 2001. In my view, the Fed will neither spike the punch bowl by cutting rates nor take it away by hiking rates. Barring a significant policy mistake by the Fed, I don’t foresee a recession occurring in the next 12-18 months.

The bull market that began in March 2009 is now ten years old. Following a brutal December, the S&P 500 ended 2018 down (6.24%). However, the market has strongly rebounded and the S&P 500 is now up 15.7% year-to-date. In the same way, the image in a pointillist painting is obscured when observed up close, the long-term trend of the equity market is obscured by analyzing annual returns. Although we don’t know when exactly the party will end, we believe that our focus on high-quality stocks combined with our valuation discipline is the ideal way to be positioned for this late stage of the market cycle.

Sincerely,

Ankur Shah

Managing Member

Ashva Capital Management LLC

P.S. I firmly believe that a key differentiating factor of our investment approach is the ability to take a long-term view. This is only made possible because we selectively choose limited partners that are compatible with our philosophy. Thus, referrals are one method we utilize to ensure new partners share our values. Additionally, we severely restrict the number of new partners that can join the fund annually because the onboarding process is time-consuming from an administrative perspective. We are currently accepting only three new limited partners during the second quarter of 2019. If you know of any individuals, families or investment vehicles that would be suitable, please have them email Cindy Valencia at [email protected] to join the waiting list. Thank you for your support and I look forward to updating you at the end of the second quarter of 2019.

This article first appeared on ValueWalk Premium