Arquitos Capital Management commentary for the first quarter ended March 31, 2019.

Wait for that wisest of all counselors, Time. – Pericles

Q1 hedge fund letters, conference, scoops etc

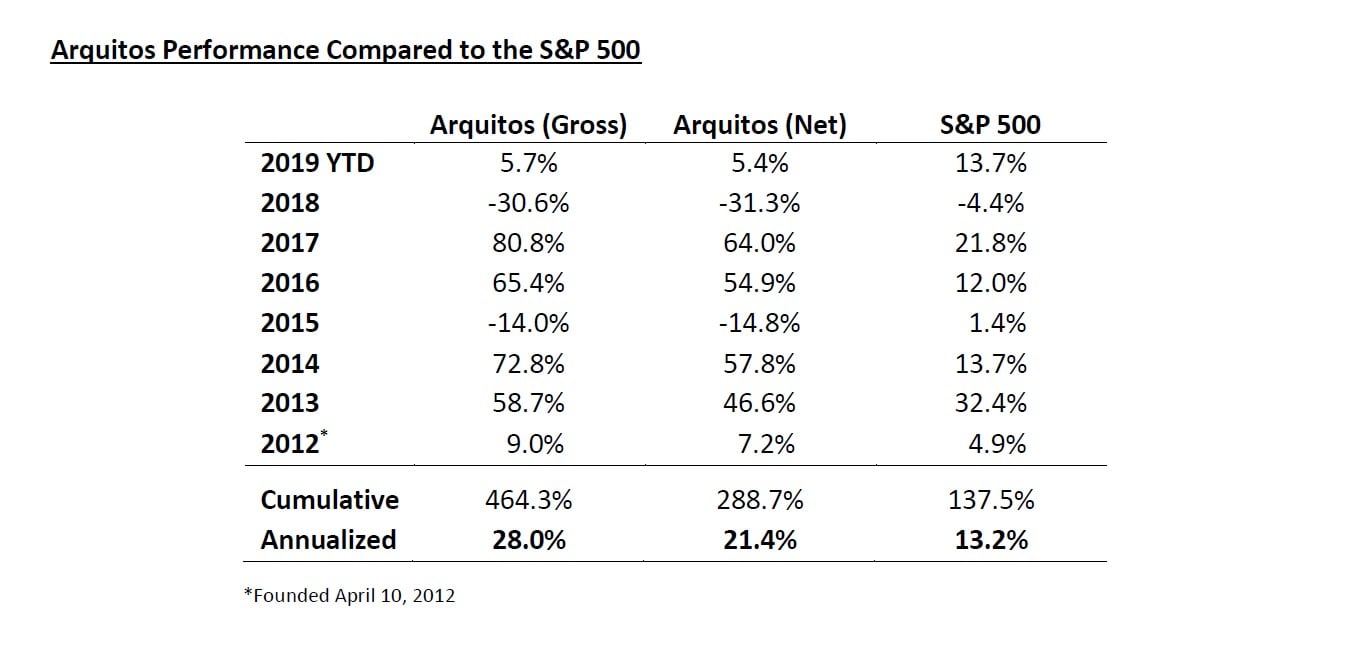

Arquitos returned 5.4% net of fees in the first quarter of 2019. Our annualized net return since the April 10, 2012, launch is 21.4%. Please see page 6 for more detailed performance information.

**********

I am making my annual trek to Omaha from May 2-6 for the Berkshire Hathaway annual meeting. If you will be in town, my colleagues and I at Willow Oak Asset Management invite you to a panel discussion on May 4 from 4:30pm-7:00pm. I’ll be joined on stage by the managers below, each of whom I hold in high regard:

- Scott Miller, Greenhaven Road Capital (Keynote)

- Michael Bridge, Willow Oak Select Fund

- Bill Chen, Rhizome Partners

- Jessica Greer, Willow Oak Fund Management Services

- Rudi van Niekerk, Desert Lion Capital

- Dan Roller, Maran Capital

- Keith Smith, Bonhoeffer Fund

- Matt Sweeney, Laughing Water Capital

- Dave Waters, Alluvial Fund

You can find more information and register for the event at: Value Investing in a Volatile Environment.

**********

Last quarter, I mentioned how the price decline in the portfolio in 2018 presented us with several attractive opportunities. These opportunities continued into the first quarter.

On average, our four largest positions trade at only 81% of book value. The fifth largest position completed a transaction after the close of the fourth quarter that provided the company with more cash than its market cap. That company, Aimia (AIM.TO), has subsequently commenced a tender offer to repurchase one quarter of their outstanding shares.

MMA Capital (MMAC) filed their annual report in March and reported even higher book value than I anticipated. This is a situation where a transition is being made from valuing the company by its balance sheet metrics to valuing it on its income statement characteristics. MMAC is solidly profitable and, at some point in the future, will trade at a multiple of the fees it generates. Until that happens, it remains cheap on a price-to-book basis. Book value is $36.20/share. The last trade went off at $30.78.

There is a strong possibility that MMAC will be added to a Russell index over the next few months. We will know for certain in June. If that occurs, we will likely see a more appropriate valuation given to the stock. Even if they are not added to the index this year, they will be at some point over the next few years.

Index inclusion, especially with smaller companies that have a limited public float, can cause some rapid price changes. We saw this with ALJ Regional Holdings (ALJJ) a few years ago when they were added to the Russell Microcap Index.

MMAC has a relatively high percentage of insider ownership and also has a number of large shareholders who are unlikely to sell anywhere near today’s prices. That supply/demand imbalance may be meaningful should the index need to acquire a large number of shares in a short amount of time.

Westaim (WED.V) also announced strong financial results. Book value increased to C$3.30 from C$2.92 year over year. Assets under management in their Arena Group subsidiary increased to US$1 billion.

Westaim is looking to monetize their other subsidiary, Houston International Insurance Group, and recent news reports indicate positive developments in that effort.

Enterprise Diversified (SYTE) reported poor earnings primarily associated with its real estate division. The problems in that subsidiary are being aggressively addressed by our CEO, Michael Bridge, and CFO, Alea Kleinhammer. They have already massively de-risked the subsidiary and dramatically cut costs.

There is substantial low-hanging fruit with high-interest debt that is being paid off. Paying off that debt provides an immediate double-digit return. Once they are done, the subsidiary will be left with roughly 100 core units that will more closely reflect the original idea for the acquisition.

On a more positive note, the asset management subsidiary, Willow Oak Asset Management, continues to be a bright spot. Alluvial Capital and Bonhoeffer Fund continue to raise assets, and Willow Oak Select is attracting unique ideas from its partners.

Peter Thiel has said to “dominate a small niche and scale up from there.” Willow Oak's niche is to partner with unique investment managers. We have a tremendous network of emerging managers, both internal and external to the company. There are a variety of opportunities to expand those relationships and provide value to investors, fund managers, and SYTE shareholders. It is an exciting time for that subsidiary, which is the future of Enterprise Diversified.

Enterprise Diversified’s book value at the end of 2018 was $6.25/share. The stock price has now dropped below that level. Book value fails to capture a few important things. For example, Enterprise Diversified has a legacy internet division carried on the balance sheet at $642,948. Net income from that division in 2018 was $637,604, meaning that the actual value of the internet division is much higher than its book value.

Additionally, the real estate division had a write-down of $964,743 in 2018. GAAP requires this when the current value of a property is less than its cost basis. GAAP does not allow for a “write-up” on properties where the value is above its cost basis. Depreciation also reduces the carrying value. In order to help SYTE shareholders better understand the actual overall value of the real estate, I have asked management to put together an investor presentation that will provide a realistic net asset value for the holdings that relies on actual appraisals.

Look for that presentation at the annual shareholder meeting on May 21. The first-quarter results will be filed a few days before that and should provide additional clarity, as well. I remain as optimistic as ever about the future of the company.

Now that I have been bumped up to chairman of Enterprise Diversified, our CEO Michael Bridge is the person to direct any questions that you may have about the company. The annual meeting will be a good opportunity to talk with him and the rest of senior management, and I encourage you to attend.

A Word of Caution

I have written about the three companies above extensively over the past few years. Some of you have taken an interest in following them in addition to your investment in the fund, and a couple of you have even told me that you check their prices daily on Yahoo Finance.

Hearing about that daily price check horrified me. I only occasionally check the price of our holdings. Certainly not daily. Doing so would destroy any advantage we have of long-term outperformance. There is no meaning behind the daily increases and decreases in the holdings. Most of our holdings have little news between quarterly filings, so following the stock price in between those filings is pointless unless shares get to a price where we want to buy or sell.

I typically do not even make decisions from those quarterly filings. You have to give a company more time than a quarter or a year to carry out its strategy.

Following specific holdings, or even the portfolio itself, over such a short time period is a recipe for unnecessary stress and can only serve to harm efforts at maintaining discipline. If the stock price goes up in a short amount of time (and by this, I mean a few years), you run the risk of getting overly excited and making a poor decision. If it goes down in a short amount of time, you run the risk of getting overly depressed and making a poor decision.

In every study I have seen related to mutual fund and ETF investors, the investors themselves have underperformed the actual fund by at least 2% annually. That underperformance primarily occurs because investors withdraw funds after a decline and tend to add funds after an increase in value. Investing in a hedge fund or private equity with lock-up periods or restricted withdrawal periods helps to somewhat protect investors from their own emotions because it provides a cooling-off period for any decision. Conversely, an investor can typically withdraw from, or add to, a mutual fund or ETF on a daily basis.

I encourage you to ignore short-term performance and read these quarterly updates as interesting observations, not as anything actionable.

Morgan Housel gave a speech a few years ago where he quoted Blackrock’s Larry Fink:

“Larry Fink was having lunch with the CEO of one of the largest sovereign wealth funds and the CEO of the sovereign wealth fund said, ‘Our goal as investors is to think generationally. We're not thinking about this quarter or next year or even the next 10 years, we're thinking about the next generation and the generation after that.’

And Larry Fink said, ‘Great, how do you measure returns?’ And the CEO said, ‘Monthly.’

And I think there's just so much disconnect between people who want to be long term thinkers and what long term thinking really means in investing.”

Housel’s point is that the type of thinking from the CEO creates problems and risks that otherwise don’t exist. It is risk itself, much bigger risk than anything from the economy. That thinking clearly leads to bad decision making and directly leads to a heightened emotional state which, of course, you don’t want as an investor.

Everyone is susceptible to short-term thinking, especially during times of volatility. The best way to keep the focus on what truly matters, where you have an actual advantage, is to control your environment.

Don’t watch CNBC. Don’t check stock prices daily. Don’t have the Bloomberg in your office.

The news is simply outrage porn, designed to increase your emotional response. Once you really realize that, you’ll lose interest in following it. When your investing horizon is a decade or more, you won’t care that the yield curve turned negative for a short time in late 2018. You won’t care what some talking head said one morning.

As Bill Murray so eloquently put it, but probably did not mean in the same way that I apply it here, “It just doesn’t matter!”

What does matter is the long-term operational performance and capital-allocation skills of the company

itself. Watching a stock price isn’t going to help you with that analysis.

Truly taking a long-term approach is liberating and less stressful. Most importantly, it significantly improves the chances of outperformance. Time arbitrage is the greatest edge in investing.

Thank you again for your investment in Arquitos and for your commitment to this style of investing. That alignment of interests is what has facilitated our significant outperformance over the past seven years. Best regards,

Steven L. Kiel

This article first appeared on ValueWalk Premium