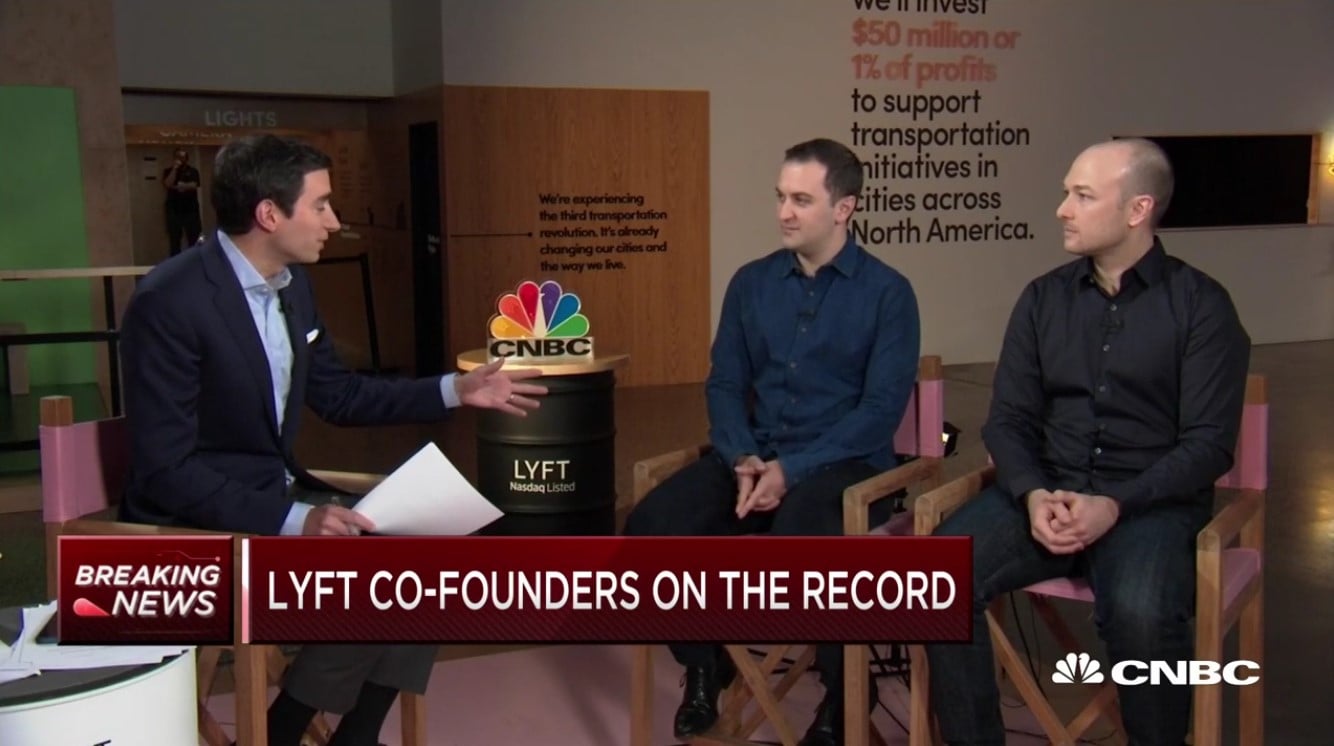

First On CNBC: CNBC Transcript: Lyft’s John Zimmer And Logan Green Speak With CNBC‘s Andrew Ross Sorkin On “Squawk Box” Today

WHEN: Today, Friday, March 29

WHERE: CNBC’s “Squawk Box”

Following is the unofficial transcript of a FIRST ON CNBC interview with John Zimmer, Lyft Co-Founder and President, and Logan Green, Lyft Co-Founder and CEO, and CNBC’s Andrew Ross Sorkin on “Squawk Box” (M-F, 6AM-9AM ET) today, Friday, March 29th. Following is a link to the video from CNBC.com:

Q4 hedge fund letters, conference, scoops etc

Watch CNBC’s full interview with Lyft’s co-founders John Zimmer and Logan Green

All references must be sourced to CNBC

Andrew Ross Sorkin: welcome back to "Squawk box" this morning right here on CNBC. Lyft set for its public debut today on the NASDAQ. Joining us right now is John Zimmer, the Co-founder and President of Lyft . And Logan Green, the Co-founder and CEO of Lyft for their first big interview ahead of this big day. You started this company in 2007 you didn’t think this was going to happen when you started

Logan green: this has surpassed all of our expectations

Sorkin: did you -- I mean, I’ve known you now for a long time and I remember we used to have conversations -- there was a moment I don’t know if you remember back when it was Uber and Lyft and everyone said winner takes all only one company can win this thing. You said it’s more like Verizon/AT&T you remember that?

John zimmer: absolutely. It’s been a wild ride.

Sorkin: we’ve talked a lot about and we’ve shown a lot of the tape from our almost carpool karaoke thing. We needed an xl or something wider for that conversation.

Green: it was a little tight.

Sorkin: but let’s have a conversation now almost the kind of questions, I think, that were probably asked to you during the road show about the business because there are a lot of people that have not had an opportunity to hear from you on this who are thinking do I want to get in on this, what’s going on with this explain this this is a company that’s had enormous growth but also enormous losses at the same time talk to us about how this company gets to profitability.

Green: yeah. We’re going after a $1.2 trillion market. Consumers spend $1.2 trillion every year in the u.S. Alone on consumer transportation and we’re investing aggressively in that market so we think this is going to be potentially the largest market that ever shifts from an ownership model to a service model. So not only are we investing in ride sharing, we’re investing in bikes and scooters, we’re investing in autonomous vehicles but if you dig into the numbers, every year the economics are getting better and we are investing unapologetically in the space and think the returns are going to be really incredible

Sorkin: just to put a fine point on it, if you stopped investing in some of the newer forms of transportation, let’s say scooters and bikes or autonomous vehicles, for example. Not so clear the company becomes profitable automatically either.

Zimmer: we’re very confident in the long-term profitability of this model. And again, as Logan said, we’re making a decision that is aligning with our shareholders to go after the long-term opportunity.

Sorkin: but how much is it the current model

Zimmer: works very well the economics are good and again, we would be not doing the right thing if we were focused on the next one or two years. We’re focused on the next three, four, five

Sorkin: just speak to the current model and we’ll get to -- I want to talk about the future as well but under the current model, it appears like on every ride -- every ride is not a profitable ride, am I wrong

Green: that’s not correct.

Sorkin: that’s not correct okay.

Green: and we’re a contribution margin positive in nearly every single city. So the margin on the business if you track the numbers we went from 23% contribution margin in 2016 up to 46% contribution margin in 2018 and think long-term will be at a 70% contribution margin.

Sorkin: if you’re my mother and you’re watching this right now, you’re thinking do I want to own Lyft what is the time horizon with which you would tell her this could be a profitable company?

Zimmer: I wouldn’t be allowed to give forward-looking guidance, but I would tell your mother that if you believe in the idea that American households spending $9,000 every year owning and operating a car and using it 5% of the time, if you don’t -- if you think we can make that more efficient and save people thousands and thousands of dollars by doing all your transportation services in one place, then this is the right company for you.

Sorkin: you priced higher than expected yesterday some people are calling it surge pricing. When you think about the price, what are the comps or metrics you would look at the valuation and say this makes sense? You can compare it to "X." because we were talking earlier today, this company is now going to be more valuable than united continental the airline business

Zimmer: I think what investors are looking at is revenue multiples over the next few years. And that’s giving them confidence in the long-term value of the company

Sorkin: and when you think about the company long-term we talked about autonomous vehicles, there was an expectation. I would say even as not far back -- 9 or 12 months ago that autonomous vehicles, full-on autonomy was going to be here in two years if not sooner. We heard from Elon Musk and other on that. How far do you think it is away and how has it changed the business if it is coming

Green: I think as with new technologies pi think people overestimate the near term impact and underestimate the long-term impact so we don’t think that there’s going to be an autonomous vehicle in the next few years that can do all of rides it’s not going to just drop down and sort of take over. We do think a few years out and we don’t have, you know, a magic number but a few years out, you’ll probably start to see first generation autonomous vehicles that can do a small percentage of rides

Sorkin: but this is even a couple years out. Before you are doing those

Green: absolutely.

Sorkin: how does that change the unit economics?

Green: the unit economics, you know, will shift where we would have 100% take on those rides but the promise is that the price of the ride would come down a lot and that’s part of the excitement about autonomous

Zimmer: I actually go back to what we talked about with AT&T and Verizon. When you bring in something like 4g coverage which I will call autonomous, you don’t need to put it everywhere you need to put it in certain instances. For autonomous it will be for fixed routes, under a certain miles an hour in good weather we believe that the driver community is going to continue to grow because there will always be use cases that will be better served by people in cars.

Sorkin: let me ask you this Dan Primack was on earlier one of the points he made was in an autonomous world if we get there, instead of it just being an AT&T/Verizon, an Uber and a Lyft, all of the sudden it could actually open up the competitive landscape even further so you’re playing against Waymo, playing against car companies that have fleets

Zimmer: I think what’s important to realize is for us to be successful we have to be great at technology including software you named several software companies. And we have to be great at physical operations. We’re here today in our driver service center which we’re building out across the country. It’s not enough to just have software you need to combine that with the real world that’s something we believe we can do better than anyone else.

Sorkin: what are you going to use the proceeds of this IPO for

Zimmer: to invest in that long-term opportunity, to add additional new modes, build infrastructure for bikes and scooters, invest in r&d. Not only for autonomous. Actually, the majority of our r&d is being spent on our existing business to push down on operating costs like insurance. So we are investing for the next few years.

Sorkin: for the model to work meaningfully, how much of it has to be about pooling people in the cars together. Meaning, relative to me sitting in the back of one car individually versus me and three or four other people

Green: yeah, that’s not needed --

Sorkin: because that was the vision and dream originally for you

Green: yeah. That’s a big part. So a big part of the inspiration for me was growing up in l.A. Being stuck in traffic seeing one person per car thinking, we can make this more efficient you know, and at any given time there’s got to be, you know, dozens if not hundreds of people on the road sitting there going to the same place so let’s put them in the same car. That was one of the, you know, key innovations that we led with in the market. And we’re close to rolling out a new product called shared saver. Where we are promising not to flex the price so no surge pricing. We’ll always give you a flat price. And instead we’ll flex how long you wait and we think the efficiency will be really impressive

Sorkin: how do you think about your company versus Uber? I think of it as the pure play transport. That’s sort of how I’ve been describing it. But there are two players in this market. One is significantly bigger than the other.

Zimmer: yeah. So, one, we’ve been and will always be focused on what we can control and do and that’s paying off people are choosing Lyft we’ve seen our market share go from just over 20% to nearly 40% across the united states and yes, Lyft is focused on consumer transportation, focused on North America, and focused on taking care of our drivers and passengers and that’s paying off.

Sorkin how much of this, by the way, you talk about North America the good news there is there’s an opportunity eventually to go international. But where does that fit in the sort of list of priorities for you?

Green: we look at international as a great call option. As we look around the world anywhere where there’s just a single player, we think there will be at least two scaled players in each international market eventually. But every time we sort of weighed that trade off, we decided to go deeper in transportation in the u.S. You know, if you look at the entire ride sharing industry, it still makes up less than 1% of all vehicle miles traveled so we’re just scratching the surface of what we can do in the u.S.

Sorkin: when you look at what uber has done internationally, is that something you say to yourself I wish I had done that?

Zimmer: no I think we’re really happy with the focus that we’ve had. We’re not, you know, needing to pull away from markets we’re going at the right pace. We’re going deep in transportation and deep in the markets we’re in that allows us to gain the share we’ve gained as Logan said, it’s a great call option down the road.

Sorkin: one of the things in your filings is the idea that in this battle with Uber which is an intense competition, you’re spending a lot of money. And you spent a lot of money in the last six months in terms of marketing dollars to get people and discounting to get people in the cars Uber is doing the same how long does that battle last

Zimmer: I think one thing to realize in 2016 and prior, there was a need for us to get up to scale. Scale in our business is a three-minute pickup time beyond that, now what we have is 80% of our passengers are coming in organically. They’re coming in because of the brand, because of the service, because of our driver community. And so it’s not about a price, you know, battle between the two players anymore. It’s about getting the best service, having the best software and real world operations

Sorkin: I have to ask about this given the valuation today back in 2014, Travis Kalanick was running Uber tried to buy Lyft. He confirmed that. Can you tell us what he offered you? Because I know back then, you didn’t take the deal

Zimmer: no, I don’t think we can comment on that.

Sorkin: you can’t tell us what it was worth back then? I mean, I assume today you have to be very happy you didn’t take the deal

Green: very happy.

Sorkin: let’s go to this which is about workers.We’re here in the drivers center right now. You’re trying to do a lot for drivers. But there’s also a larger debate in this country right now about the idea of contracted workers there’s also shifting political winds in this country as well in terms of what’s going on with labor, if you will

Zimmer: yeah.

Sorkin: what do you think is going to happen and how -- what could that do to your business if at some point along the way the political winds shift in such a way where they say to you, you know what? All these drivers, they actually have to become employees

Zimmer: I think the important thing is even over the last year, the Lyft platform created 1.9 million flexible jobs. And the majority 91% of Lyft drivers are driving less than 20 hours. Drivers on the platform have earned over $10 billion. Why are they wanting this type of work the typical 9:00 to 5:00 is not getting them where they need to go so they’re using Lyft for suplimental income they’re using Lyft potentially as a single parent that needs more flexibility in their job. And, you know, I think work in this country has been defined one way historically and there’s a way people want to do it differently going forward.

Sorkin: the other big semi-political question has to do with congestion pricing which you are starting to see in New York and others and what that ultimately does to the business. Meaning if the price gets materially higher and in New York, I think $2 or $3 addition to every ride already, I see it even myself saying I might take the subway now

Green: we’re big fans of congestion pricing.

Sorkin: you are

Green: we are. You know, politicians sometimes say there’s no silver bullet to solve traffic. That’s not there is and it’s congestion pricing. We actually advocated and are very supportive of the congestion pricing program in New York. That’s already gone into effect. I believe it’s collectively raising about $400 million for the MTA system and we think that’s incredible I think, you know, our business is based on the roads. And if the roads aren’t functioning well, our business isn’t functioning well and pricing them creates all the right incentives it and can contribute a ton of money to public transportation it also creates incentives for shared rides which we’re really excited about.

Sorkin: what do you say to those -- you know, the whole idea I think when you started this project company, really, was to get -- to actually create less traffic, not more there have been some studies and analysts out there that have suggested between Uber and Lyft, there’s actually now more traffic that you’ve created more traffic in the cities. I’m looking at one study from Bruce Schaller that said it created 160% increase in driving on city streets.

Zimmer: yeah. I mean, I think, again, Lyft and our competition combined to be less than 1% of miles traveled in the united states that said, I think there are multiple effects of creating something new. And the investments we’re making in shared rides. The push we’re putting behind congestion pricing to solve the problem.We want as Logan said, no traffic. We intend to be part of that solution.

Sorkin: bikes and scooters, what is next beyond that

Green: We’re rolling out public transportation integration into the app. So we want Lyft to be the first place you go to figure out which type of transportation you’re going to take. We don’t care if it’s a ride on our platform or its the bus or the train. And in fact, we love to connect you to whatever the best option is

Sorkn: in terms of the value proposition margin for you on a bike or on a scooter I’m assuming much higher

Green: not today the economics of bikes and scooters today are very early on. Particularly the scooters have a short lifetime because they haven’t been designed and hardened for their shares use case. We think in the near future they will improve a lot

Sorkin: Becky back in New York has a question

Becky quick: I just want to ask you guys, when the lockup period expires, do you plan to sell some of your shares to lock in the money you made after building for a lot of years or make sure you hold onto the shares as long as possible so you can still have as much say in it I guess with the dual share split it is a little different but what’s your plan

Zimmer: to be honest, we haven’t thought too much about that. We’re focused on the long-term execution. Obviously we believe long-term in the value that we can create. And genuinely are focused on our mission which is to improve people’s lives with the world’s best transportation.

Sorkin: related to that, let me ask you about governance because one of the controversies that’s come up over the past couple months with this IPO but also with companies in the valley across the board is this idea you have super voting shares those shares give you a outsize control of the company. And whether ultimately that’s a good or bad thing.

Green: we spend a lot of time with our board and investors to put together a thoughtful approach to governance. Dual class being one of them. We also selected an independent chair of the board and over the last several years we’ve been making great effort to make sure we have a diverse board coming from all types of different backgrounds. Collectively, we really need to set the company up for this long-term opportunity and to create the type of durable growth we’re going after

Sorkin: mike, I think you got a question in New York

Mike santoli: yeah. Thanks I think this would be for Logan given how you’re investing so heavily and so many investors are basing the value of the company on this total addressable market, and you say it’s all consumer transportation and that people who own a car, you know, pay thousands of dollars and only use it 5% of the time I’ve often thought of that as, well, I’m counting the time I use my refrigerator only when the door’s open. People have a car because it’s an option to go somewhere. Any time they like so just legitimately outside of urban areas, how much do you think services like yours will displace car ownership

Green: we think almost every mile will take place on a transportation as a service network. We think people will continue to own cars but today when you own a car, you’re dealing with 10 plus different companies to piece together this experience you go to a dealership to buy. You have a separate company, go to insurance separate company to service it you’ve got to register it, park it, tow it, clean it, fuel it, charge it. And at each step of the way, you know none of these experiences are integrated with each other you are paying retail at every step we are quite confident that we can create a single better consumer experience and use technology and on the ground operations to create a better customer experience and we could use the scale of our network. Last year over 30 million unique riders across the country use lyft it’s almost 10% of the population and we can use the scale of our business and that leverage to deliver better costs at a better experience that’s the magic of service. Right? We’ve saw this play out in the entertainment industry people used to buy CDs and DVDs. Now they stream all their content. It’s a better experience at a better price point.

Sorkin: by the way, you all have kids one of the reasons people have cars is because they have car seats and they have athletic equipment and all sorts of stuff in the back of the car. Do you really think the car is going away

Zimmer: one of the most important points is we don’t need you to give up your car we are not saying that just like you have a phone and you run it on a network and you use that phone, it’s your phone. Same is true yeah, with kids, you can have your kids seat in the back, your gym bag in the back. We’re not saying we need to take that away for you in order for the business to be successful. Instead, if our negotiating power on behalf of our customers for fuel, for maintenance, for all these elements is much higher than one person doing it themselves

Sorkin: couple quick rapid fire questions. Carl Icahn is one of your investors. He I imagine may stay in the stock. Are you worried about that

Zimmer: no.

Sorkin: it’s been a good investment for him so far

Zimmer: we’ve actually --

Sorkin: he’s also an agitator.

Zimmer: we’ve had a great relationship with Carl Icahn

Sorkin: second question Logan, you said in "The New York Times" Elon Musk, Mark Zuckerberg, and Jeff Bezos are people you look up to, role models of yours. What about each?

Green: what about each you know, if you look at amazon,I think, you know, it’s – they were the first company ahead of the curve of creating a world class technology organization and getting their hands dirty with real world operations right? They run warehouses. They deliver packages. I think that’s the formula that a lot more businesses are going to have to follow. And that’s, you know, part of the mold we’re building Lyft in. I also love how customer focused amazon is. I think that’s just a critical recipe for any company to be really, really successful.

Sorkin: second question because I mentioned Elon Musk.He said the public markets are just a terrible place to be these days that if you’re trying to actually grow a business, why not just stay private?

Zimmer: look, we’re ready to be held accountable.We’re excited. I think in our case, I think what we’ve seen in talking to investors that more people are maybe surprised to see the numbers that we’re putting out and I think this is a great part of the process for us, this wasn’t the goal this is a milestone along the way. But we feel like it helps us with additional access to capital.

Sorkin: two other quick questions Warren Buffett said yesterday to Becky, no reason to buy in on an IPO did you hear that news? Do you havea thought?

Zimmer: didn’t hear that.

Sorkin: what would you tell warren?

Zimmer: he’s an incredible investor and everyone can have their own opinion.

Sorkin: final two questions are completely selfish one is about tipping how much do you tip on the Lyft app or do you pay in cash?

Zimmer: I tip on the Lyft app depends on the ride.

Sorkin: and do you get additional stars for tipping? I need to know that.

Green: no. It’s separate. So the star rating happens before there’s kind of any information about the tip. So it’s completely unbiased to the tip. Tip what you feel is appropriate to a ride.

Sorkin: and finally, I said -- I teased it before you have a very specific ring tone on your phone that I thought the audience should hear on a day like today given what you do for a living. I don’t know if you can play that near your microphone. Can everybody hear that? Do you remember this back in New York you know what that is?

Becky: I do.

Santoli: of course

Becky: hello

Sorkin: night rider.

Quick: more specifically in your self-described selfish questions, we decided you’re never going to tip again, are you?

Joe Kernen: never tip again

Zimmer: please tip your driver.

Sorkin: that’s not true I’m going to tip

Quick: and guys, you said it depends on the ride how much you tip so what’s a good ride and what’s a bad ride how much do you swing?

Zimmer: I mean, it could be several dollars. I’ve had an amazing ride that had a really big tip it just depends on --

Quick: 15%, 20% several dollars is not a really big tip

Zimmer: yeah. 15% to 20% depending on the ride is the best way to think about it

Sorkin: gentlemen, thank you.

Kernen: hey did john go to Cornell?

Sorkin: John is a Cornellian. And a sigma pi guy we were in the same fraternity not at the same time then we met each other, I don’t know, seven or ten years ago.

Kernen: but he’s much younger and doing much better than you

Sorkin: he is doing much better than -- yes. Better looking, doing better, all working out for him.

Kernen: but who’s counting.

Sorkin: but who’s counting. Good luck, gentlemen

Zimmer: thank you