When Kraft Heinz reported earnings last Friday (February 22), they shocked markets with a trifecta of bad news – stagnant operating results, a massive goodwill impairment and mention of accounting irregularities being investigated by the SEC. When they followed up by cutting dividends, the stock collapsed more than 25%. The shock was amplified for investors because of the pedigree of the two lead investors in the company – Berkshire Hathaway and 3G Capital, both with reputations for investing acumen and shrewdness. If you needed a reminder that Warren Buffett is human (though he is been open about that truth for a long time), makes mistakes and has investing blind spots, you got it. More generally, though, no investor, no matter what his or her track record, should be put on a pedestal and followed blindly. In the session, I also do an updated valuation of Kraft Heinz, which will guide my actions, but if you buy into the broader lesson, should not guide yours.

H/T Dataroma

Slides: http://www.stern.nyu.edu/

Investing Idol Worship: The Kraft Heinz Lesson

Q4 hedge fund letters, conference, scoops etc

Transcript

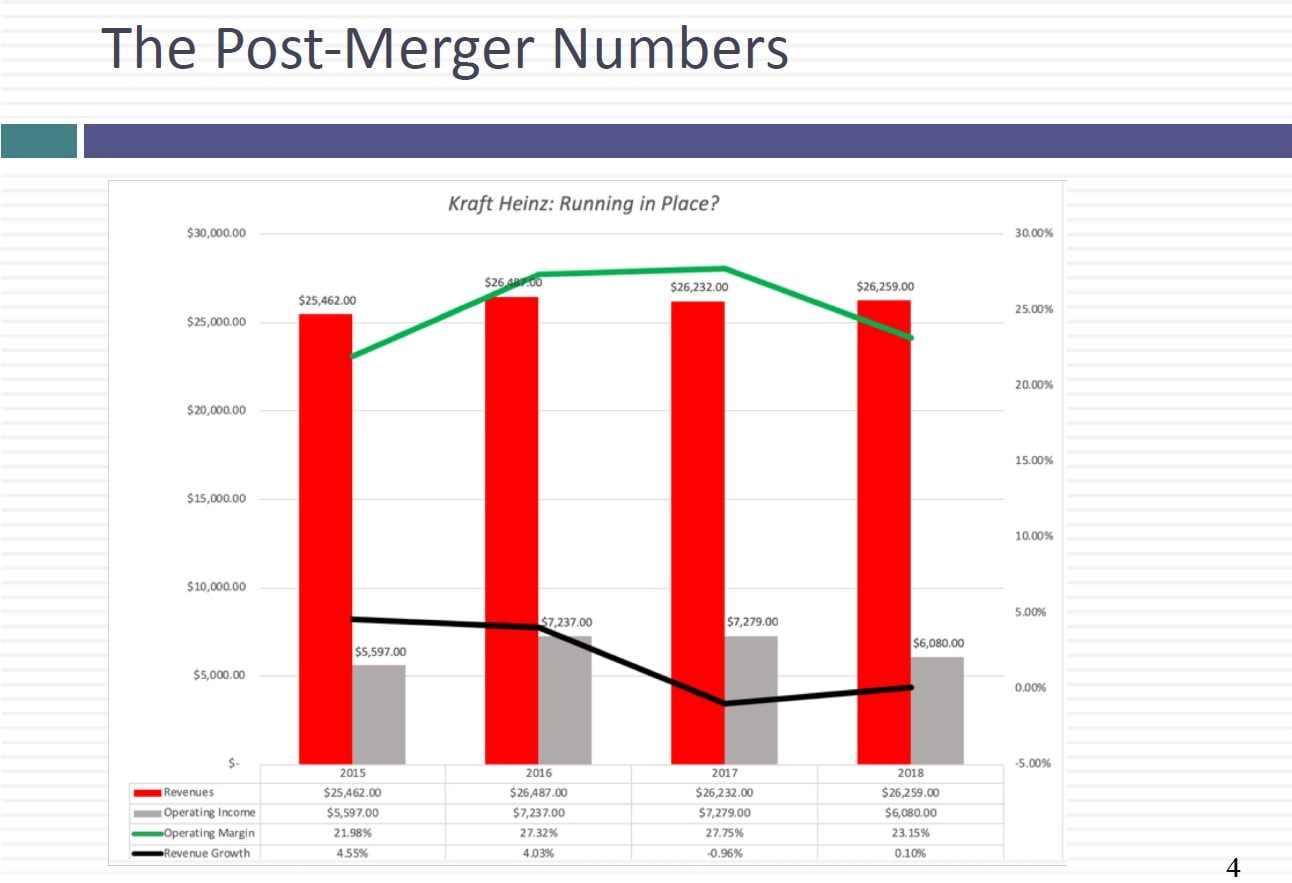

Hi. Welcome back. This session I'd like to take a look at Kraft Heinz. For those who've been tracking the news last Friday Kraft Heinz reported earnings and it contained a trifecta of bad news first on the operating front. Revenues have flattened out the revenues in 2018 were roughly what they were in 2017 but operating margins decreased their operating income drop by almost 5 or 10 percent. In conjunction with that.

Kraft Heinz reported two other piece of news. The first was that they were going to write off a big chunk of goodwill almost fifteen point four billion dollars and the second was there was going to be an accounting investigation by the SEC. a subpoena that was overhanging. So accounting irregularities goodwill impairment of operating bad news. And to top it all off they also cut their dividends. The stock price dropped almost 25 percent overnight. Now you're saying another stock with bad earnings reports what's the big deal. What makes Kraft Heinz different is it's the pedigree of its two biggest investors. Why is Berkshire Hathaway which owns about 27 percent of the stock and the other was 3G Capital which until last Friday owned almost 29 percent the stock. The reason those two investors gave the rest of the market Solace was Berkshire Hathaway of course is Warren Buffett. So the view is if Warren Buffett pick the stock it must be a good stock and 3G Capital while it might not have the cachet that the Buffett name does is viewed in private equity and insider circles as an incredibly shrewd investor investing unit with which cuts cut costs and you know kind of ruthlessly and improves margins. So the fact that a stock that had been picked by to such well regarded investors collapse shocked investors some of them was viewed as a betrayal.

That that these investors that they believed in and followed had not delivered them the returns. And this session I'd like to take a look at Kraft Heinz but I'd also like to take a look at the dangers of following even great investors investors you view as great into stocks. So let's look at the back story for Kraft has two companies came together. One is Heintz which is almost 130 years old were born in Pennsylvania as a stock as a company that made horseradish and then expanded of course to its 57 varieties of catch up. It had a century of growth and success before it started running into trouble in the 1980s and 90s.

And now in fact it was targeted by activist investor Nelson Peltz and then in 2013 it was taken over by Berkshire Hathaway and 3G Capital made into a private company. No Kraft is in fact a younger company but it's still an old company born in 1993 as a cheese company and initially stayed and dairy products expand to other food products and then went through a deal making it was bought it was sold it bought other companies bought it merged with a company called Dart industries which made batteries and Tupperware and then was acquired itself by Philip Morris which then spun it off. But the endgame of all of this was to got into trouble đinđić two was targeted by activists investors in 2015 Berkshire Hathaway and 3G combined Heinz the company that was now a private company with crafted was a public company to create craft heights which would continue life as a public company. At the time of the acquisition much was promised and 3G Capital because of its history of cost cutting said we can improve margins and because they were a global player they said we can go global with catch up. So there were hope at that time in 2015 when the deal was made. You're going to have more revenue growth by going global and improve margins with the cost cutting. Well if you look at the actual numbers neither has quite come through. You look at the revenues across the three years since the deal has been pretty flat.

And you look at operating margins they've been pretty flat as well. So there's synergy or it's not shown up in the numbers and that's been disappointing but the stock price has stayed up partly because people believe that if Buffett and 3G believe that this is a good company must be a good company. So I'm just setting up for the earnings report because he knows what the earnings report review first and review that revenues had stayed roughly the same in 2008 and as in 2017 that operating income dropped by six point two billion to buy five point eight billion margin went from 23 and a half percent down to 22 percent. Still a decent margin but lower than it used to be. It announced accounting irregularities irregularities but at least from the description they made it seem like it was a minor issue and some on the procurement part of the company and that set aside 25 million. And the fact that it's a small number seems to signal that they think this problem is a minor problem to go away. But you have to take them at their word for the moment and they also announced that they are going to take a charge of fifteen point four billion for impairment of goodwill.

For those of you are puzzled by what this is this is basically a reflection of the fact that they overpaid in an acquisition maybe.