Whitney Tilson‘s email to investors discussing KHC’s Cash Receipts; Asia Wealth Virtual Summit; Brexit news; Theranos.

I got more complimentary feedback re. yesterday’s email about KHC than any other. It’s great to have so many smart people on this email list who are willing to share their insights, which I can then synthesize and share with a broader audience. Thank you!

Q4 hedge fund letters, conference, scoops etc

1) A few readers wrote me to point out that KHC does something very unusual with its receivables that affects its operating cash flow. One of them provided a particularly insightful analysis:

I am enjoying the discourse on 3G/KHC. Your cash flow and EBITDA analysis piqued my interest. FMCG (fast-moving consumer goods) is a fairly simple business with solid cash flow characteristics, so the disconnect between KHC’s EBITDA and cash flow just seems too high. This is not a business that relies on contract accounting and/or percentage of completion accounting.

If you dig into the cash flow statement for the past three years, a few items stand out:

KHC utilizes an accounts receivable factoring facility. Given the naturally solid cash flow characteristics of the business, I am not sure why they factor, but they do. It turns out that FASB (as of 2016) requires sold receivables to be listed as a cash flow from investing activities.

In 2016 and 2017, KHC's cash receipts from sold receivables were $2.6B and $2.3B, respectively. The true operational cash flow of the business should include these cash receipts, as KHC simply sped up the collection process through an intermediary.

There are a few things to watch out for here. If KHC were to dramatically increase the size of its AR facility from one year to the next, then that would have the effect of increasing cash flow, and likely overstate the year-over-year growth. Based on KHC's footnotes, I don't believe this to be the case. The size of the AR facility should also be added to KHC's debt levels (this appears to be immaterial relative to KHC's already high debt levels).

KHC also had a very large contribution ($1.5B) to its pension plan in 2017, which distorted underlying operating cash flow for that year.

If we make the above adjustments to reported CFO, then "economic" CFO is around $4B annually.

PS—Just a quick side note on AR financing/factoring. IFRS accounting appears to be less stringent than FASB accounting. I have come across many UK-based firms that goosed their cash flow from operations year-over-year by increasing their use of AR financing/factoring. Under IFRS, this dynamic is hidden in cash flow from operations as there is no FASB-like requirement to list cash receipts from sold receivables as a cash flow from investing activities. Under IFRS, the AR facility is off-balance-sheet, so the footnotes must be read to make appropriate adjustments.

Since an AR facility is debt, a provision for AR facility debt must be included in any EV valuation process. I have come across a number of UK-based firms that abuse the AR facility dynamic at period end. These firms typically greatly increase their AR facility at period-end, which results in a higher CFO figure being reported. Since the AR facility, under IFRS, is off-balance-sheet, the company's debt situation at period-end looks better than reality. The analyst must make the debt-level adjustment. It helps to know the average level of the AR facility during a period as opposed to the period-end level - management does not typically volunteer this figure.

Under FASB reporting, I don't believe firms can abuse AR factoring as easily as firms can under IFRS reporting.

To make things more complicated, MDLZ uses factoring as well, but the company appears to use a different accounting method than KHC. MDLZ does not have a "cash receipts from sold receivables" line item in its cash flow statement.

Here is the explanation in KHC’s 2017 10K:

In August 2016, the FASB issued ASU 2016-15 related to the classification of certain cash payments and cash receipts on the statement of cash flows. This ASU provided guidance on eight specific cash flow classification matters, which must be adopted in the same period using a retrospective transition method. We early adopted this ASU in the first quarter of 2017. We now classify consideration received for beneficial interest obtained for transferring trade receivables in securitization transactions as investing activities instead of operating activities. Accordingly, we reclassified cash receipts from the payments on sold receivables (which are cash receipts on the underlying trade receivables that have already been securitized) to cash provided by investing activities (from cash provided by operating activities). The impact on our consolidated statement of cash flows was $2.6 billion for 2016, and $1.3 billion for 2015.

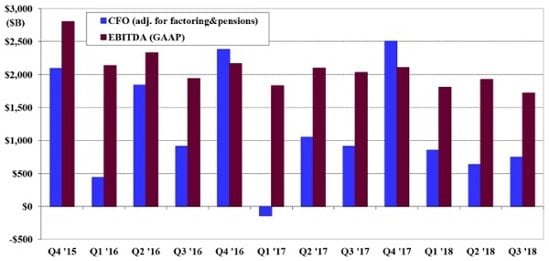

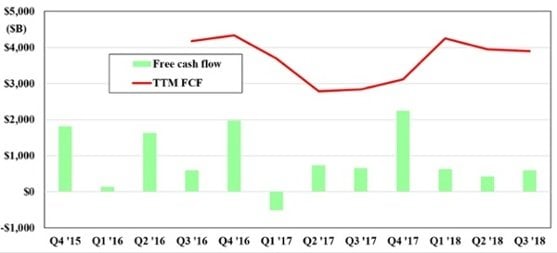

3) I added back KHC’s “Cash receipts on sold receivables” as well as “Pension and postretirement benefit plan contributions” for every period and re-ran the two charts I included in yesterday’s email. In total, in the three years from Q4 ’15 through Q3 ’18, KHC’s adjusted cash flow from operations was $14.2 billion (up from $5.9 billion unadjusted), which is still 43% below EBITDA of $24.9 billion. Still lousy, but no longer weird.

Here’s the first chart:

And here’s the second, which subtracts cap ex from adjusted OCF:

4) If you missed the Asia Wealth Virtual Summit last weekend, during which I presented The Best of Value and Growth: Make Money Investing, all of the presentations are available. They're no longer free, but you can access everything with a $49 subscription to Strategic Wealth Confidential, which has become one of the most widely read actionable investment newsletters in Asia. Just sign up here.

5) Breaking news re. Brexit: Labour Party Leader, Under Pressure, Backs a New Brexit Referendum. Excerpt:

Britain’s opposition Labour Party said on Monday that it was prepared to support a second referendum on withdrawal from the European Union, a shift that could have significant ramifications for the fate of Brexit and for the country’s future.

After the resignations of nine Labour Party members last week, and amid the prospect of more, the party’s leader, Jeremy Corbyn, dropped his longstanding resistance to a second vote on leaving the bloc.

Getting an amendment for a new vote through Parliament any time soon is unlikely, but Mr. Corbyn’s support for one will cheer pro-European Britons, who have been fighting to reverse the outcome of the 2016 referendum decision. Without the support of Labour, there is no chance of a second referendum ever being authorized by lawmakers.

Though lacking in detail, Labour’s announcement suggested that, under pressure from many of his own lawmakers and party members, Mr. Corbyn, who is a lifelong critic of the European Union, will ultimately fall into line with those who support a so-called people’s vote.

I have long predicted that it’s 70% likely that the Brits will revote and call it off this stupid idea, which only passed by a whisker thanks to endless lies and – what else? – Russian interference. (For more on this, see: Why isn’t there greater outrage about Russia’s involvement in Brexit?) In light of today’s news, I now increase my estimate to 80%.

Here’s a 21-minute video from comedian and political commentator John Oliver with a scathing and witty look at the Brexit debacle. The ending is a hilarious mock documentary that intones:

…Through all this, our stiff upper lip has prevailed, because this country is not for turning, not when other countries have tried to destroy us, and not when we’re in the midst of trying to destroy ourselves.

And I know some are yelling, “Britain, come back, don’t do this! You’re pointlessly f*cking yourselves!”

And to them we say, “Oh, we have not yet even begun to f*ck ourselves! We shall f*ck ourselves at the ports, we shall f*ck ourselves in the shops, we shall f*ck ourselves in the hospitals, in the fields…we shall never surrender!”

…And once we deliver this mortal wound to ourselves, we will savor the taste of victory!

6) Two of my sharp-eyed readers noticed a mistake in last Friday’s email: the last item in the subject line was Theranos, but there was nothing about the company in my email. That’s because at the last minute, I decided that it was already quite long, so I took out this section (but forgot to change the subject line):

Run, don’t walk, to read this highly entertaining article: “She Never Looks Back”: Inside Elizabeth Holmes’s Chilling Final Months at Theranos.

What a total sociopath! It's good to see that the Justice Department is all over this and that she’ll soon be behind bars as punishment for her vast fraud. Yet I don’t doubt for a moment that she genuinely believes she’s a victim. Unbelievable… Excerpt:

When I asked the former executive close to Holmes if she has come to regret what happened, the response surprised me. “Elizabeth sees herself as the victim,” this person said. “She blames John Carreyrou, she blames David Boies, and she blames Heather King.”

…Holmes is currently living in San Francisco in a luxury apartment. She’s engaged to a younger hospitality heir, who also works in tech. She wears his M.I.T. signet ring on a necklace and the couple regularly post stories on Instagram professing their love for each other. She reliably looks “chirpy” and “chipper.” She’s also abandoned the black-turtleneck look and now dresses in athleisure, the regrettable attire of our age. Notably, she is far from a hermit. She tells former colleagues, according to the two executives, that she is greeted by well-wishers on the street who are rooting for her resurrection. It’s a stark contrast to many of her old colleagues. Former Theranos employees I have spoken to have relayed horror stories about their inability to find work after leaving the company, now with a permanent stain on their résumé.

Holmes, for her part, still doesn’t seem to think the work of Theranos is finished. Like her dog’s famed namesake, she still wants people to know that Theranos was going to save the world. But in order to do so, she needs to share her side of the story. She has recently held more meetings with filmmakers to try to collaborate on a documentary about her “real” story. And Holmes desperately wants to write a book. In Holmes’s eyes, according to former employees, this is only the beginning of yet another redemption story—possibly one that is too good to be true. As for Balto, Holmes still tells people he’s a wolf.

If you’re like me and can’t get enough of this story, I highly recommend one of the best books of 2018, Bad Blood: Secrets and Lies in a Silicon Valley Startup, as well as the ABC News podcast, The Dropout (see the two-minute video here), which I just listened to last week. There’s also a documentary I haven’t seen, The Inventor: Out for Blood in Silicon Valley, which is in a few theaters and will be airing on HBO on March 18th. Here’s a review: The Inventor examines the $9 billion Theranos scandal, and blames Silicon Valley.

PS—This part of the story about her stupid dog made me laugh out loud:

Immediately after returning to California, Holmes decided that Balto would hardly leave her side on the quest to save Theranos. Each day, Holmes would wake up with Balto at the nearly empty Los Altos mansion that she was renting about six miles from her company’s headquarters. (Theranos covered the house’s rent.) Soon after, one of her two drivers, sometimes her two security personnel, and even sometimes one of her two assistants, would pick them up, and set off for work. And for the rest of the day, Balto would stroll through the labs with his owner. Holmes brushed it off when the scientists protested that the dog hair could contaminate samples. But there was another problem with Balto, too. He wasn’t potty-trained. Accustomed to the undomesticated life, Balto frequently urinated and defecated at will throughout Theranos headquarters. While Holmes held board meetings, Balto could be found in the corner of the room relieving himself while a frenzied assistant was left to clean up the mess.

Around this same time, Holmes says that she discovered that Balto—like most huskies—had a tiny trace of wolf origin. Henceforth, she decided that Balto wasn’t really a dog, but rather a wolf. In meetings, at cafés, whenever anyone stopped to pet the pup and ask his breed, Holmes soberly replied, “He’s a wolf.”

PPS—The denial of some of her backers – all smart, accomplished people – is mind-boggling. Tim Draper is going to have a hard time living down this interview: Check out this surreal chat with Theranos investor who says he’s “thrilled.” Excerpt:

In yet another jaw-dropping interview that seemed to be broadcast from an alternate universe, venture capitalist Tim Draper tenaciously defended the failed blood testing company Theranos and its disgraced founder and CEO, Elizabeth Holmes.

In the interview, which aired on CNBC, Draper called the limping start-up “one of those extraordinary companies” and said he was glad to have backed Holmes, whom he knows personally. Draper provided $500,000 in seed money when Holmes was just starting the company as a 19-year-old Stanford drop-out. “It was a great mission and she did a great job,” he said. “I’m thrilled with what she’s done.”

He went so far as to call Holmes a “great icon,” to which CNBC “Closing Bell” co-host Kelly Evans responded bluntly: “Icon of what?” Draper didn’t respond to the question, though.

…“Why is [Theranos] worthless? It’s worthless because this writer was like a badger going after her, like a hyena going after her, and then it became a bigger and bigger thing,” he said. “She got bullied into submission,” Draper explained, adding that if it weren’t for Carreyrou and other opponents, Theranos “could have been one of these big, huge winners.”

Amid his mind-boggling defense, the investor did admit that Theranos was now in the “loser column” of his investments list, a list that also includes Tesla and Bitcoin. But Draper argued that Holmes’ blood testing technology would live on and get picked up by other entrepreneurs. “It’s going to happen,” he said. “We’re eventually going to change healthcare as we know it, and she will have had a huge hand in making that happen.”

PPS—Note to Elizabeth Holmes: when you are under indictment for 11 felony counts for harming and defrauding thousands of people, don’t post pictures of your happy, carefree life with your fiancé on social media. (He's an MIT grad – I thought MIT guys were supposed to be smart?):