Rowan Street Capital commentary for the fourth quarter ended December 31, 2018.

“A military genius is the man who can do the average thing when everyone else around him is losing his mind.” – Dwight Eisenhower

Q4 hedge fund letters, conference, scoops etc

Dear Partners,

What a wild ride! From the worst December since 1931 to the best January since 1987. Past two months have clearly shown why there are no market timers on the Forbes list!

In 2018, our fund was down -1.2% net of fees and expenses vs. a decline of -4.4% for the S&P 500. Please check your individual statements as your actual performance may differ depending on the date you became a Partner. If you look at the chart below, 2018 was a negative year for every single asset class with the exception of stuffing cash under your mattress. It was also the first negative year for US large cap stocks since 2008. International developed markets where down -14%, emerging markets where down -15% and most mutual funds and hedge funds lost money in 2018.

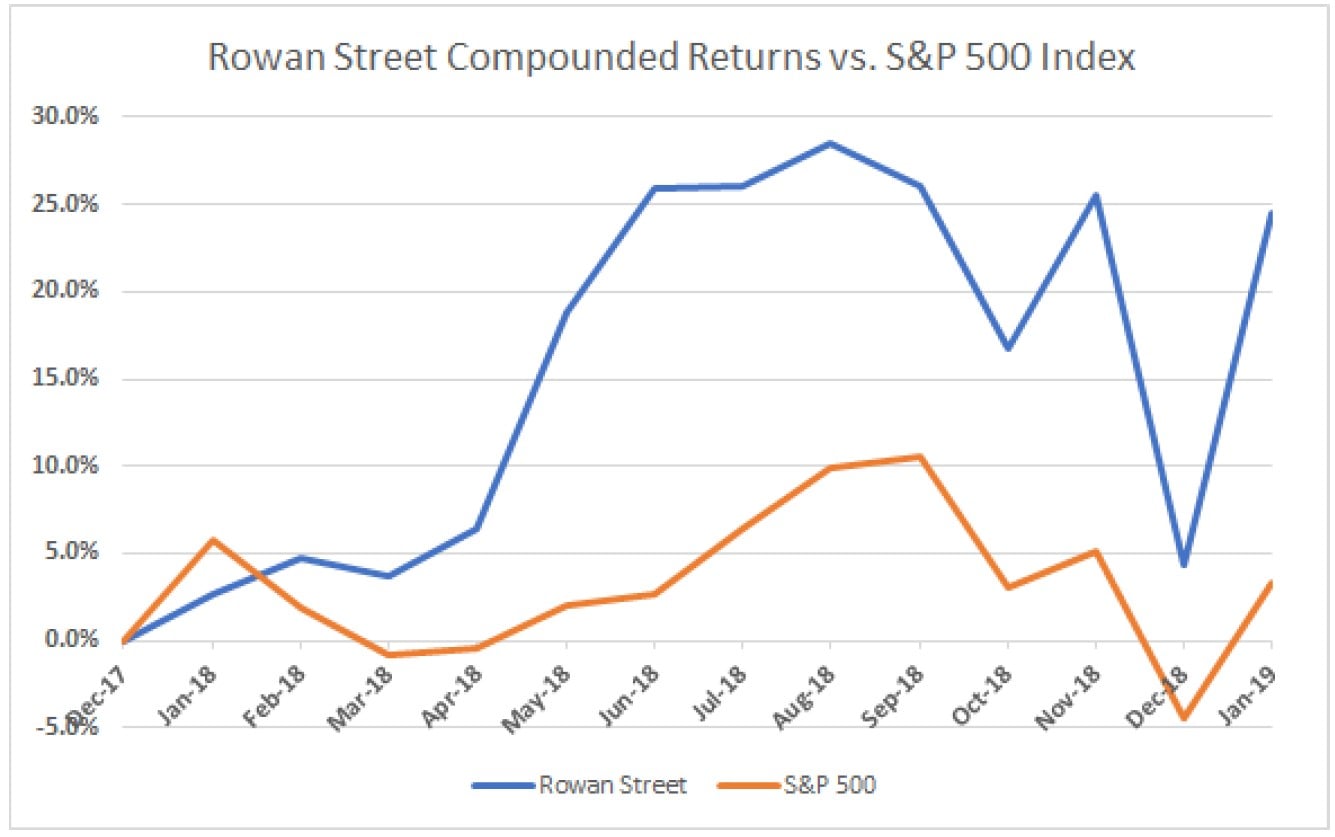

However, as a limited partner in Rowan Street Capital (RSC), if you went on vacation to a deserted island for the past 13 months (as of this letter) without access to the internet or any kind of news flow, you would have come back to our fund being up +24.4% (gross of fees). The general market, as measured by the S&P 500 index, was up only +3.3% during the same time period. The chart below shows the volatility that took place in the interim, with a big drop in December and a significant rebound in January, eliminating December losses for our fund. We believe this chart is a more meaningful presentation of the value-creation that Rowan Street has experienced as opposed to just referring to 2018 numbers, which do not tell the whole story.

That significant outperformance over the past 13 months as depicted by the graph above was due to the opportunistic investments that we made back in 2017. In our 2017 year-end letter we wrote:

We were very fortunate to raise a lot of new capital throughout the year, which is great news for our fund and for all its partners. In fact, we closed the year with 2.4x more capital than we started with, which we are more than pleased with. It so happened that the bulk of new capital came in the summer months, at which time we had opportunistically deployed the new funds into new ideas that, in our view, present significant long term value. As such, these new investments represented over 40% of our entire portfolio and are still in early stages of our investment cycle, thus they have not had the time to contribute to our returns yet, at least not by December 31st (investment performance of companies often does not correlate with calendar year end).

How our 2017 investments played out in 2018

Under Armour (UA): we laid out our investment thesis for UA in the 2017 year-end letter (you can find our past letters on www.rowanstreet.com). It was the biggest contributor to the outperformance in 2018 as the stock was up about 60% as of November.

Tractor Supply (TSCO): we shared our investment rationale on TSCO in Q3 2018 letter. The stock was up 20% as of September, which is when we sold our position as we needed cash in order to take advantage of more attractive opportunities. Overall, we made 70%+ on this position since we first bought in summer of 2017.

Chipotle (CMG): we talked about this investment in Q3 2018 letter. The stock rebounded quickly in 2018 and we sold in August to register an 80% gain.

TripAdvisor (TRIP): the stock was a solid contributor to the outperformance in 2018 as it posted an 85% gain as of November.

Gentherm (THRM): we started building this position in Q4 2016 and added to it in 2017. The stock was a solid contributor to the outperformance as it was up 42% as of end of September. We ended up selling the entire position in Q4 because we needed cash to take advantage of better opportunities presented to us by Mr. Market.

PLEASE NOTE: Even though several of our holdings mentioned above had a pretty quick turnover, this is not our intent. They just happened to discount several years of earnings power into a short period of time. And at the same time, we had much better quality opportunities (four to be exact) that became available to us at very attractive valuations. As you know, we are long term investors and we typically invest with at least 3-5 year investment horizon. However, we will boldly take advantage of opportunities presented to us by temporary market dislocations, which was the case in the fourth quarter of 2018. On average, you should expect us to stay with our positions for 3-5 years or longer.

Our Behavior in December

As we started building out our new positions, December happened. Both the Dow Jones Industrial Average and the S&P 500 had their second worst December on record (only behind December 1931 when the market lost 14.5%) as fear about the trade war, high interest rates and worries about slowing corporate earnings took over investors’ minds. It was very frustrating to watch such a great year’s performance “evaporate” before our eyes. However, at Rowan Street we try to be as logical and unemotional as possible. Fear is a very strong emotion that can negatively affect investor's judgement, and we are always happy to take advantage of the irrational decisions that take place in the marketplace.

Even though many were spooked by the market volatility in the fourth quarter, at Rowan Street we view volatility as our friend, not our enemy. In fact, assets can fluctuate greatly in price and not be risky as long as they are reasonably certain to deliver increased purchasing power over their holding period. We believe there is no wealth creation without volatility! It is simply the “price of admission” that the market demands you to pay, yet there is so much effort on Wall Street that is dedicated towards minimizing volatility. These efforts are catered towards nurturing clients’ emotional well-being while creating an illusion of safety, but almost always come at a huge cost of reducing clients’ long term returns.

In the last three months of 2018, and especially in December, Mr. Market has finally given us an opportunity to own businesses that we had dreamed of owning at prices that presented us with some very attractive expected rates of returns. In fact, our internally calculated IRRs (Internal Rate of Return) for the next 3-5 years for these investments are in excess of 20% per annum. We used this difficult quarter to our advantage, and in our view, we entered 2019 with a significantly better quality of companies in our portfolio with much more favorable long term prospects than we’ve ever had since the funds’ inception. Since we are still in the process of building out our new positions, we will be discussing these investments in our future letters.

Thank you again for your confidence and trust in our investment discipline. We will continue to invest with a long time horizon like it is our own money – because it is. We appreciate the opportunity to grow your family capital alongside ours. As always, should you have any questions or comments, we would be very happy to hear from you.

Sincerely,

Alex Kopelevich, CFA

Joe Maas, CFA

This article first appeared on ValueWalk Premium