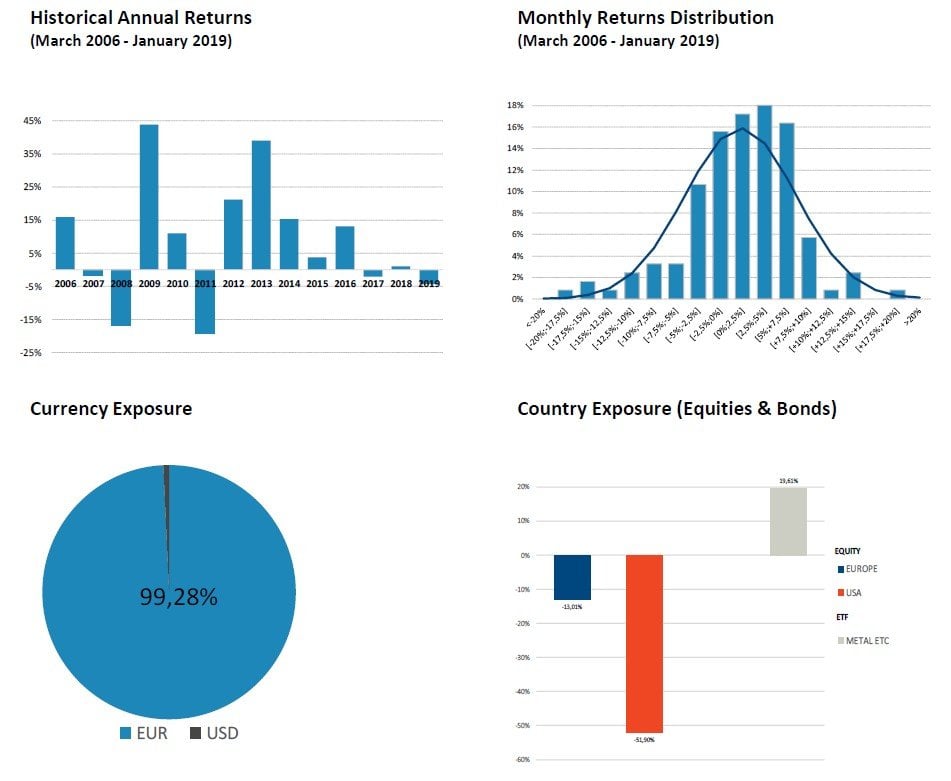

Global Allocation Fund commentary for the month ended January 31, 2019.

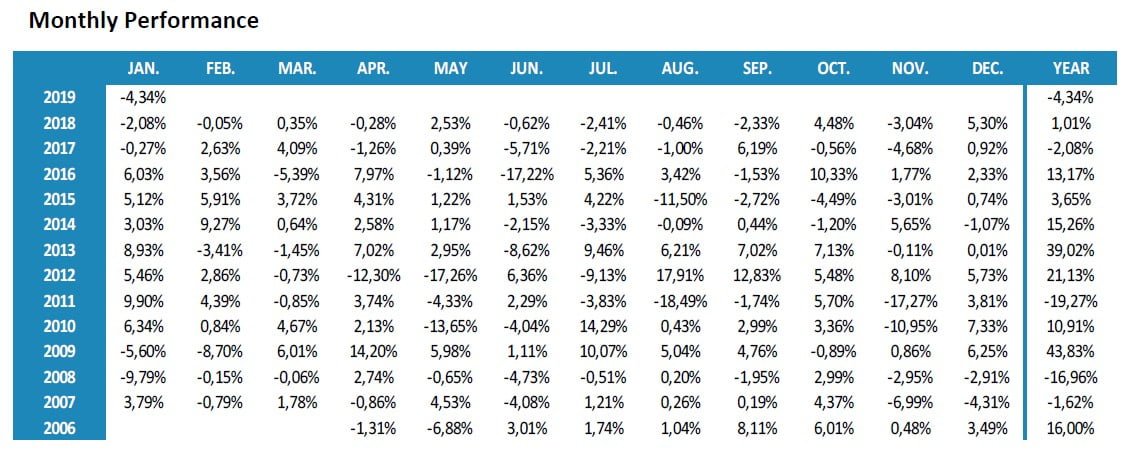

January has been the best month for equities in the last seven years. The panic reached at the end of December and the clearly oversold condition of markets have been the main reason to rally.

Q4 hedge fund letters, conference, scoops etc

About credit markets, which worries us and is a better measure of the economic environment, they have witnessed a pronounced improvement as well. Less so in Europe and clearly concentrated in the last days of the month.

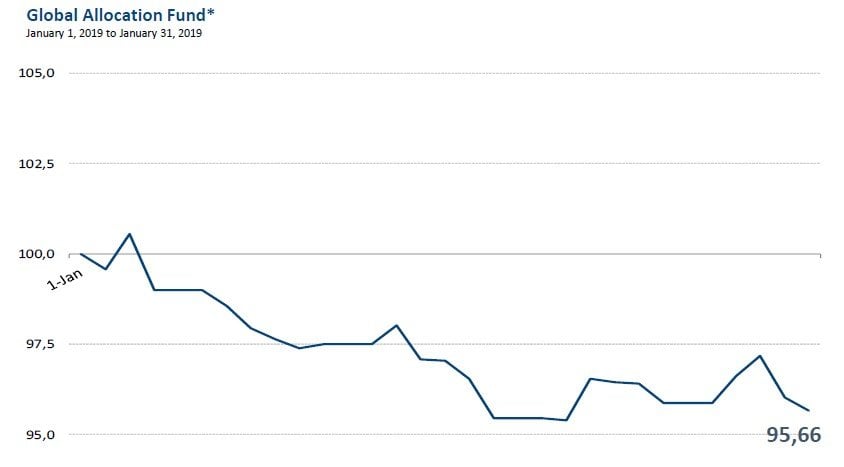

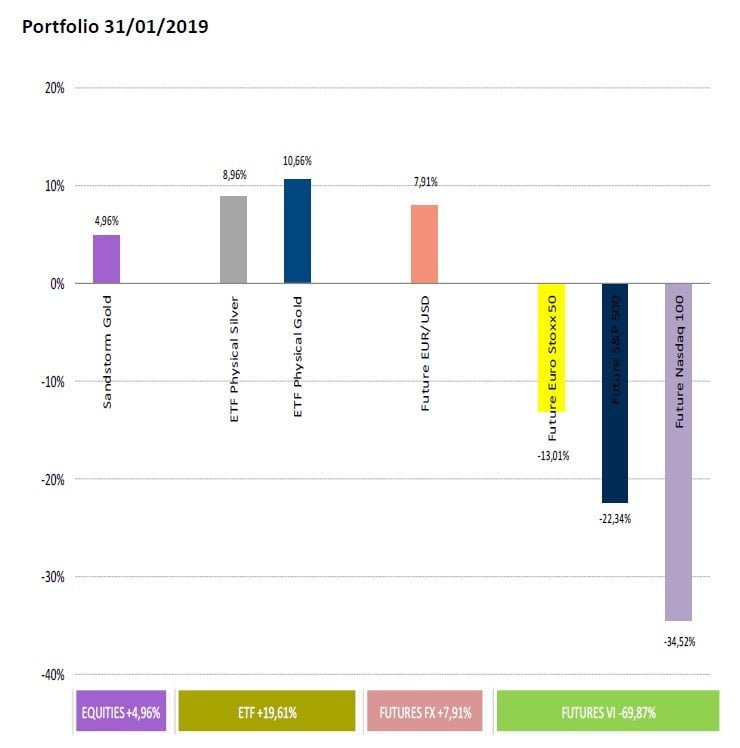

During the last days of 2018 we saw this recovery starting. Nevertheless, the year started with downward revisions both in sales and income by China (followed by numerous companies, specially in China, but also in the US and Europe), which provoked an ugly start of the month. We decided to start implementing our views by shorting the market and have been increasing our short during the month as markets rallied.

Although it is true that market internals have improved considerably, both macroeconomic (with bad data from China and both in Europe and the US) and microeconomic data (with constant downward revisions to earnings during the month) have not been positive at all.

Markets have been helped, as could not be otherwise, by Central Banks, with the FED leading the movement indicating a revisions of rates hikes expectations, hinting on a possible freeze and even stopping the reduction in the balance sheet if necessary.

Thus, once more, investors have jumped into risk assets again, with blind trust that Central Banks are in control and the party will continue. No doubt that by now Central Banks are achieving the task, but we cannot help to see that the way travel from Central Banks to car dealers keeps been a little too long…

Obviously, we have serious doubts that this plan will succeed this time around. We have no doubt that Central Banks will do as much as they can. We will follow closely both macro and micro dynamics to see if anything makes us change our mind. Meanwhile, we think this rally is a good opportunity to sell. We hope the trees do not prevent us from seeing the forest.

This article first appeared on ValueWalk Premium