Forge First Asset Management commentary for the month ended January 31, 2019, discussing the positive returns of Forge First Long Short Class F Lead Series and Forge First Multi Strategy LP CL F Lead Series.

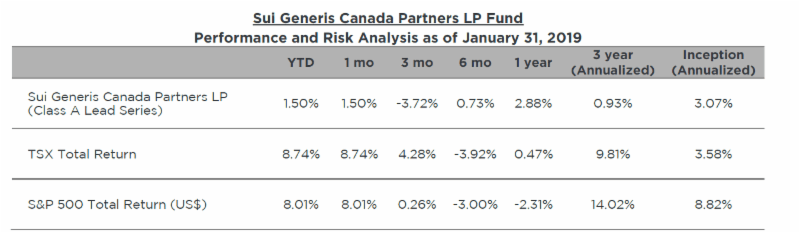

The Sui Generis Canada Partners LP fund was up 1.50% for the Class A Lead Series during January 2019, resulting in a year-to-date net return of 1.50% since inception (March 1, 2015) and cumulative net return of 12.57% (3.07% annualized).

Q4 hedge fund letters, conference, scoops etc

Forge First Asset Management January 2019 Commentary

What a difference a month makes. While December found itself in the conversation for the “worst month ever”, January represented the polar opposite with stocks rallying in an aggressive and unrelenting fashion throughout the month. Amusingly, the violent swings in equities can best be explained by changes in sentiment rather than changes in any particular fundamentals as we believe investors have chosen to swing back and forth between optimism, pessimism, back to optimism again despite no substantive change in the backdrop. Of course there have been some changes to economic numbers but nothing that warrants a 15% round trip in stocks. Traders’ obsession with the language used by the Federal Reserve of the U.S. has reached a fever pitch with the new interpretation being that Powell the uber-dove will keep the cheap money spigots open forever while signaling a potential reduction of the balance sheet normalization program the Fed had undertaken.

The flip side of the return of cheap money and the subsequent arrival of ‘TINA’ (there is no alternative) is that central bankers wouldn’t have pivoted back towards stimulative policy so quickly if the economy wasn’t flashing some alarming warning signs. All of this is to say investors are skittish, chasing stocks both to the upside and the downside based on a daily deluge of macro-economic ideas with few having a firm grasp on what’s actually going on. At Forge First, while we assess this macro data & adjust the gross and net exposures of the funds as we deem appropriate, the vast majority of our time is spent researching companies and picking stocks, leaving the bulk of the economic forecasting to the forecasters, brave souls that they are.

As can be deduced from the lack of increase in the net exposure of hedge funds between 12/31/18 & 1/31/19 seen in the graph on the above left, the extent of the bounce back in equities caught many investors by surprise, including us at Forge First. Most indicators of global growth are exhibiting deteriorating trends. To show just one example, the graph on the above right suggests a lousy outlook for world trade volumes in 2019 given the sharp fall in the new orders component of global PMI.

Combined with the uncertainty that lies with the pending binary outcome from the Chinese American trade talks, our funds remained defensively positioned through the month of January. We had presumed that while the extreme bearishness and negativity that gripped the market at the end of 2018 could have been overdone, any substantive bounce would be met by selling. Of course this was not the path that materialized.

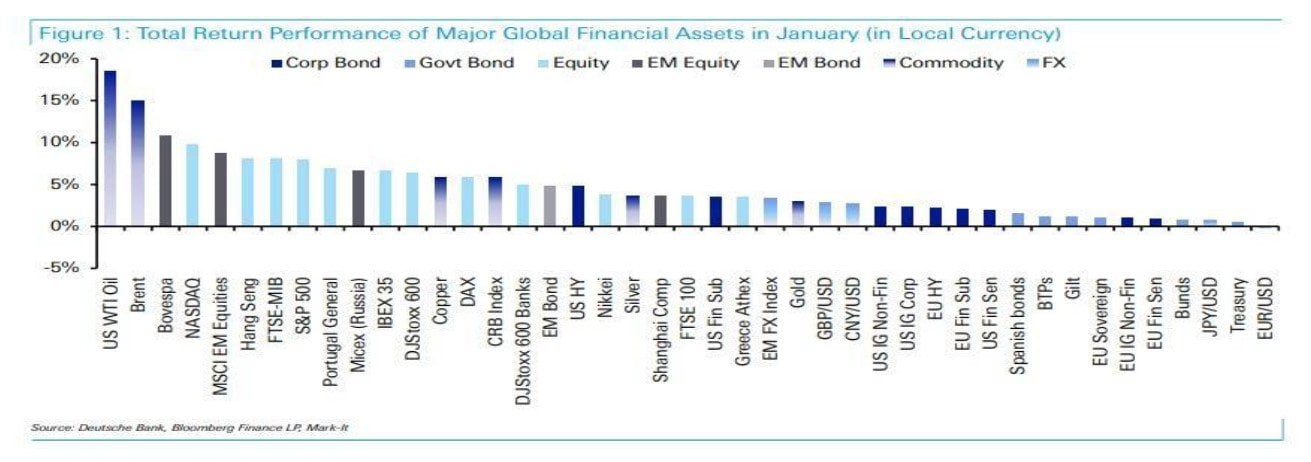

It has now been well documented that 2018 was the year when “nothing worked” as represented by Deutsche Bank’s aggregate of 38 different financial assets (to be fair, 93% of them were down…almost nothing worked). Striking as that is, it is eclipsed by the fact that January 2019 was the first time ever that all 38 assets in the group posted a positive return. So the snap back in assets after the truly dreadful 2018 was truly (and literally) unique.

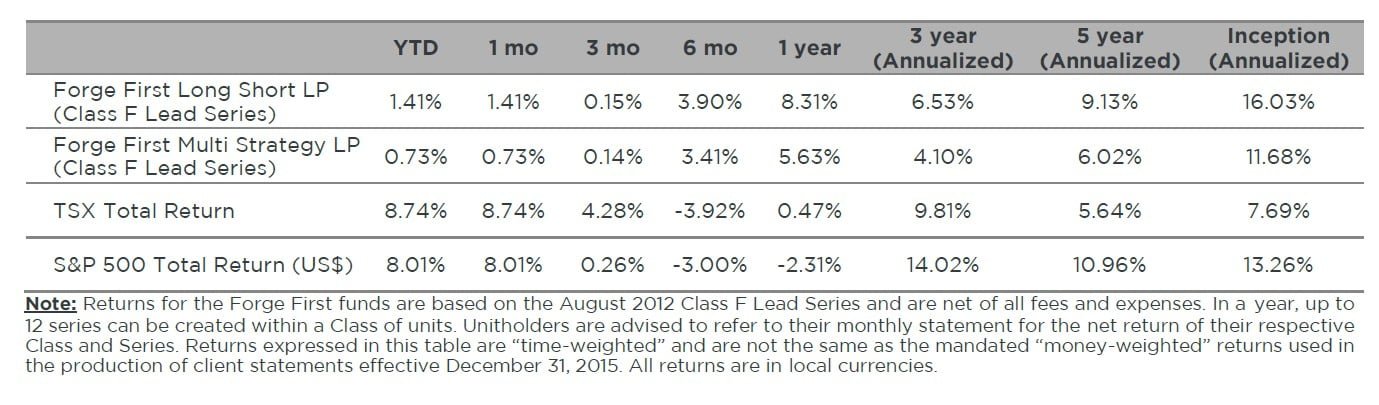

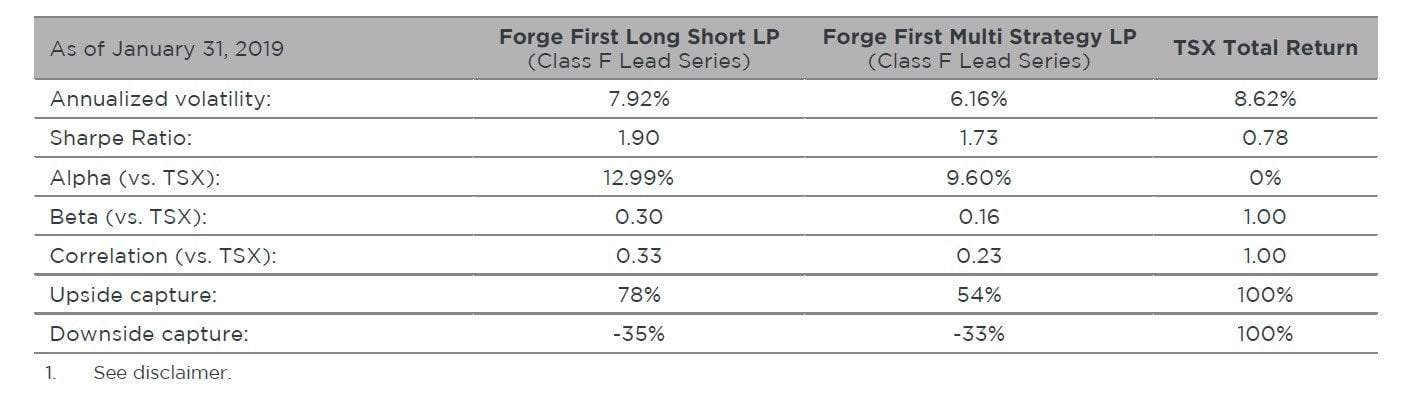

In spite of what turned out to be an overly cautious stance, the funds both generated positive net returns in January with the Forge First Long Short Class F Lead Series gaining 1.41% net of fees while our Forge First Multi Strategy LP CL F Lead Series advanced 0.73% net of fees.

We always like to say that we let the ideas generate the net exposure in our funds. We don’t ignore the macro picture, one would be negligent to do so, but we simply do what we can to let the strength of our ideas dictate how the funds are positioned.

If the team happens to generate more ideas showing a strong free cash flow yield our funds are likely to tilt towards the longer side. Conversely if everything seems expensive and decent valuations are hard to come by, that likely tells you the market has gotten a bit ahead of itself and as a result our funds may naturally drift towards a lower net exposure, complemented with an options overlay to hedge beta. The result at the moment is that our funds are positioned very similarly to December, a mild net long orientation with a focus on our core competencies.

In a continuation of the reversal of fortune theme, contributions in January came, as one would expect, almost entirely from the long book while our hedges and alpha shorts largely represented a drag on performance; the cost of insurance as it were. Speaking to the long book, the gains were broadly distributed by sector while top contributions came from varied sectors with four long-term holdings representing the biggest gains; Parex Resources (PXT.CA), Air Canada (AC.CA), and Atlantic Gold (AGB.CA).

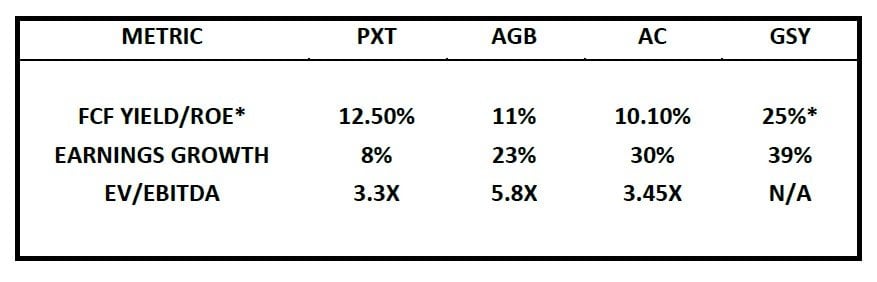

Metrics for these four holdings are highlighted in the above table. Each company offers the rich FCF yield (GSY.CA or goeasy being a financial is a ROE story versus a FCF story) that we seek in an investment, but with growth and attractive valuations to boot! Also, this small sample shows that even within industries that are typically capital heavy (and thus, free cash flow light), one can find well run businesses that generate lots of cash and fit in our square, it’s just a matter of turning over enough rocks to uncover the gems. To that end we believe the time is likely right to tighten up your exposure to equities and focus on your highest conviction names rather than featuring more generic market exposure.

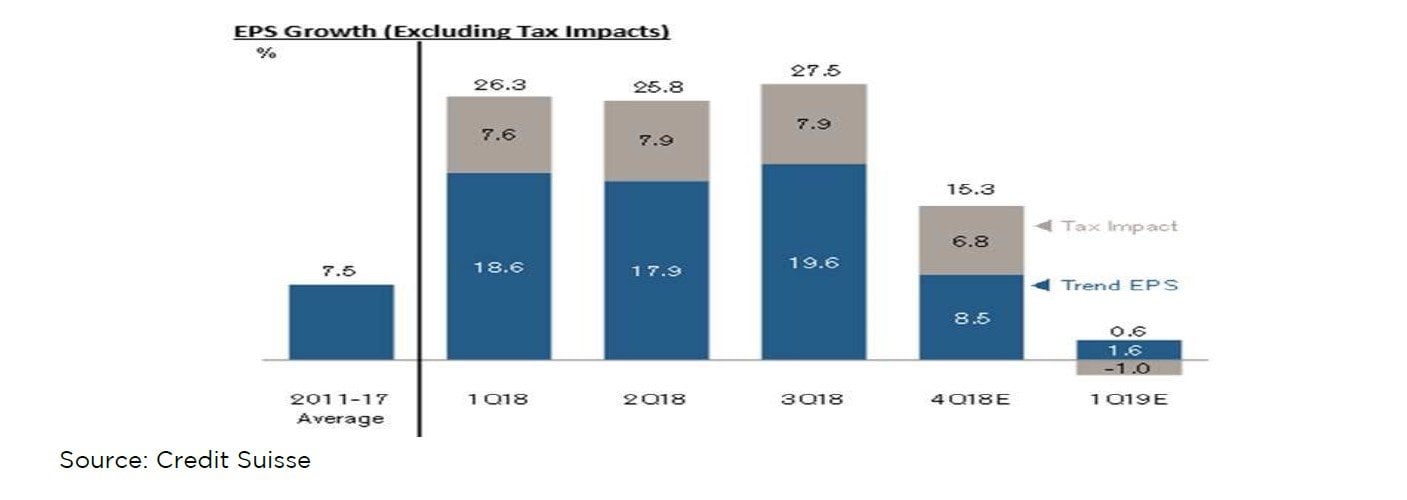

Looking ahead we’re going to go out on a limb here and assume there is at least a mild mean reversion in February. That said, we would not be shocked to see equities continue more modestly higher if earnings continue to beat lowered Q4 2018 expectations. However, as you can see from the table above, earnings growth is definitely contracting for the S&P 500. But all of the fear that had taken stocks lower in Q4 appears to be gone and the result is that the multiple contraction in stocks has been almost entirely reversed. A particularly striking representation of this is the seven consecutive weeks of decline in the VIX, something that has happened only twice before. We would caution against looking too much into this since with the previous two instances stocks rallied after one decline and selling off after the other. So, per our MO we will keep focused on what we do and prepare for things to fall somewhere in the middle of the recent extremes, something that should allow us to generate a consistent net return for our investors.

Our funds preserved capital in December and had solid net gains for 2018 as a whole. In talking to investors about the year ahead, no one questions that we’re “late in the cycle”; it’s a matter of whether it’s the 8th inning or we’re already in extra innings. The “easy money” has been made this cycle and we’ve entered a period that’ll probably last a few years where you need to focus on managing risk, and preserving your capital, versus just chasing returns. You know we’ll continue to work hard to merit your attention and deserve your business.

Please visit our website for information on our funds. Should you have any questions, please contact us.

Thank you,

Daniel Lloyd

Portfolio Manager

Andrew McCreath

President and CEO

This article first appeared on ValueWalk Premium