It’s starting to look like the fourth-quarter bear market may have been just a mere blip on the market radar. Active portfolio managers have been returning to risk-on positions over the last couple weeks. They’re back to buying perennial favorites like the Communication Services sector, which now contains the likes of Facebook and other momentum names, according to Bank of America Merrill Lynch.

Momentum stocks appear to have mostly picked up right where they left up before the widespread asset-price plunge, although Thursday’s pullback suggests the ride up may not be as smooth as it was almost a year ago.

Q4 hedge fund letters, conference, scoops etc

Back to Communication Services

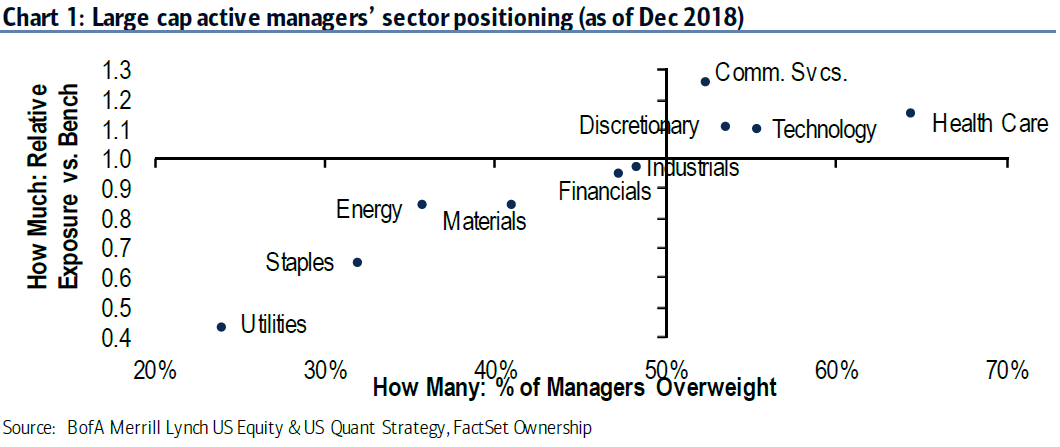

In their update on active managers' holdings this week, BofAML strategists Savita Subramanian and James Yeo said that the two "consensus picks" over the last month were Communication Services and Health Care. Active managers' exposure to Communication Services is now the highest relative exposure at 1.26 times average funds, they explained.

Almost two-thirds of funds are now overweight Health Care, which they said is the second-highest exposure they have observed in the sector since 2015. Within Health Care, funds are now at a new record overweight reading in Providers and Services at 1.5 times.

BofAML also observed "modest" overweights in Tech and Discretionary," but this has been a trend through their data's history.

"Legging it" back into risk

The BofAML team also found that active managers have rushed back into risk over the last month. Rotation from cyclicals into defensives plunged to multi-year lows in September, but that has since dramatically reversed course in just a short time.

They said exposure to Industrials over the last month climbed nearly to equal-weight at 0.98 times. In fact, they found that funds now own more Industrial names than Financials, marking the first time that has happened in two years.

The BofAML team particularly noted a rally in Aerospace & Defense, which soared from record-low levels in July to the highest level in 16 months at 1.21 times. Road & Rail also hit its highest exposure level in over two years at 1.15 times. However, active managers continue to shun Machinery as exposure to the subsector tumbled close to record lows.

Exposure to Consumer Staples, which is generally seen as "classically defensive," tumbled for the third consecutive month, reaching a new record underweight of 0.65 times in January. The strategists also noted "a clear tilt" from multinationals in preference for domestic names over the last month.

Returning to Energy

They also reported some interesting observations in Energy and Materials. They explained that as sectors shrink, sometimes investors see them as "too small to matter," so they remain persistently underweight. They saw this behavior in Energy and Materials as exposure to both sectors tumbled throughout the last six months of 2018.

However, they said that over the last month, relative exposure to Energy among active funds jumped to the highest level since April 2017. They cited the 30% rally in oil prices off December's lows. Even though funds are still underweight on Energy, "on an oil beta-adjusted basis managers are now overweight Energy stocks." They also observed steady inflows to the sector.

However, the BofAML team declared that the Materials sector is still "in purgatory" as exposure has fallen to its lowest level in a year and the third-lowest level recorded since at least 2008.

"But everyone else is buying it..."

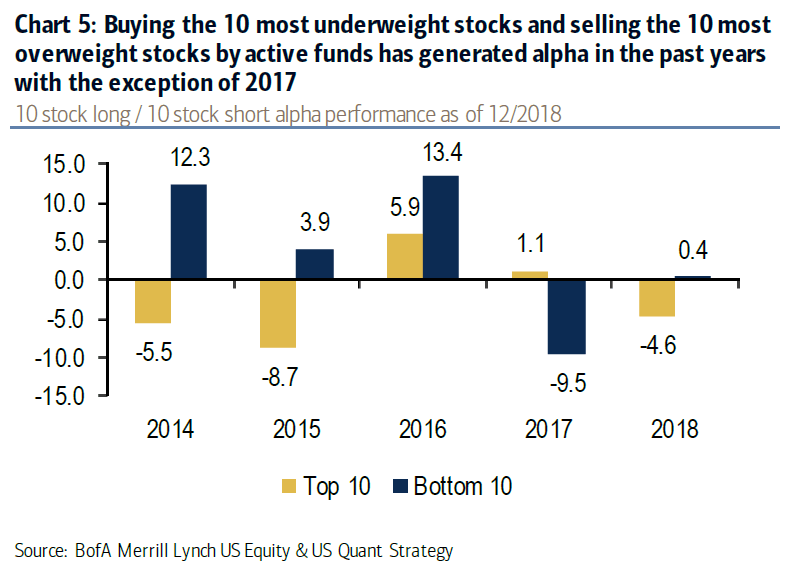

The strategists also highlighted a trend we've been hearing more and more about recently. Crowded stocks have long been a topic of conversation, but during the fourth quarter, crowded names were especially troublesome for some fund managers. In fact, some managers capitalized nicely on avoiding crowded stocks.

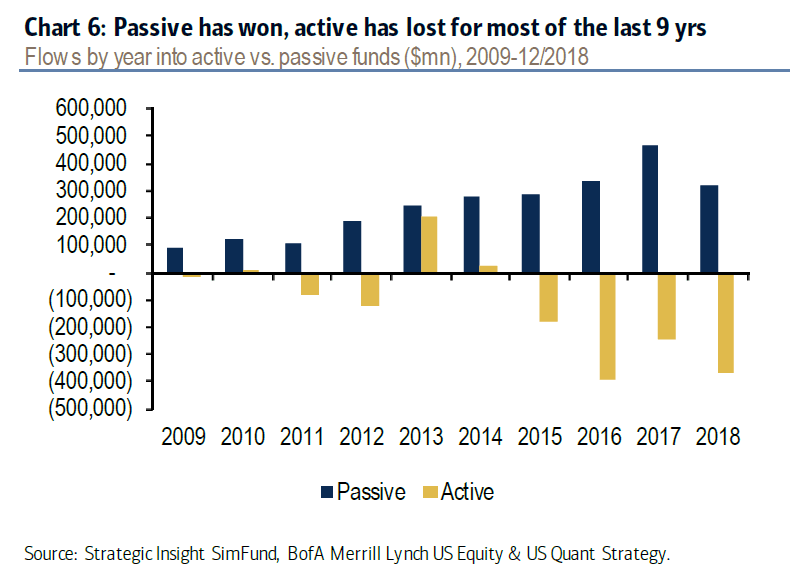

BofAML noted that outflows from active funds were again close to record highs at $370 billion.

However, the firm also said that last year, the 10 most crowded stocks lagged the 10 "most neglected stocks" by more than 5 percentage points, a trend that continued into the new year. The firm estimates the annualized spread at about 5 percentage points, noting that buying the most underweight stocks and selling the most crowded stocks usually generates alpha.

This article first appeared on ValueWalk Premium