Whitney Tilson’s email to investors discussing his seminar videos; Mondelez; short-sellers’ tactics; Canadian scammers engineered a blatant pump-and-dump, Cool Holdings; exercise.

1) Quite a few folks are asking when Glenn and I are going to next teach the three seminars we developed and taught all over the world last year: Lessons from the Trenches: Value Investing Bootcamp, How to Launch and Build an Investment Fund, and an Advanced Seminar on Short Selling. The answer is, given the upcoming launch of Empire Financial Research, we haven’t scheduled anything and probably won’t for a while – later this year at the earliest.

Q4 hedge fund letters, conference, scoops etc

All three seminars are, however, available on video – but only for another few weeks, so don't wait to register! (Once you do so, you'll have access to all of them for a full year, as well as permanent copies of all of the slides we teach from).

More information about them is posted here, and you can check out free sample videos and register here, here and here. There are big discounts if you register for all three, as well as for students and investors under 30 – just email me for details.

2) I’m scratching my head about what investors could possibly be thinking these days with Mondelez (MDLZ). I owned the stock a couple of years ago because I thought Kraft Heinz (KHC) would make a bid for it, but now that that’s off the table, I can’t figure out why it’s at an all-time high, trading at 3.3x sales, 16.8x trailing EV/EBITDA and 20.8x trailing EPS.

KHC’s woes are bad news for MDLZ for three reasons: a) KHC isn’t going to bid for it; b) most of the headwinds affecting KHC are impacting the rest of the sector as well; and c) to the extent that some of KHC’s woes are self-inflicted (cost-cutting and price-raising that went too far), they’re addressing them, which is bad news for competitors.

3) This Heard on the Street article in today’s Wall Street Journal, U.S. Cannabis Law Is Helping Canada Make Hay, reminded me of an article I included in an email a couple of weeks ago about how regulators are supposedly investigating short sellers (SEC, OSC examine short-sellers’ tactics). I just learned that the author of this article, Christina Pellegrini, has just left the Globe and Mail to…wait for it...go work for a cannabis company!

Hmmm, you think there might be a relationship between this and her making a 180-degree turn, going from being objective and unbiased in her earlier reporting on the sector to writing favorable articles about the cannabis industry and highly criticizing short sellers???

It reminds me of one of Munger’s favorite sayings, a German proverb: “Whose bread I eat, his song I sing…”

4) In contrast, here’s a story by someone doing real journalism, David Milstead, also at the Globe and Mail: How two Canadian financiers took an obscure Apple reseller for a wild ride. In it, Milstead exposes how Andy “the goat f***er” DeFrancesco (click here to see what Gabriel Grego exposed about his dirty deeds at Aphria at my shorting conference in December) and Aaron Serruya, who is also up to his eyeballs in the cannabis sector, engineered a blatant pump-and-dump last year of an obscure company, Cool Holdings (which, it won’t surprise anyone to learn, is based in Miami; the only scammier place in the country is Boca; watch out for Nevada and Utah as well…).

Last May, DeFrancesco and Serruya joined the board of a tiny, money-losing company called InfoSonics, which sold smartphones in Latin America. A month later, they renamed it Cool Holdings and gave it a new stock ticker AWSM (“awesome” – get it?).

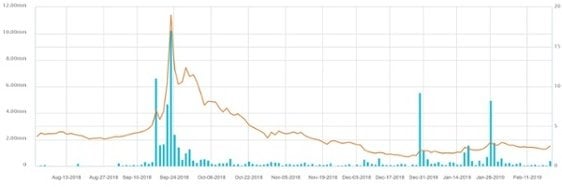

Then, they paid some shady companies to write highly promotional articles, which goosed the stock from around $3 to a high of $22.61 on September 21 before it collapsed (of course), as you can see in this chart:

I’m sure you will be shocked – shocked! – to hear that the company hasn’t issued a press release since October and its auditor as well as both DeFrancesco and Serruya resigned in December.

Where is the SEC???

5) I had to run to catch my train earlier this week, which was the only exercise I got that day, so I was glad to read this article about the health benefits of short bursts of activity: The most effective form of exercise isn’t “exercise” at all. Excerpt:

Have you recently carried heavy shopping bags up a few flights of stairs? Or run the last 100 meters to the station to catch your train? If you have, you may have unknowingly been doing a style of exercise called high-intensity incidental physical activity.

Our paper, published today in the British Journal of Sports Medicine, shows this type of regular, incidental activity that gets you huffing and puffing is likely to produce health benefits, even if you do it in 30-second bursts, spread over the day.

In fact, incorporating more high-intensity activity into our daily routines—whether that’s by vacuuming the carpet with vigor or walking uphill to buy your lunch—could be the key to helping all of us get some high quality exercise each day. And that includes people who are overweight and unfit.