January 4, 2019 – For going on ten years I have been making the case that governance is a superior forward-looking indicator of how well a company will perform – both in terms of risk and return. But governance is far more than the standard tick-the-box factors like board chair / CEO separation and like-minded metrics. Governance is how a company lives. It’s how a company pursues its objectives and what it expresses as its values – not just in writing, but also by its actions and the environment which it establishes.

Governance is a measure of trustworthiness and even further, governance is a measure of the respect that companies have for their owners and other providers of critical capital.

I’ve long stated that governance is much broader than the G that populates ESG ratings which have become so popular. In fact, ESG is more accurately described as a subset of what constitutes governance, not vice versa. That’s one of the reasons that a broad approach to evaluating governance is a superior differentiator for investment models that simply use ESG metrics.

Q3 hedge fund letters, conference, scoops etc

The year that just ended demonstrated this yet again.

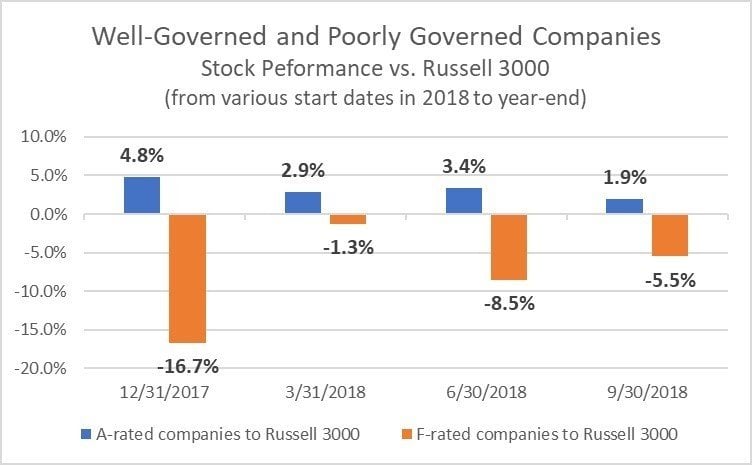

The relative performance of U.S. listed companies that receive A ratings (A+, A, and A-) and F ratings (F+, F, F-) using this method of evaluating governance - something we call a Trust Rating® – showed that the A-rated companies outperformed the F-rated companies by 11.3% during 2018. A-rated companies outperformed the broad market by more than 3% and F-rated companies under-performed the broad market by more than 8%.[1]

In actuality, for forward-looking investment performance, one needs to take these Trust Ratings® one step further and ask whether the market has already priced in the information or if the market is misunderstanding the expected future risk and performance of a company – something a reliance on ESG ratings misses. We call these Sustainable Value Grades ® and the relative performance is striking.

Figure 1 – Sustainable Value Grades ® and Investment Performance

Companies with A-ratings (Sustainable Value Grades ®) at the end of 2017 outperformed the broad market by nearly 5% and outperformed F-rated companies by more than 21% during 2018. Measures of relative performance from each quarter-end to December 31, 2018 tell a similar story. And the volatility of the respective groupings likewise shows the ability to make a superior differentiation – the A-rated companies are less volatile.

Down markets are ideal for demonstrating the value of this differentiation because this kind of evaluation helps to truncate losses in portfolios by identifying the companies most likely to experience large downside movements in price.

For most of the ten years that I’ve discussed this concept of linking governance with risk and performance, asset managers and allocators have greeted it with skepticism. I’d like to explain this in the most favorable way that I can: we speak different languages around the meaning of risk and maybe also around governance. My view on risk is that it has two sides - positive and negative. It’s an expression of uncertainty about deviations from expectations, both good and bad. It’s a measure of the relationship that capital providers have with capital users. And, it has to be forward-looking and probabilistic, not based on past quantitative relationships.

If you consider any relationship, trust is built when you experience few deviations in what you expect from that relationship. This applies to work relationships, personal relationships, or relationships that you have with a service provider. As you hope for good relationships to continue, you want to trust that what they present to you in image and experience is real and enduring. The past is an important gauge of this. But the past doesn't tell all.

High trust levels lead you to commit more of your personal capital to a relationship - to put more at risk to future engagements. So, you don’t want to worry that you are being fooled. Not knowing the future with any certainty, what steps might you take to determine if those kinds of relationships are likely to be trustworthy on a going-forward basis? Would you simply stop at saying, "it's been good so far?"

Investors likewise seek trustworthy relationships with the companies in which they invest. No one wants to be the fool with someone else’s money. So, when grading a company, investors want to know if it's more or less trustworthy than other possible recipients of their capital. They need to ask dozens of forward-looking questions about how one company compares to similar ones – not just in the same sector or industry, but across factors like quality, risk, and value. Since an investment is simply an exchange of capital today for a set of expected, yet uncertain, cash flows in the future, investors need to compare expected risk and return profiles across multiple dimensions and ask whether the price they are paying for this one set of expected cash flows represents a good deal, or if their capital (and trust) are better placed elsewhere.

To answer this, investors should ask forward-looking questions about risk, risk expectations, quality, valuations, substitute investments, governance — both financial and more traditional ESG, market psychology, institutional psychology, potential accounting manipulation, and much more. They need to understand whether they are more or less likely to be surprised in this relationship and whether such a surprise is more likely to be a good one or a bad one. Further, they have to know how the market will most likely react to either realization, as “the market” has expectations too.

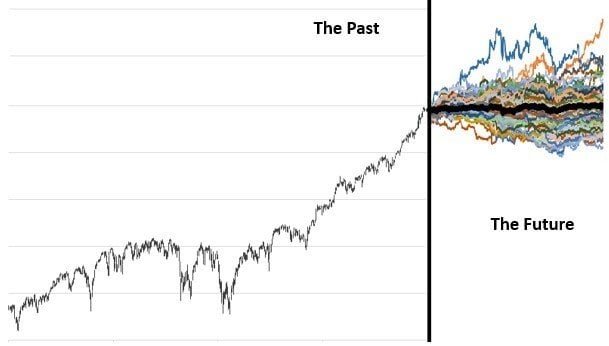

Consider this forward-looking profile of the possible price of one company’s stock:

Figure 2 – Assessing the Future Distribution of the Price of a Company’s Stock

The future distribution shown above comes from assessing trustworthiness and value through how governance is "lived" and is the driver for how we determine Sustainable Value Grades ®. Those companies with a better shape to their future-returns distribution – with higher expected value relative to required risk capital ratios – earn higher grades.

In an article that I wrote back in 2012 called Reshaping the Distribution of Outcomes, I talk about how companies can achieve a better forward-looking distribution of valuations through a different mindset about risk management. This is a small subset of the discussion of the concepts in my book Governance Reimagined: Organizational Design, Risk, and Value Creation, originally published that same year and updated in 2018. But you can use both to understand how to better assess these forward distributions.

This approach to assessing trustworthiness and value is a remarkably powerful way to understand whether a company is likely to be a good user of your risk capital – one that you can trust in an ongoing relationship. Particularly (and more responsibly), it is a remarkable way to construct portfolios that have a better shape overall – a more positive skew which makes even better use of your risk capital (see video here).

Stocks are like any financial vehicle. Their value is based upon expected performance adjusted for expected risk. If forward-looking risk is higher than the market expects, there is greater risk to a downside adjustment in price. If forward-looking measures of performance suggest that a company is overpriced for the risk that it presents, realization of that under-performance will lead to capital flowing away from that company. And, since both realizations run counter to expectations, the flow of capital away from the company will tend to be more rapid and more violent, hurting your overall performance if that company is in your portfolio. Getting rid of these kinds of companies – ones that are more likely to experience large downside movements – helps to truncate the loss side of the distribution of possible outcomes. It makes portfolios better.

When I first began this drive to help companies understand the importance of governance, I met with one of the founders of a very large investment firm. After hearing about the link between governance and performance, he told me “our company would never be interested in that.” Now, ten years later, that company is a vocal advocate for ESG-themed investing and for better corporate governance. Times change.

I’m very pleased to see how much more widely ESG investing has been adopted in these past ten years. But there is still so much more that can be done to incorporate the way in which companies live their values – how they are governed – into the investment process. There is so much more than can be done to better utilize the scarce and precious risk capital that investors allocate each and every day.

Incorporating ESG metrics can add value. Using data from two leading providers of ESG metrics and selecting the top 20% and bottom 20% of companies on December 31, 2017, we find that in 2018, the best ESG companies outperformed the worst ESG companies by just over 1%. That’s valuable. But that’s also more than 20% less than was realized when the rich array of forward-looking governance factors was utilized instead.

Assessing and incorporating how companies "live" their governance is better than ESG.

As of December 31, 2018, more than 40 of the 500 largest listed companies in the U.S. have Sustainable Value Grades ® of F. And further, more than 10 percent of companies given A grades for ESG have Sustainable Value Grades ® of F. The odds are high that your ESG-themed portfolio includes many of these.

Times have changed, but there is still more that can be done to appreciate the value of good governance.

David R. Koenig is the author of Governance Reimagined: Organizational Design, Risk, and Value Creation. Through his company, (b)right governance consulting, he provides discrete advisory services to boards, board members, key executives, and activist investors, as well as the evaluation of trust and sustainable value in publicly traded companies. He is the founder of the Directors and Chief Risk Officers group – a global organization of leading board members and c-level executives focusing on developing and sharing best practices around board risk governance. He was the recipient of one of the inaugural M-Prizes for management innovation as well as the Higher Standard Award, the top honor bestowed by the Professional Risk Managers’ International Association. His LinkedIn profile can be accessed at https://www.linkedin.com/in/davidrkoenig/

[1] Using a cap-weighted portfolio