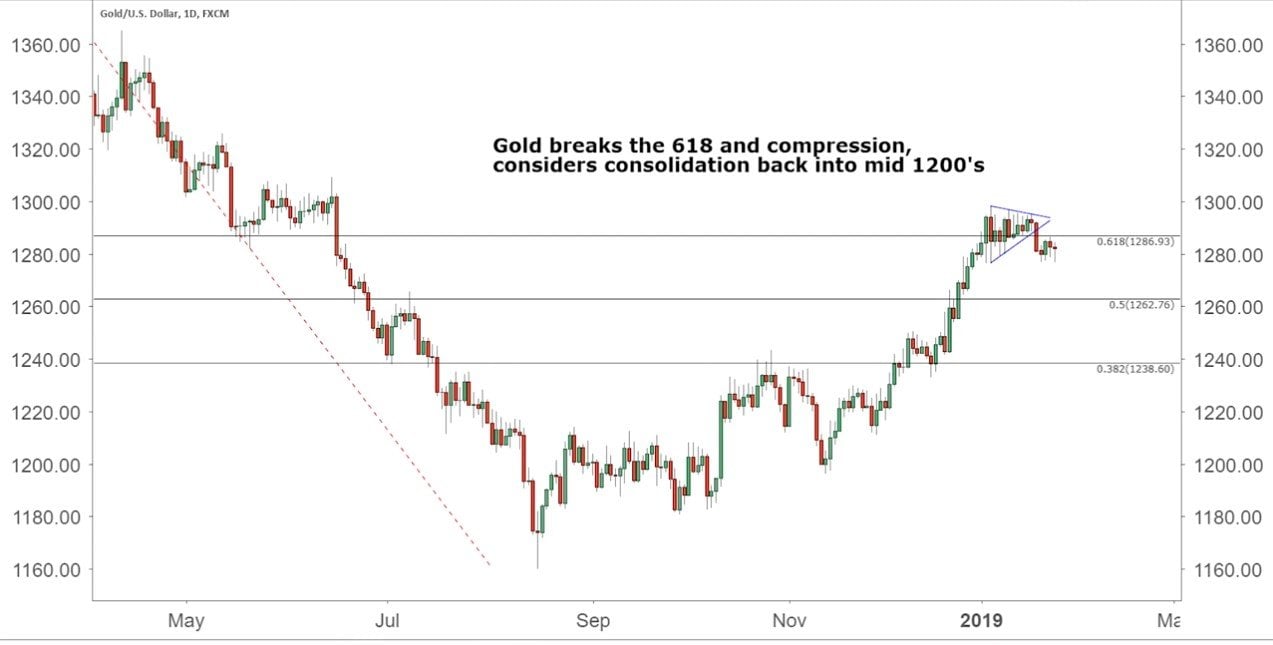

This week we review the price movements of gold, silver platinum, palladium, The US Dollar Index, Euro, & Pound. Gold has seen a small correction as discussed on last week’s program. We continue to watch Platinum as last week’s special guest highlighted the important market updates and moves to watch in 2019.

The Pattern In Gold, Silver And Platinum Is Breaking – Golden Rule Radio

Q4 hedge fund letters, conference, scoops etc

Transcript

Welcome back to the radio. We're seeing the pullback that we've been expecting in gold but I don't think it's finished. We've seen about a 10 to 12 dollar decline from the twelve ninety five range down to the 12 18 12 18 today. Silver is doing about the same pulling back platinums pulling back as well and testing the previous lows while palladium continues to be the winner.

Sure we're definitely seeing that pattern in gold silver and platinum breaking at least gold and silver as you mentioned breaking below those trend lines platinum as you mentioned and you know we had a great show with Rob last week kind of talking about the historical levels in platinum. So it is fascinating to see as it plays around that bottom level where it's going to find that final bottom and make its turn. As you've mentioned palladium I think breaking above 4300. So I know last week I threw out a potential high point on palladium up in the low to mid 40s. So maybe another driver to here as palladium has definitely gone the way of Bitcoin a few years ago and looks very parabolic.

The other three metals that are pulling back gold silver and platinum are moving counter to the U.S. dollar. The U.S. dollar has been strong relative to almost all the major currencies except for what the pound the pound is rallying with this Brexit talk. And that may be counter to what a lot of people would normally think. But the pound is rallying the dollar is strengthening as well and then the metals are pulling back.

Sure. Pound up euro down is definitely counter to what I think a lot of people both here and in Europe would have expected with the Brexit conversation last week. So Euro down dollar up pound up more which is what Robert's talking about and the dollar continues to surprise because I think there are a lot of people out there talking about the dollar rolling over. I continue to argue dollars go into 100 at least on the index over the next couple of months followed by the ultimate reversal back down. I mean that's the point I just think the short term high point is a little higher than where we're at now. But ultimately we're looking at some really tumultuous days for the dollar in the coming years.

Yes so the previous high on the dollar being 103. You don't think we're going to go up and violate and break to a new high. You're just saying from about 96 where we are. It has some room to it get stronger come into though a 100 range in kind of form a head and shoulders top right that's what you're saying. Yeah I definitely think it's likely. Yeah I would agree. We'll see. You know it's at this turning point we've been talking about this 96 97 level needs to go one way or another. And I think time will tell just like with the gold and silver prices it still has some room to come down which would be healthy for the market because of this nice run. So this is a good opportunity with it pulling back into the mid 12 hundreds I think with gold. Good opportunity coming into the market before it heads higher.

Robert I'm glad you brought gold back up because I think it is important to look at what corrections actually mean on a grander scale not just specific to the metals or any individual stock or commodity but what the purpose of a correction is and it really is cleaning out trade orders out of the market and building new bases. So we expected to see a correction we talked about it about two weeks ago. For me it is actually good to see gold pulling back. Here's some it can build that next base. And we do have some febe levels below us we've talked about in the mid 12 hundreds where we should see that reversal and continuation back up that I think is ultimately here going to test the 13 50 13 60 highs we've had in recent past. So don't get concerned with corrections. Trading is all about trends and watching where those trends are going and then looking for these pullbacks as injury opportunities into the precious metals or any other commodity or equity you may be looking at investing some money into.

So while we're making predictions on the show with gold pulling back into the 12 hundred's the dollar possibly rallying a little bit from here I'm going to make a prediction for this year and going forward somewhat indefinitely. And that would be the use of the Internet and how dependent a lot of companies are on the use of the Internet to back that up. Look at all the data breaches that have happened in one of the largest ones in history. Just a couple of weeks ago.

All right Robert I'm going to jump in here. You know I really want to point out the fact that one. Ok I agree with you. All right. Two we are seeing this increase with frequency and enormity. Right. So they're getting larger larger larger and we're getting numb to them now. Right. And with the advent of social media and that compiling your data and your identity details we're going to see it continue to grow so.