Over the years, my good friends at Capitalist Exploits (I highly recommend subscribing) have put together a number of outstanding thought pieces on where they see things headed.

They recently came out with a great overview of where Europe is headed. The trends they highlight are both interesting and actionable for those willing to put the time into thinking through the consequences of the new “Strongmen of Europe.” The EU has now had a decade of economic crisis and is slowly moving from economic crisis towards a full-fledged political crisis which will be its ultimate undoing. There will naturally be many actionable trades along the way. Most important amongst these will be;

Q4 hedge fund letters, conference, scoops etc

- Increased inflation

- Issues with energy security

- Increased national sovereignty

- Ultimate breakup of the EU

Having a roadmap, gives you the ability to stay a few steps ahead of events with your positioning. With that in mind, I suggest you read the roadmap from Capitalist Exploits. While I don’t agree with everything that they point out, it is those minor disagreements that make late night Skype calls so interesting…

Insider Special Report: What Lies In Store For 2019

Specific Focus: The European (dis)Union

There is so much going on that it can be hard to know where to look without throwing your hands up in the air and saying, “oh fuck it, I give up”. The problem is ignoring problems doesn’t make them go away, and if we get it wrong, we could end up seriously regretting decisions made today.

I’ll be honest with you, we’ve spent time reviewing much of what is taking place in the world at the moment. Not here with you, but with my team and often inside my wee head, hunched over my keyboard at 1AM after tossing and turning annoying my gorgeous wife and getting out of bed to look into something that’s bugging me and keeping me from sleep.

Much of what passes across my desk never makes it to the pages of Capitalist Exploits.. Quantity is not quality, and our capacity to take in and make sense of too much information has a tendency to rapidly invoke overwhelm.

In this service I attempt to tread the fine line between bringing to you what we feel is important, without drowning you in too much information and overwhelming your ability to keep up.

Onward…

I’m not sure what the most important topic to focus on is... but I do believe there are some that are more important than others. In the “important” category we feel that the Eurozone stands out like a diamond in goat shit.

Many may disagree with this assessment, and, if we scan the headlines during the course of 2018, we could have spent a godawful amount of time trying to figure out how the Ruskies colluded to bring Trump to power, or if they did so at all. We could have further - even more importantly - spent time figuring out whether this would have any

impact on investment markets or not. We could have spent an even ungodlier amount of time focussed on little Kim and his stated ambitions to nuke the “Great Satan”.

Probably more important than the aforementioned “non events” but staying in Asia, the fact that China completely ignored international law and has now all but secured the South China Seas, building military installations including missile shelters and aircraft runways, surely deserves attention.

Who cares about some little uninhabited islands anyway?

It’s not so much the islands but the fact that military installations on them extend Beijing’s powers substantially, and most importantly Beijing has now de facto secured control over the goods traded through these waters. This has all happened while the world has been caught up worrying about how badly May will botch Brexit, Russian bots, and which of the 598 genders we’re now supposed to call someone who refuses to acknowledge their biology.

Astounding!

For example, over 30% of global oil moves through the South China seas. Why this isn’t on everyone’s radar is pretty astounding to us here at Capitalist Exploits HQ.

We think this last topic (and not the Russia did it hysteria) is ridiculously underestimated and certainly under-reported, with the potential to be a serious issue over the coming decades.

But with all that said, it’s not the topic of discussion today. Today we’ve what I believe is equally if not a more pressing issue.

That something is the Eurozone.

The weakest link

What I’m writing about here today is taking place in what is arguably one of the most inopportune global backdrops we’ve seen in 20 years.

At the turn of the century global debt was about $84T. During the GFC that number more than doubled to $170T, and as I write to you today it’s mushroomed to about

$250T. Now granted we’ve had growth during this period and obviously total debt isn’t particularly useful to look at without looking at the economy which supports that debt. An economy that grows twice as fast as debt levels isn’t getting itself into any sorts of trouble. If only that were the case!

Since 2008, global debt to GDP has risen by about 35%. Now you probably already know much of this. At least the fact that we have “holy mother of Mary is this for real?” debt levels globally, which have largely shifted from the private sector to government balance sheets. Which, as an aside, is why the next major crisis will be in sovereign debt and thus politics will play a much much bigger role.

But realise that much of this debt expansion has been taking place with a backdrop of global growth.

Thank you, China!

Well, Chinese growth itself has come at a price. That price is and was massive credit creation, which is now faltering. The Chinese slowdown is as far as we can tell engineered in order to remove risks… particularly in the shadow banking sector.

The slowing Chinese economy in and of itself wouldn’t be too much of an issue, but it’s come at a time when US dollar liquidity is being removed - and that is really bad timing. These two factors provide a very dangerous situation… not for either the US or China, but for Europe. Why?

The EU: How we arrived here

Europe has entered a period of serious turmoil and it couldn’t come at a worse time. Let’s take a step back and review where this began, how and why.

What’s surreal is that when we take a look at what the purpose of the European Union originally was, it’s impossible to identify it today. Let’s take a look.

The EU was formed as a political and economic union of 28 member countries with a fundamental purpose being “to promote greater social, political and economic harmony among the nations of Western Europe.”

It was back in the 1940s and ‘50s that calls for the unification of Europe began. It was our grandparents who, after enjoying an all-expenses paid vacation to the beaches of Normandy courtesy of allied governments, decided this was something they’d rather not do again. EVER!

Rebuilding Western European economies was hard work, and the clear advantages to pooling resources across nations brought a strengthening of economic ties between nations. How could it not? This was attractive to leaders especially since these economies relied heavily on trade with one another, and also because none of them were (or indeed are!) self sufficient.

The primary impetus, however, was predicated on ensuring no more of those deadly vacations would ever be allowed to encroach onto European soil. In short, a deep desire for peace and prosperity was at the heart of the EU’s creation. This is something that even the most depressed grumpy bastards among us could get all chubby with excitement over.

And it led to one of the greatest booms in economic expansion the worlds ever seen.

Trade amongst nations has a long history of proving highly advantageous to the parties involved. In fact, in the wonderful book “Sapiens - A history of humankind”, Yuval Noah Harari makes the case that one of the primary reasons homo sapiens are at the top of the food chain is due to our ability to communicate at scale, and to collectively get behind abstract ideas.

This is powerful, though not always good. Clearly, getting behind Stalin, Hitler, Moa and many others was a catastrophically bad idea, while at the same time the forces that defeated these thugs presented the same dynamic - folks getting behind an idea and at scale. That idea was of course freedom from the tyranny the Nazis represented.

When looking at Europe today I’m reminded of this:

Getting behind the original ideals proposed by the European Union was a bit like being asked if you’d care for a cold beer and a large umbrella after being stranded in the Sahara naked - a bit of a no brainer. But, as the saying goes, too much of a good thing is often a bad thing… and this was the case with the European Union.

As European prosperity grew, so did the ambitions of the technocrats who gravitated to Brussels to head the EU.

Moving some of that fine Heineken from Amsterdam to St. Tropez without pesky customs nonsense was clearly a great thing because (as I can attest) getting sozzled in St. Tropez is way better than doing so in Amsterdam.

And when Pedro in Portugal wanted to take his girlfriend to Paris for a dirty weekend away, the fact they no longer had to get visas and stop at borders reduced a lot of friction, which meant that goods, services, and people flowed more efficiently and with greater volume.

The freedom of the movement of people, goods and services within the countries in the EU was always a great thing. Nation states still retained their sovereignty, and individuals retained their customs, traditions and national identities. Probably most importantly when stresses built in the trade system as they always do and always will, they were released via the individual countries monetary policies.

Constraining this reflexive dynamic was the first poison pill of the Eurozone and it came in the form of the Euro.

Although the Euro was born in 1999, it didn’t begin trading with issued notes and coins until 2002.

To understand why the Euro is such a pernicious beast, we need only understand how small inefficiencies that are never corrected and produced at scale eventually collapse any structure.

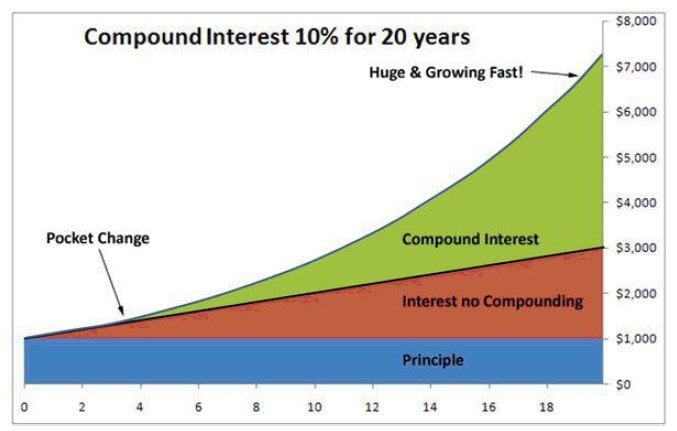

Consider the simple example of compound interest.

We all understand how compounding works and we all understand its incredible power. Now instead of interest compounding replace that with inefficiencies compounding. That is in a nutshell the Eurozone.

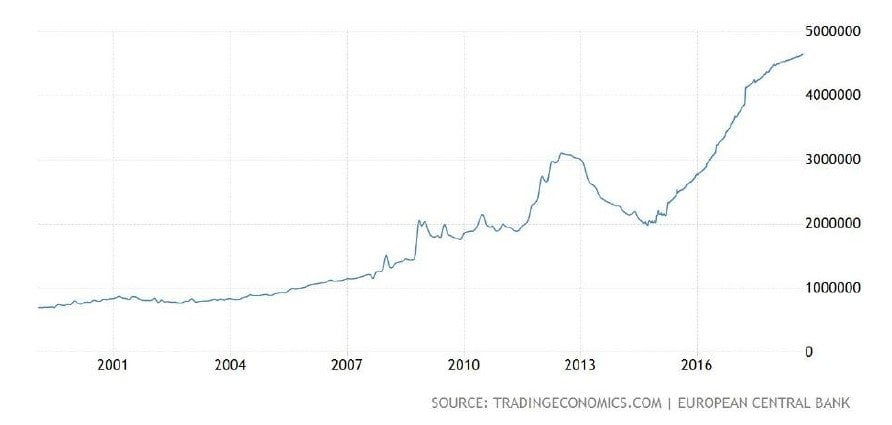

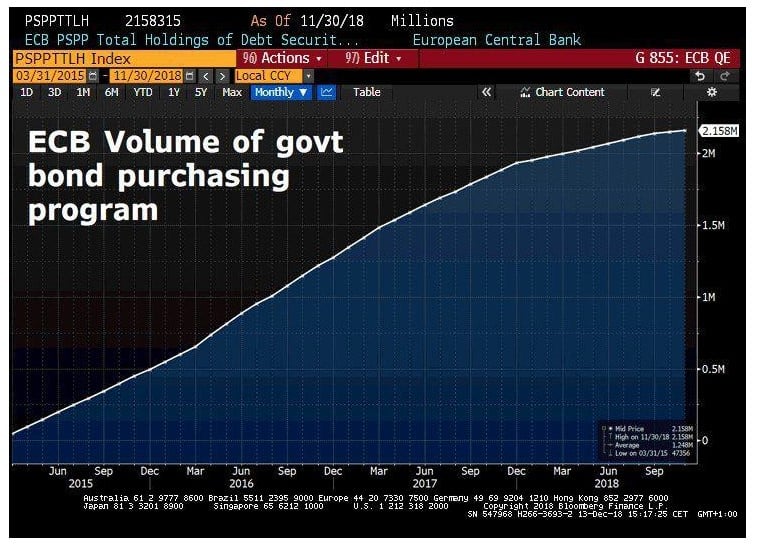

Is it any surprise that the ECB balance sheet looks like this?

Every asset manager worth their salt knows that risk builds slowly and then happens fast.

So let’s assess some of the most critical risks that have been building.

Structurally Screwed up

Germany is an export powerhouse generating a huge trade surplus. Its trading partners on the other hand run large trade and budget deficits, particularly Portugal, Italy, Ireland, Greece and Spain. The PIIGS.

You may be shocked to know that Germany's exports at $1.4 trillion are roughly the same as those of China. China sports a population of a whopping 1.3 billion people, while there are a comparatively miniscule 82 million of our German friends roaming about. That’s about 6% of China’s population... impressive!

Together these two countries are the world’s largest exporters, with the US trailing a distant third. How the hell did those beer drinking, bratwurst eating krauts achieve that, you might ask?

Great question!

To answer this, let’s first take a look at some of our... ahem… less fortunate members boiling in the cauldron of the Eurozone. You can probably guess who they are. They’re all running massive trade and budget deficits. We don’t need to cover each and every one of them here as they’re all bad. Instead we’ll pick on our Italian friends (because who doesn’t love those scooter riding hand waving feisty folk?) who run a $55 billion trade deficit and a budget deficit of about $120 billion. Their total public debt is an eye watering 116% of GDP and rising.

The imbalances are significant, and they’re growing.

These imbalances have been growing because of the straight jacket imposed by having a single monetary regime which has meant that when pressures build they can no longer be released, either by defaults and restructurings and/or by currency repricings.

Like the EU itself, it’s pretty ironic that the Euro was actually supposed to make the entire process of trade more efficient. And in many ways it certainly did that. Today you can travel across borders without changing currencies, you can quickly and easily

evaluate price differentials in the costs of products across the Eurozone, but it’s underneath all this where massive structural problems have been brewing.

Differences in how member state countries operate have allowed inefficiencies to build. Take Germany for example, where the costs of production has been kept pretty tightly controlled while at the same time exports have grown.

That’s not been the case in member state countries. With Germany holding down production costs they’ve become far more efficient than their Eurozone neighbors… who, by the way, are also their largest export market - representing 2/3rds of their exports. So Germany has effectively engineered a devaluation of their own production costs providing a structural advantage.

No wonder German exports have grown so strongly under the EU, and no wonder it’s been Germany leading the charge at the EU gleefully bossing about all those peasant class member states.

To give you some perspective, between 2000 and 2009 the per labour unit cost required to produce a German good rose 5.8%. The equivalent in Italy, Ireland, Spain and Greece rose by 30%. That’s a 500% differential.

And because all these poor bastards are stuck in the same monetary system, the mechanism that Italy, Ireland, Spain, Portugal and Greece (and really any country that experiences such stresses) used to use in the “good ole days” is no longer available to them. So the pressures build… and so does debt.

But it gets worse.

The other pernicious thing about the member states all “enjoying” the same monetary system is that they’re all tied into certain constraints. For the time being we’ll ignore whether or not these have been strictly adhered to (they have not) and focus on what it’s meant for their economies.

Member states have been able to use the strength of the Euro (and incredibly low interest rates - thank you Draghi) to expand their borrowing.

Example

Play a game with me, and imagine being Italian for a minute.

Flick the channel to see how Juventus or AC Milan fared on the weekend, talk loudly with your hands, almost spilling your espresso, so you can get a feel for it. Better still,

imagine you’re an Italian politician who is facing the conundrum of falling economic growth, rising unemployment and calls to “do something”.

What do you do?

I’ll tell you what you do. You rant a bit, wave your hands about and then you get down to borrowing like your life depends on it. All the constraints that were there before you and your fellow countryman were part of this thing called the Euro, such as a market who would have laughed in your face if you’d ever proposed borrowing money from them at such absurdly low interest rates, have miraculously vanished.

It’s astonishing.

Even while your budgets are blowing out and your trade deficit has ballooned you can still borrow money at stupidly low rates. Presented with an urgent problem... it’s no surprise what you do.

Remember that prior to the Euro whenever we had this sort of imbalance, it was corrected by an adjustment in the nations bond and currency markets. The Italian Lira would have fallen, making Italian goods cheaper on the world market, boosting exports. Sadly, Giuseppe wouldn’t have been able to afford the BMW made by the Germans any longer, but this had the wonderful mechanism of reducing imports and the supply-demand and credit-debt imbalances were restored.

But that was then. This is now.

Whether the pointy shoe crowd didn’t see this coming or chose to ignore it is now irrelevant. We’re way past what “should have been done”.

Remember the “Greek debt scare”? Well, Greece promised austerity (which hasn’t, and never will work) and the EU promised financial assistance to “fix” the problem. It was the same sad story but this time a Greek tragedy rather than a Roman one.

Here’s the problem. These deep structural problems can’t be fixed by providing cheap credit to a massively indebted nation anymore than giving a junkie another hit can help “cure” an addiction.

It’s so bloody stupid that only an academic could have come up with it.

An EU Banking Crisis

The problem we now face (and this looks to be coming to a head) is that this leaves Germany with the unenviable task of bailing out member states. It’s ironic because the very structure that was put in place, largely by Germany, has allowed them to become an export powerhouse. But as you can see it was built on flimsy foundations with an exponential factor embedded whereby the longer it remains in place the worse the pain for all involved will ultimately be.

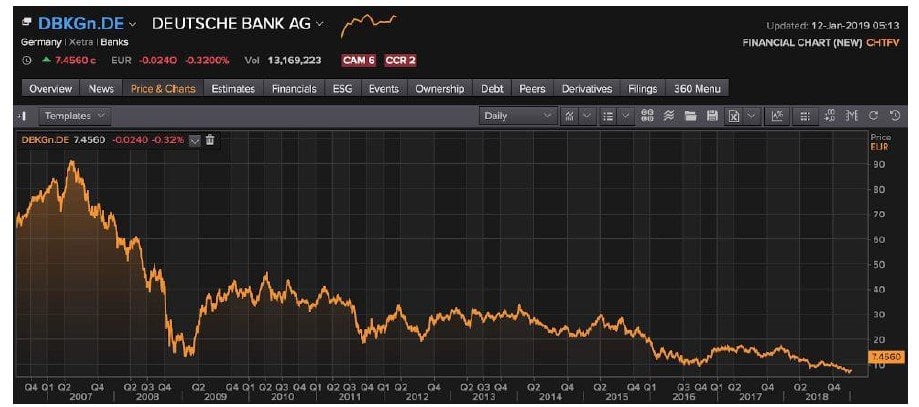

Here’s none other than Germany’s most “prestigious” investment bank. Deutsche Bank.

According to Business Week German banks are exposed to over $250 billion in Eurozone nations bonds. But really, who the hell knows. How much is held in offshore SPVs which are also “off balance sheet” and how much of that Greek, Portuguese, Turkish (yeah looking at you BBVA), Spanish, Italian, Cypriot NPLs haven’t been market to market? We don’t know.

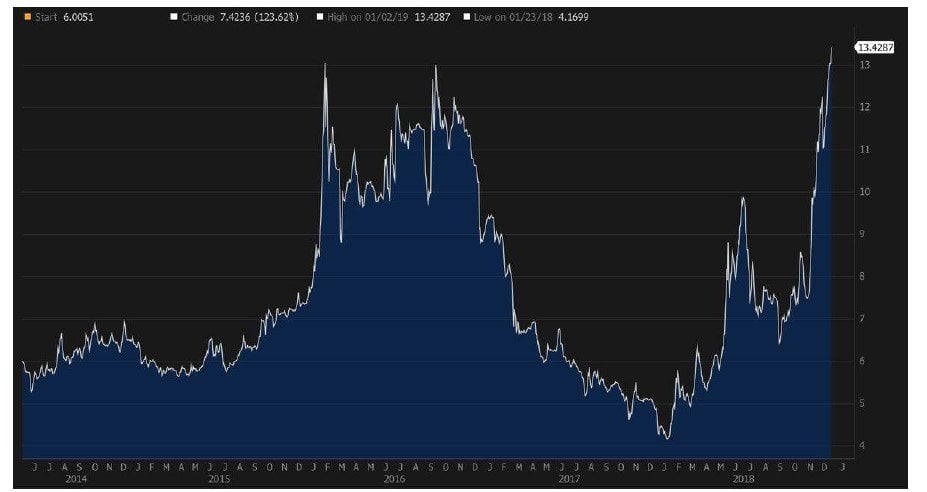

What we do know is that Deutsche’s yield on their €6% CoCo’s now yield 13.43%. Something’s definitely not right here...but you already know that, right?

Witness the proposed merger between Deutsche and Commerzbank. The reason this merger can never take place between Deutsche and say BNP Paribas is because within the EU rules we’re not going to have cross border bailouts.

Mark my words: this is a bailout by the German government right here.

And I’m sure it’s not lost on member states’ governments that this is the very thing the Germans have been wagging their fingers at the PIIGS about.

In the end, the German government will likely end up owning both Commerzbank as well as Deutsche.

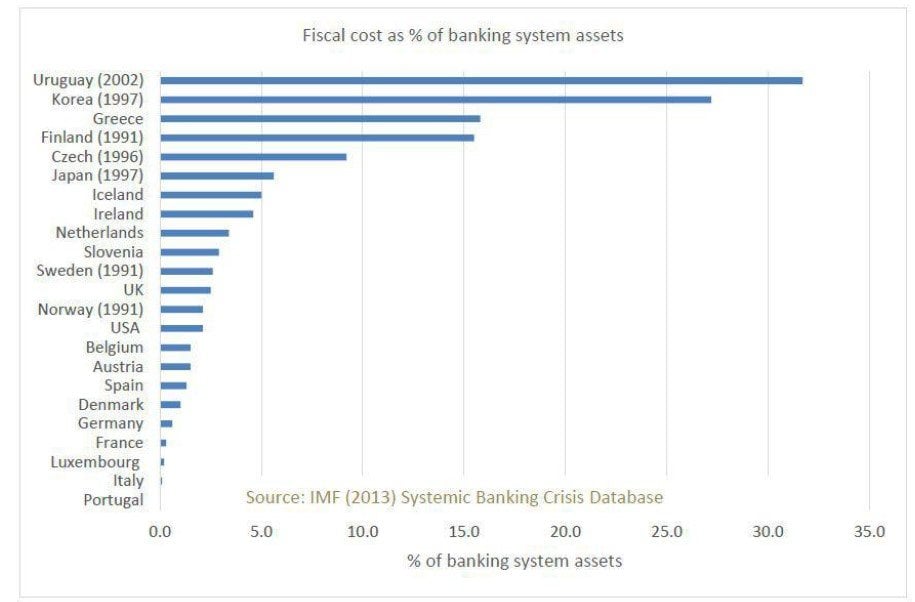

And this is where it’s important to understand what this actually means. I found a wonderful chart while bedtime reading a mammoth report issued by The Reserve bank of NZ. The kind of stuff that would surely put most anyone to sleep. In any event here it is.

It shows the fiscal costs associated with various banking crises.

Now remember this point because it’s important for the coming fiscal spending in the Eurozone (more on that in a minute).

And so if the Eurozone banks have been the hosepipe delivering the “fixes” promised by Brussels, it’s been the ECB that have provided the faucet.

In fact the ECB has been the only driver of recovery for many parts of the Eurozone.

Take that liquidity away and you’re left with a whooshing sound. A black hole. A vacuum. This is why the ECB are going to have a helluva time raising rates this year as promised.

One problem that’s particular about the Eurozone is that when the GFC hit, the ECB had already been providing gargantuan amounts of liquidity to the banking sector.

It was a situation quite unlike in the US.

Consider that when the ECB launched QE, excess liquidity stood at 125 billion Euro. That’s a isht ton. Since then it’s grown like kudzu and sits at over 1.8 trillion Euro.

Here’s the problem in the EU: it never had a liquidity problem. The problem is that via the pointy shoes in Brussels, an interventionist centralised economic system has been stalling business on main street.

You can’t create economic growth with stifling bureaucracy.

To recap: The primary mechanism for Brussels to keep those recalcitrant member states in line has been via the banking system.

Germany helped enable profligate borrowing by member states via its banks and now it’s caught between a rock and a hard place.

Either Germany now continues (via the ECB) to bail out member states, which makes perfect sense if they’re to keep their export economy booming, or it lets member states default and thereby allow its export markets to collapse as well as watch their banking sector implode.

The thing is… left as things are with member nations’ debt levels rising, we’re fast reaching a point where even the mighty Germany won’t be able to bail them out. That is,

if German voters allowed such a thing before they too begin donning yellow vests, torching cars in the streets and yelling verpiss dich Merkel.

In some ways this is all a bit depressing. I used to love a good crisis but this one coming just isn’t going to be of the garden park variety and it has the real potential to turn into something quite nasty that can morph beyond ways we can even imagine at this point.

--------------------

What we’ve just talked about are all problems that emanated from a political level but manifested in the wonderful world of finance.

My world.

But I’d always said that what we needed was a political catalyst to bring about change… and boy, are we getting that now. But first… let’s have some context.

The case of a deposed head of state

2012 saw the Italian Government on its knees.

Crippled by unmanageable debts which needed repaying, Italy was completely shut out of international credit markets. The long standing, extremely popular Silvio Berlusconi was primed to do what Italy had become so well known for. No no...not playing soccer, drinking coffee, or driving fast cars, but repudiating existing debt and devaluing their currency.

Berlusconi was weeks from yanking Italy out of the EU, opting out of the Euro, and bringing back the Lira, and then re-denominating its existing debts in Lira and going back to… well… being Italy. And Brits who are perpetually suffering from the miserable weather were eyeing up their favourite Italian getaways wondering just how cheap they would get this time around.

The playbook was a typical one, and seeing it for what it was no sane investor was about to throw a bone their way.

So enter Brussels who, sensing the risks to allowing the 3rd largest economy in the Eurozone to give them the finger, moved in swiftly removing Berlusconi from office and appointing in his place a technocrat. With this move came liquidity injections into the Italian banking sector. Ahhh...all was saved!

Not quite.

It’s hard to state how incredible this maneuver really was, and furthermore how little press it garnered. Consider for a moment that an unelected group of pointy shoes removed the democratically elected head of state of a sovereign nation, and not a single bullet was fired in the process.

And realise this: Berlusconi was no girls blouse. We’re not talking about a Theresa May pushover here. The only thing tougher than this guy is the residue of a Weetabix left in a cereal bowl for a week, which is the toughest substance ever encountered by mankind.

In all seriousness, this was arguably one of THE most dangerous events in the last decade. Why? Because it emboldened these thugs in Brussels. Now they knew that they could control member states and enforce their will.

Theory had been tested and proved correct.

If anyone doubted the true intent and dictatorial nature of the beast that was growing in Brussels then what happened in Italy in 2012 should have once and for all put to rest any doubts.

What this action was of course designed to do was to send a very clear warning message to all member states. Don’t screw with us because we’re the Fourth Reich, and this time we don’t need thugs in black boots to take you out back, we can and will take you down in our suits, ties and pointy shoes.

Times change, but human nature never changes. Never.

And if we look at events throughout history, it’s hard not to think to ourselves… perhaps the foie-gras eating, perrier swilling elites in Brussels had simply done their homework and learned from the best...

Who?

The US, of course, who for years have made an art out of influencing governments throughout the mid-east and Latin America (in particular)… going so far as replacing them when deemed necessary.

Remember Panama and Torrijos… or Ecuador and Roldos? Cleary the system works for them. Why not follow it?

Italy of course are but one example. At varying stages all member states have had their share of bullying from Brussels. The Brits had a guts full of it and opted out… only to then get Theresa “I’m completely hopeless” May to make it all happen. But Britain is a story for another day…

Politicians being what they are, the easiest path has for a long time been to appease Brussels. Even when this has been at odds with what a democratically elected leader should be doing for their people, the repercussions have been too severe, and so they’ve towed the line.

This is why we have always said that despite unmanageable and unbelievable debts, despite massive and growing inefficiencies, and despite persistent economic stagnation we believed that the pivotal catalyst would be on the political front not the economic one.

The economic conditions work in a reflexive way, causing the political climate to change, but it is the political climate we needed to see shift. This is a point that we’ve been making for a long time here at Insider and one which the broad investment community still seems to not grasp.

And 2018 brought exactly what we’d both predicted and had been waiting for.

Where those member states elected governments simply colluded with and appeased Brussels we’re now seeing the electorate boot them out of office replacing them with what I called “strong men” back in 2016.

The political tide is turning.

Politics shifts

Here at Capitalist Exploits HQ we always maintained and pointed out to anyone who cared to listen that when the will of the people was ignored while at the same time their own personal circumstances deteriorate this would translate into angst amongst the peasants.

It was easy to see coming. Consider Greece.

If Greece was an outlier, it’d be ok and we’d tell them to bugger off and go drink ouzo and enjoy some olives. But it’s not. Greece is a symptom of a problem far larger. The reason populist leaders are increasingly attractive to citizens is because they promise to “unfuck” whatever country they’re in.

The chart below shows the aggregate impact of EU government policies since the inception of the EU on the Greek economy up until 2010.

Oh... dammit! I’m sorry that’s actually those poor, pathetic, unwashed masses according to Brussels. Some of us just call them Greek folk. People like you and I. This is them

rioting in 2010. Recall that in exchange for a bailout, austerity measures were the bargaining chip. Brussels won. Greeks lost. Round 1.

Now let me see if I can find that chart I was looking for. Ah...here it is.

Shit, I’m sorry! I messed up again. This is actually Spain, where by referendum Catalonia elected independence. Silly peasants...thinking they can actually vote democratically and have a say!

The rest of the unruly peasants across Europe have been watching all of these events. The elites in Brussels run largely by France and Germany have been watching this thinking to themselves:

“Look at those unruly peasants in the lower class countries. We’ve no such problems here at home. We’re stable, our governments well entrenched, loved and respected.”

Oh jeez is that the Champs-Élysées I see in the background?! By golly is that Paris?

And you see this is the trouble with peasants... They get so agitated when their way of life is turned upside down and their culture destroyed.

Damn those poor, huddled, unwashed masses!

This must be more annoying to Brussels than running out of Dom Pérignon when hosting one of their lavish parties.

The demand for a “man on a white horse” across EU member states is building, and whilst in this blind rage, people tend to forget that a man on a white horse is not always good... and that’s what makes the entire Eurozone so incredibly dangerous.

The longer the pointy shoes manage to cling to power, the greater the inefficiencies grow, and the greater the angst amongst the masses.

And realise this: The worse any situation becomes, the more drastic a response will be called for by the people and you can be damn sure someone will rise to fill that role.

No more moderates

Think about it... there are no more moderates. Look around you. In the US, folks are either pro-Trump or Anti-Trump. There is very little middle ground. In Britain you’re either pro Brexit or anti Brexit and across Western Europe we see the same thing. There is very little in between.

This means that compromise and finding workable solutions to what are increasingly complex, unmanageable, problems (such as unsustainable debt) mean the probabilities of these problems being resolved in anything but a violent clash of power are falling with each passing day.

It is our belief that the unbearable weight of unpayable debt is going to cause the structure to collapse at free fall speed.

Could 2019 be a year of this taking hold?

Obviously we don’t know, but we do know that things are heating up and we’re closer to this taking place than many think. We know this because all the events such as Brexit, the election of Trump, the Yellow vest uprisings have come as a “surprise”.

As you’re aware, they’ve not only been predictable to us here at Capitalist Exploits, but we’ve been promising it.

No backing down

If we were to place EU member countries into the master and servant categories, there is no question whatsoever that France, Germany and Belgium are the power brokers here and the member nations have been bullied in some shape or form with increasing intensity.

These “masters” are now suddenly finding themselves under fire. And yet, they’re doubling down.

When Merkel was booted as Party Chairman you could have thought… thank God that belligerent old windbag is going away. But not so fast! She’s back.

Nationalism “is not patriotism, because patriotism is when you include others in German interests and accept win-win situations.”

This is a direct assault on the rising nationalism not only in Germany, but throughout the European Union, despite the fact that this is anti-democratic it follows closely behind Macron’s recent statements that “patriotism is the exact opposite of nationalism [because] nationalism is treason”.

As I said… No middle ground here, and that bodes very well for conflict.

Fiscal spending oh how we missed you

But this is one reason we think that 2019 is going to be a very important year for the Eurozone. This ideological clash we’re seeing each side has its own weapons. For populists it is physically fighting back against this unelected stifling bureaucracy, and for the Brussels elite it is monetary measures, provision of liquidity, credit lines and so forth, as mentioned earlier.

Austerity has been one “tool” used to try to rebalance imbalances caused by this crazy setup. And, as we’ve seen, it’s brought folks out into the streets with molotov cocktails.

And now we’re seeing it in none other than France, where Macron seems completely perplexed as to why this is happening - and further, how to deal with it.

So, put under pressure by the yellow vests Macron folded like a cheap tent, scrapping his fuel tax first, and when that didn’t calm the peasants down now, he’s promised free “stimulus’.

The problem with this is that it’s exactly what the pointy shoes have been wagging their fingers at the PIIGS about… and now here we are and they’re doing it themselves.

If these folks were any stupider we’d have to water them twice a week.

And what has the ECB said about France’s decision to flout EU laws with respect to their national debt?

I’m glad you asked. You can read all about it here.

“It crucial now that Macron continues his reform agenda, especially in the labor market, and that France remains on its growth track. Under this condition, we will tolerate a national debt higher than 3 percent as a one-time exception. However, it must not continue beyond 2019.”

So… where were we?

Yeah, austerity is going to be a dirty word and fiscal spending will be back en-vogue. Watch. That combined with a break in the sovereign bond markets is NOT deflationary. Stagflationary more likely.

The markets are telling us risks are rising

Speaking of bonds. German bunds have been rallying vs all other member states. Ask yourself: why the hell may that be?

Well it’s easy when you see a risk to the single currency, you go buy something that when redenominated, will be in Deutsche marks and not in Lira, Drachmas or Pesetas.

The Italian 5 Star Movement late last year held a conference where they specifically explained how they were considering redenominate Italy’s debts into Lira, as an option on the table.

Obviously, this would wipe out bond holders, but since the bond holders are the ECB and German banks it’s… ahem… not their problem. Also, they’re strongly considering leaving the EU, and so this poses less of a problem to them than if, for example, their own citizens were holding those bonds and they redonominated them in Lira.

This was a public meeting… not something hush-hush, done behind closed doors.

How do you think this makes Merkel feel? At the end of the day the reason Bunds are rallying is because folks are figuring out that Bunds will be worth something while BTP’s would be worth somewhere between zero and nothing.

We’re sorry to tell you, but we think anyone today investing in European sovereign bond markets and anyone investing today in a short USD long EUR trade and the multiple variations of same is setup for long term losses.

The fact that the Eurozone can’t consolidate its debts, can’t consolidate it’s fiscal spending, and yet shares the same currency will ultimately prove to be its undoing.

At this point this cannot be avoided. That sucks but it needn’t suck for you.

So there you have it. Lots to think about. I’ll leave you with a number of key points that we believe are worthy of your fine eyes...

- Fiscal spending in Eurozone countries will accelerate making an increased mockery of the EU

- No more countries will be joining the EU or the Euro and many will begin making noises about

- Capital will leak out of Europe. It’s already begun leaking out. That leak will turn into a stream and then a

- Brussels will do what they can to stop this from happening. Various forms of capital controls will come into force but this won’t stop it from

- Europe’s energy complex will change dramatically as domestic security arrives centre stage. Member states will begin taking back various elements of their national Key among these will be military security and energy security. This will mean different things for different countries.

- The breakup of the Eurozone as it stands today will be one more nail in the expansion of globalisation which has dominated markets for our

- Globalisation was incredibly deflationary for goods and inflationary for the financial sector. There is a very real risk that we’ll see globalisation reverse. This will be deflationary for the financial sector and inflationary for hard

- Sovereign bonds and then currency get called into question. We have always believed that gold will shine only when we have a loss of faith in And by currency we mean a major currency. Euro, Yen or dollar. Of the three we think the Euro is in the worst shape. A loss of faith in the Euro will be bullish for dollars but potentially bullish for gold too.

- Green schmeen. Forget about environmental policies enacted over the last 2 decades. This isn’t a judgement call on whether or not we should have these policies. What I think doesn’t We’re only interested in what will happen.

- Trump exited The Paris accord. He just showed the path forward. Expect European leaders to come to the stage who will do the same, in favour of “resurrecting their country’s energy security”. So you can forget about Carbon emissions, the red spotted owl and suchlike. When push comes to shove political security will trump No pun intended.

- Military buildup and military spending in the Eurozone countries is going to happen at a rate that will shock

During the course of 2019 we’ll be looking at the various ways to execute on all of the above.

As always, thanks for reading and being part of Insider. Sincerely,

Chris MacIntosh

Founder & Editor In Chief, Capitalist Exploits Independent Investment Research

Founder & Managing Partner, Glenorchy Capital

Full Disclosure: I own some Euros (despite having zero confidence in them)

Article by Adventures In Capitalism