GreenWood Investors letter for the fourth quarter ended December 31, 2018, titled, “Race To 100x.”

“Sweet are the uses of adversity, Which like the toad, ugly and venomous, Wears yet a precious jewel in his head.” – William Shakespeare; As You Like It

Dear GreenWood Investor:

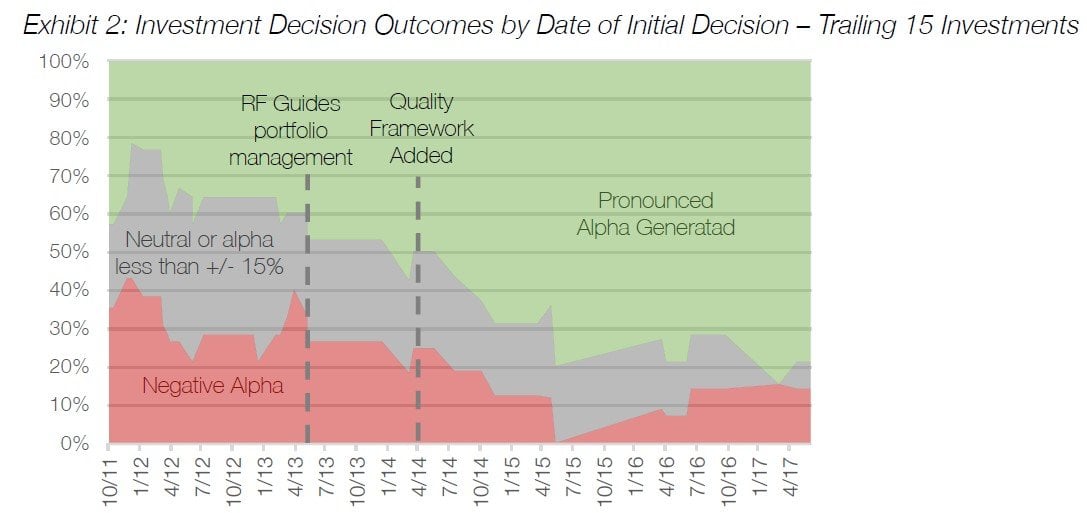

We had a frustrating end to an otherwise good year of alpha generation. We used this difficult quarter in the markets very well and have set ourselves up for an even better year of outperformance. We have cleared out old mistakes, examined them, and have evolved our process in order to avoid such mistakes going forward. We entered 2019 with two new positions and a very sound playbook for gamma generation, creating the highest risk-reward, and quality, portfolio in GreenWood’s history.

Q3 hedge fund letters, conference, scoops etc

We have all the tools we need to generate sustainable alpha in an absolute-return context. Our global bottoms-up process has no shortage of long and short opportunities for us to research. Particularly since starting our efforts relating to the coinvestment, we have been significantly capacity-constrained to research the significant flow of ideas we originate organically and through our wonderful network of partners. Chris Torino joined us in the quarter from Lazard Asset Management specifically to alleviate this backup. I have known Chris for nearly two years, and we have worked on many names together. His smell test is very keen and he is going to help turbo-charge our ability to process our flow and continue to reduce opportunity cost.

While we were patient and let the transition for Chris happen naturally, when we started talking about him joining, we were in great need of attention to short opportunities, which filled the top decile of our pipeline during the summer. Our patience was not rewarded, as the market correction was in full effect when he finally joined in November. Yet, thanks to our frequent communications over the past couple of years, he hit the ground running and his first idea generated recently made it into the portfolio.

This is one of the best short opportunities we have ever seen, and most importantly, it is not crowded. Due to us wanting this to remain as such, we are reserving our research only to investors with skin in the game. Given how sensitive shorts can be, and how scarce we find non-crowded opportunities, we have decided to limit all new short research to investors. It is in our best interest to keep these opportunities to ourselves to lower our borrowing costs. Readers can get a bit of insight into what inspires Chris by reviewing his first article posted titled, "The Old Lion’s Framework.”

Now that we have three shorts under the belt, we thought it would be a good opportunity to explain how we look at these ideas. First of all, we are only bottom-up investors, and so each short opportunity will be evaluated next to all potential long ideas. We’ve inverted our process by which we normally look for good management teams and boards, highly conscious businesses with solid end-markets and investment capacity. The opposite of this will be firms with significant negative externalities, management teams with no skin in the game, and deteriorating industries with limited opportunities to invest. But we also have the expectations gap to consider. This means Mr. Market cannot be aware of this deterioration in any pronounced way. Crowded shorts behave erratically, and often rise in bear markets.

Because all of our ideas have so much leverage in them, with very favorable risk-reward profiles, we do not need portfolio leverage on top of this. Given all of our net worth is invested alongside our investors, while we have a healthy risk appetite, this hunger completely stops when it jeopardizes the solvency of the entire portfolio. Thus, while many long-short investors will have significant amounts of portfolio leverage, we will never go there - it’s in our fund documentation.

Jim Chanos, perhaps one of the best short-sellers of all time, has generated an absolute return marginally below 0% for the life of his short-only fund. If the best that we can aspire to achieve from this portfolio is roughly zero, then why should we not treat it as cash? Our cash in the portfolio has ranged from 5-20% for much of our history, and has been driven by the availability of good investable opportunities. Accordingly, through a cycle average, we should expect our short portfolio to average out to 10-20% of our exposure. Yet, at times shorts are better than cash, for in market corrections, the value of this portfolio shrinks and gives our net cash a boost exactly when we need it to deploy in long opportunities. Earlier this summer, had we had the capacity to properly diligence all the short ideas in the top decile of our ranking framework, we wouldn’t have been surprised to see the exposure reaching 30%. Yet, of course there are other times when we will have trouble finding shorts with limited upside (towards the bottom of bear markets) and the short exposure could go to virtually zero.

Researching shorts also helps us invert our investment thesis on our long opportunities, and provides another lens through which to look at the world. As psychologist Gary Klein noted in his brilliant book Seeing What Others Don’t, insight is most commonly derived from looking at a particular subject through a new lens. Chris brings a completely complementary set of strengths to our group, and with these strengths, new ways of looking at the world.

Furthermore, our transparent research elicits feedback from numerous other points of view. This systematically increases our likelihood of arriving at novel insights.

Because our shorts are generally well-liked or face a complacent market, they may not immediately offset general market weakness. We are typically waiting for specific developments to occur which will drive investors to lose faith in the target. While the ranking framework is intentionally bottoms-up and not driven by macroeconomic theories, the movement of the top decile does actually provide interesting anecdotes that often rhyme with our macroeconomic leanings. As has been the case since 2013, we will let our bottom-up framework guide us.

Speaking of our ranking framework, we have recently implemented a couple updates to our qualitative criteria. As a quick reminder, we optimize our opportunity set on three separate continuums: for value (risk-reward ratios), quality (with a conscious capitalist lens), and the expectations gap. This is a quantum mechanics approach to the world, as we are seeking skewed potentialities with the preconditions in place to drive performance towards the higher end of the range of possibilities. We added assessments of the board of directors as well as an assessment of the analyzability of the business drivers to our quality criteria in response to both a mistake we made in the year as well as research conducted in preparation of a white paper we are due to publish later this year.

We have also added a new important milestone to our process. When an opportunity has taken a while to actualize the upside possibilities we had foreseen upon our original investment, we will now require a complete re-underwriting of our assumptions a year into the investment. This is not intended to become a reason to sell, rather will require a re- examination of the range of outcomes in order to ensure these positions do not turn into realized losses. Given the lessons learned from studying our past successes and failures were too numerous to encapsulate in a short quarterly letter, last week we penned a separate article called “Boiled Frog Prevention.” We detail the lessons learned and give more color on our continuously improving process. In his great work Superforecasting, author Phillip Tetlock showed that having a process by which a forecaster uses to drive the continuous improvement of one’s estimates is three times more likely than intelligence to predict the accuracy of the forecaster.

During the quarter, we threw out a lot of assumptions on legacy positions and re-underwrote our range of outcomes. This led to exits in Flybe and Front Yard Residential. A very lackluster board and chairman at Flybe, who turned down a takeout offer earlier in the year, proceeded to hire a bankruptcy attorney before trying to sell the company. We’ve rarely seen such mismanagement affect such a large organization. While we realized losses in Flybe, we used the opportunity to ensure this type of mistake never happens again. While the downside in Front Yard is still very low, the upside has been capped by a destructive board of directors and a management team with ulterior motives. While it was somewhat painful to sell a portfolio of single family homes at a 40% discount to their value, we were particularly eager to find tax loss sales to eliminate our tax bill for the year. We reallocated this capital to a very compelling new idea, Criteo.

Criteo is well-hated and faces a very skeptical stock market. Yet, its customers, who enjoy a 17x return on their marketing spend with Criteo, think otherwise. Customer churn is less than 1% a month, and 80% of their clients have uncapped budgets. The company is inventory-constrained and is working very diligently to solve these ad placement constraints. Mr. Market began its dislike of Criteo starting September 2017 due to policies enacted by Apple eliminating the ability to track users in its Safari browser. This created a sizable headwind for Criteo as it removed 16% of inventory for the company and led to the first revenue contraction in its publicly-traded history. The market punished shares and the EBITDA multiple contracted from 17x to 3.5x while profitability continued to climb. Since that time, the founder returned to the role of chief executive, purchased stock, and implemented a share repurchase program. The team used its own period of adversity well and launched three game changing products to help its 20k retail partners more effectively compete against Amazon. Not only do we get these potentially transformative call options for free, but are buying its core retargeting business for a pittance just as its revenue trajectory is inflecting back to growth. Shares became so cheap, that the risks are limited from our cost basis, which is key in the very volatile AdTech industry.

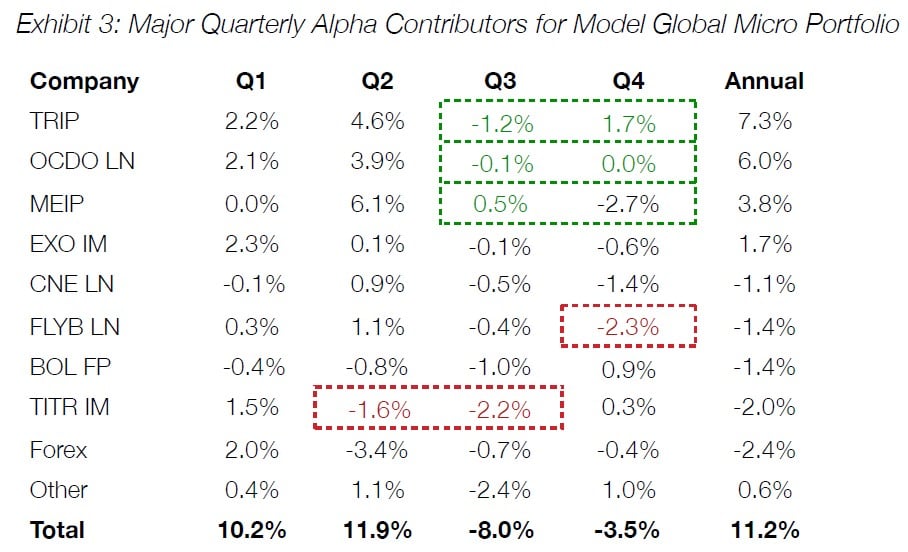

With an unprecedented valuation and a complacent consensus, Criteo’s expectations gap is very wide on the eve of it increasing its addressable market by >4x. While this ranking continuum is the newest in our framework, it has been a very pronounced driver of alpha since we started using it in early 2017. Exhibit 3 breaks out a few mistakes and a few areas where we managed positions well based on this expectations gap criteria.

As we noted, our new Boiled Frog intervention should help prevent “dead money,” from turning into losses. Removing Flybe from our portfolio at the beginning of the year would have improved alpha by 1.4%, hardly a disaster, but enough to demand improvement. Our worst mismanagement of the portfolio, however, was ignoring a dramatic narrowing of the expectations gap in Telecom Italia after an activist investor became involved and brought with them a large number of ambulance chasers in the form of fast-money international funds. Due to the pronounced risk-reward of the shares in the first quarter, we ignored the worsening expectations gap and were not motivated to reduce our exposure to the name. Excluding foreign exchange fluctuations, this oversight was the single biggest detractor to the alpha generated by our portfolio during the year. In order to prevent this type of mistake going forward, we have demanded that all ideas face a thorough re-underwriting of the expectations gap every quarter. The emotions of the erratic Mr. Market can change quite swiftly. To ensure we are staying on top of these mood swings, we’ve implemented this simple yet comprehensive review. Removing these two mistakes from our performance would have boosted our alpha by over 6%.

While it is most important to diagnose areas where we can improve, it is also important to acknowledge a few things we did well. The active management of our positions in TripAdvisor, Ocado, and MEI Pharma helped us hold onto a large portion of the alpha given to us by these three special situations. In the third and fourth quarters, as all of these positions experienced drawdowns, we mitigated their effect on the portfolio as we had substantially reduced our stakes in these names around their second quarter peaks. In the case of TripAdvisor and MEI Pharma, we repurchased these shares at materially lower levels. We still like all three companies, and believe 2019 will be transformational years for TripAdvisor and MEI Pharma. Positive fundamental transformations are also likely at Bolloré’s Vivendi, Rolls-Royce, Cairn Energy, Criteo, and yes, even Telecom Italia.

Yet, no position includes such a compelling roadmap as our coinvestment, which frustratingly gave back all of its outperformance in December. This means it has the widest gap between market expectations and fundamentals in our entire pipeline. The market is missing very significant fundamental shifts in the financial and strategic portfolio of the company, and we are excited that 2019 will mark the first year we add gamma to the portfolio. A concept developed by value-add property investors, gamma is the outperformance added to a portfolio through strategic actions taken by the investment manager on the asset. In an environment that gave us the 2018 market development, we are excited that we can take steps to generate value regardless of market circumstances. Because this is by far our most favorable risk-reward with the highest expectations gap, we closed our fund’s founder class to ensure this remains our largest position. With a bit of room to increase our exposure to the coinvestment, we have limited capacity still available in our fund’s founder class should any have an interest.

On a personal note, I am frequently asked where I am taking GreenWood, in terms of goals around assets and investors. I have always found this question uncomfortable until this summer. While most of our positions that generate alpha would allow us to comfortably grow to over $1 billion in assets, I do not have asset-based goals for the long-term. This summer, in the hours following the unfortunate news of the death of a key role model, Sergio Marchionne, a stark realization came over me. Sergio was reported to have had a sarcoma and ended up dying from a heart attack at the age of 66. A cold sweat came over me as I realized the other man I most want to be like in life also had a sarcoma and died from a heart attack at 66. Walter Carucci, the original minority owner of GreenWood, continues to provide so much inspiration for our group. The two men I most want to emulate, both died from the same affliction at the age of 66. In that moment I decided I would reverse-engineer my life such that if I only had 30 years left on this earth, I would have fulfilled a very ambitious mission. Part of that mission is that I want to have generated performance of a minimum of 100x. In order to hit this goal, we need to realize performance better than 13% a year, with near-term outperformance having a very favorable long-term effect. While we came close to this alpha in 2018, all the conditions are in place to do quite a bit better. And we will do better. The quicker we can return 100x, the better the chance we have at approaching a 4-digit number, and dare we say, even a 5-digit figure. While I realize the challenge inherent in such an ambitious goal, I am also reminded daily of Sergio’s wisdom that “mediocrity is not worth the effort.” We limited expansion of our fund’s founder class in order to ensure it is optimized for performance, not size.

Because our long-term incentive comes in the form of a performance fee, and we have committed to lowering the management fee with greater scale, having the right investor base is key for this performance to actualize. And you are a terrific group. We had another year of zero redemptions and counter-cyclical flows in the most recent quarter, many of them coming from existing investors. While some funds would seek to lock investors in so that flows don’t become pro-cyclical, we have opted for a different approach. Given our investors are very sophisticated, we have given them the tools to evaluate the attractiveness of our opportunity set. We have research on all of our positions and we report our portfolio monthly, along with the stats around the opportunity set. Our opportunity set has never been better. This steep risk-reward has traditionally translated to subsequent alpha. Even assuming our shorts go against us while our longs do the same, our fund’s risk-reward is over 50x. Yet, assuming our shorts offset the decline in our portfolio in a weaker market, the risk-reward is over 100x.

This very full risk-reward comes at the same time the quality of our portfolio has never been higher, and the expectations gap on our names remains very wide. Now with the fourth evolution of our ranking framework, we have all the tools we need, and all the support we need, in order to achieve a very ambitious set of goals for the year ahead. We are humbled by your support, and extend a particularly warm welcome to our newest investors during the fourth quarter, many of whom I’ve respected for quite some time. We look forward to reporting progress in the year ahead.

Annuit cœptis,

Steven Wood, CFA