Steuern! I always liked that word, it seems to exude a no nonsense seriousness. It’s a German verb meaning Control, or to be in control of, something that seems to have been singularly lacking in the markets these last few days.

What an exciting month? Starting with the Mid-east turmoil, then the Fed raised interest rates, and finally the Great Government Shutdown.

[REITs]Q3 hedge fund letters, conference, scoops etc

The Dow seems to have a mind of its own, now up, then down, and now up again…whew! And thanks to its influence even the other markets…London to Tokyo, with Dubai, Shangai, Hong Kong, Mumbai…all of them whipsawing around like no one’s in Control.

‘May we live in Interesting Times’ indeed!

A reasonably smart bystander may look to buy some good stocks on the cheap, a canny day-trader would think to chance a quick buck on a short position, an intelligent investor on the other hand would start looking at opportunities to diversify their portfolio.

Real Estate is an option, but is generally over invested in at the moment with even prime properties in London and Manhattan going a-begging for buyers.

Crypto deserves a look, but with Congress looking to regulate the market and the sheer numbers of new currencies (some of which are dubious) coming into the market, which ones can even be trusted?

Oil and Natural Gas are stuck in the low fifties, and with the cracks within OPEC becoming even more pronounced (Qatar Left OPEC), who knows where that goes?

Fin-Tech and Food-Tech are already heavily oversubscribed.

Metals and Minerals is an option, most heavy industries require it for manufacturing, and Industrial Automation is just about coming of age. Not to mention their demand as jewelry or fashion accoutrements.

In industry there is a growing demand to mechanize or increase the use of industrial robots and the reasons all make good sense – Less risky to use in hazardous industries like mining, oil and gas etc., Less prone to make mistakes in rote work, don’t need sick-leave, overtime etc., No labor hassles…the list goes on.

Use of rare earth metals in Medical devices is growing as the latter are becoming even more sophisticated in identifying and diagnosing conditions that hitherto went un-detected until it was too late. Most of these machines rely heavily on electronics apparatus which in turn use metals like silver as conductors.

The Internet of Things (IoT) revolution that we are a part of is only going to grow, being able to manage all our utilities, gadgets with our smart devices is just the beginning, and these too require some sophisticated electronics to function.

In the IT and communication industry the use of silver and copper are a given.

So I buy Neodymium or Lanthanum or Dysprosium or Palladium or Vanadium or…?

Not so fast, to start with most rare earth minerals are not available for sale to individuals, but even if you could buy let’s say a ton of cerium, or five tons of Neodymium – what are you going to do with it?

Most industries don’t buy these in job lots or trade for them on their own; they work through a network of suppliers to get their requirements fulfilled. There isn’t even much of a brokerage in the physical supply of it, and it isn’t like you can go and sell a ton of Palladium to GM.

Even more importantly most of these metals are too niche and the potential payday too limited for a non-industry investor to bother about.

Gold and Silver troy ounce prices at lows and about to soar?

For a person entering this sphere, there are only two truly established metals that have a wide range of uses, can be stored indefinitely, can be traded online without a physical transfer of the metal, and have a track-record of being valued by consumers (the layman on the street) which in turn guarantees a certain minimum price for it.

I’m of course talking about Gold and Silver.

The two enduring metals that have held a special place in the annals of history, and have captivated explorers since the dawn of time, have seen wars fought over their possession.

They are valued by industry for their chemical properties, especially silver which holds pride of place in having the highest thermal conductivity and light reflectance of any element found so far.

It holds intrinsic value for the person on the street who uses it for jewelry or as a hedge against future catastrophe. Of all the metals Gold and Silver can be traded in physical form or ETFs, and their prices can be tracked by any novice with access to a smart phone.

Both these metals tend to be spoken of in the same sentence; gold has always dominated the Metal space and is usually an indicator of how metals are going to perform.

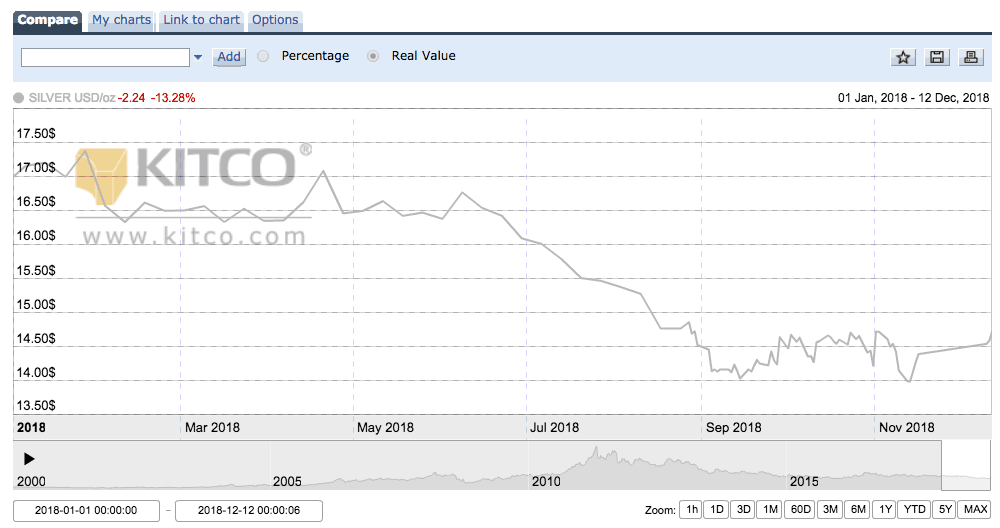

A disastrous 2018 has seen the price of these metals plunge over 14% for Silver from over $17 per Troy Ounce in January to a low of just over $14 in November, and for Gold from $1,362.40 per troy ounce to $1,176.20 in August.

Reasons vary all the way from an unusually strong rally of the dollar to falling industrial output etc. etc..

Gold has since been trending upwards even as global currencies are shedding all the gains of 2018. As of early last week the price of Gold was $1,269.11 per troy ounce, Silver on the other hand barely registered any gains at all.

This is why you should take a look at silver. Silver touched a three year low in November testing the bottom at $14 per troy ounce, and unlike Gold is yet to really bounce back, also unlike Gold Silver tends to be more elastic – when the price peaks it books record profits, and when prices fall it just bottoms out. So considering Silver is touching a three year low and has found support at $14 per troy ounce, there’s just one way for it to go.

As of now experts are looking at Silver to be anywhere between mildly bullish with gains of 20% all the way to wildly bullish with gains exceeding 50%.

Over the last week spot prices of silver have jumped from 468.30 USD/KG to 493.06 USD/KG. And as I’ve always said – The Trend is Your Friend. So get on the silver train before it leaves the station.

Thank you for reading my post. I regularly write about private market opportunities and trends. If you would like to read my regular posts feel free to also connect on LinkedIn, Twitter or via Atlanta Capital Group Investment Management.

Greg Silberman is the Chief Investment Officer of ACG Investment Management LLC (“ACGIM”). ACGIM specializes in creating custom private market solutions for RIA/Family Office clients.

While diversified commodity exposure can provide investors with a number of potential benefits, investing in commodities entails risks as well. In particular, commodities may not perform well during cyclical downturns in the U.S. or global economy, when consumer and industrial demand slows, they may also be impacted by market, political, regulatory and natural conditions, and may not be suitable for all investors. A commodity futures contract is an agreement to buy or sell a predetermined amount of a commodity at a specific price on a specific date in the future. Trading in commodity futures contracts is highly speculative due to high amount of leverage involved in holding futures contracts. Given this large amount of leverage, a very small move in the price of a commodity could result in large gains or losses compared to the initial margin. Unlike options, futures are the obligation of the purchase or sale of the underlying asset. Simply not closing an existing position could result in an inexperienced investor taking delivery of a large quantity of an unwanted commodity. Speculation using short positions in futures can lead to unlimited losses.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. It is not possible to directly invest in an index. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. Advisory Services offered through ACG Investment Management, LLC. ACG Investment Management is an affiliate of ACG Wealth Inc.

Source of Data: