Forge First Asset Management commentary for the month of December 2018.

The Sui Generis Canada Partners LP fund was down -3.59% for the Class A Lead Series during December 2018, resulting in a year-to-date net return of 1.38% since inception (March 1, 2015) and cumulative net return of 10.91% (2.74% annualized).

Q3 hedge fund letters, conference, scoops etc

Forge First Asset Management December 2018 Commentary

Well, the dust has settled and Forge First has concluded a great year with each of our funds providing solid net returns to our investors. The S&P 500 on the other hand suffered one of its worst months ever, finishing down 9% for December 2018. This of course could have been much worse if not for the heroic rally that brought stocks back from their lows on Christmas Eve, at which point US stocks were down 14.82% on the month. By comparison Canadian stocks fell a paltry 5.75% over the month (9.5% down at their worst, also Christmas Eve). This sort of startling volatility is the result of a great divergence in opinions within the financial arena at a time when liquidity has become increasingly scarce. The disagreement is palpable and characterized by the violent moves both up and down.

Is this nothing more than a harsh correction or were the September highs the end of the bull market? And yes while it is worth pointing out that US stocks did briefly hit the definition of a bear market last month, declining 20% from their highs, the question we’re asking, and aim to decipher, is whether there’s a further 20% downdraft or is the next move, be it up or down, more modest in nature.

In other words, what sort of bear market are we in? One that is long and painful, analogous to the reflection of systemic financial risk that characterized the “great recession” of ten years ago? Or a far shallower event similar to the relatively mild and short recession of the early 2000’s, often considered a “wealth effect” recession catalyzed by the punishing declines in technology stocks post the tech bubble. In the short term, perhaps the latter is more likely given the undeniably bubbly behavior during the past twelve months in the cannabis and block chain markets.

Obviously these questions can’t be answered yet but can justifiably be debated at great length. Our partial answer to the question, for what it’s worth, is that we have yet to find the type of systemic risk in the banking system (Deutsche Bank (DB.US) notwithstanding) that could cause a financial/liquidity crisis similar to 2008. But it’s possible that this cycle could ultimately find its nemesis in the sovereign debt market, but we don’t think we’re there just yet.

We don’t run macro funds at Forge First, however, we do believe it’s prudent to keep our fingers on the pulse of both economic and market cycles. To that end, it strikes us that there are two macro elephants in the room that must be understood before we get any real macro clarity. The first is the China/US trade negotiations and to us it feels as though a “deal”, while not particularly material from an economic perspective, could light a fire under stocks, while an acrimonious conclusion could tank the market. Unfortunately the outcome seems binary so we’ll have to wait and see what happens. The second item to continue to monitor is the continued surge of populism around the world, particularly in the US with the emergence of a far left contingent of Democrats; remember, 2020 is next year!

But while there are a lot of predictions to take a swing at, we know ourselves well enough that beyond awareness of the facts with an overlay of simplistic scenario analysis, our time is best spent on what we’re best at; continued emphasis on bottom up stock picking with our focus on free cash flow while maintaining a close eye on the cycle. We believe those tactics will continue to generate success for our investors.

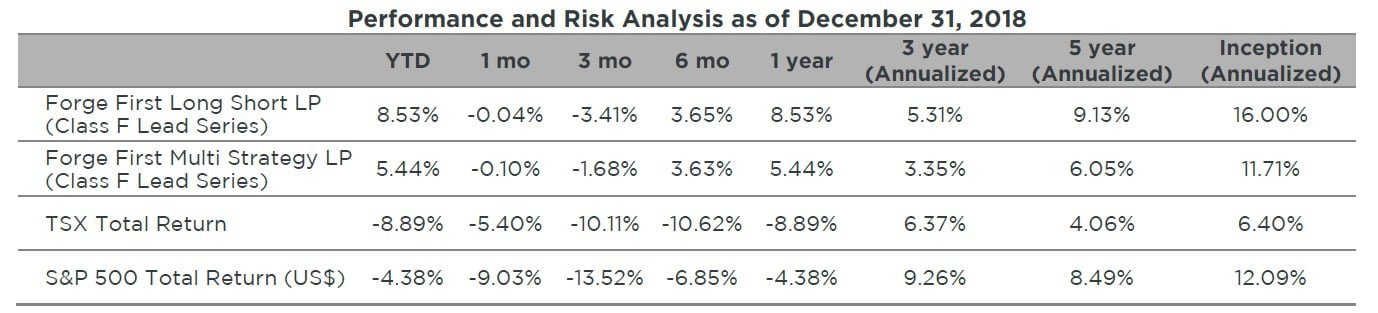

During December 2018, each of the our two funds held in like champs, with the Class F Lead Series of the Forge First Long Short Fund (FFLSLP) losing 4 basis points or 0.04% net of fees and the Forge First Multi Strategy Class F Lead Series (FFMSLP) falling 10 basis points or 0.10% net of fees. As a result both funds delivered solid positive returns to investors for 2018, with the Long Short fund gaining 8.53% and the Multi Strategy fund delivering a 5.44% return, net of fees.

Note: Returns for the Forge First funds are based on the August 2012 Class F Lead Series and are net of all fees and expenses. In a year, up to 12 series can be created within a Class of units. Unitholders are advised to refer to their monthly statement for the net return of their respective Class and Series. Returns expressed in this table are “time-weighted” and are not the same as the mandated “money-weighted” returns used in the production of client statements effective December 31, 2015. All returns are in local currencies.

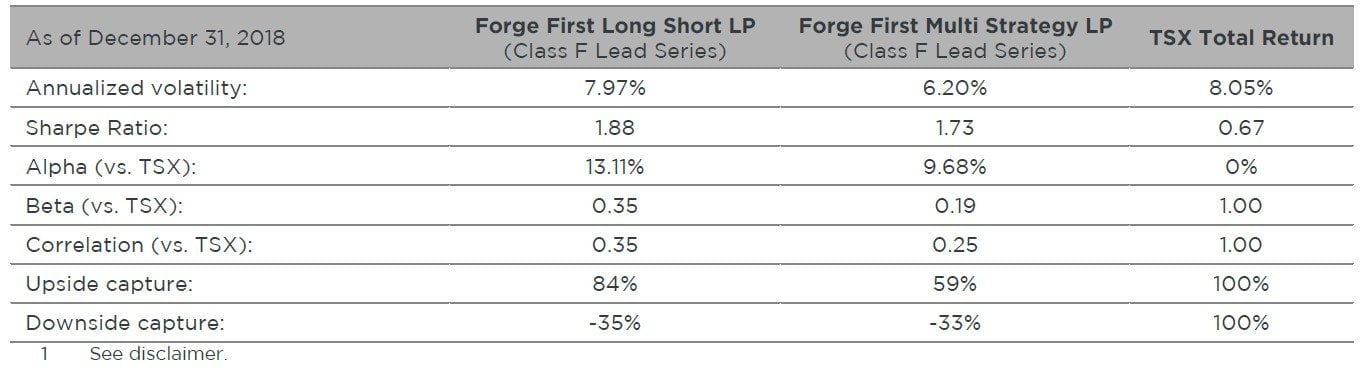

As can be seen in the above tables, these statistics leave the 3 year & 5 year net CAGRs for each of the two funds at 5.31% & 9.13% for FFLSLP & 3.35% & 6.05% for FFMSLP. Downside captures are negative, at –35% & -33% respectively while the Sharpe ratios for the two funds sit at 1.88 and 1.73.

In a call back to our November 2018 commentary, the ideas we highlighted in that note happened to be amongst our strongest contributors during the month of December. These ideas included long positions in gold producers and our short positions in US credit card lenders Capital One Financial Corp (COF.US), American Express Co (AXP.US) and Discover Financial Services (DFS.US) and added considerably to the positive side of the performance ledger. We continue to hold these positions and in fact have added to our weight in gold producers.

On the negative side, to be blunt pretty much everything in the long book other than gold, our REIT positions and bonds were negative contributors, with our positions in the industrial and consumer discretionary sectors being the hardest hit. One final note regarding the performance in December, it was interesting to observe the outperformance of the energy sector after tax loss selling abated. We belief this relative outperformance should continue during the first half of 2019.

Also in H1 of 2019, we foresee many interesting investment opportunities for each of our long and short books around the suddenly topical possibility of earnings revisions. The opportunities are two-fold and they come in the form of identifying those companies we believe may see earnings revisions (let’s be honest, downward earnings revisions) into their Q4/full year earnings reports while also finding value for the long book in businesses we believe have priced in an overly pessimistic outlook.

Let’s first consider the idea of downward earnings revisions. We used the word topical earlier given the market’s reaction to chop off US$75B from Apple’s market capitalization post its revised guidance; our point is that with the recent heightened volatility in equity markets, negative earnings surprises or guidance revisions downward are unlikely to be treated kindly.

If the glass is half empty (looking for shorts) we think the impulse will be to look for vulnerable sectors based on the perception of where we are in the market or business cycle, however our sense is that these events will be more company specific rather than industry wide. A basic “for instance” would be that Apple’s negative surprise was blamed entirely on weaker than expected China sales, but this development obviously shouldn’t doom the entire technology sector (ie. our largest technology long position, Alphabet Inc. (GOOG.US), does not even conduct business in China).

Another example may be the consumer discretionary sector. While we certainly agree various consumer-facing businesses could be vulnerable to downside surprises given that a) consumer discretionary stocks as a group still trade more than four P:E multiple points higher than the market and b) consensus expectations are still for solid earnings growth for 2019 (Figure 1 below), hence, we would caution against blanket assumptions and focus on specific factors that could cause an earnings issue for a particular company. The obvious short example would be the hybrid consumer/financial exposure provided by the aforementioned credit card lenders contrasted against Alimentation Couche-Tard (ATD.B.CA), a consumer name that we believe has very specific tailwinds that should propel the stock to strong relative outperformance during this time of economic flux. Our point being that one can harp on about the cycle all they want, but the bottom up, in-depth knowledge of companies is what will allow us to short the bad, own the good, and outperform.

Conversely, if one wanted to adopt a glass half full approach you could consider some of the deep cyclical industries that have experienced dramatic declines in their share prices, leaving many priced for a worst case scenario (Figure 2 above). Certain energy and industrial companies fit this bill despite having strong balance sheets. In our mind, the share prices of these companies offer significant upside potential. Further, as it pertains to the energy sector, we would emphasize that not all energy is created equal (obviously…we’re in Canada after all) and in such uncertain times we would emphasize those industrials with a sustainable moat (think railways).

The basic materials space has also been particularly hard hit, however, for the time being we choose to avoid the space as it’s still a China-driven sector and we aren’t ready to head down that rabbit hole just yet. And to be honest it isn’t particularly difficult to find stocks that have declined by 30, 40 or even 50% over the last year and many of these are not broken businesses as the share price might suggest.

So all of this is to say we believe there are as many long and short opportunities as a fund manager could possibly hope for right now. We are working hard to identify those names we believe possess a combination of overvaluation and optimistic earnings expectations for our short book. Inversely we are scrounging through the wreckage of the last month to find names that have been unjustifiably beaten up to the point where should there be a lowering of earnings expectations, we can safely say it is already priced into the stock.

Overlaid on all of this is our core belief that companies generating free cash flow throughout the businesses cycle (that we may or may not be at the end of) will always represent the vast majority of a long book that we consider to be rock solid. In contrast, our shorts, companies that have continued to burn cash through the expansion and bull market, may suddenly find that finding others that are willing to fund their business becomes much harder.

So while each of our funds is net long at this juncture, our positioning is cautious as opposed to dogmatic given the unpredictable nature of the U.S. China trade negotiations. We’ve completed our scenario analysis and will be ready to act when we believe it’s time to do so. However, for us, fundamental investors versus fast money traders, such tweaking is more about managing risk than attempting to chase returns.

At Forge First we like to think of our funds as being tortoises, not hares. And as you know, tortoises like to bask in the sun. Given that we’re nearing the end of an economic & market cycle, investors are once again understanding the utility of active versus passive money management. In addition, we’ll shortly enter a decade of dis-savings versus the 15-year cycle of excess savings that stocks have feasted upon. This shift will boost the cost of capital, lowering returns. Together, these factors generate a forecast with lots of sun for money managers that consistently include a diversified short book in their investment portfolios.

Thank you for your interest and your business during 2018. We look forward to being a part of your portfolio solution during 2019. As always, please contact us with any questions.

Thank you,

Daniel Lloyd

Portfolio Manager

Andrew McCreath

President and CEO