Arquitos Capital Management commentary for the fourth quarter ended December 31, 2018, discussing their long positions in Enterprise Diversified (SYTE), MMA Capital Holdings (MMAC), and WESTAIM (WED.V).

Point of view is worth 80 IQ points. – Alan Kay

Dear Partner:

Arquitos returned -31.3% net of fees in 2018, compared to -4.4% for the S&P 500. Our annualized net return since the April 10, 2012, launch is 21.3%. Please see page 8 for more detailed performance information.

Q3 hedge fund letters, conference, scoops etc

Structured for Permanence

In "Perennial Seller: The Art of Making and Marketing Work that Lasts," author Ryan Holiday writes about artists and goals and reality. Why do movies like “The Shawshank Redemption” or “Citizen Kane” or “The Sound of Music” endure? What about Shakespeare or The Beatles or Tiffany diamonds? Why does “Les Misérables” still play on Broadway and on London’s West End after all these years?

Music provides the clearest example. Some musicians intentionally attempt to create timeless works. It shows. Their lyrics are about love, loss, spirituality, and other enduring aspects of human nature. Other musicians without that intent sing about unimportant topics in a way that won’t be remembered. Or, worse, their short-sighted lyrics get mocked in the future.

There is a surprising number of forgettable songs from the 1980s and early 1990s involving lyrics about pagers, for example. Though my doctor friends still use pagers for legitimate purposes, I believe these songs are about illicit drug sales and parties and not about summoning a medical doctor to a patient, unfortunately.

Holiday implores creators to be intentional. Intentionally produce, position, and market for permanence. He must communicate that intention to his audience. To do that, first, the product must be great. The creator must be focused and must want to create meaningful work. Holiday references Robert Greene, who said, “It starts by wanting to create a classic.”

What about positioning and marketing? The only thing that matters is word of mouth. For a work to become a classic, it must have advocates. It must have champions. It must have a core audience that appreciates the creator’s intentions and is committed to the artist and the idea behind the work.

You may be asking yourself, what the heck does this have to do with an investment portfolio, let alone one that just finished the year with pretty miserable performance?

I started Arquitos in 2012 with just a few investors. I had been managing separate accounts from friends and family for a few years prior to that. My thought was that I was managing a portfolio with my own money, and I planned to do so for the rest of my life. Why not invite others to join? It was not important how many joined or with how much money they joined. What was important was that I could give them long-term financial security. They had confidence in my investment ability, they knew the fund would be around for a long time, and their investment time horizon matched the time horizon of the portfolio.

Experiencing tough years occasionally is inevitable. It is part of the business. The price of stocks often does not match the underlying value of the company. Stock prices get ahead of themselves at times. Other times, the operations get ahead of the stock price.

The concept is pretty simple. Buy when the stock price is cheap compared to the long-term prospects of the company, and sell when it is expensive.

The concept is also one of the hardest things to do in the world. It involves expertise in analysis, which can be learned. Discipline in decision-making, which is much more rare. And extreme humility that the market is right most of the time and extreme confidence that, on this occasion, the market is wrong. The application of that last one is what separates great investors from others. It is a personality trait, I believe, that can’t be learned.

An investor, whether passive or active, also must have long-term confidence in human ingenuity. The stock market is about human progress. The companies that make up the stock market are about creative destruction, efficiency, and accountability. You have to have optimism to fully appreciate the power of compounding. Of, over time, the good overcoming the bad. The efficient destroying the inefficient.

Skeptics make good investors. Pessimists do not.

Investing is also challenging because mistakes are guaranteed. Some of these mistakes will be in analysis. Some will be mistakes in judgment. Some will be psychological. That’s also part of the business. Add on the challenge of attempting to learn the right lessons from a mistake. I have seen a lot of investors overcorrect, turning one mistake into two.

Permanence is about intentionally structuring the fund to not allow mistakes to destroy the fund.

I designed the portfolio to last. We will always be able to endure volatility like we had this year. I don’t buy on margin, so I won’t be a forced seller because of volatility. The fund has a large number of investors, 83 at last count. Our largest investor makes up 11% of the fund; so the liquidity needs of one investor cannot negatively affect the entire portfolio. Investors have committed to me that they are in it for the long term. This commitment and diversification among investors help prevent volatility from turning into permanent capital loss. They help to prevent the creation of risk where none was.

Permanence is also about alignment of interests. Most of my family’s net worth is in the fund. Likewise, I look for companies to own in the portfolio where there is large insider ownership.

Just like I don’t want debt in the portfolio through margin loans, I also look for companies with a low amount of debt and strong balance sheets. This both protects the company from operational volatility and allows it to take advantage of opportunities that may come up. Finally, most of the companies we own in the portfolio were originally purchased below book value. Today, the portfolio is so cheap that most of our holdings again trade below book value, in some cases significantly so.

At the outset, I designed the portfolio and the fund to last. I intentionally sought to create the fund to be a classic. I sought diversification among investors. I rejected investors who were not like-minded in order to ensure the portfolio’s resiliency.

I am singing about love, not pagers.

Seth Godin talks about striving to be the top 5%. Being in the top 1%, he explains, requires luck and magical talent. You can’t control that, and, in investing, you really only know if the portfolio manager has magical talent in hindsight.

The top 5%, though, is attainable. It can be achieved through focus, effort, and desire. It is not a competition against others. It is internal competition.

“To be in the top 5%, one in twenty, is mostly about choices,” according to Godin.

Arquitos is striving to be in the top 5%. In long-term performance, not size or notoriety. I believe we have accomplished that so far. On a gross basis, we have beaten the S&P 500 by 16.7% annually since the fund was launched more than six and a half years ago. Overall, our record is exceptional.

A Review of 2018 and a Look Ahead

This letter has two different audiences with significantly different experiences with Arquitos. One audience is the 37 investors who joined more than 18 months ago and, in most cases, have enjoyed astronomical gains over a relatively short amount of time. Most of those investors went through 2015, when the fund also struggled, and then enjoyed significant returns in 2016 and 2017. Those positive returns happened because of decisions made in 2015. This audience knows, and has experienced, the periods of reaping and sowing.

The other audience is the 46 new investors who joined Arquitos in the last 18 months. That experience is different. These investors didn’t enjoy the success created over the first five years of the fund. This next section of the letter is really for this audience.

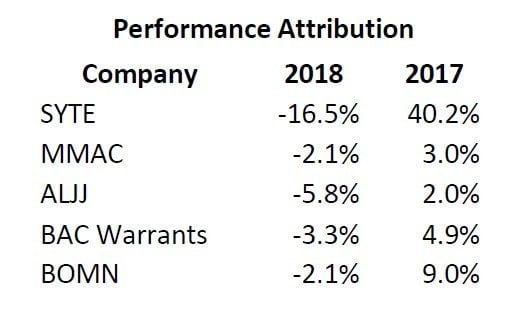

To get proper context for 2018, we have to look back at 2017. The table below helps.

* Intrawest Resorts (SNOW), which was bought out by another company in 2017, made up another 5.4% of gains that year.

Enterprise Diversified (SYTE)

In 2017, Arquitos returned 80.8% before fees. Of that, almost half was generated by SYTE. We gave back some of those gains in 2018 but are still significantly ahead of our original cost basis.

Clearly this position has an outsized effect on our portfolio. It currently makes up 29% of the fund. At the end of 2017, the stock traded at $14.88 and a multiple of book value of 2.2. As chairman, I won’t publicly provide my opinion of valuation on the company, but it is fair to say that I believe the company is worth far more than book value. Book value is understated for a variety of reasons, chief among them is that it does not take into account our relationships with a number of talented money managers.

Those relationships contain fee shares with SYTE’s Willow Oak Asset Management subsidiary. As the funds grow, this provides exponential increases in revenue for SYTE with no corresponding expense. These fee shares provide positive leverage with no downside risk.

When you are partnered with talented managers, there is no better business than investment management. Our managers are driven, smart, and unique and have a long runway ahead of them. Plus, SYTE expects to team up with more fund managers through its Fund Management Services in 2019. There is a lot of potential with little risk for the company.

Let me give one illustration. The Bonhoeffer Fund is managed by Keith Smith, who is a SYTE director. Keith is a talented investor who runs a differentiated portfolio. He owns stakes of companies in South Korea, the Philippines, South Africa, Italy, and other countries.

Bonhoeffer was launched in July 2017 and currently has $14 million under management. SYTE has a 50% fee share with the Bonhoeffer Fund. It is not unreasonable to assume that by 2022 Bonhoeffer gets its assets under management up to $50 million. Let’s also assume, as a thought experiment, that the fund returns 30% that year. Too high you might say? 30% is the average yearly return that Keith made in his personal portfolio in the 11 years prior to launching the fund. (This includes a 146% gain in 2013 when Arquitos only returned a lowly 59%).

With Bonhoeffer’s fee structure and SYTE’s fee share, SYTE would earn approximately $1.5 million in 2022. Book value for SYTE’s Bonhoeffer interest is currently $0. The market cap of the entire company is currently $22 million. One relationship and one year has the ability to earn 7% of the entire value of the company.

SYTE also owns 100% of Willow Oak Select Fund and receives a fee share from Alluvial Fund in addition to its direct investment. Additionally, as part of the Fund Management Services agreement with Arquitos, SYTE receives a small fee share from Arquitos. This comes from the management company, not the fund. All of these relationships are extremely valuable to SYTE and are carried on the books at $0.

At the end of 2018, SYTE traded for $8.70 and a multiple of book value of 1.1. Book value grew in 2018 (through Q3, with Q4 not yet being reported). Quite frankly, given the details about the potential of SYTE’s asset management subsidiary above, does it really matter why the sentiment changed and the multiple of book decreased? Are there any legitimate doubts among SYTE investors that the long-term value of the company far exceeds its current valuation?

MMA Capital Holdings (MMAC)

I recently put together a detailed presentation on MMAC and am happy to provide it upon request. I have written about the company several times over the years. Amazingly, the company is cheaper now relative to its book value than it has ever been during our holding period.

Estimated book value at the end of Q4 2018 is $35.31. Shares are currently around $26 and had ended the year at $25.20. MMAC has simplified their business significantly and is now primarily a niche asset manager focused on short- to intermediate-term lending on renewable energy-related projects. The company has a large co-investment in the space and earns management and performance fees from the portfolios they manage.

MMAC also has a huge pile of cash and equivalents relative to their market cap. In addition to trading at 0.7 times book value, they also trade at just 4 times trailing earnings and somewhere between 6 to 8 times estimated 2019 earnings. Finally, they continue to buy back about 10% of their shares each year. For this reason, the fact that shares trade at such a large discount to book value provides a huge benefit to us as shareholders.

MMAC negatively affected the Arquitos portfolio in 2018. It is a classic example of the stock price being wholly disconnected from the reality of the company. It is our second largest holding. If I could buy more shares, I would.

WESTAIM (WED.V)

I am a member of the Manual of Ideas, a community of talented portfolio managers and investors run by John Mihaljevic. Manual of Ideas holds several idea-sharing events each year. I presented MMAC a few years ago to the group and, just this past week, presented Westaim. If you’d like to see the presentation, please let me know. It contains a great interview I did with Westaim’s COO, Rob Kittel. I came away more impressed than ever.

Westaim is our third largest holding and extremely undervalued. Its book value is C$3.10 with a share price of C$2.58 as of December 31, 2018, or 0.8 times book value.

Westaim has two subsidiaries: a specialty insurer, Houston International Group; and a credit fund, Arena Group. The insurance subsidiary is likely to either be sold or strategically divested. It is held on the books at 1.1 times book value and is likely worth at least 1.6 times book. It is not distressed in any way and, in fact, has dramatically improved its operations over the last few years as it has gained more scale.

Arena Group is the more exciting of the subsidiaries. It is made up of three entities. Arena Finance is internal capital. Arena Origination serves as the origination arm. And Arena Investors provides investment management services to third parties through pooled funds and separately managed accounts.

The value of Arena Finance and Arena Investors counts in Westaim’s book value, but Arena Investors does not. Like the SYTE example I gave with Bonhoeffer Fund, Westaim’s stake in Arena Investors is incredibly valuable. AUM is pushing $1 billion, performance has been great, and Arena has increased its marketing activities so AUM will likely continue to increase.

We get all of this for less than Westaim’s liquidation value. The market has given us a gift at this price.

Other Portfolio Holdings

Our fourth largest position trades at less than 2 times EBITDA. We own another company that trades for 75% of its liquidation value. We own a company that has a 7% plus dividend yield and trades at 70% of book value. We own the Berkshire long-dated options that I talked about last quarter, and we were able to add to them at much lower prices.

I hope you sense my enthusiasm in this letter and for this portfolio. I am more excited now than I have been since I launched the fund.

Howard Marks once said, “If it’s cheap you buy. If it gets cheaper, you buy more. If it’s cheaper, you buy more.”

He then half-jokingly said, “and if you run out of money, you ask your clients for more money.”

I am selectively reaching out to investors to ask for more money. If you would like for me to contact you to discuss an additional investment, then please let me know.

I can’t predict the timing of when the stocks we own will increase in price. I can tell you that the underlying companies have all increased in value, yet their stock prices have declined. This is a recipe for long-term positive performance in the portfolio. It is part of the fear and greed cycle in the stock market that happens time and time again. Do the opposite.

Fear forces out some investors from the market when stock prices decline. Greed brings them back in when stock prices go up. This is where investing is simple, but not easy at all and why investing is ultimately a psychological sport, not an analytical one.

Thank you again for your investment in Arquitos and for your commitment.

Best regards,

Steven L. Kiel

Arquitos Capital Management

This article first appeared on ValueWalk Premium