Vivendi has unveiled its five-person slate for election to the board of Telecom Italia, moving forward with a proxy contest aimed at regaining control of the board. Vivendi this time has changed tack, including on its slate four Italians, who it said are independent.

Vivendi lost control of Telecom Italia earlier this year when Elliott Management’s slate of 10 Italians won against candidates close to the French group. Vivendi requisitioned another meeting on December 11 after the Telecom Italia board abruptly fired CEO Amos Genish and installed turnaround specialist Luigi Gubitosi, a board member from Elliott’s slate.

Q3 hedge fund letters, conference, scoops etc

Vivendi is seeking to remove Chairman Fulvio Conti and directors Alfredo Altavilla, Massimo Ferrari, Dante Roscini and Paola Giannotti de Ponti. To replace them, Vivendi advanced Flavia Mazzarella, Franco Bernabè, Gabriele Galateri di Genola, Rob van der Valk and Francesco Vatalaro. Bernabè served on behalf of Vivendi one year through 2018, and he also was Deputy Chairman. Bernabè has a long history with Telecom Italia, having served briefly as CEO in 1998 and again in 2008. De Genola is currently non-executive director at Assicurazioni Generali and served as chairman of Telecom Italia four years through 2011.

What we'll be watching for this week

- How will Amber Road respond to Altai Capital Management’s push for a sale of the company?

- Will EQT follow through on its promise to contact the Rice brothers? And if it does, how will the activists respond?

- How will Elliott Management respond to Vivendi’s five-person slate, which the French media group nominated for election to the board of Telecom Italia?

Activist shorts update

Troubled cannabis firm Aphria is reportedly considering parting ways with its longstanding law firm Stikeman Elliott after Quintessential Capital Management and Hindenburg Investment Research questioned the company’s recent Latin American acquisitions. The short sellers released a joint presentation on December 3 that alleged Aphria's acquisition of Latam Holdings in September was done at highly inflated prices to funnel capital to a group of insiders. Stikeman lawyers advised Aphria on the acquisition. Since the announcement of the short position, the long-standing relationship between Aphria and Stikeman has slowly deteriorated, sources told The Globe and Mail.

Meanwhile, the company has formed a special committee of independent directors to review the governance processes related to the Latam Holdings acquisition and has promised a full rebuttal of the short report - initially for last week, now put back until the investigation has been completed. The Aphria special committee hired law firm Lenczner Slaght Royce Smith Griffin as its legal adviser.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

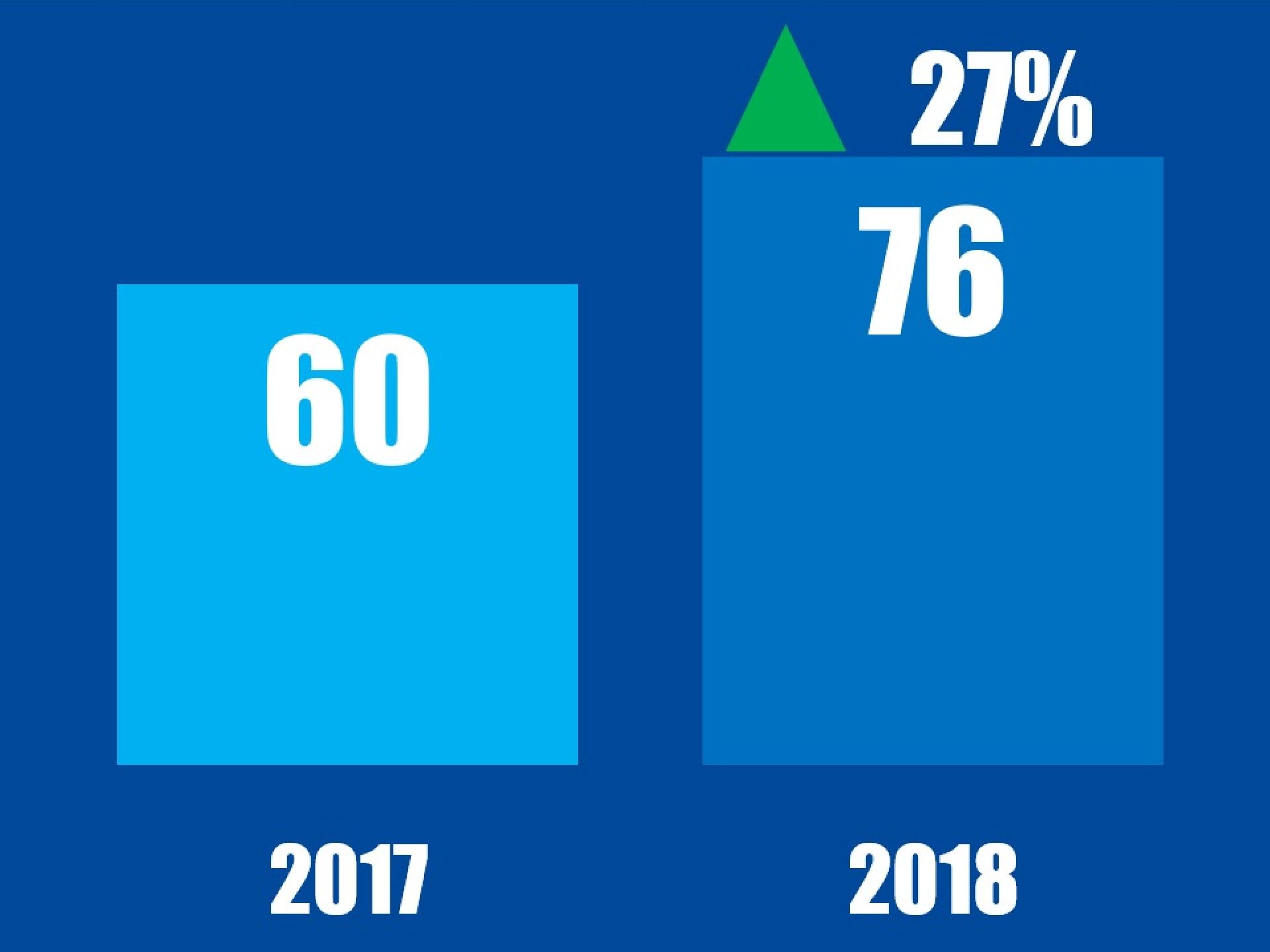

Chart of the week

The number of companies based in Australia publicly subjected to activist demands between January 01 and December 14 in respective years.