Wise investors tend to be not only careful but also extremely patient. Now it’s starting to look like patience could be about to pay off for value investors—big time. More and more datasets and reports are starting to show that growth and momentum stocks are about to bite the dust while value stocks are starting to take center stage.

Now Morgan Stanley analysts are predicting this very thing.

Range-bound S&P 500 predicted for 2019

Analyst Michael Wilson and team didn’t hold anything back in their “2019 U.S. Equities Outlook” this week. They’re predicting disappointment in the equity market next year, and they recommend value going into 2019.

Q3 hedge fund letters, conference, scoops etc

"After a roller coaster ride in 2018 driven by tighter financial conditions and peaking growth, we expect another range-bound year driven by disappointing earnings and a Fed that pauses," they wrote. "Valuation should be key factor in stock selection."

They expect next year to look much like this year, but with some key differences. They had forecast a consolidation range of 2,400 to 3,000 for the S&P for 2018, and they expect the index to remain roughly within this same range next year. However, they expect the fundamental drivers for the index next year to be quite different than they were this year. They're predicting flatter growth and multiples with different sectors and stocks dominating the year.

Beware the "Rolling Bear market"

Wilson and team also highlighted what they describe as a "Rolling Bear Market." Their thesis basically suggests that we should expect other dramatic pullbacks over the next year. They note that the S&P 500's forward PE multiple peaked at 18.5 times in December 2017 and then tumbled to its most recent low of 15 times at the end of October.

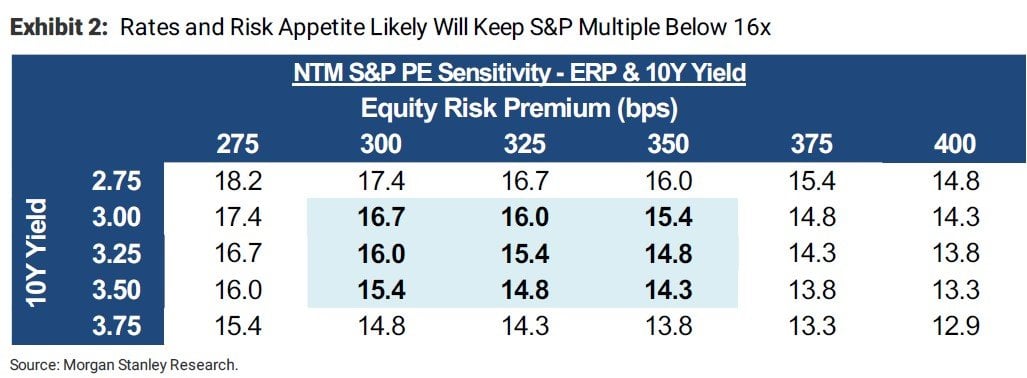

According to the Morgan Stanley team, this is the biggest decline since 2011 and the last time a "more traditional bear market" was observed. They believe a multiple of 15 times is the bottom while 16 times is the high end of the range, based on 10-year Treasury yields and equity risk premiums ranging from 325 to 350 basis points.

However, they also said that a narrow PE range and "stagnant" earnings per share estimates could mean the bumpy ride will continue until the umbers adjust or there is some positive or negative shock which pressures multiples in either direction.

"In short, the Rolling Bear is tired from all the mauling he has done this year," they wrote. "However, he is likely just resting rather than hibernating."

The Morgan Stanley team doesn't expect the last leg of this rolling bear market to come until estimates for next year are reduced. Nonetheless, they expect that pullback to be less extreme than the multiple compression which occurred this year. They also said it could take some time for this last leg to arrive because companies and analysts reduce their estimates at various times rather than all at once.

The big switch: from growth to value

Wilson and team also covered the style balance between growth and value, and they see "a major leadership change" occurring in value's favor. In fact, they think value stocks could enjoy a much longer time in the sun than what most market watchers are expecting. They explained that growth stocks "finally got mauled by the rolling bear" in October.

The S&P has been stabilizing since that deep pullback, and the Morgan Stanley team also observed that value stocks are still outperforming growth, based on the Russell Large Cap Value and Growth indices. They add that this shift toward value stocks doesn't mean growth stocks can't work at all, but they do emphasize that valuation is now much more important than it was.

"The bottom line is that investors need to pay more attention to valuation now, especially for over loved growth stories that are effectively the longest duration assets in the world," they emphasized.

This article first appeared on ValueWalk Premium