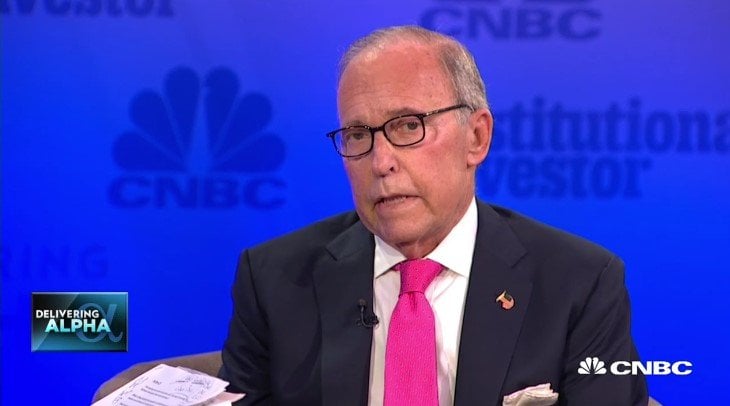

First on CNBC: CNBC Transcript: National Economic Council Director Lawrence Kudlow Speaks with CNBC’s “Squawk on the Street” Today

WHEN: Today, Friday, December 7, 2018

WHERE: CNBC’s “Squawk on the Street”

The following is the unofficial transcript of a FIRST ON CNBC interview with National Economic Council Director Lawrence Kudlow on CNBC’s “Squawk on the Street” (M-F 9AM – 11AM) today, Friday, December 7th. The following is a link to video of the interview on CNBC.com:

Q3 hedge fund letters, conference, scoops etc

Watch CNBC's full interview with Lawrence Kudlow

CARL QUINTANILLA: Let’s get to Lawrence Kudlow joining us this morning on the back of the jobs number. Labor department says that job growth did slow in November, $155,000 jobs added for the month. A touch below expectations. Unemployment steady at 3.7. Larry good morning. Good to have you.

LAWRENCE KUDLOW: Good morning, Carl. Thank you.

CARL QUINTANILLA: So our three-month average goes to 1.70. Our weakest goods producing print since March. ADP yesterday suggested job growth has peaked. Has it?

LAWRENCE KUDLOW: I don’t know if it’s peaked. I mean, we’re running, what, 200,000, 206,000 a month for the entire year through November. That’s pretty good. Last month was 250. This month 155. I was impressed with the manufacturing number, which was what -- about 27,000. This has been a blue collar recovery. The best blue collar job performance since the mid-1980s and also the best blue collar wage performance. So I don’t know, I think it’s a very decent number.

CARL QUINTANILLA: Month on month, average hourly earnings were revised down from .20 to .10. Market’s going to like that news. Can you blame them?

LAWRENCE KUDLOW: Well, I don’t know. Look, I like higher wages, by the way. I like working people getting higher wages. I like everybody -- I even like broadcasters getting higher wages. So I think, you know, we’re 3.1% average hourly earnings year on year. Times hours worked – you’re probably running about near 5% as an income proxy for you know, main street workers. I think that’s very, very good. You’ve got 3.1% as I said – you’ve got 3.7% unemployment, Carl, as you know. Actually, that number you could almost tweak it to 3.6%. It was very close on the rounding error. So I think it’s a solid number.

JIM CRAMER: Larry, it’s Jim, how are you been?

LAWRENCE KUDLOW: Good, how are you, Jimmy?

JIM CRAMER: Okay. I think when I read this number, I think the President made a good case to say, “Hey, listen, let’s let it play out. Let’s have all these people be employed.” Do you think it is right that an elected official, the president, makes those statements? Because they turned out to be right.

LAWRENCE KUDLOW: The guy’s a good forecaster, and I don’t have any problem with it. I think a lot of things are coming home. I’m reading all these Fed officials are now saying that the inflation rate is actually coming down a bit. The economy is growing, the supply side tax cuts and deregulation is working. There’s capital deepening, which is great for productivity and real wages. Sounds to me like the Fed’s spokespeople are signaling maybe one more rate hike in December, later this month, and maybe no more for quite some time. Or maybe they won’t move this month. But again, the president, as I said a million times, he has a lot of experience as a businessman and investor, so he knows his stuff.

JIM CRAMER: Well, let me ask you, you were down in Argentina. I find it disturbing. You taught me the notion of Red China Rising. And Red China Rising is not necessarily a blessing for our interest – our national interest. When I see the Canadians willing to comply and arrest a CFO, that means it’s serious business. The Canadians don’t do our bidding. Should we be more concerned about the national interests that we have at stake or more concerned about the profits of businesses?

LAWRENCE KUDLOW: Well look, on the Huawei story, we have warned them for quite some time, violating the Iranian sanctions. I don’t know every detail, but as I understand it we did ask the Canadian government to do this and they have been very cooperative. We appreciate that very much. And, look, we have the sanctions on Iran, it runs against our policy. Why shouldn’t we enforce that? I don’t know, by the way, that that necessarily spills over into the trade talks to be honest with you. At the moment I rather doubt it. We can get to the trade talks in a moment. But in terms of the profits of these companies, Jimmy, national security always takes precedence. And I think this is a clear example of it.

DAVID FABER: Alright, let’s – Larry, it’s David. Let’s get to the trade talks. I guess, A) why don’t you think it may not spill over into the trade talks, that being the arrest of the Huawei executive?

LAWRENCE KUDLOW: Well look, I think it’s a separate track, number one. As again, I’ve said we warned them. This kind of goes to a lot of technical issues, or shall I say technology related issues. We would like China’s cooperation. You can’t break the law. If you break the American law, you break Canadian law, you’ve got to pay the consequences of that. That was the case with other companies and will continue to be the case. These are issues of national security. But look, the bigger picture here is extremely promising. That’s the point I want to make. I tend to be on the optimistic side of this story. I was there. I heard the chemistry. I saw the chemistry between President Trump and President Xi. Perhaps as important or more so, the documents back and forth, the cables back and forth. We’ve been working on them for several weeks. It looks to me like we will accomplish quite a bit. Now, before I run away with optimism, I want to tell you trust but verify. I mean I was on the phone with Ambassador Lighthizer a few moments ago, and he reiterated to me ‘All this has to be monitored, all of this has to be clearly enforced, promises made have to be promises kept.’ So, I don’t want to go too far. But I would say given the China announcements of the last couple days, I believe those were Wednesday and Thursday that talked about immediate movement – certainly in the commodities area, energy, agriculture, industry and the car tariffs, which I think will come down rapidly, and then their willingness to discuss the main issues. I think the most important family jewel issues for the USA, and this is: I.P. theft, forced technology transfers, cyber hacking, cyber theft going into commercial companies. Those are the key, key issues. Will they have a willingness to talk? That was in the cables and notes we have. We’ll see. And of course it all has to be verified. You know, color me optimistic.

DAVID FABER: So, how would you characterize the chances that success will be reached in the next 90 days?

LAWRENCE KUDLOW: Well I think there will be a lot of success reached in the next 90. I can’t say everything. It’s hard to forecast, David. But the president has indicated if there’s good solid movement and some good action, he might -- he might be willing to extend the 90 days. We’ll have to see on that. That’s going to be up to him and his discussions with President Xi. But I think we’re going get a lot done. You know, I’ll tell you a quick antidote about this whole story. Bob Lighthizer and Steve Mnuchin and I were discussing -- we had a two separate meetings with Li Keqiang, the Vice Premier and the top economics guy. We know him and we know his top deputies very well. And we saw them Friday and we saw them Saturday before the dinner, and one of the things so interesting to me was Li’s statement to us, that things could change and that China wanted them to change "immediately." Now that’s a word I have never heard from China, because they never say yes to anything so far, in our bargaining this year. And I asked, “What does immediately mean?” He said basically, “immediately means immediately.” And that’s a good sign. And if you look carefully at the China Commerce Department’s public statements on Wednesday and Thursday, you also see that word “immediately” not only in terms of opening up markets and lowering tariffs for various commodities and so forth, but also in discussions on the key technology related issues. So look, I can’t make a promise here. I’m part of the group that’s discussing this. We will wait and see whether it’s satisfactory to the president and so forth. But again, I like the word immediately. And I think President Trump himself is rather optimistic right now.

CARL QUINTANILLA: Larry, on Huawei, "Washington Post" has a piece about executives and whether or not they may reconsider any trips to china that they have what would you tell them?

LAWRENCE KUDLOW: You mean, American executives?

CARL QUINTANILLA: American executives, yeah.

LAWRENCE KUDLOW: If I were they, I wouldn’t -- I wouldn’t stop business or disrupt business just on the basis of Huawei. If I were they, I would try to help us with all the Chinese officials regarding these trade talks and trade openings, and tariff reduction, non-tariff barriers of course the technology issues. So they should join us. I don’t necessarily think they have to disrupt all their business. But, look, you know the center of this discussion. I just want to -- this is, I think, a very important point I saw this at the G20 plenary sessions. We’ve heard it from a lot of top American business people. I was at the BRT yesterday speaking on these subjects. The center of gravity here has really shifted. Okay? There’s no longer a debate about whether or not China needs major reforms. There’s no longer a debate about the I.P. theft issues. There’s no longer a debate about the forced technology transfers or the cyber interference to American commercial operations. There is unity that these problems have to be resolved. And I saw the same thing at the G20. Country after country, we’re talking about the need for major reforms of the WTO, for example, and major changes in China’s behavior. I think that had an impact on President Xi. Alight? As I watched him at our dinner, which I don’t know -- went three hours or something, he and Trump, you know, going back and forth. I think President Xi was much more accommodative than anything I’ve seen or heard up until then. And I think it’s spilling over. So all I’m saying is on this, Carl, the rest of the world -- I call it a trade coalition of the willing -- the rest of the world is now essentially agreeing with the United States. There’s no disagreement here. I think China feels that heat, and that’s why I think, among other reasons, they will be more cooperative and accommodative. I hope so. But again, to echo Ambassador Lighthizer, trust but verify; we’ve got to see the timetables met, the enforcement procedures met, et cetera, et cetera.

LAWRENCE KUDLOW: Larry, you introduced me to a man named Peter Navarro. I think he’s a brilliant man. I think he knows more about the way China acts and thinks than anyone I ever talked to. He talks about the 2025 Domination Plan. Isn’t it time for the Chinese to take that back? And Vice President Pence has been remarkable, both at the APEC conference and also in the October 4th Hudson Institute speech, talking about the notion of belt and road, and talking about the notion of Chinese forced hegemony. Isn’t it time for them to renounce some of their worldwide domination? You know I’m not joking. That’s what Navarro calls it. Isn’t it time to go back -- to go back to what they said they’d do when they joined the World Trade Organization in December of 2001 and renounce some of these what I regard as being war-like comments against our great nation?

LAWRENCE KUDLOW: Well, I don’t like war-like comments. I agree. Peter Navarro is an old friend, and a valued member of our trade team, and so forth. Jimmy, I would -- look, I would be very happy, very pleased, and I think our group would, and I think President Trump would, to see China make these crucial changes in the trading area, and in the WTO. I mean look, for example, China is no longer an undeveloped country. Can we agree on that? So that Most Favored Nations which gives them tariff powers, they shouldn’t have anymore, that’s got to be stopped. That’s got to be part of WTO reform which, as I said earlier, almost every other major country in the world supports. That’s got to be reformed. China has itself in passing talked about WTO reform. We will learn more as time goes on to see if their attitude is changing. I hope it does.

DAVID FABER: Larry, finally to transition to an issue that I think we’ll be discussing a lot in the new year, which is the growing budget deficit, and how it may impact your legislative priorities in the administration. Isn’t it time to admit that the tax cuts are not going to pay for themselves?

LAWRENCE KUDLOW: No, I think quite the opposite. Of course, you and I disagreed about this for I don’t know, what, two, three years, David, maybe going back longer than that. I think the tax cuts are working. I think nominal GDP is much higher than people expected. Even the CBO has acknowledged as much. I think you’re going to see the budget deficit come way down. There’s a shared GDP because of faster economic growth. I mean, you know, we’re in a really good spot here, if you ask me. I hear all this pessimism coming off Wall Street. Okay, I understand corrections and whatnot. But look, we’re getting tremendous increases in growth. You know, we’re running 3% year-on-year and nobody thought that would be possible. And we’re there. I think for all of President Trump’s quarters, except the very first quarter when he just came into office, I think the growth rate has been 3.1% at an annual rate for something like seven quarters. Meanwhile, the inflation rate --

DAVID FABER: You really think the budget deficit’s really going to start falling next year, Larry? You really do? I mean, revenues don’t seem to be pointing to that. CBOE doesn’t point towards that. What underlies that? Even if we maintain 3%.

LAWRENCE KUDLOW: Yes. I think you’ll see bigger increases in revenues. The president has already talked about a very tough budget. 5% reduction across the board for non-defense accounts. That’s a very tough budget the combination of spending limits and economic growth will do the trick. I mean, the deficit as share of GDP will come down a lot in the next few years. I don’t want to predict exactly, but that’s the view. And as I was saying before, the supply side tax cuts and the rollback of regulations and opening of energy and so forth, we’re producing very significant growth with virtually no inflation. Inflation is coming in under the Fed’s target, which may be cause for their reassessment. So look, I think it’s a good position to be in and I do think that we have to spend good time trying to hold back budget spending. I agree about that part.

CARL QUINTANILLA: Larry, we didn’t get to the yield curve or the trade deficit. Next time you’re in town stop by the set. Ok?

LAWRENCE KUDLOW: Love to talk yield curve. Love to do it, Carl. Thank you very much. Jimmy, David. Thank you folks.

JIM CRAMER: Good to see you, Larry.

CARL QUINTANILLA: Lawrence Kudlow.