Whitney Tilson’s email to investors discussing shorts working today; Eddie Lampert & Sears; Nelson Peltz & GE, P&G; The Dream/MLMs; cyrpto scams.

1) Wow, what a day for short sellers:

- Aphria (APHA), the target of Gabriel Grego’s epic takedown at our shorting conference on Monday is down another 12% (it’s been more than cut in half this week). Here is an interview Gabriel did with Bloomberg yesterday.

- Signet Jewelers (SIG), which Matt Kliber pitched, is down 20%.

- MiMedx, a heavily shorted stock, is down more than 66%.

Q3 hedge fund letters, conference, scoops etc

2) Michele Celarier with an in-depth look at how Eddie Lampert brought Sears to ruin (yet apparently still ended up making a boatload on this debacle) (I'm quoted briefly): Eddie Lampert Shattered Sears, Sullied His Reputation, and Lost Billions of Dollars. Or Did He? Excerpt:

They called Eddie Lampert many things. “The Next Warren Buffett,” Business Week gushed in 2004. “Genius,” according to Fortune in 2006. A “celebrity shareholder,” Institutional Investor labeled him in 2013.

But in mid-October of this year, they were calling him something entirely different. Privately, hedge fund managers distanced themselves, with one calling Lampert a practitioner of “predatory capitalism.” But perhaps the worst assaults came from those claiming to be employees of Sears Holdings — the company that Lampert had famously spent $1.5 billion to acquire, manage, and, as of that month, drive into bankruptcy.

The “CEO egomaniac” whom some called “Fast Eddie” was “ruining the company,” they wrote. “Eddie Lampert doesn’t know the first thing about retail,” another complained. “He is just a hedge fund manager that is looking for an exit strategy.”

One person put it more bluntly: “Eddie Lampert sucks.”

The tale of Eddie Lampert’s Sears fiasco is a blueprint for how the financial engineering in full swing across corporate America could so utterly fail — with hedge fund managers reaping rewards along the way.

Although current Sears shareholders have lost almost their entire investments, tens of thousands of employees have lost their jobs, and creditors — including the U.S. government — and others are owed $11 billion, Lampert has still made nearly $1.4 billion to date from his Sears investment, a number that has never been calculated before. It’s also a sum that could change radically — up or down — depending on the outcome of what is likely to be a contentious bankruptcy process, which is now unfolding.

3) Speaking of legendary investors who got tripped up investing in a former blue-chip company, here’s Fortune with a story on how activist investor Nelson Peltz is struggling with P&G and has gotten clobbered in GE: The Investor That Tripped on GE & P&G. Excerpt:

Trian owns 71 million shares of GE stock, qualifying GE as Peltz’s most disastrous investment in a long, successful career. He’s down over $1 billion, about 50%, since buying in three years ago, with the stock’s latest drop following word of a federal criminal investigation into recently disclosed liabilities.

…Together, GE and P&G have mauled Trian’s previously sterling record: Over the past five years, Trian’s rate of return has averaged an outstanding 11.9% annually; over the past three years, a mediocre 6.5% annually; in 2018 through October, a dismal –1% or so, according to a Trian investor. Much of Peltz’s personal wealth and his reputation as a high-performing activist are tied up in those two companies.

How Peltz fares with General Electric

4) Here’s an interview with the host of the podcast, The Dream, which uncovers and exposes the endless scams in the multi-level marketing industry: What we get wrong about multilevel marketing, explained by the host of the popular podcast about it. Excerpt:

The Dream, a Stitcher podcast hosted and produced by the Hairpin and This American Life alum Jane Marie, has plenty of juicy seller horror stories. (Just wait ‘til you get about the woman who missed her best friend’s wedding to go to a direct marketing conference!) But it also takes a deeper look at the history of these companies and the networks of financial and political influence that have allowed them to thrive relatively unchecked since William Penn Patrick established Holiday Magic in the early 1960s.

So The Goods sat down with Marie in advance of The Dream’s season finale, which comes out Monday, December 3, to talk about not treating people like idiots, the possibility that there actually is an Illuminati, and where you end up when you follow the money all the way to the top.

5) Robert FitzPatrick, who has probably done more than anyone to fight the MLM industry, shares his thoughts in his year-end letter. Excerpt:

With an MLM-owner-promoter now sitting in the White House and Amway's Betsy Devos presiding over American education, and with the FTC's humiliating surrender to the influence-buying of Herbalife, many people are asking about the state of Truth related to "multi-level marketing." Has the Big Lie won over Truth, they ask me (and I have asked myself)?

The merchants of deception are in the forefront, but truth-telling has not abated. In fact, it is popping out in new and more powerful formats.

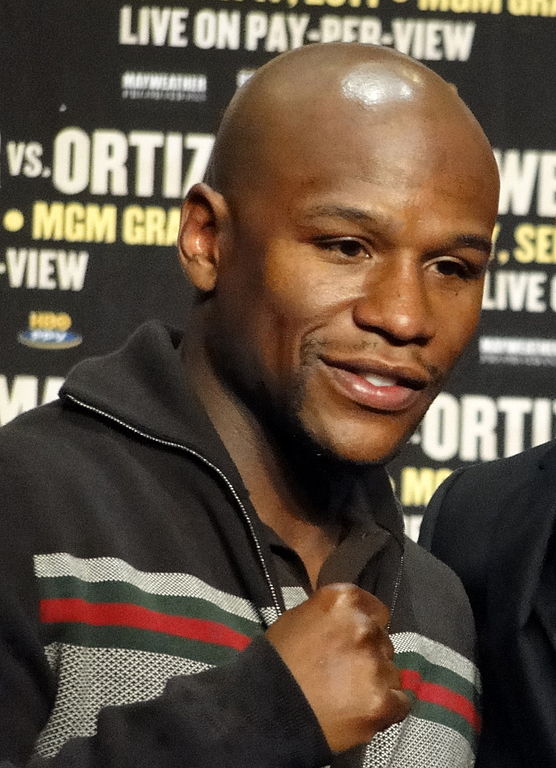

5) Speaking of totally scammy industries, it’s good to see the SEC (finally) cracking down on the promoters of these cryptocurrency scams. Boxing Champ Floyd Mayweather Jr., Music Producer DJ Khaled Agree to Settle SEC Cryptocurrency Charges. Excerpt:

Boxing champ Floyd Mayweather Jr. and music impresario DJ Khaled became the first celebrities to face punishment over their roles in touting cryptocurrency deals that regulators say were fraudulent.

Mr. Mayweather was paid $100,000 to endorse a coin offering promoted by three men who all face civil and criminal securities-fraud charges.