Activist Insight’s shareholder activism summary for the month of October 2018.

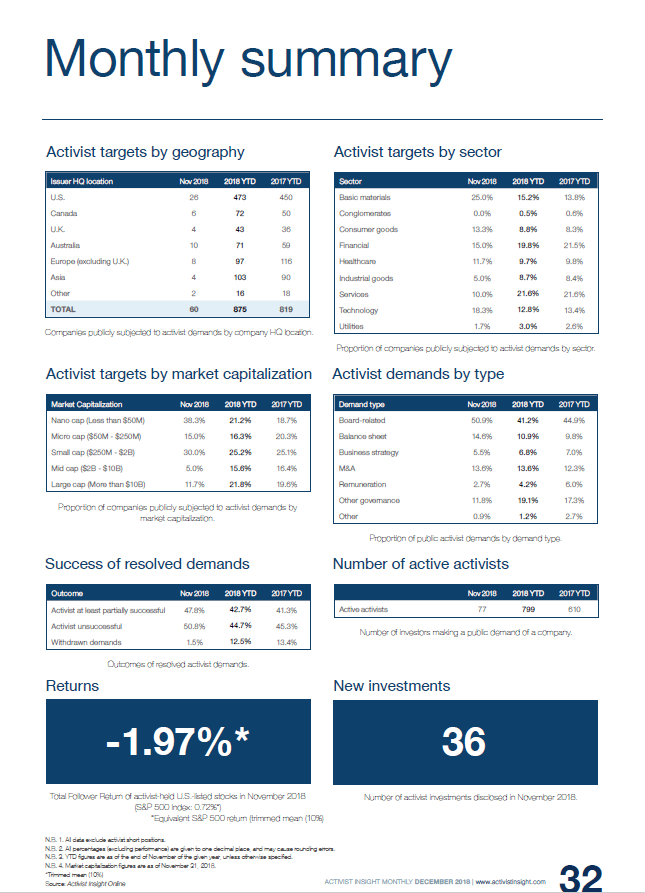

Please click here to see a fact-sheet containing statistics on activist investments from January to November 2018 (click on the image itself for a clearer view).

Q3 hedge fund letters, conference, scoops etc

The below data points are global in nature unless otherwise specified.

- The number of companies publicly subjected to activists demands worldwide (875) exceeded last year’s total of 857 and looks set to top 2016’s record, of 887.

- The number of activists making public demands in 2018 is already at a record level (799), compared to 714 in 2016.

- New activist investments dropped in November to 36, the lowest since September.

For any questions about the data, or if you have a follow-up request, please contact Josh Black at [email protected]. Please note that bespoke data requests may take 24-48 hours depending on the amount of manual work required.

We look forward to assisting you with your articles.

Kind regards,

Josh Black