Like other industries, the credit system’s landscape is continually evolving. Thanks to modern technology and innovation, lending groups and other creditors now offer various options, products, and services that make applying for financial assistance simpler and quicker.

New tools and advancements in the credit industry are transforming the way consumers borrow cash. Before, loan options were limited to government entities (Pag-IBIG and SSS), banks, credit cards, cash advance from credit cards, and loan sharks. These financial institutions (apart from loan sharks) are heavily regulated, but with a roster of new methods offered today, loaning has become more accessible and borrower-friendly.

[REITs]Q3 hedge fund letters, conference, scoops etc

There are now inexpensive loan options available for the different types of borrowers and their various needs. Now, credit consumers are able to stretch their finances without the added anxiety towards person-to-person contact and heavy repayments.

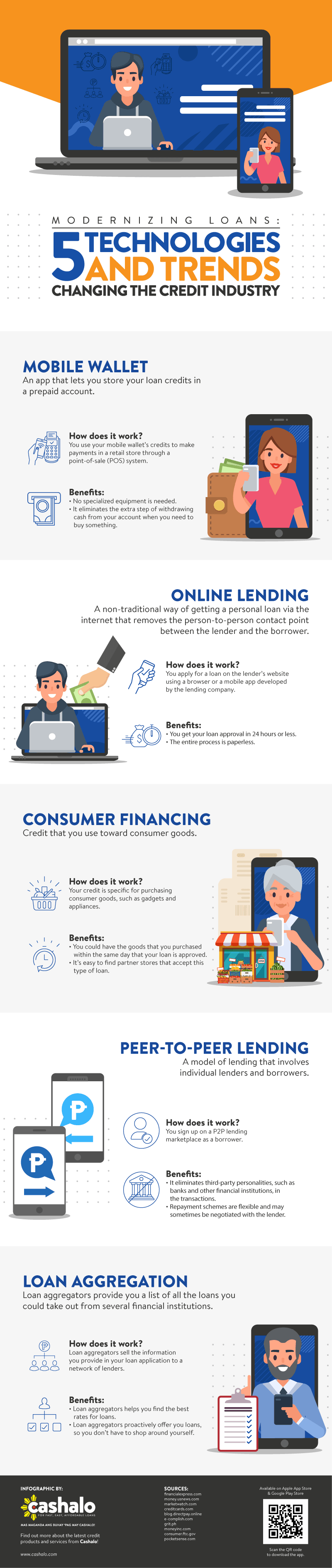

Here’s an infographic to illustrate modern tools and systems that are shaping the economy of loaning and borrowing money.

5 Technologies and Trends Changing the Credit Industry

Applying for a loan used to mean gathering all the necessary documents you need and submitting it to your bank or credit institution. It used to be a complicated and tedious process where you fill out a handful of application forms and accomplish a list of requirements before you get approved. Worst case scenario, you go through this only to get denied.

Good news is these days are long gone. These new tools and systems introduced by lending companies work hand in hand to make the process easier and faster for both creditors and borrowers.

- Mobile Wallet

Have you ever experienced the need to buy something, like groceries, but you’re already short on budget? But, you don’t have a credit card yet and borrowing from friends or families isn’t a viable option.

Say hello to mobile wallet apps. These serve as your prepaid money account where you can keep tabs on your cash and loan credits. Mobile wallets make it possible for the user to pay for purchases via the virtual wallet. These apps are armed with technology that hooks up your mobile wallet account to an accredited store’s (point-of-sale) POS system, allowing you to pay for parking tickets, utilities and bills, groceries, and many more.

With the mobile wallet’s convenience and functionality, lenders are able to send a borrower’s approved loan amount straight to the app. If you don’t have a physical credit, debit card, or enough cash at hand, you can apply for a loan through your mobile wallet.

- Online Lending

If you’re in need of immediate cash for any unexpected shortcomings or personal emergencies, you can whip your laptop out and go online for a paperless way of borrowing money. You have the internet to thank for this innovation.

Using your browser, you can head straight to the website of your reliable online lender. For first-time borrowers, you need to create an account to submit your loan application. The online loan service will require basic identification documents such as valid IDs and proof of income. A lot of these loan applications take no longer than 24 hours to process. Once your loan gets approved, you can expect the fund to reflect on your account (or any preferred receiving method) in as fast as 30 minutes.

Online lending eliminates the person-to-person contact between lenders and borrowers. It’s becoming a go-to option among many technologically savvy people for its convenient and speedy process with affordable interest rates (depends on your agreement and their terms and conditions).

- Consumer Financing

Consumer financing refers to credit that borrowers use specifically for consumer goods such as appliances, home essentials, electronics, and clothes. Since financial intuitions are very strict when it comes to loan applications, a small loan application can be hard to get approved or worse, denied.

Consumer financing allows you to shop for consumer goods such as electronic devices, home appliances, furniture, or even shoes and apparel. You can purchase a new gadget on the same day your loan gets approved, which can be in as fast as 10 minutes (depending on your online loan provider).

- Peer-to-Peer Lending

A lot of people rely on family and friends when financial crises occur. But, technology has taken it up a notch. Now, you can borrow from other people you’ve never even met through online peer-to-peer lending. Indeed, innovations are making the credit industry broader and more flexible for borrowers.

Peer-to-peer (P2P) lending is a system that clears out third-party contacts. It pools money from members/investors, which becomes the source of funds used to lend to borrowers. It allows individual borrowers and money lenders to directly connect through a P2P platform. Since it’s a more laidback approach than the traditional forms of money lending, in P2P, borrowers can find better repayment methods with reasonable interest rates.

- Loan Aggregation

If you think you need someone to assist you when it comes to which loan to apply for or where, you can call for help from a loan aggregator—a middleman who shops around for loans for customers and clients. They basically do the legwork of enquiring at several financial institutions and gathering necessary information to help you get the best deal.

Loan aggregators collect personal information borrowers declare to any potential lender. They then present this to other lending companies, who might be capable of offering a better loan option.

In simpler words, loan aggregators are matchmakers to borrowers and lenders. The borrower, having presented with the options the loan aggregator collected, will then decide which loan fits their financial needs.

Wrapping Up

From mobile wallets to online loans, technology is continuously paving the way for improvements in the credit industry. With friendlier policies and accommodating terms, loans are no longer viewed as a trap, but a reliable fallback in times of financial crises. Soon, you’ll find more lending groups or companies adapting to these trends, and introducing more innovative products and services in the future.