Sui Generis Canada Partners LP fund commentary for the month ended October 31, 2018.

The Sui Generis Canada Partners LP fund was down -1.95% for the Class A Lead Series during October 2018, resulting in a year-to-date net return of 6.88% and since inception (March 1, 2015) cumulative net return of 16.92% (4.36% annualized).

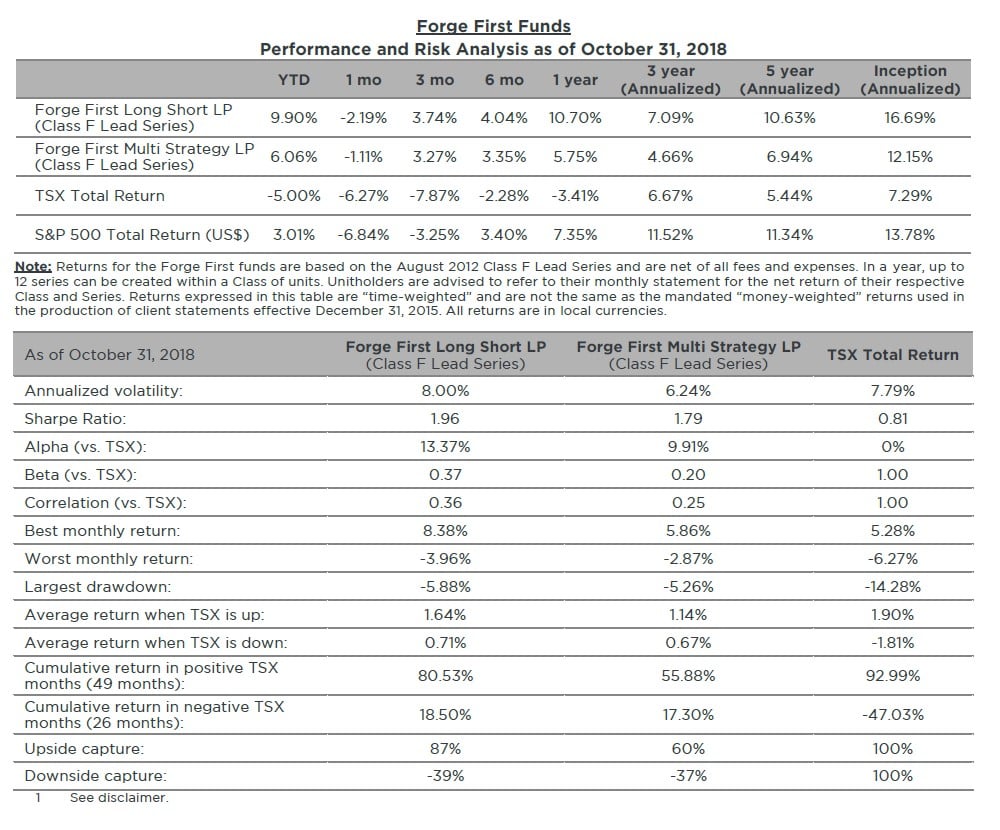

Four months shy of its 10th birthday, October marked this equity bull market’s 2nd 10% drawdown of 2018. Unless an investor was in cash, held a short book or perhaps a fund whose underlying assets aren’t marked to market on a monthly basis, it was a tough few weeks. Each of the S&P 500 & the TSX delivered total return losses of greater than 6% for the month, leaving Canadian equities red year to date. The Class F Lead Series of our Forge First Multi Strategy LP declined 1.11% net of fees while our Forge First Long Short LP Class F Lead Series fell 2.19% after fees. However, as shown in the table below, each of our funds remains solidly positive year to date and for the rolling 12 months.

Q3 hedge fund letters, conference, scoops etc

Stocks began to fall on October 4th, the day after yields on U.S. Treasury bonds spiked higher, a repeat of what catalyzed the equity sell-off last February. Yields on the U.S. 10 year bond had jumped from 3.05% to 3.22% triggering significant systematic equity selling. This stampede occurred at a time when corporate America was blacked out from share buybacks, an important source of demand for stocks given that the graph on the below left shows this year's announced U.S. buybacks running 40% ahead of their 3 year average. Then came the earnings warnings from companies reporting quarterly results. Slowing growth in China, the higher U.S. dollar, uncertainty surrounding the now signed USMCA trade deal, rising input costs and of course Trump's tariffs. While all these items were previously just headlines that equities didn't care about, last month they finally hit home and stocks were badly hurt. In turn, these warnings caused hedge funds to pounce, as shown by the rise in short exposure as a percent of total gross exposure in the graph on the below right.

While tech's momentum stocks led U.S. indices lower, here at home, marijuana, banks and resource stocks drove Canadian equities down to levels last seen during late 2016. By the latter part of October we began to increase the net equity exposure levels of our two funds, especially the Long Short fund, for two reasons. First, in our view, the absolute level of interest rates is not yet high enough to mark the end of this equity cycle. Second, companies continue to enjoy a positive spread between their cost of capital and the return on their capital. Also, with equity valuations having shrunk markedly during the month and the imminent reduction in political uncertainty south of our border, we foresee a 'Santa Claus' rally during the next several weeks. However, there's little question that the recent increase in volatility is a signal that this bull is getting tired. Short rates are rising, economic output gaps have shrunk, financial conditions are tightening, and the standards driving credit issuance have deteriorated.

Subject to an exogenous shock, last week's U.S. jobs data confirms that the Fed should be expected to hike rates in each of December and next March. Those hikes imply that by the end of March 2019, the yield on a 2 year U.S. government bond will be >3%, a level that should begin to attract investor capital away from stocks. Speaking of fixed income, given our belief that pension funds will continue to immunize their portfolios (matching future cash flow streams vs targeting percentage returns) by selling stocks to buy bonds, rising short term rates should ensure that yield curves flatten by next summer, historically a prescient predictor of a recession 12 months further out during the 2nd half of 2020.

Moving towards the 2nd half of 2019, we expect that positive corporate profit spread will begin to narrow due to rising rates, a zero percent rate of change in U.S. fiscal stimulus, slowing global growth & the effect of wage growth which by then is likely to be 3.5% south of the border. And as this scenario kicks in, we expect stocks to begin to fade. Then during 2020, we suspect private credit funds will begin to ‘feel the pain’, given the bubbles in commercial real estate and corporate credit.

So post the gargantuan buffet of stimulus tabled after the financial crisis of 2008 that's driven the almost ten year bull market, the recent churning in markets amidst these sign posts supports our view that we’ve entered the period of transition before moving to the other side of the fence from bull to bear. But as previously stated, due to the magnitude of October's downturn, we foresee medium term opportunities on the buy side.

While the nearly 7% decline in the S&P 500 and the TSX Composite was nothing to shake a proverbial stick at, we believe the more arduous task for investors was dealing with persistent intra-day volatility. Violent selloffs and rallies (and then selloffs) within the same trading session were a common occurrence and while we often say that we are directionally agnostic and that’s absolutely true; we will say once again that some direction would be nice. To mitigate the potential losses of both capital and sanity that come with this type of volatility, we often use options as protection. This sort of strategy is very useful when the selling is indiscriminate, a signpost of a sharp correction, with the market punishing both high and low quality companies.

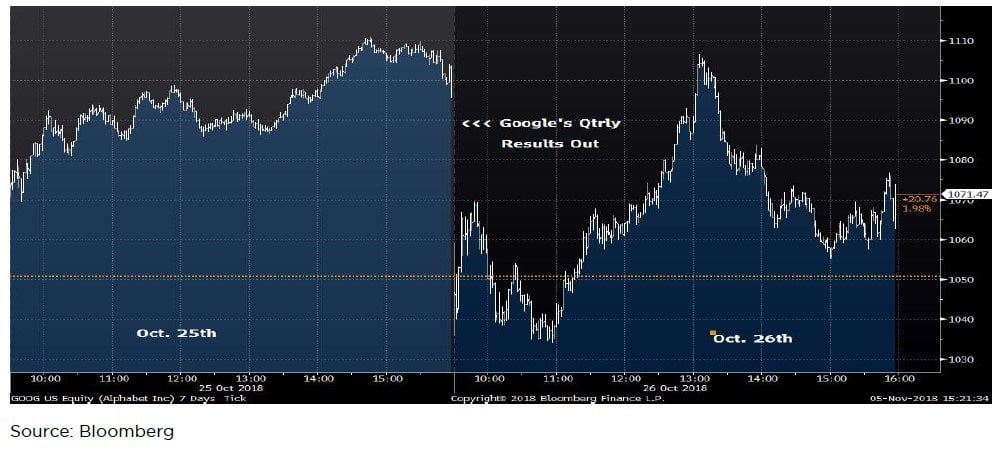

A good example of this tactic from last month was the protection of our Google position for which we purchased at the market puts minutes before the company reported its quarterly report. Tape action shaped our attitude that even a beat of quarterly expectations wouldn’t necessarily propel the stock higher and as a result, we decided to protect our investors against what seemed like a high likelihood of ensuing volatility. The next day played out as follows:

To summarize the picture above, after reporting an earnings beat and a slight revenue “miss”, Google dropped nearly 7% on the open, representing a loss of market value of nearly $50 billion, then immediately regained half that drop; after hitting a new low around 11:00 am the stock abruptly rallied and traded positive on the day by 1:00 pm, then eventually closed down $24/share or 2.2%. We highlight this volatility because having paid for the privilege of being able to largely ignore this intra-day nonsense we afforded ourselves the opportunity to see through the noise and focus on whether or not the thesis we invested in played out, and in this case it did. Google remains a reasonably valued free cash flow machine with multiple properties that can propel their next leg in growth.

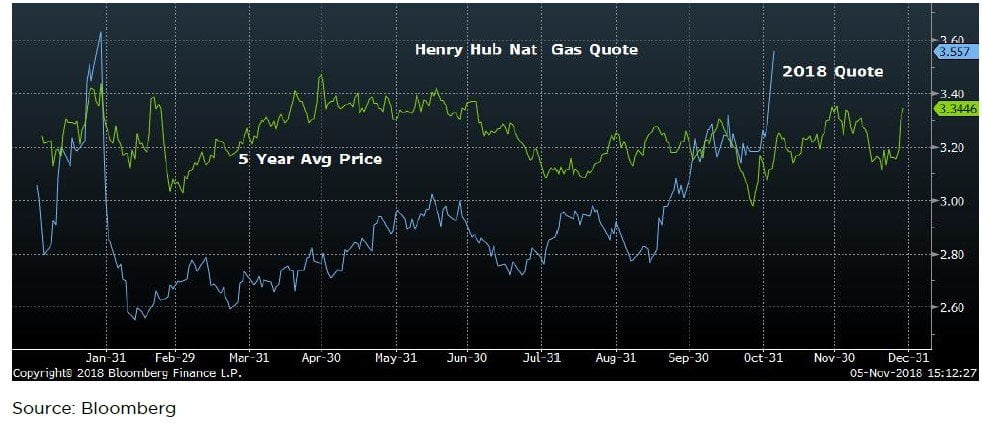

We still took our lumps like everyone else and the most cyclical exposure in our portfolio, our energy book, represented the biggest hit to our performance. This is in spite of a strong bias towards natural gas and the persistent strengthening in natural gas prices (blue line in the graph above), but as previously stated, when the selling is indiscriminate it really doesn’t matter how compelling a story is.

On the other side of the ledger, the funds enjoyed positive contributions from each of our non-cyclical consumer and basic materials sector positioning. The contribution from the basic materials exposure was driven from the short side, exemplified by Teck Resources, (TECK/B.CA), one that has since been covered. Overall, our short book contributed roughly 250 bps to each of the funds, with our index put spreads contributing incremental positive returns.

More broadly speaking the month was largely influenced by a few important portfolio adjustments. The Forge First funds entered October with what turned out to be advantageous position, having reduced our net exposures substantially given the combination of a tougher tape & rising interest rates during September. Both our long/short fund and multi-strategy fund took on the volatility with substantially reduced net long exposures that would represent our lowest net equity exposures of the year. This reduced risk exposure enabled us to “go shopping” after greater than 10% declines in certain compelling companies, putting their shares into our strike zone, usually representing a more compelling free cash flow yield or price to book multiple. The result was a steadily increasing net exposure through the month to a level that most would still consider quite low. After all, the aforementioned risks have not disappeared and as stewards of capital our first goal is always to protect it. However, we do believe we have judiciously increased certain long positions for our investors so as to gain exposure to compelling value while only marginally increasing the beta of the portfolio into the end of the year.

Please do not hesitate to reach out to us if you wish to learn more about how our strategies can complement and lower the volatility of your investment portfolio. As always, we welcome any feedback, and for more information please visit our website at www.forgefirst.com.

Thank you,

Daniel Lloyd Portfolio Manager

Andrew McCreath, CFA President and CEO

This article first appeared on ValueWalk Premium