Financial Finesse’s Financial Wellness Think Tank is releasing a new study based off its award-winning ROI model, which shows that even a moderate improvement in financial wellness can help employees retire up to two years sooner, while also saving large employers upwards of $65 million dollars. The study, The ROI of Improving Employee Retirement Preparedness, based on a national sample of 18,148 American workers, is being released on November 14th, but we invite you to write about it immediately.

2018 Special Report: The ROI of Improving Employee Retirement Preparedness

Abstract

Inadequate retirement preparation has a measurable impact on employers from the costs of delayed retirements for employees who would like to retire but are financially unable to do so. In this report we propose best practices for workplace financial wellness programs to offer retirement guidance across an employee’s full career. Additionally, we analyze the positive impact of financial coaching on improving retirement outcomes. We offer a model for measuring the ROI of reducing the costs of delayed retirement for these employees.

Q3 hedge fund letters, conference, scoops etc

Executive Summary

Comprehensive financial wellness programs that repeatedly engage employees can effectively mitigate current and future costs associated with delayed retirement. Even modest improvements in employee financial wellness generate meaningful cost savings. For a typical 50,000-life employer:

- An upward shift in the average workforce financial wellness score1 from 4.0 to 5.0 can generate $33 - $49 million in annual cost savings.

- An upward shift in the average workforce financial wellness score from 4.0 to 6.0 can generate $65 - $97 million in annual cost savings.

This report builds on our 2016 ROI Special Report,i which offers a predictive model for measuring the cost savings of reduced delayed retirements. The 2016 study found that as financial wellness scores increased, so did retirement plan contribution rates. Over time, the collective increase in retirement plan contribution rates improves workforce retirement preparedness and reduces the average projected retirement age. Reductions in projected retirement age occur across all career stages.

Repeat engagement in financial wellness programs drives improvement in overall financial health, so this isn’t a “one-and-done” process. Improvements are incremental and increase with the number of interactions. Companies that offer financial wellness benefits should focus on creating multiple channels to reach employees and develop techniques that encourage continuing engagement in the program. Retirement plan design practices, such as auto-enrollment and auto-escalation, are foundational, and should be incorporated with an easy-to-use retirement calculator and unlimited access to financial coaching.

The Cost of Delayed Retirement

Employers face expensive challenges when retirement-eligible employees delay retirement for financial reasons. These challenges include:

- Lower velocity of talent that blocks promotions for younger employees;

- Higher compensation and benefit costs associated with longer-tenured employees;

- Reduced productivity among employees who would prefer to be doing something else other than continuing to work; and

- Increased absenteeism.

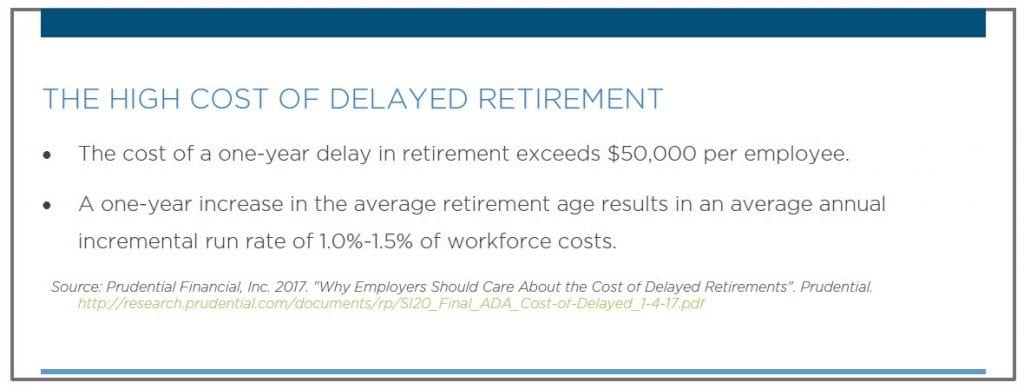

The cost of delayed retirement can be substantial. According to a 2017 Prudential study,ii the cost of a one-year delay in retirement exceeds $50,000 per employee. For an entire workforce, a one-year increase in the average retirement age results in an average annual increase of 1.0%-1.5% of workforce costs.2 Based on these estimates, a one-year increase in the average retirement age of a 50,000-life employer could cost over $30 million a year.

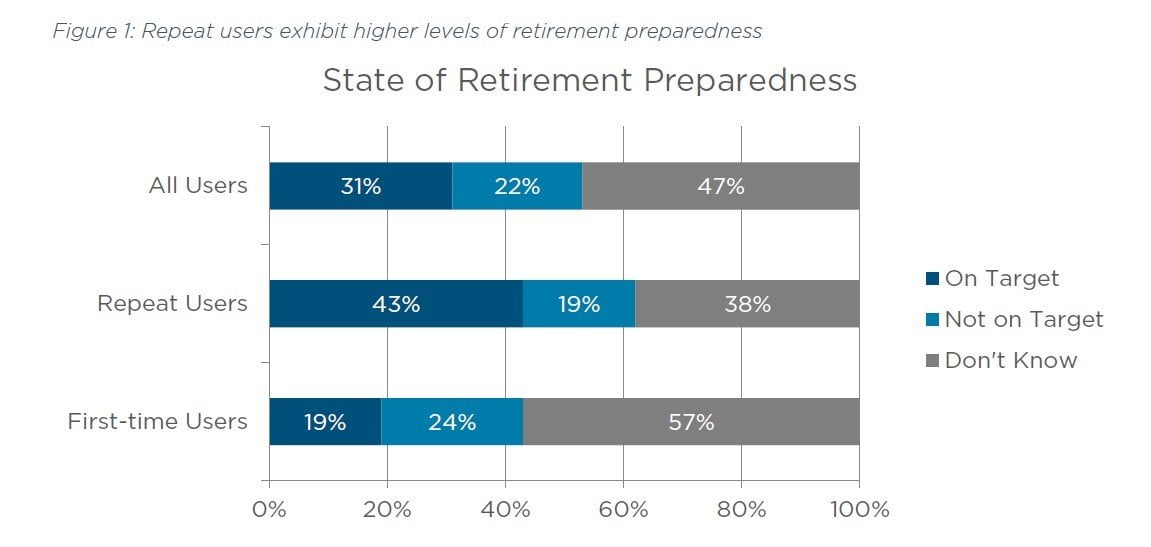

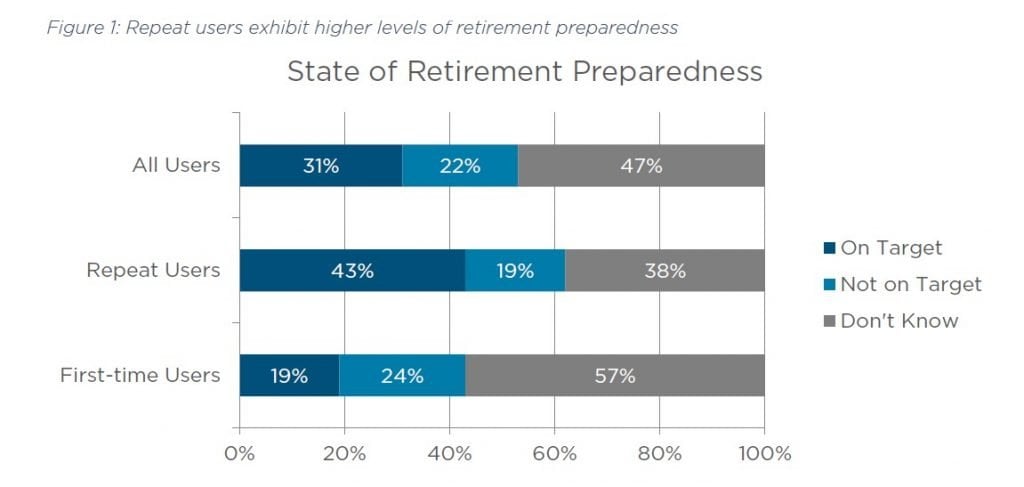

Employers continue to look for ways to improve employees’ retirement preparedness to reduce the likelihood of delayed retirement. Though much has been done in the way of enhancements to retirement plan design—such as auto enrollment and auto escalation of deferral rates—only 31% of employees that completed a Financial Wellness Assessment in 2017 indicated they were on track to achieve their retirement income goals (Figure 1). Enhanced retirement plan design by itself is not enough to address the issue of delayed retirement.

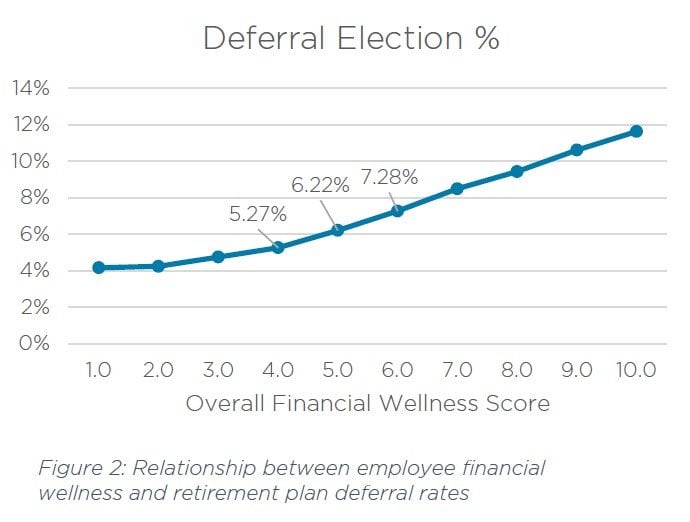

A more effective way to improve retirement preparedness is through repeat engagement in a financial wellness benefit. As noted in our 2017 Year in Review report,iii repeat users improved their overall financial wellness score by over one point between their first and last financial wellness assessment. Further analysis found that every one-point increase in overall financial wellness scores equated to an approximate one-point increase in average deferral rates (Figure 2). This improvement contributed to higher levels of retirement confidence among repeat users. In 2017, repeat users were more than twice as likely as first-time users (43% vs. 19%) to report being on track to achieve their retirement income goals (Figure 1).

Calculating Return on Investment (ROI)

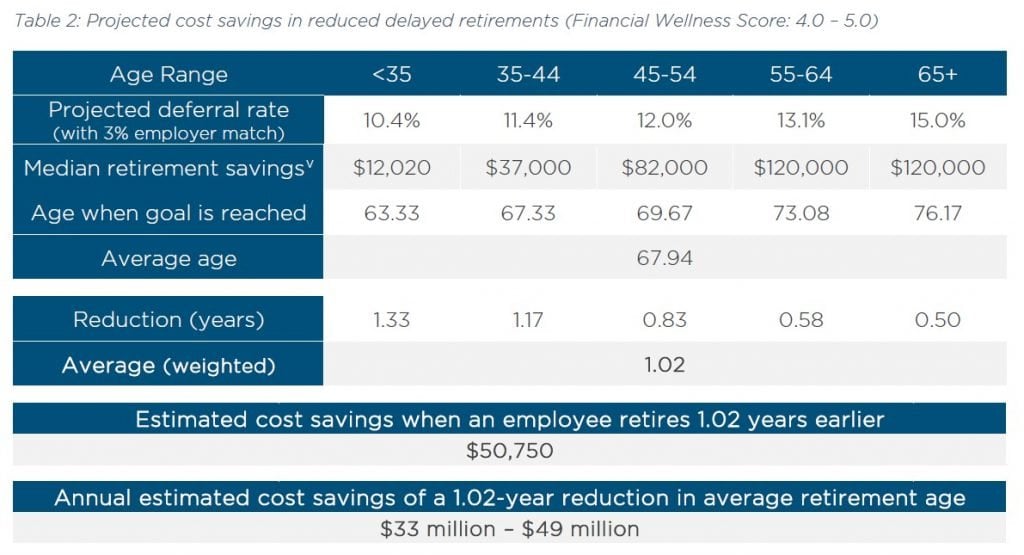

To estimate how a financial wellness benefit can help reduce the cost of delayed retirement, we analyzed the length of employment needed for the typical American worker to save enough to replace 80% of their income at retirement using current and projected contribution rates. For example, at current median contribution rates, we estimate the average workforce retirement age at 68 years and 11 months (Table 1).

Small Improvements Make a Big Difference

As employees’ overall financial wellness levels increase, so do contribution rates to retirement plans (Figure 2). When we increase contribution rates by the observed improvement when financial wellness scores move from 4.0 to 5.0, the estimated average workforce retirement age drops to 67 years and 11 months. That one-year decrease equates to over $33 million a year in savings, or over $50,000 per employee (Table 2).

The study will be released on November 14th 2018.