Activist investor Third Point Partners and soup company Campbell have reached a settlement agreement ahead of the company’s annual meeting this week. As part of the potential settlement, Third Point will be granted two board seats as well as have a say on a third director and Campbell’s next CEO, who is expected to be identified by the end of the year. The activist will also be granted two meetings with the board and two meetings with the CEO of Campbell within the next year. The addition of Third Point’s candidates will expand the board size from 12 members to 14, as opposed to replacing two incumbent directors.

It was also reported last week that a handful of parties are interested in potentially acquiring Campbell’s cookie brands, Arnott’s Biscuits and Kelsen Group. Among the bidders are Mondelez International, Pacific Equity Partners, and Kraft Heinz. No final decisions have been made, however, and the suitors may not even submit bids.

Q3 hedge fund letters, conference, scoops etc

What we'll be watching for this week

- Will Lev Mizikovsky succeed in his fight for two board seats at receivables manager Collection House on Thursday?

- How will Myer Holdings shareholders vote on Solomon Lew’s complete board replacement at the company’s annual meeting Friday?

- Will Elliott Management-backed ASG Technologies up its bid for Mitek Systems?

Activist shorts update

Short seller Emmanuel Lemelson filed a brief last week, discounting the U.S. Securities and Exchange Commission’s (SEC) charges against his firm, Lemelson Capital Management, regarding its alleged short and distort campaign at Ligand Pharmaceuticals. The shamed investor argued that the accusations were irrelevant to the law the SEC is trying to enforce and that his position in Ligand was “radically different” to those challenged previously by the federal agency.

The investor also explained that all opinions and views on Ligand were his own and that he genuinely believed the company to be overvalued and misleading in its disclosure statements. Lemelson argued that all the SEC theories failed because they were based on an interpretation of a ruling that has not been used before. He also claimed that he did not manipulate the stock.

Also, Kase Learning announced that it will be hosting its second short selling conference on December 3 - it is the only idea-led conference to focus exclusively on shorts. They have kindly increased the discount they are offering Activist Insight readers to 40% using the discount code ACTIVIST40. This offer is good for both in-person and livestream registrations on the ticketing site.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

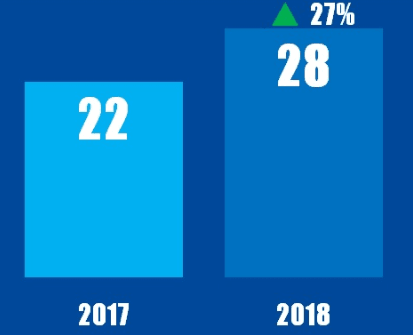

Chart of the week

The number of global companies publicly subjected to an activist takeover bid between January 1 and November 23 in respective years.