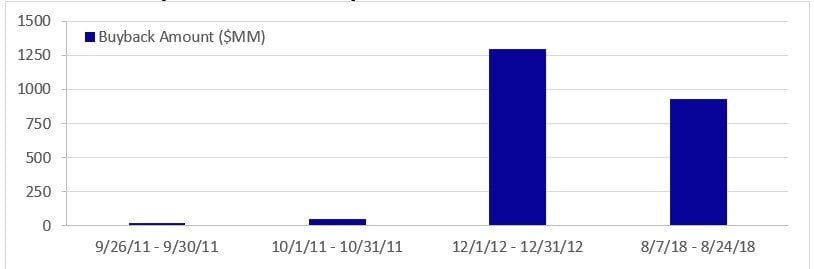

This week, Warren Buffett’s Berkshire Hathaway (BRK/A) revealed it had conducted its first buyback since 2012, repurchasing $928 million worth of stock between August 7 and August 24. This announcement followed a modification of the company’s share repurchase program policy in July, which prefaced intrinsic value over a premium cap on the repurchase price. Combined with the fact that this buyback is only Berkshire’s fourth in its history, this is a strong signal to investors that the company’s stock is one of the best investment opportunities available on the market.

The Oracle of Omaha’s has an impressive, proven track record and this recent buyback signals Buffett’s belief that Berkshire stock is currently trading below its value, and thus is an investment poised for gains. This transaction essentially suggests that investors have the opportunity to buy Berkshire’s stock at a favorable price and potentially realize the benefits of a well-executed buyback program.

Q3 hedge fund letters, conference, scoops etc

Warren Buffett continues to be a supporter of buybacks, but his execution varies wildly from his peers. A typical share repurchase program is based on quantified dollar value or share count authorization. Apple, for example, authorized a $100 billion buyback in May. Other companies have authorized a specific number of shares, 50 million for example. Berkshire on the other hand, puts no such quantifier on its repurchase program, instead assessing opportunities through the lens of intrinsic value.

Since its initial buyback authorization in 2011, Berkshire's requirement has always been valuation-based. Buybacks were restricted only to the extent that repurchases were made at no higher than a specified premium over book value and that a minimum cash balance was kept on the books. Because of these strict parameters, Berkshire’s buyback activity was limited over the years.

Berkshire has only executed limited buybacks since 2011

Source: Berkshire Hathaway

Although Berkshire has expanded its buyback flexibility since initially launching its program, it continues to maintain strict parameters relative to a vast majority of share repurchase programs. Buffett indicated that Berkshire’s transition to an operating business rather than an investment business had deteriorated the usefulness of book value as a measure of intrinsic value, and thus was the catalyst for this change. The emphasis on intrinsic value, though remains. Authorizing transactions only when Berkshire's stock trades at a reasonable valuation has allowed Buffett to significantly outperform the market with each buyback.

| Date | Buyback Program |

| September 2011 | At prices no higher than a 10% premium over the book value of shares |

| December 2012 | At prices no higher than a 20% premium over the book value of shares |

| July 2018 | At any time Warren Buffett and Charles Munger believe the repurchase price is below Berkshire’s intrinsic value, conservatively determined |

Source: Berkshire Hathaway

This latest repurchase is the first buyback transaction since the company’s new repurchase program. The buyback was executed at about a 37% premium to book value, almost double the amount of the previous limit of 20%. In August, Buffett explained that Berkshire had bought back shares “at what we know is a price where the continuing shareholders are going to be better off because we bought it.” Had the previous program been in place, this buyback would never have happened.

Opponents of buybacks often argue that dividends would better serve shareholders. Since Buffett took over Berkshire in May 1965, the company only paid one dividend in 1967, for which Buffett joked that he “must have been in the bathroom” when the decision was made. Dividends are often treated as an obligation and do not allow management to selectively deploy capital to buy undervalued stock.

Investing in the business or a stock buyback at an undervalued price have the potential to create more long-term shareholder value than paying a dividend directly. If Berkshire paid a dividend rather than buying back shares in September 2011, investors would have missed out on a subsequent 206% return through November 6th, 2018. A $1000 dividend payment could have turned into $2062 in just over seven years. Even if investors had invested that dividend into S&P 500 exposure rather than holding cash, they still would have been worse off with just $1826.

Berkshire has significantly outperformed the S&P 500 TR index following every buyback

Aggregate return as of November 6, 2018

| Start Date | BRK/A | S&P 500 TR | BRK/A +/- S&P 500 |

| 9/30/2011 | +206% | +183% | +24% |

| 10/31/2011 | +180% | +155% | +25% |

| 12/31/2012 | +144% | +118% | +26% |

| 8/24/2018 | +5% | -4% | +8% |

Source: Bloomberg LP

Since 1989, BRK/A has returned 3670% versus 2332% for the S&P 500 TR Index. In both cases, a continuing investor would have been far better off with Buffett’s decision to resist the dividend. This aligns with Buffett’s philosophy that the best use of cash is to repurchase stock if it is one, underpriced and two, there is no other valuable place to invest it.

With $103.6 billion in cash on the balance sheet as of September 30 and increased flexibility to determine a fair valuation, more buybacks may be on the horizon for Berkshire. This buyback not only reveals that now may be the time to buy BRK/A or BRK/B, but it also exhibits how seeking out the right buybacks may allow investors to outperform.