Whitney Tilson’s email to investors discussing Tesla Inc (TSLA) earnings, Charlie Munger, housing market, BBB bonds, Best Buy Co Inc (BBY) and Facebook, Inc. (FB).

1) The raging debate over Tesla continues. The stock is up 7% today on the company’s Q3 earnings report yesterday (hat tip to Andrew Left for calling it) that even skeptic Anton Wahlman (who will be speaking at our shorting conference on December 3) acknowledged was “a pretty solid quarter, all things considered. Actually, the first truly solid quarter Tesla has ever delivered in its history.”

Pease use “VW10” for a discount!

Q3 hedge fund letters, conference, scoops etc

That said, Walhman remains a skeptic for many reasons he shares in this article: Tesla's Q3 Beat Expectations, But Guidance For Q4 And Q1 Was Weak. Excerpt:

- Until we have seen the 10-Q, it looks like the Q3 earnings beat came mostly from a better-than-expected automotive gross margin.

- But stay tuned for the 10-Q, because just as with the last quarter, the 10-Q revealed important caveats around how the company achieved its gross margin.

- More importantly, the company was very tepid in guiding for Q4 and especially Q1 profit growth. Basically, no commitment to profit growth.

- Management is hoping that international Model 3 deliveries will offset U.S. weakness in the wake of $7,500 Federal tax credit being reduced January 1.

- The slowing sequential growth from here, along with peak annualized earnings of $1 to $1.5 billion, applied to an automotive industry multiple means the stock could fall below $50.

This anonymous writer thinks Tesla’s numbers are fishy: “Q3 Results Secured”. Excerpt:

Accounts receivable is usually where frauds hide the questionable transactions. If you give me enough beers, I can dream up a list of one-off reasons that a car may be sold without payment having occurred, but I will struggle to give you $585 million reasons (red). On the conference call, they noted that accounts receivable increased due to their last day of sales occurring on a Sunday. Sounds logical and all, except Q4/2017 also ended on a Sunday and accounts receivable showed a 15.2% sequential decline. Back then, energy generation, services and other (the things that normally have accounts receivable) were 17.8% of sales, today they are 10.6% of sales. Have you ever driven a car off the lot and not paid for it first? Something simply makes no sense here.

Lastly, this was posted on ValueInvestorsClub two days ago:

"With positive FCF going forward"

That's where this bullish opinion loses all respect. There is no positive FCF after Q3. Q3 is as good as it gets. Volumes are way down in October. Musk pulled forward tons of demand into Q3 precisely to draw this bullish image. If you consider all the circumstancial evidence, it's clear what's going on here:

- Easier to reserve a Tesla now. Most deliveries were to people who reserved long ago

- Less color options. Less interior options. Why??

- Tesla not paying various people on time, including firefighters, suppliers. Not returning funds to customers who canceled or demanded refund. One customer who returned their car was told a wire transfer can take up to 6 weeks. Other similar stories.

- 1-2-5 hour wait on the phone

- Tons of games with rescheduling of deliveries, reassignment of VINs

- Salespeople being told to lie, including selling Full Self-Driving post-discontinuation

- Number of deliveries down hard when counted using announcements on public forums.

- Also, deliveries down as per reports by shorts who live close to the action

- Tons of consumer lawsuits or complaints including under lemon law, fights at delivery locations

The company is stretching working capital to make FCF as huge as possible. They want the market to extrapolate the FCF numbers but it is the most un-extrapolatable FCF of any public company, at least in absolute $ amount.

There is some amazing grassroots work being done by a half dozen shorts on Twitter. Reading all that, the Chanos thesis is just the tip of the thesis in my view. Audi and Jaguar are just the beginning of the issues here. Regardless what happens in Q3, the next one, Q4, will be ugly. There's no demand for 5k per week and if they don't raise enough money in the next 3 months, they'll be pretty close to bankruptcy. And some people have interpreted that TSLA is effectively barred from raising cash via publicly traded equity. I think one key factor is credit rating agencies. They're not dumb and if they see volumes decline, the rating will follow, and then bonds will follow.

2) In my last email, I linked to the audio of an interview Charlie Munger did with Li Lu in August with a Chinese outfit. I just discovered the actual videos, which are posted on YouTube here:

- Munger (part 1)

- Munger (part 2)

- Munger (part 3)

- Li Lu (part 1) (audio only with English subtitles)

- Li Lu (part 2) (audio only with English subtitles)

3) Speaking of Munger, at the May 2009 Berkshire annual meeting, less than two months after the stock market’s nadir, he and Buffett called the bottom of the housing market. Here is the official audio and transcript (see Chapter 11, Housing Markets Are Beginning to Improve). Excerpt:

BUFFETT: in the last few months, you’ve seen a real pickup in activity, although at much lower prices…we see something close, I would say, to stability at these much-reduced prices in the medium to lower group…in the lower levels, there’s plenty of activity now. Houses are moving. Interest rates, of course, are down so it’s much easier to make the payments.

The mortgages being put on the books every day in California, are much better than, you know, the mix that you had a few years earlier.

So it’s improving.

…we’re going to eat up the inventory. And you can’t do it in a day. And you can’t do it in a week. But it will get done.

And when it gets done, then you’ll have a stabilization in pricings. And then you will create the demand for more housing starts. And then you go back up to a million and a quarter, and then our insulation business and our carpet business and our brick business will all get better.

Exactly when that happens nobody knows. But it will happen.

Charlie?

MUNGER: Oh, I think in a place like Omaha, which never had a really crazy boom in terms of housing prices, with interest rates so low if you’ve got good credit, that if I were a young person wanting a house in Omaha, I would buy it tomorrow. (Applause)

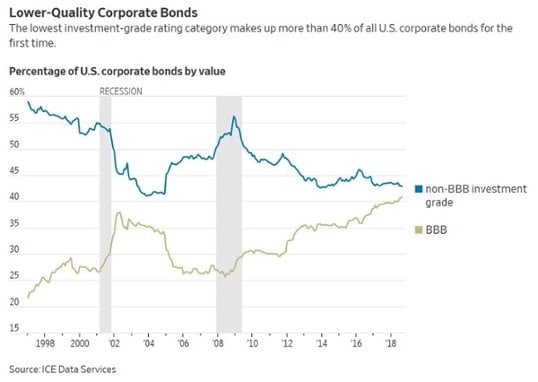

4) A cautionary sign: There Have Never Been So Many Bonds That Are Almost Junk. Excerpt:

...high-quality bonds aren’t as high-quality as they used to be, while junk bonds are a little safer than they were. This summer for the first time more than 40% of the value of U.S. corporate bonds was rated BBB, just eking over the line into investment grade, and an even higher proportion was BBB in Europe.

Back in 2007, bond spreads were a little lower than today, but a smaller slice of bonds was on the bottom rung of investment grade and so at risk being downgraded to junk; only 26% of U.S. bonds were rated BBB, and only 20% of eurozone bonds, according to Intercontinental Exchange data.

Chief financial officers have been borrowing as much as they can get away with without their debt being classed as junk, because the move to junk leads to sharply higher borrowing costs. The attention paid to that rating boundary means the usual danger of leverage comes with an extra risk: the buildup of BBB bonds could mean even more downgrades to junk in the next recession than usual.

5) It’s worth studying the remarkable turnaround at Best Buy, which I didn’t see coming at all. How Best Buy survived the retail apocalypse. Excerpt:

As rivals were being felled by balance sheets overloaded with debt, Best Buy was cleaning up its own.

The year 2012 is also when Hubert Joly was brought in as CEO. As an outsider with a McKinsey pedigree and stints at hospitality and media companies, Joly recognized the interplay between physical stores and online sales in building customer loyalty. He turned the stores into showrooms for the company's wares, while completely overhauling Best Buy's shipping infrastructure. The company's software was updated, its warehouse systems and procedures were revamped, and its same-day delivery was massively expanded. From 2012 to 2018, the company's online sales doubled to 16 percent of all revenue — a much higher portion than other major retailers.

Early in his tenure, Joly took a particularly big risk by promising to match the prices of Amazon and a number of other competitors. But he also did something clever: Joly brought brands like Amazon, Apple, and Samsung into the fold, allowing them to open boutique mini-showrooms in the stores. They basically pay Best Buy rent for the opportunity, saving them the money of opening their own stores and allowing Best Buy to piggy-back on their brand success.

Meanwhile, the Geek Squad became a kind of in-house, in-person tech support for Best Buy customers.

6) I think Facebook’s stock is a buy (along with Google’s – I own both; see my slides here), but they need to invest heavily to do a much better job of combating bad actors using the platform to spread hate speech and foment violence, as John Oliver reports here.