Gross corporate profits from the rest of the world hit a record high this year, but slower global growth, a stronger U.S. dollar, and a world increasingly disenchanted and disillusioned with America could weigh on U.S. foreign profits over the near term — amounting to a noticeable headwind to third-quarter earnings and beyond.

Not yet detected by the markets, the world is souring on a more protectionist and antagonist America, a trend that could potentially undermine global demand for a host of U.S. goods and services in the years ahead. Commerce can certainly trump diplomacy—but the latter still matters.

U.S. Foreign Profits Look Sturdy – At Least For Now

First the good news: Gross corporate profits from the rest of the world (ROW) hit a record high of $820 billion (seasonally adjusted annual rate) in the second quarter of this year, a figure up modestly from the prior quarter but some 14% higher than the same period a year ago. Meanwhile, foreign affiliate income, a narrower metric of U.S. global earnings, also posted strong results in the second quarter, rising 10.6% from the same period a year ago and by over 11% in the first half of the year. Both figures come courtesy of the Bureau of Economic Analysis and underscore the twin tailwinds of solid global growth and a softer U.S. dollar on U.S. foreign profits.

Q3 hedge fund letters, conference, scoops etc

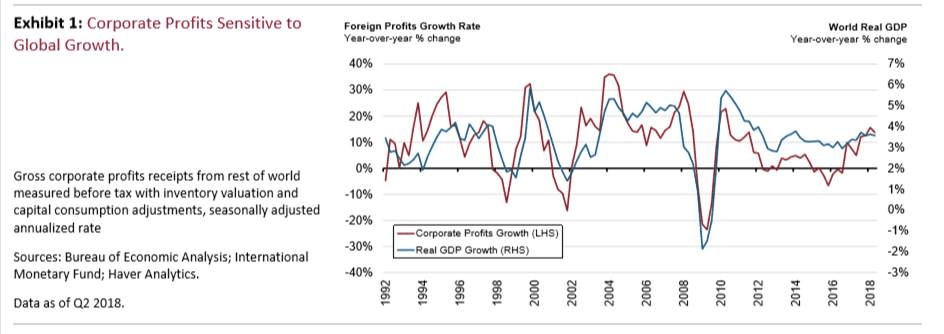

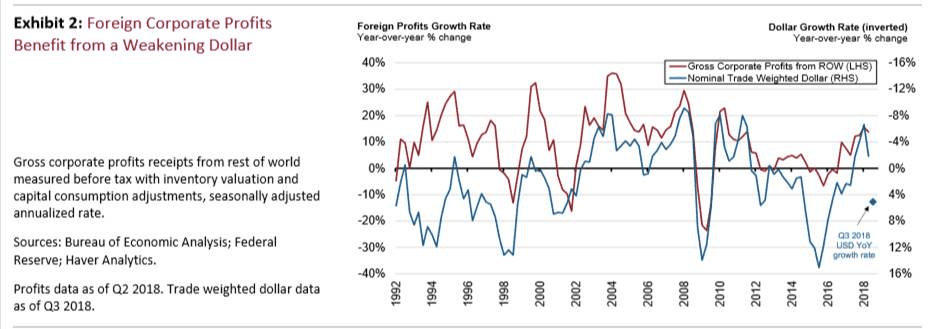

As Exhibit 1 highlights, foreign profit growth of U.S. firms closely tracks real global GDP, with the upturn in global demand since 2016 boosting U.S. foreign profits. Ditto for the weaker U.S. dollar, which was posting negative year-over-year growth rates through Q2 of this year (Exhibit 2).

Meanwhile, besides the one-two punch of strong global demand and a competitive currency, other variables have underpinned solid foreign profit growth over the past few quarters, including corporate America’s global brand leadership; broad global footprint via foreign direct investment; and “best-in-class” technological capabilities. Against this backdrop it is little wonder ROW gross corporate profits have marched steadily higher over the past few years, rising 24% between the start of 2016 and mid-2018.

Now the less encouraging news: The global backdrop for U.S. earnings has deteriorated over the past few months and could amount to a noticeable headwind to third-quarter earnings and beyond. The tide has shifted in two important respects. One, the synchronized global expansion evident at the beginning of the year has fizzled and become more desynchronized owing to stronger-than-expected growth in the U.S., China’s economic slowdown, and trade and currency shocks in a number of EMs (Turkey, South Africa and Argentina). Growth in the Eurozone has also lost steam over the past six months, leaving the U.S. the locomotive of the global economy.

Souring on America

In addition to the above, and just as important to future earnings, in our opinion, is the simmering political bad blood between the United States and its major trading partners, and the attendant rise in anti-American sentiment around the world. Not yet detected by the markets, the world is souring on a more protectionist, belligerent and antagonist America, a trend that could potentially undermine global demand for a host of U.S. goods and services in the years ahead.

According to a new 25-nation Pew Research Center survey1, America’s global image has plunged in the past two years, notably in key foreign markets like Mexico, Canada, France and Germany.

According to that report, “President Trump’s international image remains poor, while ratings for the United States are much lower than during Barack Obama’s presidency,” with a median of only 27% of those surveyed saying they have confidence in President Trump to do the right thing in world affairs. Some 70% lack confidence in him. Slightly more encouraging, of those polled, a median of 50% have a favorable opinion of the U.S., while 43% offer an unfavorable rating. In general, however, favorable views of the U.S. remain at historic lows in many countries—a worrisome backdrop for any U.S. company/sector dependent on foreign sales/earnings to drive growth (Exhibit 3 highlights the sectoral foreign exposure of the S&P 500).

This is not to suggest that there is a one-to-one correlation between what foreigners think of Washington and their desire for American goods and services. Commerce can certainly trump diplomacy—but the latter still matters. Take for example China’s recent seven-day Golden Week, a time when some 7 million Chinese travel overseas. Last year, the United States ranked as the fifth most popular destination among Chinese consumers, although America dropped to 11th this year according to Ctrip, a popular Chinese booking agency.2 According to the company, Chinese travelers place a great deal of weight on the current state of foreign relations when deciding where to travel, and not unexpectedly, given tense U.S.-Sino relations, many Chinese tourists have opted to bypass the U.S.

According to the data source ForwardKeys, Chinese outbound bookings to the U.S. are down roughly 10% year-to-date, which means billions of lost revenue for a variety of U.S. service providers in the U.S. (think transportation, retail, travel and leisure, etc.). No foreign visitors spend as much in the U.S. as the Chinese, with U.S. travel export receipts from China totaling nearly $31 billion in 2016, the last year of available data. That figure is up nearly 10 times from the levels of a decade ago (or $3.5 billion in 2006). Incidentally, the U.S. enjoys a massive trade surplus with China in travel services, with the surplus hitting a record $26.2 billion in 2016.

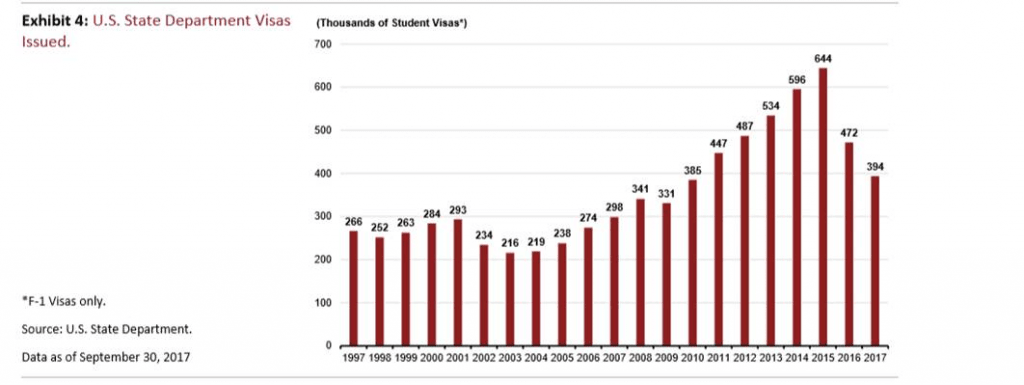

Another potential sign of trouble ahead: the decline in the number of visas issued to foreign students wishing to study in America. In the year ended September 30, 2017, the State Department issued nearly 400,000 student visas, a 17% decline from the prior fiscal year and down nearly 40% below the 2015 peak (see Exhibit 4). Big drops were reported among Indian and Chinese students, with tougher immigration rules and regulations one key reason cited for the drop.3

Long-term, the decline in the number of foreign students in U.S. universities represents a double-edged sword. The U.S. is not only losing a source of demand (students are consumers) but also a future source of supply (or potential workers upon graduation).

The Bottom Line

Earning expectations for the third quarter are relatively buoyant (in excess of 20% year-over-year) and basically already priced into U.S. equities. Not yet fully discounted are the growing headwinds to foreign profits, notably slower global growth, a stronger U.S. dollar, and a world increasingly disenchanted and disillusioned with America, with the latter a potential long-term catalyst for lost demand for U.S. goods and services.

1 Pew Research Center, Trump’s International Ratings Remain Low, Especially Among Key Allies, October 1, 2018.

2 See “China’s 7m Golden Week shoppers head to Japan, Thailand and Korea,” Nikkei Asian Review, September 29, 2018.

3 See “Visas Issued to Foreign Students Fall, Partly due to Trump Immigration Policy”, WSJ, March 11, 2018.

The named research analysts in these materials certify that: the views expressed in these materials accurately reflect the analysts’ personal opinions about the securities, investments and/or economic subjects discussed and that no part of the analysts’ compensation was is or will be related to any specific views contained in these materials. This publication is designed to provide general information about economics, asset classes and strategies. It is for discussion purposes only since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Always consult with your independent attorney, tax advisor, and investment manager for final recommendations and before changing or implementing any financial strategy.