Every so often the internet throws up an undiscovered gem from the world of value investing. The latest offering is a selection of articles written by Benjamin Graham in 1919 for the Magazine of Wall Street.

If you’re looking for value stocks, and exclusive access to value-focused hedge fund managers, check out ValueWalk’s exclusive value newsletter, Hidden Value Stocks.

These articles cover several topics including analysis by Benjamin Graham on several securities, giving us a fascinating insight into the way the Godfather of value investing analyzed securities and how he looked for value.

Q2 hedge fund letters, conference, scoops etc

I've already covered one of these articles which looked at a so-called, "Speculative Opportunities In Railroad Stocks." In this piece, I'm going to look at another of Graham's Magazine of Wall Street articles, which takes a look at utility company Consolidated Gas, and evaluates whether or not this business has hidden value.

Hidden Assets of Consolidated Gas

The article, written in 1919 starts with a broad assessment of the utility industry of the time. The industry was in recovery mode, after WWI which was a period of surging costs and declining profitability.

After the signing of the armistice agreement, investors' opinion of the sector improved, but Graham starts off by warning that it may be some time before the industry can return to 1914 levels of profitability.

Despite this view, he seemed to think that some sections of the market had hidden value:

"Such considerations may restrain speculative enthusiasm in the public utility stocks, but they cannot overthrow the basic proposition that these companies have seen the worst and should gradually regain their former prosperity. What does this fact mean in the case of Consolidated Gas, which three years ago sold above 150, a few months ago around 83 and is currently quoted near par? If we were to assume that its former earning power will eventually be regained, then ought not its intrinsic value be fully as great as before-since the last two years, difficult as they were, could not have sapped its resources to any appreciable extent? If Consolidated Gas was actually worth 150 in 1916, then it should again be worth very nearly that figure in 1920."

The rest of the article is devoted to an in-depth analysis of Consolidated Gas's balance sheet and company's potential. The author notes that the previous run up to $150 was a result of market speculation surrounding "stories of hidden assets."

So, Graham turns his analytical eye to Consolidated's balance sheet, to try and determine if these 'hidden assets' are indeed real or just a figment of Wall Street's imagination.

"Instead of vaguely estimating the subsidiaries’ earnings and assets, let us compile definite information on this subject so that we can determine the value of Consolidated Gas stock in a logical manner on the basis of a combined income account and balance sheet covering all the companies as one system."

When looking at the data, the Dean of Wall Street immediately runs into a problem. Consolidated Gas's annual report does not contain the information required to produce a reliable analysis. "The source of our information will not be the ludicrously inadequate report that Consolidated Gas issues annually to its stockholders," Graham writes. Instead, he turns to data provided by the company to the Public Service Commission. He says the utility "fairly deluges this august body with operating and financial statistics."

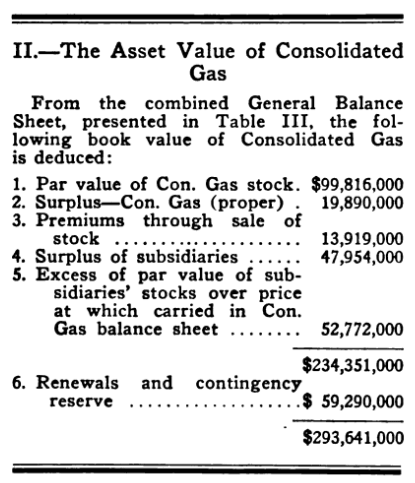

Analyzing the financial data, Graham can put together a table showing the asset values of Consolidated Gas as they were at the time. He finds his hidden value on the balance sheet form of the company's ownership stakes in subsidiary businesses:

"Items 4 and 5 [items on the table] , aggregating $100,000,000, are the real hidden assets, representing the excess of the book value of the subsidiaries' stocks as shown by their own balance sheets over the price at which they are carried in the Con. Gas investment account. N. Y. Edison stock, for example, with a par value of $66,000,000 and a surplus of $36,000,000, is valued on the holding company's books at only $39,000,000 an apparent understatement of no less than $63,000,000, or $63 per share of Con. Gas. These figures give Con. Gas stock a book valuation of fully $234 per share compared with only $113 in the company's balance sheet. To this large figure many claim that at least a large part of the replacement and contingency reserve of $59,290,000 should be added -- which would bring the actual value up to somewhere between $234 and $293 per share."

However, while these acids may immediately seem attractive, further analysis shows that the asset values are inflated and do not provide a reliable and accurate indication of value:

"Nevertheless, it must be recognized that a good part of these enormous book values is indubitably the result of an inflated property account. Proof of this fact is provided by a comparison of the assessed value with the net balance sheet value of the system's real estate and plants. Considering all but the two Westchester companies, the balance sheet figures in 1914 exceeded the appraised value by no less than $121,000,000. In the past two years, however, the assessed values have been increased by fully $60,000,000, chiefly through the marking up of the “Special Franchise” account. The latter item takes into consideration the system's "incorporeal rights”-in other words, it includes an official valuation of the good-will."

After deducting these liabilities, and adjusting for the company's debt and tax figures (including adjusting for debt and taxes in subsidiaries), Graham arrives at the book value figure of $166 per share for the stock; a valuation he summarises as follows:

"This then is a fairly accurate and official valuation of Con. Gas stock. Were the shares still selling between 140 and 150, one would hardly characterize this result as particularly bullish; but with the stock below par these figures have a different significance and should provide a basis for intelligent confidence in the intrinsic merits of this issue."

The stock looks undervalued based on Benjamin Graham's analysis, but is it worth buying?

This is the next question the godfather of value investing tries to answer. Looking at the business, he notes that its operating earnings are not that attractive, as the operating environment for utility companies improves, the situation should change:

"Unless the expected improvement in operating results fails utterly to materialize, there seems no reason to anticipate a cut in the dividend. If normal conditions return, the earnings should gradually approach the level of 1916--in which nearly $13 per share was earned on the stock."

Finally, Benjamin Graham concludes that this stock could be an attractive purchase for value-seeking investors as normal industry conditions return, although a little patience might be required:

"Consolidated Gas has never been the gold mine that Wall Street liked to think it; but it is a financially sound, Well managed utility, enjoying exceptional advantages through its unique location. There is a hundred dollars per share and more of real value behind this issue and with better times ahead, the investor at these levels should find the stock a very satisfactory purchase-although a little patience may be needed."

This originally appeared at ValueWalkPremium.com