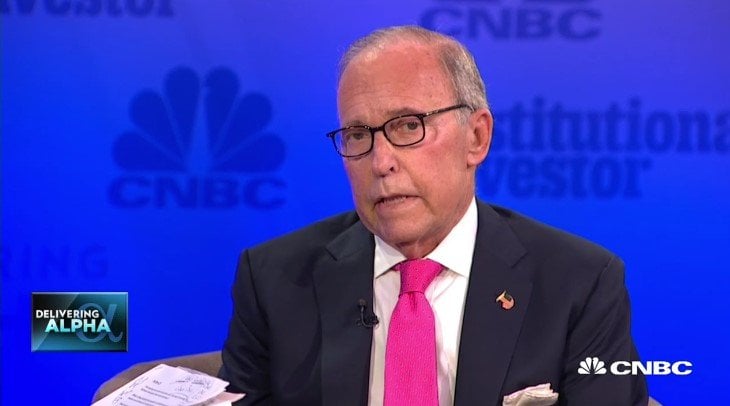

First On CNBC: CNBC Transcript: NEC Director Larry Kudlow on CNBC’s “Squawk on the Street” Today

WHEN: Today, Thursday, October 11, 2018

WHERE: CNBC’s “Squawk on the Street”

Watch NEC Director Larry Kudlow’s full interview

Q3 hedge fund letters, conference, scoops etc

All references must be sourced to CNBC.

CARL QUINTANILLA: You know, who knows better than any of us, is Larry Kudlow, the White House National Economic Council Director. Larry, welcome back. Larry, good to talk to you.

LARRY KUDLOW: Thank you, everybody. Appreciate it. I love Jimmy’s — I love Jimmy’s narrative. He’s absolutely terrific.

QUINTANILLA: Alright, so is the president meeting with Xi in November?

KUDLOW: There is a lot of discussion about it. There’s some movement toward it, that’s the G20 meeting. It will be in Buenos Aires. It’s a big crowd, obviously. I’ll be there, Secretary Steve Mnuchin will be there, a lot of people will there, John Bolton and so forth and so on. So all I can say is I don’t want to get too far ahead of that story. There may be a meeting. But it has not been set in concrete as far as I know, nor has the agenda been set in concrete. They have lots to talk about. So we’ll see.

QUINTANILLA: Larry, is the Fed loco?

KUDLOW: Is the Fed who?

QUINTANILLA: Is it — are they loco? Are they crazy?

KUDLOW: Is the fed crazy? You’re not — is that an institutional question or a personal question?

QUINTANILLA: I’m guessing you’ve heard the president’s comments on this.

KUDLOW: I have. I spoke to him yesterday for a while. Look, the president has, you know, his own views. He’s stated them many times. There’s nothing new here as far as I can tell. We know the Fed is independent. The president is not dictating policy to the Fed. He didn’t say anything remotely like that. And as i say they are independent, they’re going to do what they’re going to do. By the way, one little – one little factoid here, the Fed is –

QUINTANILLA: Apologies, Larry, IPO over here.

KUDLOW: The Fed has raised their target rate seven times in this new cycle, some under Yellen, some under Jay Powell. And Jimmy, I looked at the stock market, the Dow Jones is up significantly. 40% since the election during that period when they raised rates seven times so, look, look, I believe there’s agreement here that strong economic growth does not cause inflationary and does not cause panic increases in interest rates. I think yesterday my own view is it’s a normal correction in a bull market. The economic numbers are superb across the board. I mean, just this past week we not only started with a good jobs number, the isms were spectacular. The small business confidence was spectacular. We had a low inflation number today. Paychecks are getting fatter. Blue-collar workers are going back to work. I’m saying this because the economy is very, very sound and although I’m not here to predict the stock market, lord knows, the reality is, if you have a strong economy that will provide confidence for stocks, but corrections come and go. The president said that yesterday. He said this was a long-awaited correction. So I’ll just leave it right there. I think he’s on target. And, by the way, I think Jay Powell is on target. There’s no reason why economic growth has to cause inflation. And by the way, Jimmy, as you probably know — you all probably know this — you’ve had an increase, you know, year-to-date increase of 60 basis points in the 10-year treasury. That is a growth factor. If you look at it inside the tips market, most of that is the real interest rate. It’s not an inflation premium. That’s a sign of economic health. That is something to be welcomed and not feared.

JIM CRAMER: Well, Larry, look, you know I share your constructive approach to it and yes the market is definitely up. I am worried about near-term issues: chemicals, some housing, worried about lending, some of the basic building blocks of semis, railroads. And what I’m thinking here is that it wouldn’t be so bad for the fed to look at this near term data, maybe say “Listen, you know, we have to get tariffs through the system, people have to move their stuff out of China. Build things elsewhere. We can take a harder look, in, say three, six months from now because we’ve done our job and our job is working.” Would that be so wrong to take that approach?

KUDLOW: Well, I don’t want to get – you know, second guess them on the sectors, jimmy. There’s nobody smarter about that than you are. I don’t want to second guess the Fed. They are independent. Ok? And — I’m just saying that I think they’ve — my opinion personally, they have handled the transition from ultra ultra easy money, which many of us thought was not a great idea years ago, but they’re transitioning to something more normal. What’s really going on is that low tax rates on individuals and businesses, a massive rollback of costly and burdensome red tape and regulations, a terrific comeback in energy which has been fostered by deregulation. These are the key factors driving what I call the new Trump economy and they are taking over now from all this ultra easy money which was probably — I don’t want to even go into whether it was helpful or not. You’re seeing a transition. And the economy is going into one of the best business investment booms we’ve seen in years. We had none of that in 2015 and 2016. Cap goods, right, plants, equipments, buildings, structures, technology, campuses — we’re seeing all that develop as a result of the new opening of the economy through the tax and regulatory reductions. And that’s going to carry this, in my judgment, for several years to come. Blue-collar workers, we’re seeing the best gains there since the mid-1980s when I was a cub scout here for Ronald Reagan. Lower end. Lower, middle, and middle-class salaries and wages are rising faster than the upper end. I’m not opposed to the upper end, you know me, I want everybody to get rich and I want the non-rich to get rich. I’m just saying all these things are shaking out beautifully right now. So I don’t want to be pessimistic on the economy. You’ll draw your own conclusions on stocks but I think this picture looks as good as it looked in years.

CRAMER: Well, that would cut toward taking a pause and raising interest rates. It would also cut toward taking a strong stance against China. Larry, you know we’re retaliating against China, I don’t think we’re in a trade war. I think we’ve not done anything until now. Can it escalate to the point where we have to be concerned that there has to be collateral damage? Simply because we need to teach the Chinese a lesson because you know how many jobs they’ve taken from us. You know how — what they’ve done stealing our intellectual property. Isn’t the cost of taking on the Chinese and retaliating to some degree a possible slowdown in some of the international stocks that are based here?

KUDLOW: Well, we’ll see how it plays out. I agree with your analysis, so does President Trump. Unfair trading practices, they’ve broken many laws, they’ve broken WTO laws. As you noted, IP theft, force transfers of technology. They won’t let American companies own themselves so they can come in and literally a new regulation allows them to hack into American corporations to get information. That’s more theft. And in some cases they’re allowing better ownership, but they won’t give a license for the company to start up and of course there is a trade imbalance in the numbers. I don’t want to forecast where this leads, there’s just a lot to talk about. There may be this meeting in G20, which would be fine. I believe it’s always better to talk than not to talk. But, but, thus far their response has been unsatisfactory to our asks. And as you just mentioned, our asks are pretty common sense and Europe shares our view, and japan shares our view, and Canada shares our view. So, we’ll see how it plays out. I think the Chinese have got to come and say, “Okay, we’re going to change our structure, we’re going to abide by the laws and we’re going to make a fair trade deal that will help the American economy and the American workforce.” They’ve got to do that. They have not done that yet.

SARA EISEN: And in the meantime, Larry — it’s Sara, their market is getting hit harder than ours. Their stock market, their currency is collapsing. I mean, it appears their economy is slowing. Do you really believe that the U.S. can decouple economically and in the markets from what’s happening with the second-biggest economy in the world and the spillover effect that could create?

KUDLOW: Well, I don’t know if it’s a complete decoupling, Sara. But, look, we’re on a roll right now. You know. The government doesn’t run the American economy, the government runs a big chunk of the Chinese economy. That’s a huge difference. Economic policies matter. I believe china is going the wrong way on their economic policies. I believe the United States is going to right way on economic policies. Right now, to coin a phrase, we, our economy and the people and the workers and entrepreneurs, they’re killing it. We’re the hottest in the world, Sara. You look at the charts Europe is slowing down, Asia is slowing down, as you correctly noted, China is slowing down. We are moving rapidly, right? 3.2% first half, 4.2% second quarter, the Atlanta Fed says another 4% in the third quarter. We’d be pleased if it’s over 3. We are the hottest economy in the world. We’re crushing it right now. And i think that’s going to continue regardless of China. Long run, i would love to see some trade peace. Long run, I’ve spoken to the president many times, let’s get rid of tariffs, let’s get rid of non-tariff barriers, let’s get rid of subsidies, let’s stop the theft of IP, let’s stop the forced transfer of technology. These would be wonderful for growth in all the countries and around the world. So yeah, but right now the U.S. Is carrying the ball. I don’t see an end to it. With all due respect, I don’t think this is anything resembling a sugar high. President Trump has changed the incentives in the economy. The war on business is over. The war on energy is over. The war on success is over. You keep more of what you earn and paychecks get fatter. You keep more of what you invest and what you risk. That’s the tonic that has been missing for almost 20 years. I don’t want to be partisan, 20 years. Now, we’re getting it all back, America is on a tear.

DAVID FABER: Larry, back to China for a moment. Because when I hear you I’m parsing — not even — just listening to you, I would assume the advice you give the president when you discuss the economic impact from the worsening dispute with China is going to be very little if nothing. That’s kind of what you seem to be indicating. We’re going to go to 25% on tariffs at the beginning of the year. Sara’s point, the Chinese economy itself, second-largest in the world, really is decelerating. But you seem to be saying, “Don’t worry, it’s not going affect us.” Am I hearing that right?

KUDLOW: Basically, yes. At this point, that the juncture, that would be my case. We have so much momentum here. We’re doing so many things right. Look, I don’t want to get ahead of presidential decisions regarding tariff rate changes or new actions on that front. That’s for the president to decide. All I’m saying is right now we’re on a terrific upswing and China looks to be on a down swing. I’m just going to leave it there. All things can be fixed. You know I’m an optimist, I’m the happy warrior. I talk about the three zeros with the president: no tariffs, or non-tariff barriers and so forth, no subsidies. This is doable. This is doable. We could flood Chinese consumer markets with great American exports, you know, farm and beef, industrial supplies, if they only let us, if they only open up their markets to let us. We can do that and that will help the trade balance and everything else. So we will wait and see. I’m very calm about this. I like the position we are in. I like the position President Trump has put us in. Again, stock market corrections come and go, you guys know that as well as anybody. I would just say be calm. We are in a terrific upcycle. It’s not going to change. It’s not going to change for a good while in my judgment.

CRAMER: Alright, Larry, look. You know, I share your constructive attitude. But, you know, as you said I speak with a lot of companies. And there’s been a big decline pricing in linerboard, pricing in chemicals, housing I think has apparently peaked in a lot of parts of this country, I think the regional banks are telling you that lending has slowed, they will reiterate that on Monday and Tuesday, the basic semiconductor prices are coming down, rail carloads were very bad in the last couple weeks. Luxury good numbers have been bad. Larry, I want to — I’m creating a pastiche that I’m concerned about. It’s short term, you’re absolutely right, I think the correction will be short term. But I just think when you see those it would be terrific just to kind of let things lie and keep rates where they are. I know you favor an independent Fed as I do, but boy it would be a shame if all the things you talk about were really cut short because we decided they were inflationary, when you and I both know they’re not inflationary.

KUDLOW: Well, thank you. Jimmy, if you had told me six or 12 months ago that you wanted a seat on the Federal Reserve Board I would have fought like hell for it. No problem. No problem. You never said that. This is the first I’ve heard of this desire. So you know, let’s keep in touch on this, my friend.

CRAMER: With all due respect, Larry. I know I’m — I’ve got to be objective. Okay? But I work with this man for four years and he is a delight. And I always struggle.

QUINTANILLA: I assume this is the Philadelphia Fed. Right, Jim? I mean – that’s where you’re gonna go.

CRAMER: I struggle over it because I just think that Larry always knew i talk to companies, right Larry? I talk to companies, you do top down. And you know, I’ve always felt you’re best in business. I’m concerned. I want the strength to continue is all I’m saying. It would be a shame if people really felt that inflation was out of control, because it may be a three to six month blip-up and then we’ll be fine. And I just don’t want anything to be derailed you talked about. That’s all.

KUDLOW: no, it’s great. Look, we have to watch every number. I know that. You and I do that. I’ve got to do it here. My colleague and great friend Kevin Hassett is doing it at the CEA. Treasury Secretary Mnuchin. Of course, we’re all keen to all the numbers. But I want to say this: you can have the short-term oscillations in certain business indicators, but look at the big picture. You know, the big picture is we are growing faster than almost anybody dreamed possible. In the past year, I think it’s the biggest story of 2018. I really do. We are in an economic boom most folks thought was impossible. We have penetrated the 1% and 2% so-called secular stagnation zone. We are moving into new ground. The trajectory of the economy is going up. The unemployment rate is 3.7%. Inside that, all the different groups, including minority groups are registering amazingly low, historically low unemployment rates. Blue-collar workers are up. I don’t want to be redundant. I’m just saying there’s so much good news out there that we shouldn’t just try to find a couple of numbers that don’t look great, okay? You’re going to get your oscillation. I think the picture is terrific. I mean, the stock market — I was talking to Secretary Mnuchin, he’s working in the ASEAN conference in Bali yesterday. You know, with it all, yesterday’s correction and what not, the Dow is not far from 26,000. The S&P, not far from 2,800. Since the election, these indicators have gone up 40%, 40%, 30%. That’s a sign of a healthy economy. And even tech, Jimmy, alright tech seems to have led the correction yesterday. Tech is still up 50% since the election. So some awful good is happening there. This is something for investors and their 401(k)s. This is something for you know, blue-collar folks, main street folks, community and regional banks, by the way, where we deregulated and I expect to see better loan growth in the future. This is a heck of a story. Let’s embrace it. You may not agree with everything we do. I understand that. I’m very respectful. I have lots of friends across the aisle and you do, too, and they’re good people and I respect them. But I’m just saying for heaven’s sakes, please look at the facts. Right? Henry Kissinger many years ago, making an argument said, “This argument has the benefit of being factually true.” Okay? I’ve never forgotten that line. Right now this argument has the benefit of being factually true. Let’s enjoy it and hope to continue.

CRAMER: I know, Professor Kissinger when I had him always said, “Listen, you’ve got to do different kinds of homework.” I want what Larry is saying to continue. I am just concerned with what the companies are saying, but I think we can get there. I think we can get there.

QUINTANILLA: Larry, thank you so much. Good to see you again. Larry Kudlow from the White House.

KUDLOW: Thank you. Appreciate it.

QUINTANILLA: By the way, we’ll talk to Secretary Steve Mnuchin tomorrow morning, 7:00 a.m. Eastern time on “Squawk Box.”