Mittleman Investment Management commentary for the third quarter ended September 30, 2018; discussing their emerging markets exposure.

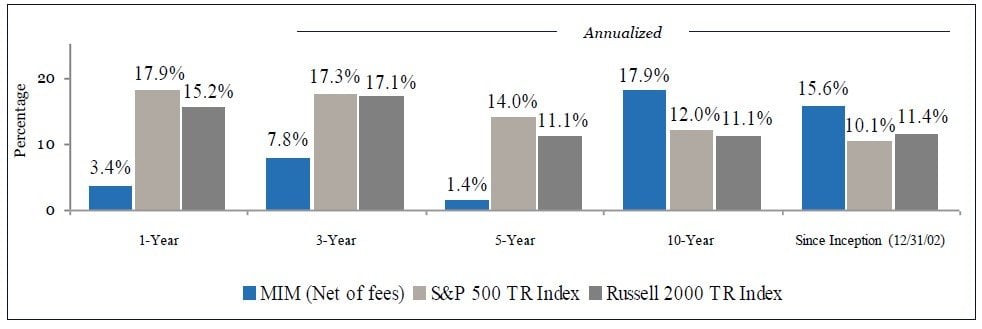

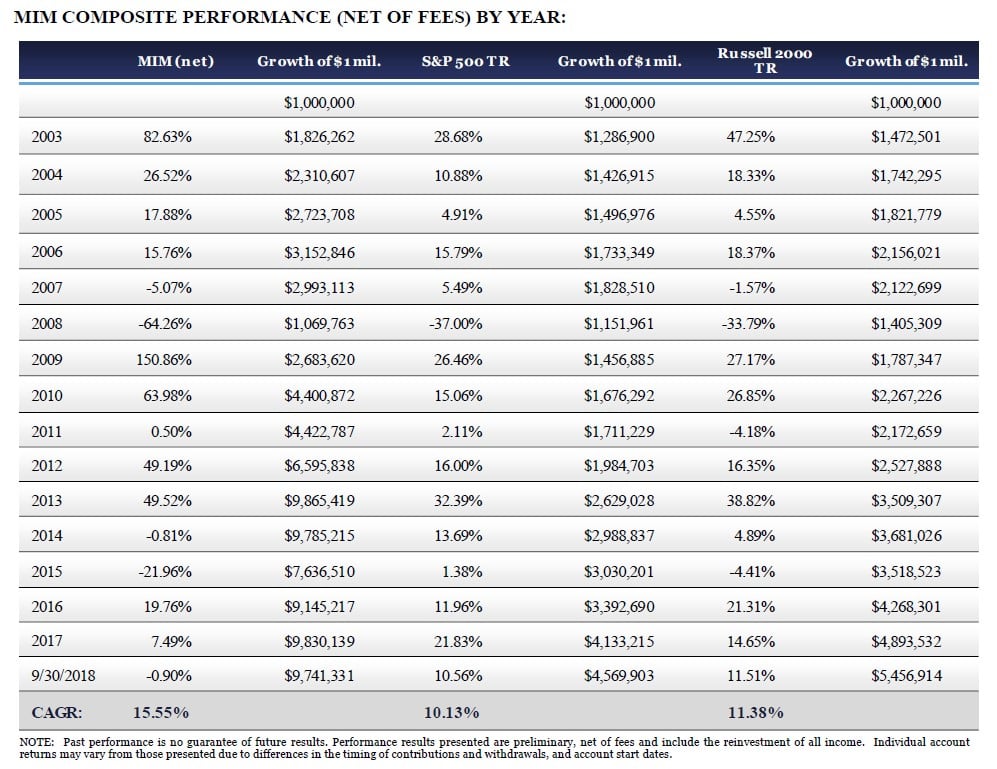

Mittleman Investment Management, LLC’s composite advanced 19.1% net of fees in the third quarter of 2018, versus gains of 7.7% in the S&P 500 Total Return Index and 3.6% in the Russell 2000 Total Return Index. Longer-term results for our composite through 9/30/18 are presented below:

“Many shall be restored that now are fallen, And many shall fall that now are in honor.” – HORACE—ARS POETICA, c. 19 BC

That quote from Roman poet Horace in The Art of Poetry circa 19 BC is found on the first page of another timeless work, Security Analysis, by Benjamin Graham and David Dodd, published 1934, which most of those reading this letter will recognize as the Magna Carta of the value investing discipline to which we’ve long strived to adhere. And while the sharp rebound we had in Q3 did much to restore our results for the year, we know that there remains much more ground to retake before our recent performance can be considered “in honor” again. That said, we are encouraged that the portfolio made such progress against yet another quarter in which “value stocks” in general significantly underperformed “growth stocks” in general, and emerging markets were down yet again.

Q3 hedge fund letters, conference, scoops etc

Our emerging markets exposure has weighed heavily on our performance this year, with the MSCI Emerging Markets Index down -7.5% YTD through 9/30/18. While on the surface it would appear that we had 25.7% of the portfolio invested in EM stocks as per the MSCI-defined country designations, on a look-through basis our true weighting in EM is really more like 40%. For example, our Singapore-listed investment (Jardine Strategic, JS SP, $36.30), which was 5.6% of the portfolio on average at quarter end, is considered a developed market investment because it’s listed in Singapore, but the bulk of its $35B NAV is comprised of investments in businesses located in Indonesia and mainland China, which are considered emerging markets. Likewise, our Hong Kong-listed exposure, considered developed market again because of the Hong Kong listings, is comprised entirely of emerging market businesses in the Philippines, Indonesia, and mainland China. So while none of that excuses our YTD underperformance, as we chose to be invested thus, it does help explain it. We believe those investments will ultimately serve us very well as those stocks are among the most undervalued that we own, and have ever owned.

We’re not alone in finding deep value in emerging markets. In Barron’s magazine over this past weekend, Ruchir Sharma, head of emerging markets and chief global strategist at Morgan Stanley Investment Management, highlighted the valuation disconnect, “…the combined market value of three of the largest Southeast Asia economies—Indonesia, Malaysia, and the Philippines—is the same as Apple ’s [AAPL] $1 trillion market value. The last time I saw such anomalies in small- to mid- cap stocks was in the late 1990s.” We, too, find the yawning valuation disparities reminiscent of 1999, which preceded a terrible bear market in the major U.S. averages over the next three years (2000, 2001, and 2002) while already cheap value stocks in general (ours included) rose significantly.

It remains to be seen if our Q3 surge will mark a more significant turning point, or prove to be another cruel head-fake that then returns us to the performance purgatory in which we’ve wallowed for the past four years now. But, as I mentioned in our Q1 2018 Investment Review, Warren Buffett’s Berkshire Hathaway spent six years going nowhere (in stock price), from $42 on 12/31/69 to $38 on 12/31/75, with the Dow Jones average up 36% in those six years. That’s 50% longer than the roughly four years we’ve suffered well below our high water mark, and yet over the ensuing four years, Berkshire rose from $38 to $320 by 12/31/79. A terrible result over six years, but an outstanding success over ten years ($42 to $320, a 23% CAGR).

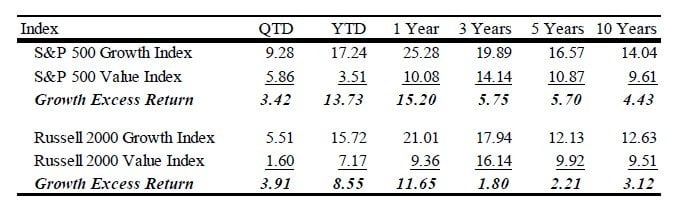

Somewhat similarly, our trailing five-year numbers now look terrible, at a 1.4% CAGR for us vs. 14% for the S&P 500, but over trailing ten-years we have significantly outperformed the major indices, with our composite of all manage accounts producing a 17.9% CAGR vs. 12% for the S&P 500. We even outperformed the S&P 500 Growth Index over those past 10 years, which produced a 14.1% CAGR as shown in the table below.

The point being, the extent of our recent time spent in the performance penalty box is unusual, but not unprecedented, and certainly not mutually exclusive with outstanding results over the longer term. And the sharpness of our Q3 recovery is a reminder of just how quickly and intensely a seemingly inexorable trend in prices can change, especially with a highly concentrated portfolio like ours. And our commitment to the investment discipline or “style” of being value-oriented does not mean we can’t make satisfying returns when value investing is out of favor, as our trailing ten-year results show.

Contributors/Detractors

The top three contributors to our Q3 2018 performance were AIMIA Inc. (AIM CN): $1.76 to $3.50 (+98.7%), AMC Entertainment (AMC): $15.90 to $20.50 (+40% with $1.75 per share in dividends paid at the end of the quarter), and Revlon (REV): $17.55 to $22.30 (+27.1%).

We covered Aimia (AIM CN) at length in both our Q1 and Q2 Investment Reviews, as it was the biggest detractor from Q1 performance, followed by being our largest contributor to returns in Q2. After wisely rejecting an Air Canada-led consortium’s public offer to buy Aimia’s Aeroplan business for CAD 250M in July, and a subsequent offer of CAD 325M, the groups reached an agreement on a transaction price of CAD 450M in cash and the assumption of an estimated CAD 1.9B in deferred revenue liability. We issued the following statement on the sale of Aeroplan and expect a definitive agreement to be signed soon: MB Comments on Aeroplan Sale. Once that sale closes (estimated by year-end), Mittleman Brothers will be the largest shareholder in a holding company that will have an NAV that we estimate at CAD 1.2B (USD 900M), most of which, CAD 700M (USD 538M) will be net cash. That does not include any value for roughly CAD 800M in tax loss carry- forwards that we estimate will be available upon closing.

We have a long history of highly successful investments in “investment vehicles” comparable to what we believe Aimia is about to become, like Leucadia National (LUK) now known as Jefferies (JEF), Zapata (ZAP), American Real Estate Partners LP (ACP) now known as Icahn Enterprises LP (IEP), Brascan Ltd. (BRSA) now known as Brookfield Asset Management (BAM), Danielson Holdings (DHC) now known as Covanta (CVA), Kinnevik AB (KINVB SS), and Harbinger Group (HRG) now known as Spectrum Brands (SPB). We also own shares of other investment vehicles from which we’ve yet to see gains such as Jardine Strategic (JS SP), First Pacific (142 HK), and HC2 Holdings (HCHC), all of which we think are worth roughly double their current prices.

We believe that Aimia has many of the characteristics that made those prior investment vehicles such successful investments for us, except this time, with Mittleman Brothers controlling nearly an 18% stake in Aimia and with two of our nominated representatives on the Board, we should have substantial influence on the mission-critical capital allocation decisions that the company will face immediately after Aeroplan is sold. We have developed and shared with Aimia’s board a strategic plan for Aimia going forward that, if the Board approves, we believe would substantially enhance NAV per share and extract maximal value from the tax loss assets and other key remaining components of value. If the Board rejects our plan and decides to liquidate the remaining assets instead (which we think would be a mistake, and wrongly strand the tax loss assets), there is still nearly 100% upside from current price to our estimate of NAV, as long as fair values are attained for the remaining assets. That would be a much less than ideal outcome, but the Board will have to consider all options, and some shareholders may prefer realizing a more certain but likely smaller amount more quickly retrievable in a wind-down and liquidation. We hope that our longer term vision for reinvesting and growing the substantial remaining assets of Aimia will prevail. Regardless, we believe that our involvement as activist investors with Aimia has already saved the company hundreds of millions in cash value that would have otherwise been lost had we not interceded when we did earlier this year. So even if we’re not afforded the opportunity to do more with those assets that we helped salvage, we’re proud of the accomplishment our efforts have produced thus far.

AMC Entertainment (AMC), our second biggest contributor to performance in Q3, reported strong earnings in August. Box office receipts YTD through 9/30/18 were up 8.7% over the same period last year and 3.8% over the same period in 2016 (which was a record year at the box office). On September 14th the company announced a transaction whereby AMC’s controlling shareholder, the Chinese conglomerate Wanda Group, would liquidate a portion of its ownership by selling 24M shares to be bought back by AMC. AMC paid a $1.55 special cash dividend on September 28th (in addition to its regular $0.20 quarterly dividend paid just days before that) in addition to buying the AMC shares held by Wanda, with funding provided by Silver Lake Partners, a highly regarded private equity fund, via the sale of $600M convertible preferred stock to Silver Lake by AMC, convertible at $18.95. Wanda Group retains a controlling stake over just over 50%. AMC’s subscription pricing option (vs. traditional pay as you go ticketing) called “AMC Stubs A-List” has proved more popular than anticipated, and while that might weigh on sales and margins in the near term, it’s great for the long term as it should mute the volatility of the business as it relates to hits or misses at the box office each week, making the cash flows that much more predictable. Subscription-based businesses tend to get higher valuations in the market, and there’s plenty of room for that here as AMC closed Q3 at $20.50, a market cap. of $2.1B, only 6.3x its annual free cash flow (FCF) that we estimate is $335M. AMC is considering an IPO of their European operations, which we believe would be a material catalyst for the stock, as valuation for theater companies tend to be higher in Europe versus the U.S.

Revlon (REV), our third largest contributor to performance, saw its Chairman and controlling (85%) shareholder, Ron Perelman, buying more stock in the open market in Q3 (365,000 shares from August 8th to September 25th at prices ranging from $15.17 to $21.29). These were Perelman’s first purchases since November of 2017. Perelman holding company, MacAndrews & Forbes, filed an amended 13D on September 21st, which included a letter indicating that so-called “independent” directors on Revlon’s board had asked for a one-year extension of the standstill agreement (initiated at our prodding on 9/15/17) that expired on 9/15/18, and that the request was granted.

There are two ways to read this: 1) as a sincere attempt by independent directors on Revlon’s board to extend the meager protection provided by the standstill for minority shareholders, or 2) it was a cynical attempt to shake out recent “event- driven” stock buyers, who were bidding up the stock price as the end of the standstill approached, presumably in belief that the event might lead to a take-private offer from Perelman. Extending the standstill dashed those hopes and getting those misguided buyers to sell brought the price back down to where Perelman was last buying stock just one week before the 13D filing. And right on schedule, he resumed his purchases immediately following that filing.

With the installation of his daughter as CEO, perhaps this is the beginning of Perelman’s attempt to take the company private. But getting from his 85% current ownership to 90% (the threshold required to do a short-form merger) through open market purchases seemed unlikely even without a standstill precluding him from doing so. Because of the ~15% of the shares outstanding that he doesn’t own, clients of Mittleman Brothers now own over 6%, leaving 9%, and index funds own 4.8%, leaving only 4.2% of shares theoretically available for purchase in the open market. So it is unlikely he could get an additional 5% of the shares through open market purchases unless he convinced an index fund or two to violate their mandate and sell him their stock. If open market purchase are logistically not going to achieve his likely end here, then a tender offer is more likely. However, in order for a tender offer by a controlling shareholder to get through Delaware without significant risk of court intervention, it is usually contingent on approval by a majority of the minority shareholders, meaning 7.5%+ 1 share of the 15% of shares held by non-Perelman entities would have to vote in favor. Since we own a little over 6%, and we believe we know of another 2% in the hands of other informed value investors, we don’t see that path likely to work for him either, unless a fair price is offered.

Regardless of what transpires, Revlon’s intrinsic value is unchanged by these actions and we continue to believe that it is worth north of $40.

The three most impactful detractors from our Q3 2018 performance were Intralot (INLOT GA): $1.15 to $0.80 (-30.5%), ABS CBN Corp (ABS PM): $0.45 to $0.36 (-21.6%), and International Game Technology (IGT): $23.24 to $19.75 (- 13.6%).

Intralot (INLOT GA) share price continued to fall in Q3 (-40% YTD through 9/30/18). There has been general weakness in the share prices of gaming companies, with Intralot’s primary competitors like IGT down 24% YTD and Scientific Games (SGMS) down 51%. As noted in our Q2 Investment Review, Intralot was wrongly tied by the media to a short-seller’s report on FF Group (FFGRP GA), which owns retailer Folli Follie and with which Intralot has no connection. The short-seller himself claimed that he had no position or report to issue on Intralot, and yet rather than recover, the stock has fallen much further since that clarification was issued, and despite aggressive stock buyback activity by the company (YTD through 8/29/18 Intralot bought back 8.1M shares (5% of shares outstanding) at avg. cost of €0.96 per share), and significant insider buying. Emerging markets exposure continued to weigh on the stock. Their operations in Turkey (15% of proportionate EBITDA) and Argentina (8% of proportionate EBITDA) were affected by currency weakness, with the Turkish Lira down 37% YTD vs. the USD (from TRY/USD 3.80 to TRY/USD 6.00) and the Argentine Peso down 53% YTD (from ARS/USD 18.62 to ARS/USD 39.63). However, the vast majority (80%) of Intralot’s cash is kept in EUR and USD, which substantially mitigates the FX risks. And the currency weakness in those markets has obscured the strong local currency results of those businesses, with sales up 30% (albeit aided by inflation in Turkey running near 18% lately) and EBITDA up 18% in Turkey in local currency terms during the first half of 2018, for example. Management also believes strongly that growth in Turkey will accelerate again in 2020 as the Turkish government will allow the sports betting payout percentage to rise, which usually leads to dramatic increases in sales. On the last quarterly conference call, 8/31/18, management estimated that if Turkey and Argentina saw their currencies stabilize at recent levels, the overall hit to EBITDA for the full year of 2018 would be approx.

€20M on a consolidated basis, and approx. €10M on a proportionate basis (the more relevant number). So we’d expect proportionate EBITDA to drop from €109M in 2017 to about €105M in 2018 (currency impact muted by strong growth from their 20% stake in publicly-traded Italian gaming company Gamenet (GAME IM €9.49), before jumping to €113M in 2019 on contribution from the Illinois lottery contract which kicks in beginning December 4, 2018 and which management estimated will generate about USD20M/€17M in EBITDA annually, and further strong growth in proportionate EBITDA from their 20% stake in Gamenet in its first full year post-merger with Goldbet, a privately-held Italian sports betting company bought at a €256M EV valuation (6.4x EBITDA of €40M pre-synergies) announced 7/24/18 that should close before year-end, offset partially by lower profitability on their contract with OPAP, the Greek lottery company, plus other adjustments. Impressively, Intralot sold its break-even business in Italy to Gamenet in March 2016 when Gamenet was still a private company, and today the value of Intralot’s 6M shares of Gamenet at €9.49 per share is €57M, which we think substantially undervalues that business. Intralot receives €3.6M a year in cash dividends from those shares.

Intralot has won big new contracts (Illinois, $340M over 10 years starting December 4, 2018) and key renewals (Ohio, along with four others, maintaining a 90% renewal rate since 2008 in the U.S., avg. contract duration now 7.6 years) recently to serve lotteries in the U.S. Intralot is now serving 10 states plus Washington, D.C. in the U.S. which account for USD 40M/€46M EBITDA (44% of proportionate EBITDA estimated for 2018). The U.S. business should grow substantially in 2019 with the Illinois contract (expected to add USD 20M EBITDA in 2019), and the company expects to sign their first sports betting contract in the U.S. before year-end 2018. The company is actively considering doing an IPO for their U.S. division, which we would expect to garner at least an 8x EBITDA valuation (USD 480M on USD 60M EBITDA in 2019), whereas in Greece the Intralot parent company trades at 6.5x EBITDA our estimate of €113M for 2019). We think the timing for an IPO of their Intralot USA division is ideal given the recent legalization of sports betting here, a business where Intralot already has major scale and should win some significant contracts. Intralot is also bidding on the Pennsylvania State lottery contract, which is a huge contract, with the results due late 2018 or early 2019 (initially due in June 2018, but one of the other bidders, IGT, filed suit against the PA state lottery agency claiming an unfair process which structurally advantaged the incumbent, Scientific Games. The Governor of Pennsylvania then interceded and terminated the tender and demanded an investigation. So the entire contract award process has thus been delayed). An Intralot win there would increase their U.S. EBITDA dramatically. Regardless, we believe that an IPO of Intralot USA, if valued at least at 8x EBITDA, would likely cause a nearly immediate doubling of the stock price on the sentimental relief of having achieved a very substantial deleveraging at a reasonable valuation. There is also a possibility that Scientific Games buys out Intralot USA, as each company has about 10% market share in U.S. lotteries, versus 78% for IGT, but with Sci-Games more exposed to instant-win printed games, and Intralot more on lottery systems. Putting the two together would be a much more balanced and potent competitor to IGT, and a 22% market share player versus a 78% share giant shouldn’t bother anyone in the anti-trust dept. of the FTC.

Our fair value estimate of €1.75 is 154% higher than Intralot’s stock’s price of €0.69 at quarter end. At some point the stock market’s focus should shift from the risks inherent in Intralot’s emerging markets exposure to the higher growth potential those markets present, and the valuation discount may even become a valuation premium at some point if/when such above average growth materializes. At some point the over-spend on cap-ex, which began in earnest 10 years ago in 2008, and will have averaged €95M per year over the 11 years through 2018 inclusive, and the resulting lack of FCF will give way to normalized cap-ex (€120M cap-ex in 2018, drops to €60M in 2019 according to mgmt., and we think €50M thereafter, of which €25M is maintenance, €25M is renewal/growth) with deleveraging and blossoming FCF for the first time in many years. An investment cycle is giving way to a harvesting cycle. We think that point is beginning now and into 2019.

ABS CBN (ABSP PM), our second most impactful detractor from performance in Q3, has been roughed up by the emerging markets sell-off and a limited float, as the founding Lopez family controls about 60% of the stock. The company is the dominant TV broadcaster in the Philippines, with a 45% audience share, versus 34% for its nearest competitor GMA7, and 7% for TV 5. They also own 57.4% of cable TV firm Sky Cable, which has 47% of the cable TV market there. They have an OTT streaming offering called iWant TV which competes well against Netflix and HBO-Go and others in that market. Their overseas pay TV channel, The Filipino Channel (TFC), brings in a steady and growing revenue stream of USD earnings from the extensive Filipino expat community living in the U.S. At quarter end price of PHP 21.30 (USD 0.40), the business has an enterprise value of $607M (inclusive of $112M pension liability), only 3.8x the $160M in EBITDA they should produce this year. EBITDA should grow to USD 180M in 2019 as costs from a failed venture into mobile phone services end this year, and targeting a more appropriate valuation of 8x EBITDA would put the stock price at USD 1.50 per share, 3.75x the current price. That should not be so hard to imagine, as we originally bought the stock in May 2014 around PHP 40 (USD 0.85) and sold half in Oct. 2015 at around PHP 60 (USD 1.30). The Philippines has a young population, with low debt, and high growth. Owning the dominant entertainment content producer & distributor in such a high growth market for less than 4x EBITDA is an unusual opportunity. Disney is buying Twenty-First Century Fox for 13x EBITDA, a business facing a much slower growing, and more cyclical demand profile in their major markets. Comcast is buying British Sky Broadcasting for 15x EBITDA, and again, the UK is not exactly a high growth market. ABS is just a well-known and pervasive in the Philippines as Sky is in the UK, actually even more so given ABS has 45% audience share in the Philippines and BSkyB has 8% audience share in the UK. So I don’t think expecting 8x EBITDA and the resultant nearly quadrupling of ABS’ stock price is in any way a stretch. Only one small brokerage firm in the Philippines follows ABS-CBN, they rate it a buy with a PHP 41.70 (USD 0.78) price target which is about double the current price but much lower than our target.

International Game Technology (IGT) fell along with its peers in the gaming sector in response to declines in Las Vegas convention attendance and a slowdown in Macau, China, as well as political turmoil in Italy, which is a huge market for IGT. We believe these are short-term issues that are overly discounted in IGT’s depressed valuation, while business fundamentals remain strong. Most people think of IGT as mainly slot machines, but their lottery business is huge, and more stable and recession proof, with contracts in various U.S. states accounting for 78% of the $74B in lottery sales made annually in the U.S. (Scientific Games has 12%, and Intralot has 10% market share). Just last night the Mega Millions jackpot hit an all-time record of $1.6B, and IGT gets about 1% of the value of ticket sales done in their states. Since 2008, lottery ticket sales have grown at a 3.8% annual rate. In addition to slots and lotteries, IGT has a big sports betting operation and is already benefitting from the legalization of sports betting in the U.S. as IGT is the technology partner for the FanDuel Sportsbook at the Meadowlands Racetrack which is growing very quickly. IGT will likely sign up many other partners to provide sports betting as other states make it legal.

At quarter end price of $19.75, IGT’s market cap. is $4.03B, which is only 8x the $500M in annual free cash flow (FCF) that the business generates. We think it’s worth $35 per share, or about 14x FCF. 50.7% of IGT’s shares are held by an Italian family through a holding company called De Agostini led by Marco Drago, an outstanding investor and capital allocator, who has been shepherding this corporation and its predecessors since 2002 when they bought a controlling stake in what was then known as Lottomatica in Italy. A 35% EBITDA margin business, with highly recurring and predictable cash flow, almost entirely recession proof, run by a discernibly excellent investor with massive skin in the game, and available at 8x FCF for a 12.5% FCF yield? Growing slowly, yes, but growing. To us this is value-investing nirvana.

In closing, we could not be more excited by the prospects of the businesses in which we’ve invested, and even more so, their stock prices. I look forward to updating you again in January.

Sincerely,

Christopher P. Mittleman

Chief Investment Officer - Managing Partner

This article was first posted on ValueWalkPremium