Fairholme Funds commentary for the month of October 2018.

Dear Fellow Shareholders:

Interest rates are rising. Stock markets are not cheap. Cash and cash equivalents are at historically high levels in each of the Fairholme Fund, the Fairholme Focused Income Fund, and the Fairholme Allocation Fund (“Funds”) given investment performance and being more fearful than greedy when balancing market opportunities and risks. Due to recent developments with certain holdings, we want to provide updates on St. Joe after Hurricane Michael, Fannie Mae and Freddie Mac after the latest court ruling, Imperial Metals after latest production reports, and Sears Holdings after the company’s announced bankruptcy where the outcome is uncertain and an evaluation of net assets is more complex in a Chapter 11 court process. Our remaining Sears Holdings’ securities collectively represent less than 2% of each Fund’s net assets.1 This represents the maximum downside exposure to Sears Holdings, as we seek to maximize recoveries and move forward.

Q3 hedge fund letters, conference, scoops etc

The St. Joe Company (JOE)

JOE owns approximately 170,000 acres, 67% of which is within 10 miles of the Gulf of Mexico. 120,000 of the 170,000 acres is contiguous within Walton and Bay Counties and surround 15 miles of the US Intracoastal Waterway and Great Northwest Florida Beaches International Airport. JOE has built a home grown management team, a fortress-like balance sheet including $250 million of liquid investments, and a profitable pipeline of projects to build homes, apartments, limited and full-service hotels, clubs and resorts, commercial villages, marinas, manufacturing and office spaces, and all else that is needed for Northwest Florida coastal work, life, and play.

It’s hard to put into words how well JOE performed during Hurricane Michael. The company’s assets benefit from high elevations and hurricane-resistant construction. It’s also hard to describe the devastation suffered by so many, so near. Before Hurricane Michael, JOE was growing. Much more is now required to meet communities’ demands after Hurricane Michael. Activities planned for the next five years must be accomplished in three. CEO Jorge Gonzalez will soon update shareholders with the company’s quarterly earnings. As a fellow shareholder and Chairman of JOE’s Board of Directors, I could not be prouder of JOE and its people, nor more optimistic about the future. There is a good reason for a long-term focus on JOE.

Fannie Mae (Fannie) and Freddie Mac (Freddie)

Until recently, a majority of judges in various venues have agreed with DC District Court Judge Lamberth’s 2014 decision that the Federal Housing Finance Agency (FHFA), as Fannie and Freddie’s government overlord, could do whatever it wanted with the companies’ past, present, and future earnings. But, on September 28th Judge Lamberth changed his mind due to allegations based on new evidence discovered in the Court of Federal Claims and decided that FHFA is not the government but a private actor. Fairholme and others can sue FHFA for money damages for breach of the implied covenant of good faith and fair dealings to be expected from any shareholder-owned company.

This is good news when you count the cash that Fannie and Freddie have earned and will earn. It is obvious that Fannie and Freddie were always sound and solvent. There was never a need for conservatorship or a “net worth sweep” as Fannie and Freddie performed their mandated jobs to protect and serve home ownership during times of financial crisis. And, as was factually obvious in 2009 or 2012 by loan vintage analysis, both have come back strong. Judge Lamberth’s latest ruling should advance the re-IPO of Fannie and Freddie in similar fashion to AIG in 2012.

Imperial Metals

Imperial Metals is improving productivity at Red Chris. The company is heading in the right direction. But, time is of the essence and management knows it needs to move faster. A resolution to near term debt maturities, a joint venture partner for Red Chris, and a fair insurance payment for the Mount Polley dam breach would allow Imperial a promising future given the size and depth of the Red Chris resource, significant copper demand growth from electric vehicles and renewable energy projects, and constrained supply growth. History has shown that commodity prices forge their own anchor.

The Fairholme Fund

The Fairholme Fund, which seeks long-term growth of capital, has $1.1 billion of net assets. Of the total, 42.8% is composed of cash, U.S. Treasury Bills, money market funds, and investment-grade commercial paper with an average duration of two weeks. 30.6% is in St. Joe common stock, 12.3% in the preferred stock of Fannie Mae and Freddie Mac, 8.9% in the debt of Imperial Metals, and 2.9% in the common stock of Vista Outdoors. Sears 8% bonds of 2019 compose 1.5% of net assets, with Imperial Metals’ common stock at 0.8% and Sears’ common stock at 0.1%. I and all other Fairholme-affiliates own 17.7% of the Fairholme Fund shares.

The Fairholme Focused Income Fund

The Focused Income Fund, which seeks current income, has $197 million of net assets. Of the total, 54.6% is composed of cash, U.S. Treasury bills, money market funds, and investment-grade commercial paper with an average duration of two weeks. 20.9% of net assets are invested in corporate bonds with maturities between 2019 and 2023. The largest bond security at 8.7% of net assets is Imperial Metals 7% due 3/15/19. The second largest bond security at 4.2% is Vista Outdoor 5.875% due 10/1/23. The third largest at 3.3% is International Wire Group 10.75% due 8/1/21. All other corporate bond positions are less than 2% of net assets. Sears 8% bonds due 12/15/19 compose 1.5% of net assets. 22.2% of net assets are invested in perpetual preferred stocks. The largest preferred category at 9.7% of net assets is variable rate bank preferred securities, with the issuers being Goldman Sachs, Citigroup, Bank of America, and Wells Fargo. Fannie Mae and Freddie Mac preferred stocks are 5.2% of net assets. GMAC Capital Trust I preferred is 3.5% of net assets. Chesapeake Energy preferred stocks is 2.7% of net assets. AT&T common stock represents 2.2% of net assets. There are no other common stocks. I and all other Fairholme-affiliates own 48.9% of the Focused Income Fund shares.

The Fairholme Allocation Fund

The Allocation Fund, which seeks long-term total return from capital appreciation and income, has $76 million of net assets. Of the total, 61.8% is composed of cash, U.S. Treasury Bills, money market funds, and investment-grade commercial paper with an average duration of two weeks. Common stocks total 17.7% of net assets. The largest common stock holding at 8.2% is in stock of St. Joe followed by 4.5% in the common stock of Imperial Metals, 2.8% in the stock of Vista Outdoors and 0.2% in the common stock of Sears. Preferred stocks total 17.2% of net assets with Fannie Mae and Freddie Mac preferred stocks at 13.1% and a Chesapeake Energy preferred at 4.1% of net assets. The only corporate bond in the fund, International Wire Group 10.75% due 8/1/21, constitutes 3.3% of net assets. I and all other Fairholme-affiliates own 53.1% of the Fairholme Allocation Fund shares.

Concluding Thoughts

Performance since inception remains positive relative to their benchmarks for the Fairholme Fund and the Fairholme Focused Income Fund. Our desire for all Funds remains long-term outperformance. However, employing a non-diversified strategy since day one has resulted in greater than normal volatility. Any single investment that experiences adverse consequences can bring long periods of underperformance. Looking forward, I remain optimistic about the future and ask for your continued patience given market prices, upcoming quarterly releases, and portfolio liquidity. Fund Factsheets will be updated as at October 31st at www.fairholmefunds.com in November. The Fairholme Funds, Inc. Annual Report will be available in January, 2019.

Yours truly,

Bruce R. Berkowitz

Chief Investment Officer

Since inception on December 29, 1999, the value of $10,000 investment with dividends reinvested in The Fairholme Fund was worth $47,888 compared to $28,626 for the S&P 500 Index (“S&P 500”).

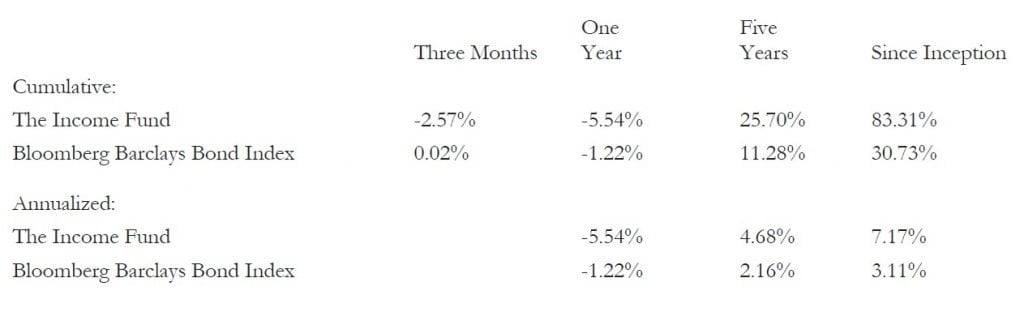

Since inception on December 31, 2009, the value of a $10,000 investment with dividends reinvested in The Fairholme Focused Income Fund was worth $18,331 compared to $13,073 for the Bloomberg Barclays U.S. Aggregate Bond Index (“Bloomberg Barclays Bond Index”).

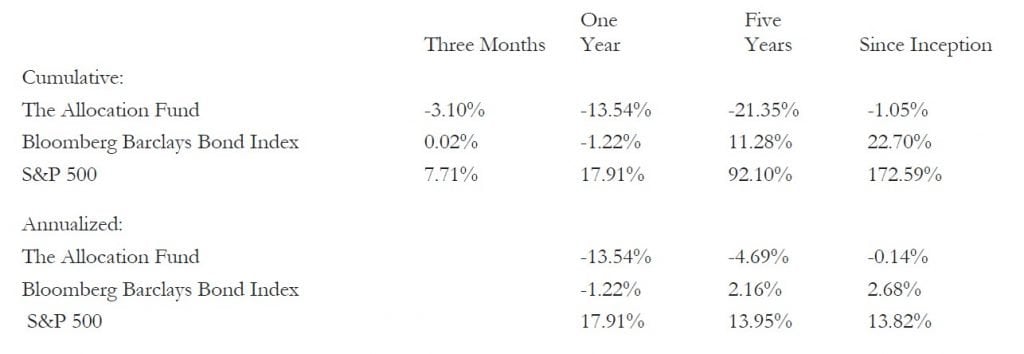

Since inception on December 31, 2010, the value of a $10,000 investment with dividends reinvested in The Fairholme Allocation Fund was worth $9,895 compared to $12,270 and $27,259 for the Bloomberg Barclays Bond Index and S&P 500, respectively.