DoubleLine Shiller Enhanced CAPE webcast slides for the month of October 2018.

TAB I – DoubleLine Shiller Enhanced CAPE® Strategies

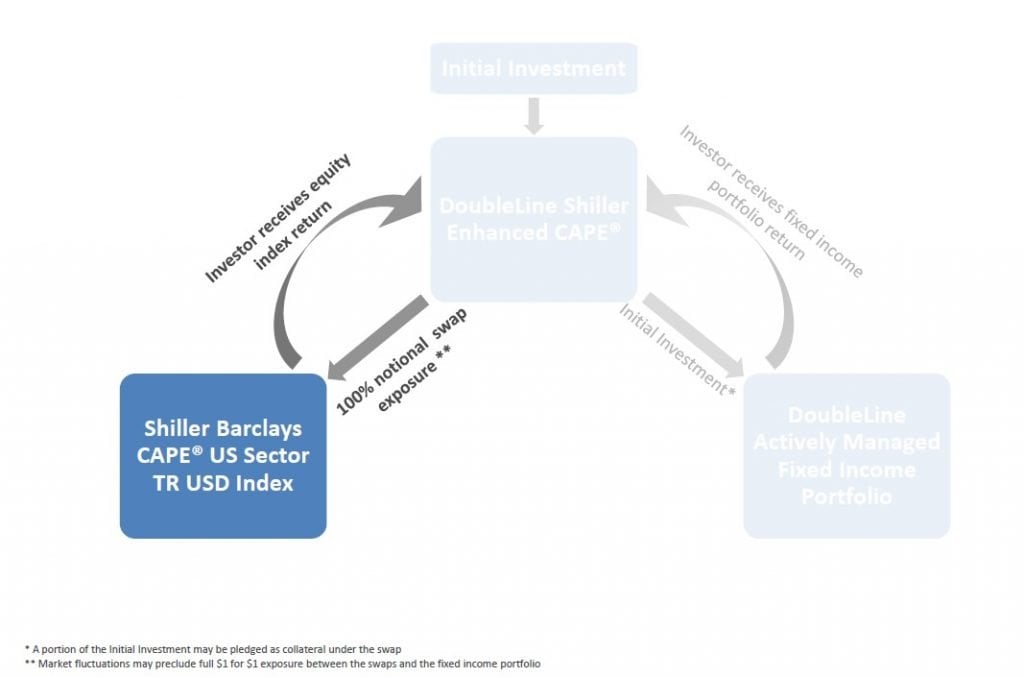

DoubleLine Shiller Enhanced CAPE® Structure

- The distinct structure of the DoubleLine Shiller Enhanced CAPE® Strategy allows investors to simultaneously access returns of the equity markets and fixed income markets. By using an equity index swap, $1 invested in the strategy provides approximately $1 of exposure to each market.

Q3 hedge fund letters, conference, scoops etc

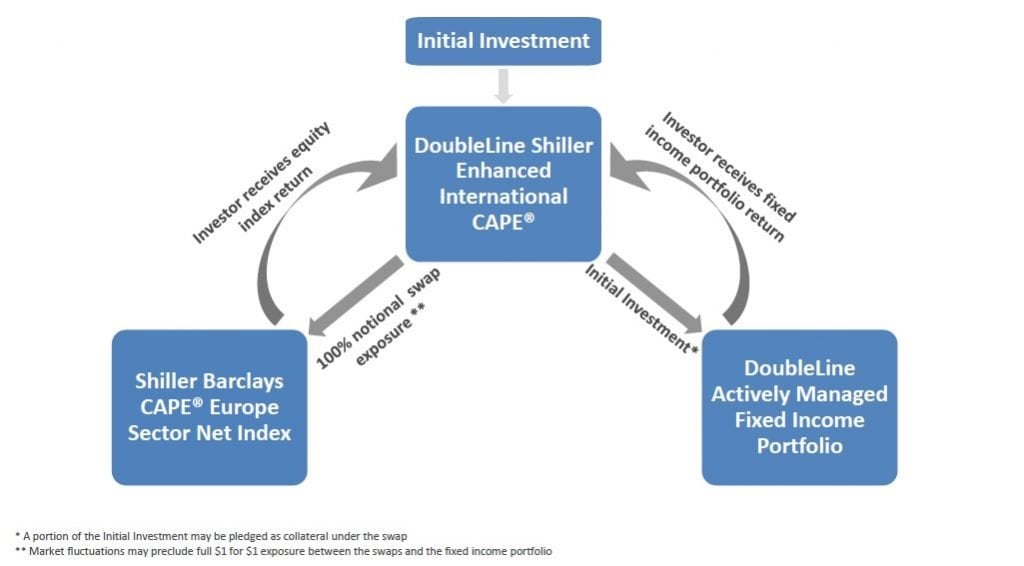

DoubleLine Shiller Enhanced International CAPE®

- The distinct structure of the DoubleLine Shiller Enhanced International CAPE® Strategy allows investors to simultaneously access returns of the equity markets and fixed income markets. By using an equity index swap, $1 invested in the strategy provides approximately $1 of exposure to each market.

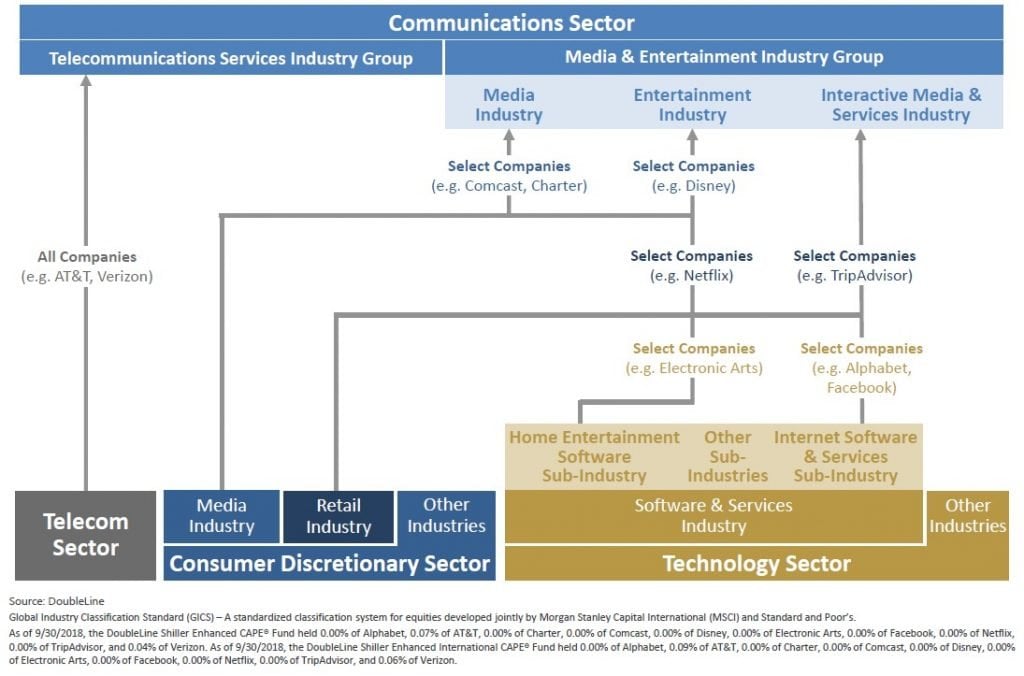

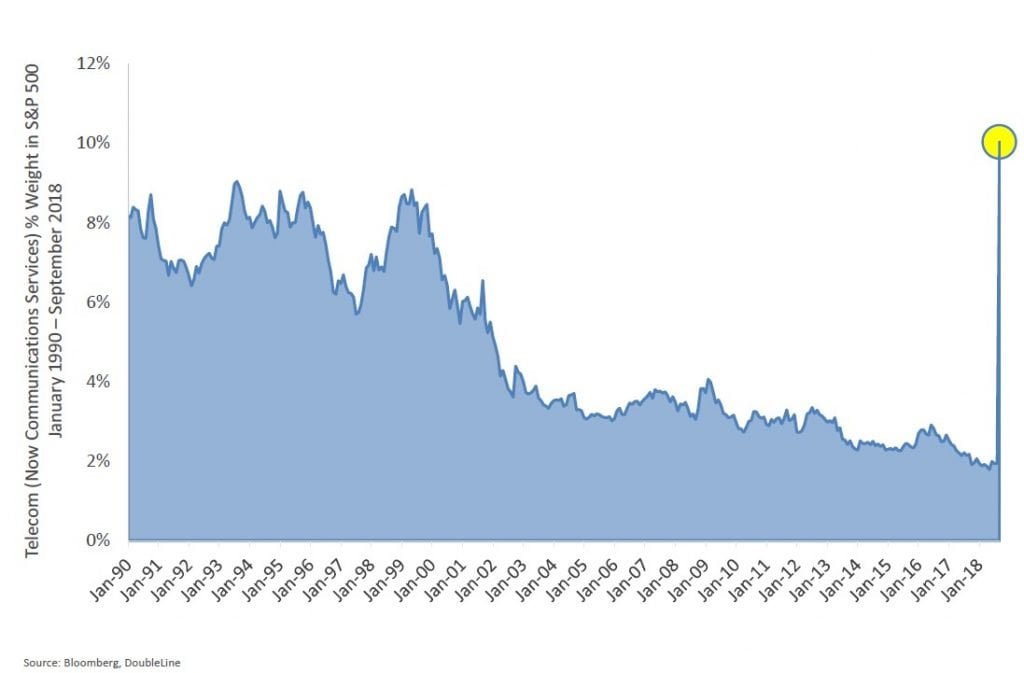

TAB II - From 10 to 11: Redefining Telecommunications

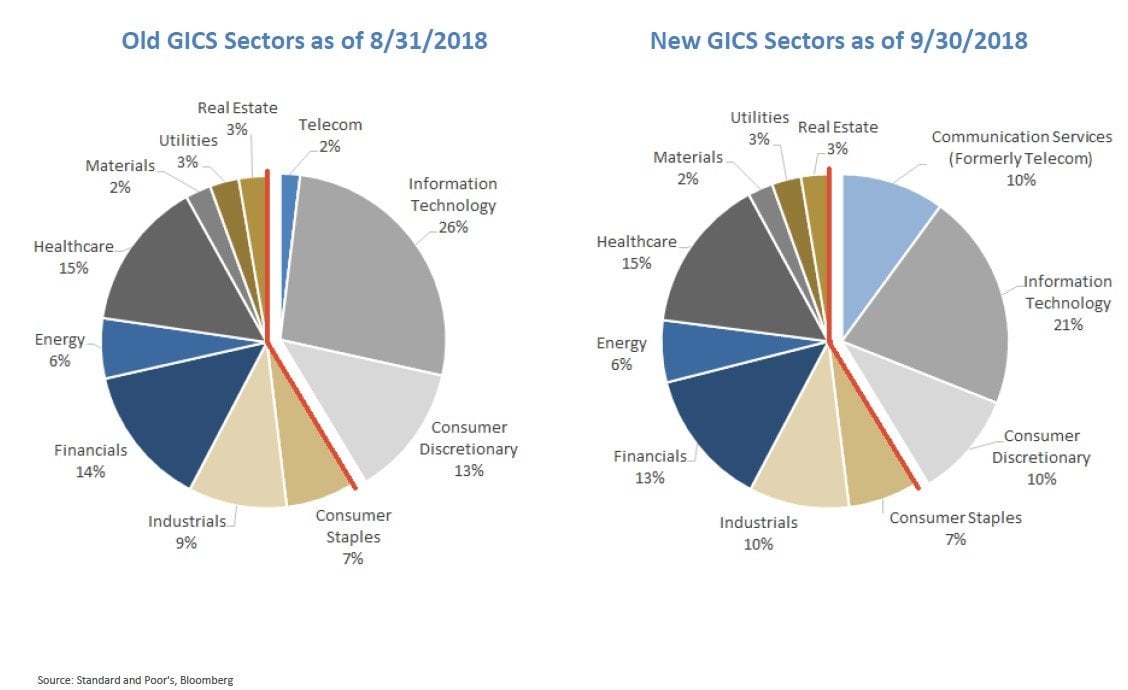

New GICS Sector

Evolution of Telecom to Communications Services

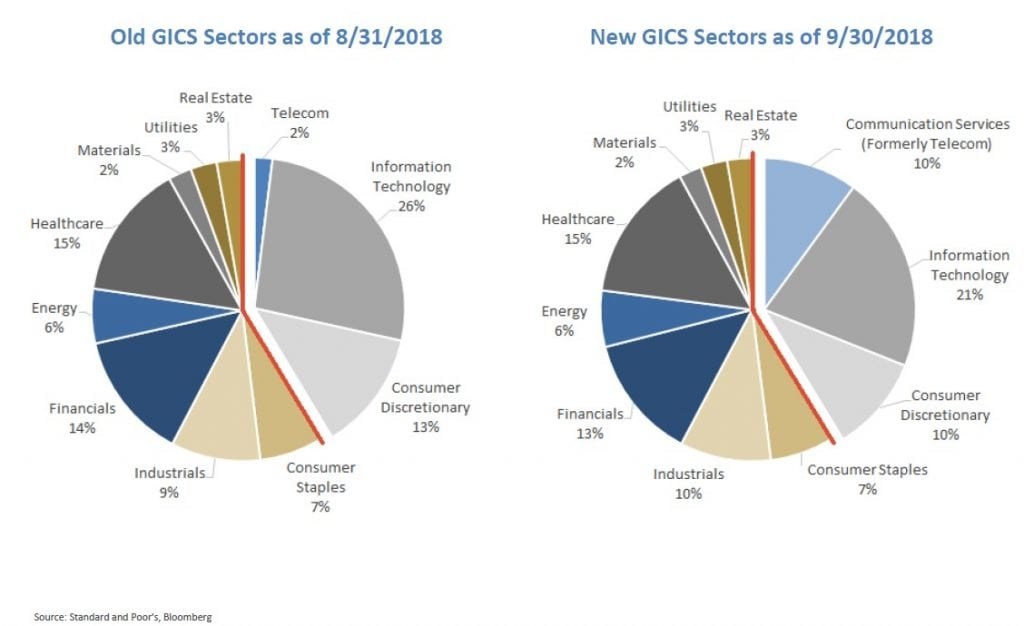

S&P 500 GICS Sector Weights

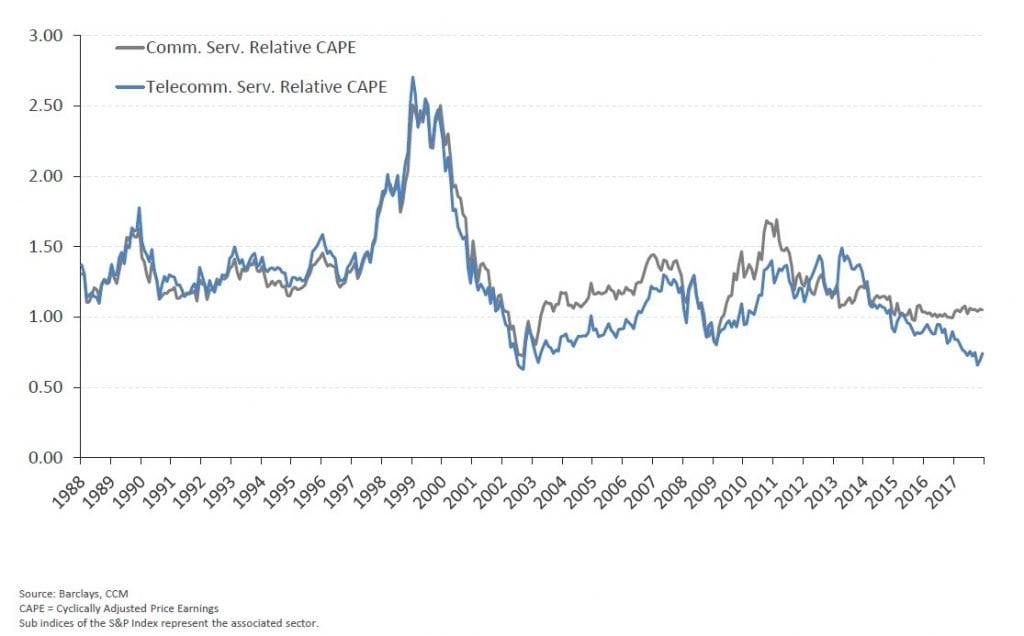

Relative CAPE® Old versus New: Communications Sector

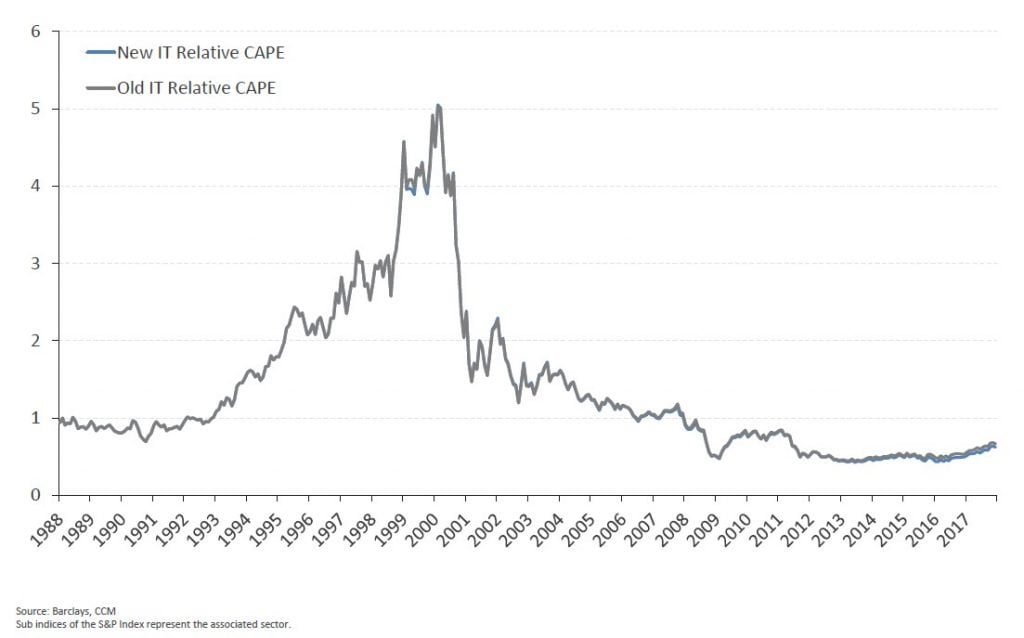

Relative CAPE® Old versus New: Information Technology

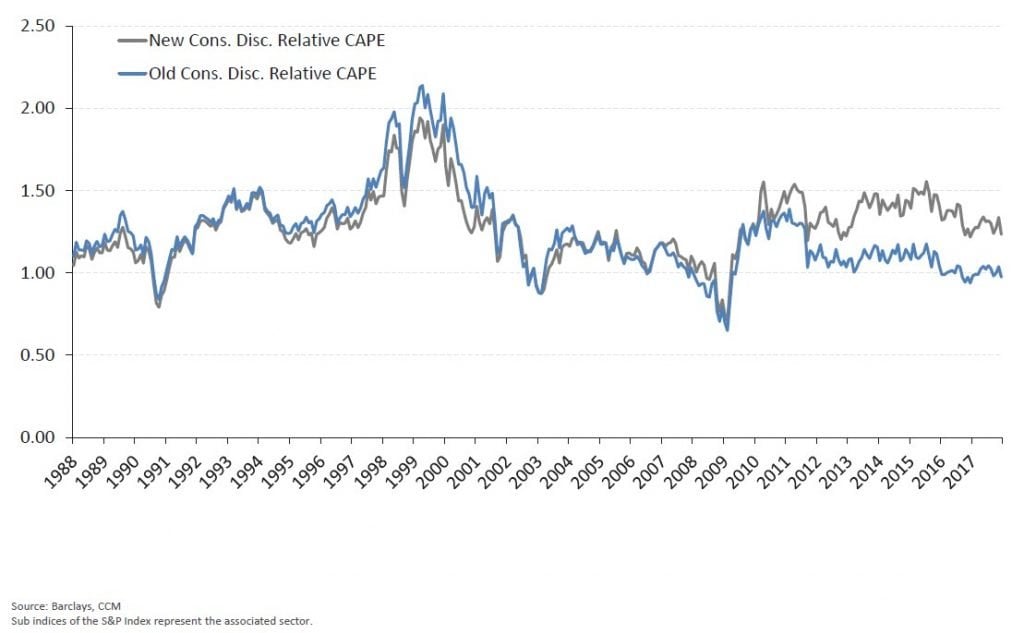

Relative CAPE® Old versus New: Consumer Discretionary

TAB III - Smart Beta: Shiller Barclays CAPE® U.S. Sector Index

Shiller Barclays CAPE® U.S. Sector Index

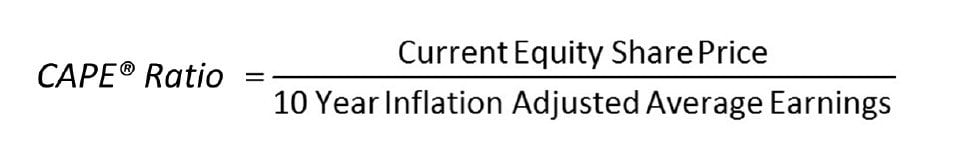

What is the CAPE® Ratio?

- Acclaimed value investors Benjamin Graham and David Dodd noted in Security Analysis that equity valuations tend to follow a business cycle of 3-7 years

- The CAPE® Ratio was formulated in the seminal 1988 piece1 from Professor Robert Shiller and John Campbell.

- CAPE® = Cyclically Adjusted P/E (Price-to-Earnings)

- The CAPE® ratio seeks to assess longer term equity valuation by using an inflation adjusted earnings horizon that is 10 times longer than the traditional P/E measure

- Similar to the traditional P/E the CAPE® can be applied to a portfolio of equities, a sector or a broad based index

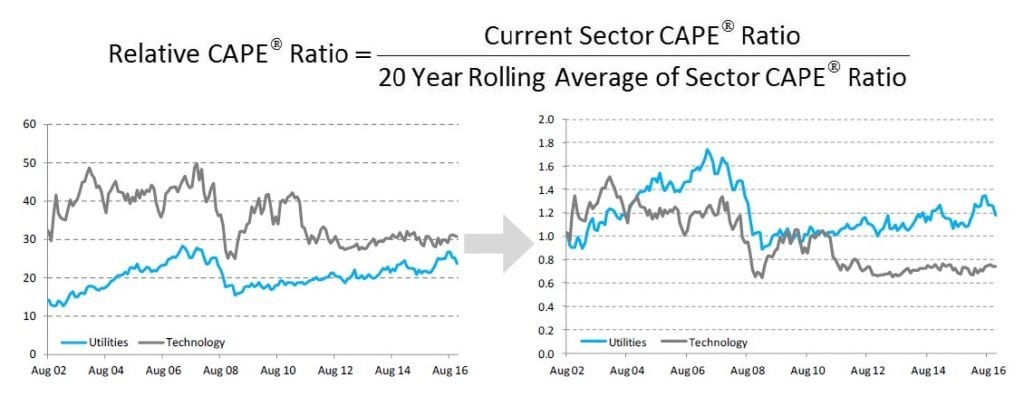

Relative CAPE® Indicator

- To account for idiosyncratic differences between sectors where CAPE® Ratios have historically been of different magnitudes one can construct a Relative CAPE® Ratio

- This may allow investors to compare sector valuations on a level playing field

See the full slides below.