Blue Tower Asset Management commentary for the third quarter ended September 30, 2018; discussing their investment thesis in Enova.

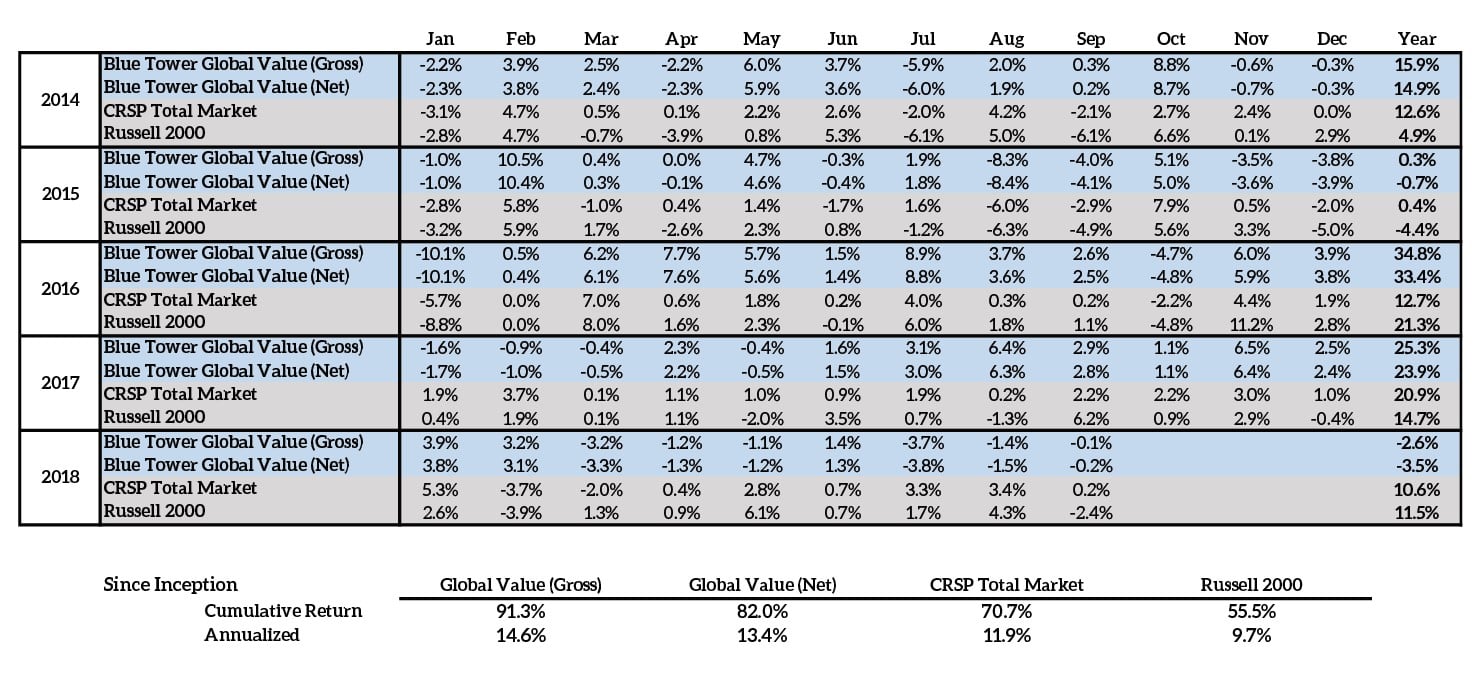

The Global Value strategy composite returned -5.20% gross (-5.49% net) for Q3. This relative underperformance is not a result of any deviation from the consistent application of our investment process. Rather it is the result of faithfully executing on our strategy to take concentrated positions in investments with compelling valuations globally. In this letter, we will review our value investment philosophy, contributors to our performance this year, and our investment thesis in Enova.

Q3 hedge fund letters, conference, scoops etc

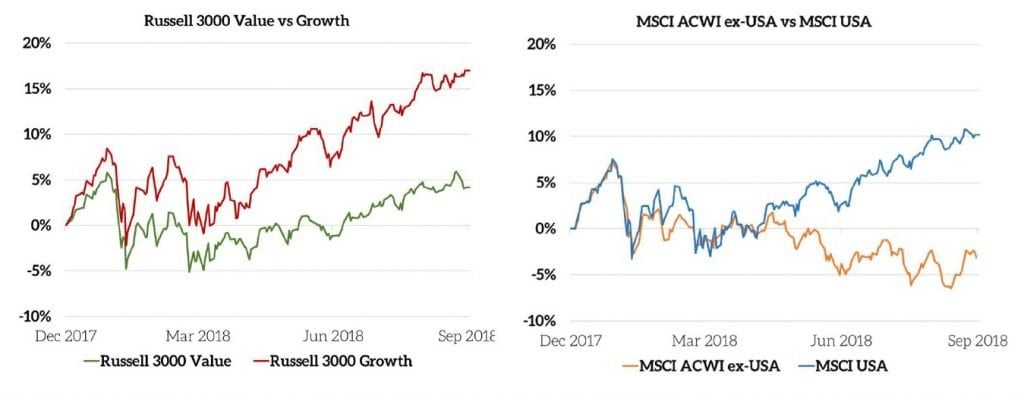

While the S&P500 is up significantly this year, international markets have not done as well as investors continue to pull capital away from international equity markets and into the United States. These market price moves have been driven partially by negative sentiments over trade disputes and sanctions. Additionally, this year has seen growth stocks continue to greatly outperform value (largely due to the tech sector). The two charts below illustrate these phenomena1. While the market prices of our overseas holdings have fallen this year, we believe that as they operate and generate profits, their fundamental value has continued to increase. Our US stocks appreciated in value this year and outperformed the overall US equity market when adjusted for their relative weight in the portfolio.

Some investors have asked us why Blue Tower uses a US equity benchmark on our quarterly factsheets when our mandate is to invest globally. After considering it, I concede this is a fair point and will find a replacement global equity benchmark to use in our future updates.

Our process is to perform research on investment ideas that are primarily generated from algorithmic screens. We have an unconstrained mandate that looks at all industries, market capitalizations, and geographies (excluding countries with inadequate investor protections). This research process examines the lines of business and management of the companies, aiming to ensure the stocks are truly bargains and not value traps. As a result of this process, we have invested a significant portion of the portfolio overseas and in smaller companies that are often mispriced due to not receiving as much attention from analysts and investors. Therefore, in environments like this, where the market is pulling capital from international stocks and value stocks, we should be expected to underperform the S&P500 in the short term. However, over the long term, the straightforward idea of buying companies for less than they are worth and selling them when they become more expensive than they are worth is a highly effective investing philosophy.

While we have successfully beaten our benchmark since inception and over most reported periods, recent quarters have shown some underperformance. This is an entirely expected outcome: to outperform the market, we must be different than the market, and anything different than the market will necessarily have different sets of outcomes, both positive and negative, over any measuring period. We expect that the longer the measuring period, the more likely we are to outperform over that period. For example, we do not expect to have any statistical outperformance in periods of minutes, hours, days, or even a year. However, we do expect to outperform most of the time over 3-year periods, even more over 5-year periods, and almost all of the time over 10-year periods. A study of great value investors shows this phenomenon.

Even among the portfolio managers who have achieved great respect in value investing circles due to their enviable track records, there have been periods of relative underperformance. For example, there have been three-year rolling periods where managers such as Bruce Berkowitz (Morningstar manager of the decade 2000-2010), Walter Schloss (mentioned in Warren Buffett’s “Super Investors of Graham and Doddsville”), and Charlie Munger (during his Munger partnership days) underperformed the S&P500 by annual rates of -9.85%, -17.98%, and -11.03% respectively2. Value outperformance is not consistent as exuberant sentiments cause periods where glamorous, ambitious companies trade at a great premium. In order to capture the outperformance of a value strategy, you need to be able to stomach these periods of underperformance. If value outperformed consistently, everyone would follow it and the outperformance would disappear.

Enova

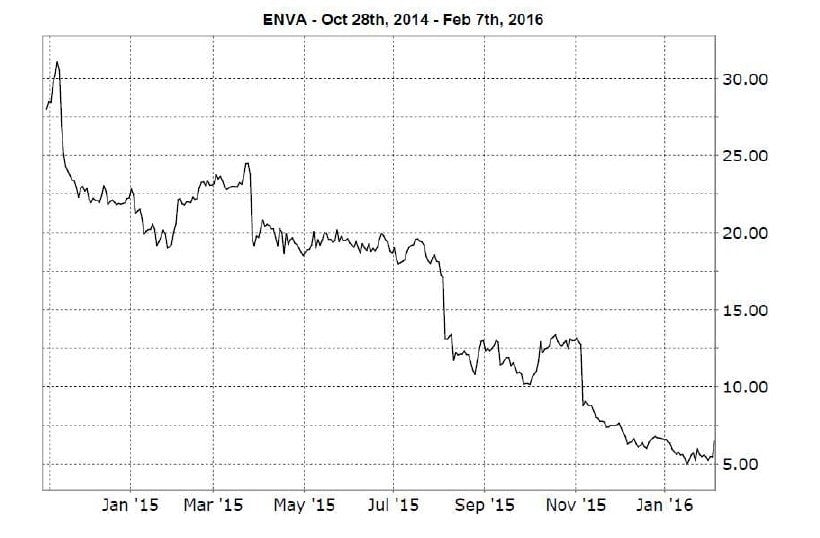

Enova has been a holding for Blue Tower for several years now. We initially entered into the position as a result of its spin-out from our Cash America International holding and later added to the position. Enova was the online-only unsecured loan division of Cash America. At this point, there were great concerns that new regulations in the US and UK could make these shortterm loan operations highly unprofitable and the regulatory concerns were casting an aura of dread over the entire company. Cash America wanted to separate Enova from its company as they believed that the market would value it more highly as a pure-play pawn shop operator. Shortly after the separation, Cash America’s stock appreciated and it was acquired by First Cash Financial at a tidy premium, showing that the separation was a wise move.

Enova was a fast-growing business as a part of Cash America and this growth continued as an independent entity at a slower rate. There were some transitionary hiccups in working with UK regulators to operate lending services that were compliant and the resulting regulated UK market was significantly less profitable.

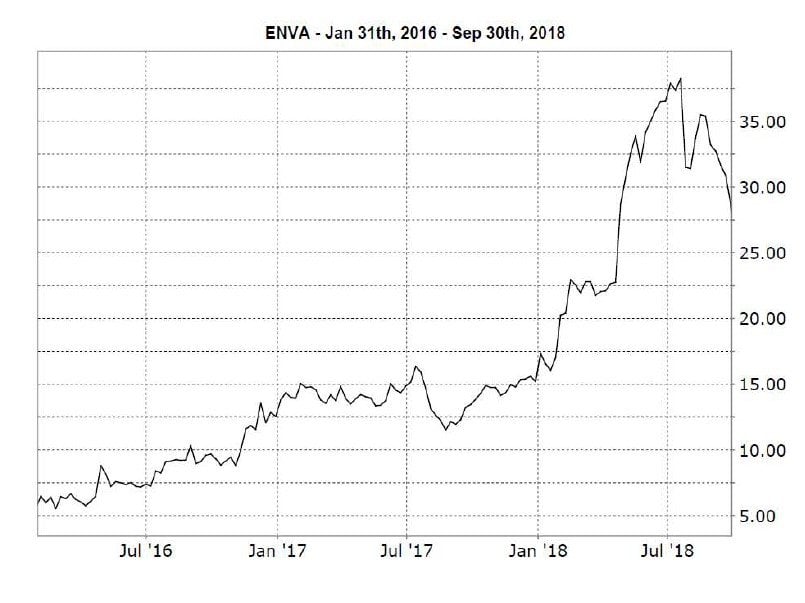

This regulatory burden could be a blessing as in other industries the difficulty of complying with regulations served to create an oligopoly of dominant players who all earn satisfactory returns on equity. The larger players in a highly regulated industry have an advantage over new entrants as the larger lenders are able to spread the fixed compliance costs of the business over a larger number of customers. This creates a barrier to entry.

Enova also has two advantages over the legacy brick-and-mortar short-term lenders. Being an online business allows them to benefit from a secular trend towards online commerce. Additionally, they avoid the fixed costs of operating a storefront and therefore face the ability to reach more customers at a lower fixed cost leading to better operating margins.

Their data platform allows them to build profiles on user behavior and use computational methods such as machine learning in order to make underwriting decisions. The utility of these data platforms increases over time and is therefore an additional competitive advantage over new entrants. As their data platform gets better, they can offer loans at more competitive rates and thereby gain greater market share. This iterative feedback process is often called a “virtuous cycle” by business analysts. Because of the increased information they have over previous customers, these returning customers are more profitable for Enova than brand new borrowers that Enova has not had a prior interaction with. We felt that these three factors (virtuous cycle of customer data buildup, increased regulatory oversight, and transitions to online commerce) made Enova an attractive business.

Despite our belief that the stock was undervalued at the time, the market initially did not agree with us leading to an over 80% decline from its peak.

Over the subsequent months, as Enova worked out compliance issues in the UK, continued generating earnings and restructuring its debt, the stock made a great recovery. This price appreciation has reached the point to where it is significantly up from where we purchased it. Sometimes it can take time for the market to agree with an investment thesis.

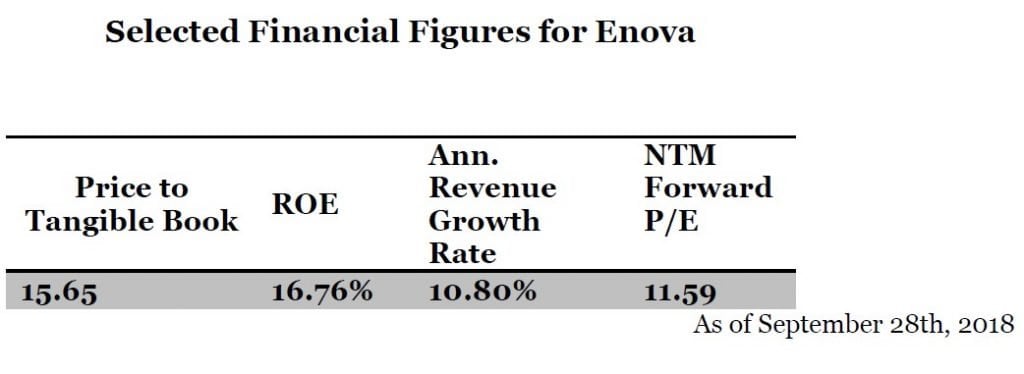

Enova has features of both a regulatory compliance and a data analytics firm. We expect that the company still has room to grow from here and are willing to hold it at the current valuation.

Sincerely,

Andrew Oskoui, CFA

Portfolio Manager