Black Bear Value Partners letter for the third quarter ended September 30, 2018.

“Far and away the best prize that life has to offer is the chance to work hard at work worth doing.” – Theodore Roosevelt

Q3 hedge fund letters, conference, scoops etc

To My Partners and Friends:

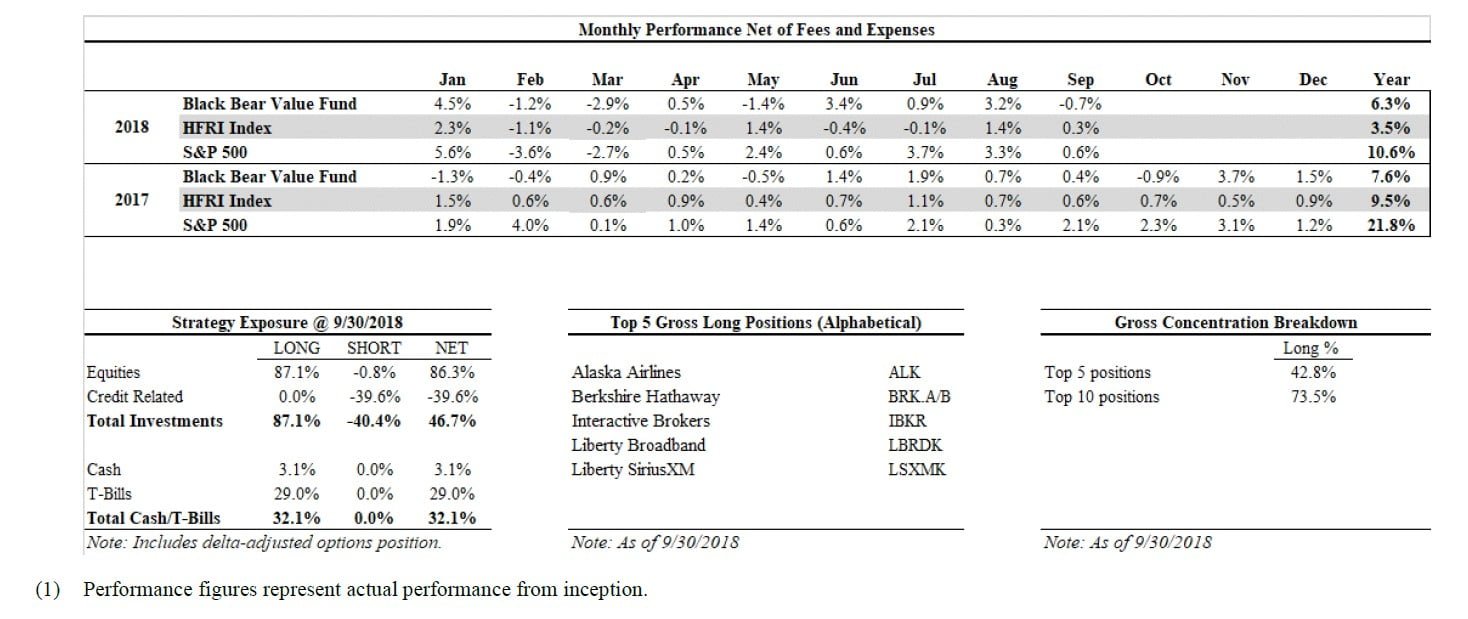

Black Bear Value Fund, LP (the “Fund”) returned approximately 3.4% in the 3rd quarter of 2018 (1) bringing the YTD net return to 6.3%. The S&P 500 returned 7.6% in the quarter, bringing its YTD return to 10.6%. The HFRI index returned 1.7% in the quarter bringing the 2018 net return to 3.5%. We own a concentrated portfolio that will not mimic the S&P 500 and will deviate both to the up and down. We entered the 4th quarter of 2018 with an approximate cash balance of ~12% and an average short position of ~40%.

The S&P 500 is an imperfect comparison and getting more imperfect for our portfolio as time goes on given increasingly less overlap. We have investments in foreign companies, in non-indexed companies, in cash and a large short credit position. However, as you have the alternative to invest in the S&P 500, its performance is still a relevant benchmark.

It was suggested to me that I provide some comparisons to other funds as an additional benchmark. We will include the HFRI multi-strategy index and provide that data point going forward.

Shorts (Securities we are betting against)

Our short credit position size has increased since last quarter (40% vs. 33%). The thesis remains the same and is summarized below. Past discussions and our presentation can be found on our website: www.blackbearfund.com. As a reminder, we are short a variety of bond ETF’s (exchange-traded funds).

Investors have unrealistic expectations of their Credit ETF holdings. There is extreme bond illiquidity underlying an assumption of daily ETF liquidity. Asset-liability mismatches can lead to painful endings.

These structures were not created for illiquid bonds in the event of a large sell-off. The underlying assumption is a market-marker will be a liquidity provider preventing the structures from breaking. It is hard to predict how things play out if the market makers lose confidence in the liquidity of the underlying bonds.

Indexing illiquid junk bonds with limited legal protections is asking for trouble if the waters start to get rocky. Note these “high yield” bonds have a current ~5-6% annual yield with a loss-adjusted yield closer to ~3-4% and possibly 1-2%. When high yield prices inevitably decline and there is a need for liquidity these structures may fall apart.

The payoff could be quite asymmetric and gives us a unique way to profit outside the norms of typical long-investing.

Longs (Businesses we own)

Brief descriptions of the top 5 long positions follow in alphabetical order. Business fundamentals do not change that much from quarter to quarter. If something meaningful has popped up I have included it at the top of the description. Otherwise, the previous description is included with some minor updates or changes. These positions comprise ~43% of the portfolio at quarter-end.

Alaska Airlines

Fuel/oil prices have dominated the headlines and increased the costs to all airlines. While a short-term drag on cash-flow, airlines have significantly healthier balance sheets than in years past. Additionally, they derive a large amount of their cash-flow from their co-branded credit cards which has little correlation to fuel prices. It will be an interesting test to see how the businesses adapt to a higher fuel environment. The management team does not seem to have their head in the sand and am encouraged by their cost and capacity discipline. Short term pain…I think long-term gains. But to date it’s been a bumpy road getting there.

Black Bear has invested in a number of companies whose headline business obscures “hidden” or undervalued sticky businesses beneath the surface. Upon closer inspection, ALK has 2 businesses: a transportation/seat-distribution business which has cyclicality and a sticky cash-flowing credit-card business with limited cyclicality. Large amounts of cash are generated by the airlines selling miles to banks irrespective of airline capacity or ticket prices. There is limited disclosure by the airlines so the sell-side focuses on predicting the unpredictable. This translates into volatility and opportunity.

Historically airlines have been a brutal category of investment, with cut-throat competition, huge fixed costs, too much debt and too much capacity. Management teams have acted like overzealous developers who see a hole and want to build (in this case “SEE CLOUDS, BUY PLANES”). The industry appears more rational today as bankruptcies and mergers have resulted in a reduced number of airlines serving customers. It appears management teams have learned from history but only their actions will prove this. At a high-level I think we own Alaska at ~9-10x earnings and ~10x free-cash-flow.

Berkshire Hathaway

Berkshire is a compounding machine with high quality businesses and an attractively priced stock portfolio. Recently Buffet/Munger changed the buyback rules, allowing them to repurchase shares of Berkshire at a price they determine to be cheap vs. the historical formula of less than 1.2x book value. I was pleased to see this change as the lower bound served to limit their ability to buy in stock cheaply.

We have written on Berkshire since the inception of the Fund and want to save you, the reader, from too much repetition. Interested parties can find past discussion in our “Letters and Presentations” section on the website.

Interactive Brokers

Welcome back to the top 5 IBKR! We missed you. IBKR was a core holding at the beginning of 2017. While it has remained a position, we reduced the size as the price seemed more fully valued. Thankfully, the stock price has come back down and we re-established a top 5 position.

Interactive Brokers is the lowest-cost automated global electronic broker with a wide variety of clientele. Management owns ~82% of the company and runs the business with a long-term growth mindset. The electronic brokerage generates a mid-single-digit free-cash flow yield today while growing the account base/client equity by 15+% per year. The stock seems to be punished for having too much capital (it’s overcapitalized by $4+BB or $10+ a share from a regulatory perspective). They want to not only be the cheapest and best broker, but the safest (zero debt on the balance sheet). Over time the combination of a great product at a discount to competitors coupled with an impeccable balance sheet should lead to a healthy compounder with very low risk of permanent capital impairment.

Liberty Broadband

Liberty Broadband is the tracking stock for Liberty’s investment in Charter Communications (CHTR). We own shares in CHTR via the tracker at a ~10% discount to current market value.

There are abundant fears of cord-cutting and declining media consumption. In reality, customers are cord-shifting and consuming increasing amounts of media and data thru alternate means (i.e. through the internet). Looking out 10 years from now it seems likely that people and businesses will be consuming more data. Charter provides the pipes to get the data to consumers and businesses and notably at much higher margins than video distribution.

When one pays their video bill, much of it is passed thru as a cost to the content providers. Think ESPN or Discovery. Those costs have continued to go up both increasing the customer’s bill but also the cost to the cable distributor (CHTR). So even though your cable bill is going up, it does not necessarily translate into more dollars for Charter. The central cost for data is laying the fiber which is akin to laying a toll-road down. Think of the data as a car driving across that newly constructed toll road. The road costs about the same no matter if anyone is driving on it. Each incremental driver increases the toll (revenues) with minimal incremental cost. When you or I call our cable company and raise our speeds much of the incremental price is pure profit to the internet provider.

Charter stands to benefit from synergies from their consolidation of 3 large cable companies. They are exiting some large-scale capital projects and should begin to harvest some of the gains of those initiatives over the coming years. They have an excellent management team who owns a ton of stock and are thoughtful capital allocators. We are happy to be partners with Tom Rutledge, John Malone and Greg Maffei as well as the rest of the team at CHTR and Liberty.

Liberty SiriusXM Holdings

This investment was covered in Q3 2017. Recently, the stock took a hit when it was announced that SIRI was acquiring Pandora ($3BB). To give some perspective, the Sirius market cap dropped by 100% of the market cap of Pandora. The day before one could buy Sirius for $1 and the next day you could buy Sirius and Pandora for the same $1. That didn’t make a whole lot of sense to me so we bought a lot more. I am not sure if the Pandora deal will add a ton of value but ultimately, I felt like we were getting the business for near-free. To be fair, Pandora burns cash and is utilizing Sirius’ capital so it’s not costless, but overall getting things that were worth $3BB for free seems interesting.

Liberty Sirius XM Group is a tracking stock for Liberty Media’s ~70% stake in SiriusXM. We own SiriusXM at a ~30% discount to where the underlying SIRI stock trades. Sirius operates satellite radio in the US providing 140+ channels to their 31mm subscribers for monthly subscription fees. SIRI is a sticky subscriber model with high margins (high 30’s) trading ~6% free-cash-flow yield. At our discount, it is closer to ~8.5% free-cash-flow yield. Management has used free-cash-flow to shrink their share count by ~20% over the past few years

Politics and Long Term Investing

As we approach the mid-term elections in the United States, some have asked how we are positioned considering various electoral outcomes. While I have a personal interest in politics, our investments are being made independent of election predictions.

Over a 5 or 10-year period we are inevitably going to experience a variety of swings in both Congress and the Presidency. Worrying about the short-term swings seems futile and distracting. Note the increased worrying and chatter among talking heads is helpful as it leads to some boost in cashflow to our media investments thru increased viewership and advertising.

We look out over the horizon and if we can own businesses with competitive advantages at discounted prices we stand to do well over the long-term, independent of who is in office.

It is worth acknowledging that regulatory risks and actions can impact industries, so we are not blind to that. Typically, we use overreactions to these risks to our advantage to source ideas. For example, we recently have been buying a healthy compounder in the UK which should be trading at a premium, but due to Brexit fears is at a market discount. Note most of their business is intra-UK so Brexit will not have as much of an impact as feared. Stay tuned to our year-end letter to learn the name. We are finding several investments both domestically and globally that suffer from short-termism as described above.

General partnership business

We recently relaunched a new and improved website which can be found at www.blackbearfund.com. All our old letters and presentations are on there. If you are an accredited investor, please email me at [email protected] and I can share the password.

Thank you for your trust and support,

Black Bear Value Partners, LP