For the first time, the number of companies publicly targeted by non-U.K. activists has outstripped activity by domestic funds, according to Activist Insight Online.

Q2 hedge fund letters, conference, scoops etc

As of September 25, 21 of the 35 U.K.-based companies publicly subjected to activist demands were targeted by non-U.K.-based investors, Activist Insight has found. Since 2013, no more than 16 companies have been publicly subjected to demands by foreign activists in a one-year period.

The data comes as Trian Partners raised a 270 million pound special purpose vehicle listed in London that may invest in a U.K. company.

Suggesting that the weaker pound and rally in U.S. markets has made the U.K. a more attractive destination for investment, the numbers indicate that Brexit may have stimulated, rather than deterred inbound activist interest.

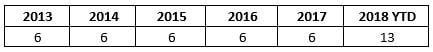

At 60%, that rate of foreign-led activism is the highest on record and significantly outstrips full-year 2017’s 42%. Between 2014 and 2017, the rate was stable within 37% and 41%, after rising from just 31% in 2013.

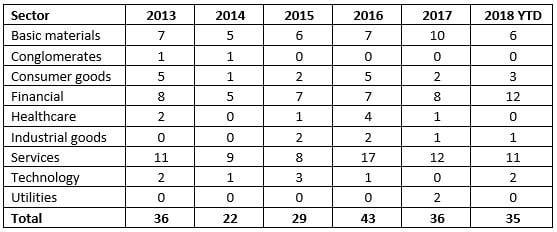

As of September 25, 35 U.K.-based companies have been publicly subjected to activist demands. The year-end total is likely to outstrip 2017’s total of 36 and may be on course to exceed the 2016 peak of 43 companies.

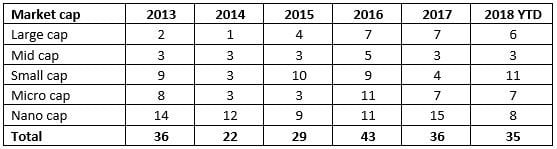

So far this year, a 50% increase in companies publicly subjected to activist demands within the financial sector compared to last year’s full count has contributed to the rising levels of campaigns, while the number of large and mid cap companies publicly subjected to activist demands has remained broadly stable.

U.K.-based companies publicly subjected to activist demands by activist HQ.

*Foreign investors may include funds with an office in the U.K., if the headquarters are located elsewhere. For instance, Elliott Management is considered a U.S. fund for the purposes of this data, despite operating as Elliott Advisors in the U.K.

Number of U.K.-based companies publicly subjected to activist demands by activists headquartered in the U.S.

Breakdown of U.K.-based companies publicly subjected to activist demands by sector.

Breakdown of U.K.-based companies publicly subjected to activist demands by market cap.

Large cap: >US$10B; Mid cap: $2B – 10B; Small cap: $250M – 2B; Micro cap $50M – 250M; Nano cap: <$50M

For questions about the data, or if you have a follow-up request, please contact Josh Black at [email protected]. Please note that bespoke data requests may take 24-48 hours depending on the amount of manual work required.

We look forward to assisting you with your articles.

Kind regards,