In this month’s Private Equity & Venture Capital Spotlight, we look at investor’s plans for the private equity asset class in the year ahead, including the regions and strategies presenting the best opportunities and more.

Private Equity Investor Update

Using data from the recently released Preqin Investor Update: Alternative Assets, H2 2018, we look at investors’ plans for the private equity asset class in the year ahead.

Eighty-six percent of investors interviewed by Preqin in June 2018 plan to maintain or increase their investments in private equity in the coming year. Over three-quarters (77%) of respondents intend to commit capital to a private equity fund in the second half of this year, while a further 16% expect to make a commitment in 2019 (Fig. 1).

Q2 hedge fund letters, conference, scoops etc

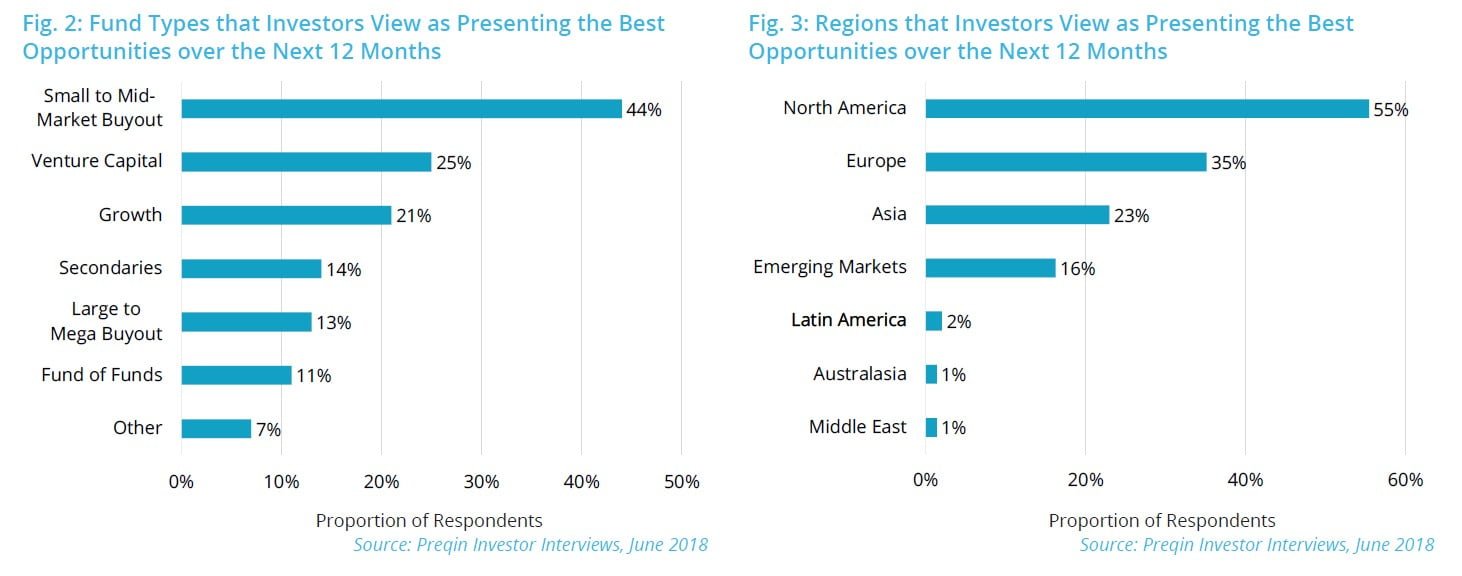

Small to mid-market buyout funds continue to present the best opportunities, according to the largest proportion (44%) of respondents (Fig. 2). While the deal market is competitive, there are more businesses in the lower middle market, resulting in more choice. The proportion (25%) of investors targeting venture capital investments has remained at a similar level to previous years, while the proportion of respondents that feel growth funds are presenting the best opportunities has fallen from 30% in 2017 to 21% in 2018.

North America was cited by 55% of surveyed investors as presenting the most favourable investment opportunities for the next 12 months, followed by Europe (35%, Fig. 3). A notable proportion of investors plan to target Asia (23%) and emerging markets (16%). With high valuations still seen as the key issue facing the industry in the next year, investors may target regions outside North America and Europe in search of relative value.

Industry News

This month’s Industry News looks at recently closed private equity funds and those currently in market, as well as recent mandates issued by investors.

Funds In Market

As at August 2018, there are 3,729* private equity funds in market, seeking an aggregate $831bn in institutional capital. The largest fund on the road is China Structural Reform Fund, managed by Beijing-headquartered CCT Fund Management. The vehicle, which is seeking CNY 350bn ($53bn), held a final close in September 2016, securing CNY 131bn ($20bn).

Hellman & Friedman Capital Partners IX is the largest US-focused private equity fund in market; managed by San Francisco-based Hellman & Friedman, the buyout fund is targeting $16bn for equity investments primarily in the US, but also in Europe. The vehicle has secured commitments from notable investors, including New York State Teachers’ Retirement System and Pennsylvania State Employees’ Retirement System.

The largest Europe-focused private equity fund raising capital is ASF VIII; managed by Paris-based Ardian, the vehicle is seeking $12bn for investments in private equity assets on the secondary market.

Outside the developed markets, the largest emerging markets-focused fund in market is Pátria Brazilian Private Equity Fund VI; managed by São Paulo-based Patria Investments, the vehicle is seeking $2.5bn for buyout investments in Brazil, focusing on the consumer products & services industry. The fund held a first close on $484mn in January 2018.

Investor Mandates

As at August 2018, there are 917 investment mandates for private equity. Among these is AP-Fonden 6. The Stockholm-based public pension fund plans to commit $400-700mn across up to 10 private equity funds in the next 12 months, focusing on mid-cap buyout and venture capital vehicles across North America and Europe using a mixture of new and existing managers in its portfolio.

Ke Nako Capital, a Cape Town-headquartered private equity fund of funds manager, expects to invest ZAR 250- 300mn across up to two mid-cap South Africa-focused growth funds in the next 12 months using a mixture of new and

existing managers in its portfolio.

Allianz Capital Partners will look to commit €2-3bn across 30-40 private equity funds, focused on buyout, growth and venture

capital strategies with a global reach. Stichting Spoorwegpensioenfonds will invest €150mn across 4-5 funds, focusing on buyout and secondaries strategies across North America and Europe, using a mixture of new and existing managers in its portfolio.

Recently Closed Funds

So far in 2018, 671 private equity funds have held a final close, securing $255bn in institutional capital. The largest fund

closed in this period is Carlyle Partners VII; managed by Washington DC-based Carlyle Group, the vehicle held a final close on $18.5bn in July, above its initial target of $15bn. Investors with known commitments to the fund include California Public

Employees’ Retirement System (CalPERS), California State Teachers’ Retirement System (CalSTRS) and Washington State Investment Board.

Carlyle Group also managed the largest Asia-focused private equity fund closed in 2018 YTD. Carlyle Asia Partners V secured $6.55bn in June 2018 and invests across a diverse range of businesses, engaging in buyouts, privatizations and select minority investments throughout Asia, excluding Japan. As well as CalPERS and CalSTRS, the fund secured commitments from other

notable investors including CPP Investment Board.

BGH Capital Fund I is the largest fund focused on regions outside North America, Europe and Asia. The buyout fund, which is managed by Melbourne-based BGH Capital and secured AUD 2.6bn in May 2018, targets investments across Australia and New Zealand.

Private Equity Funds To Watch

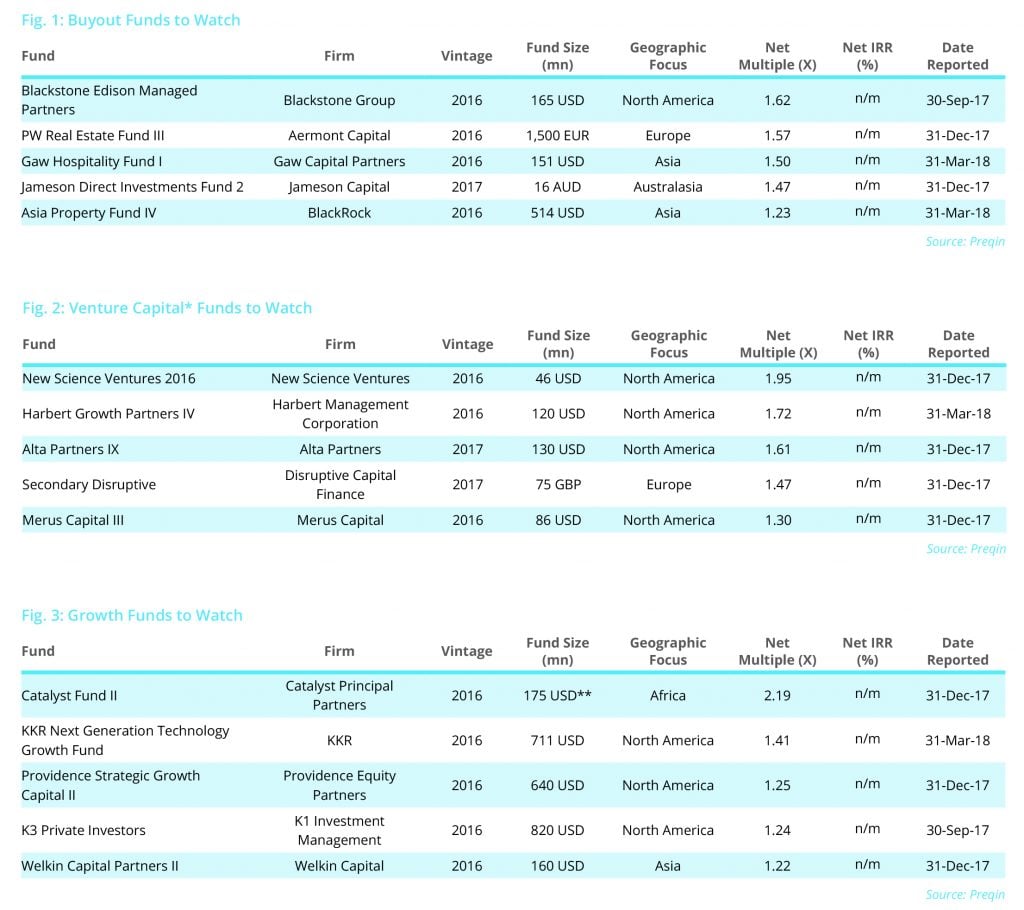

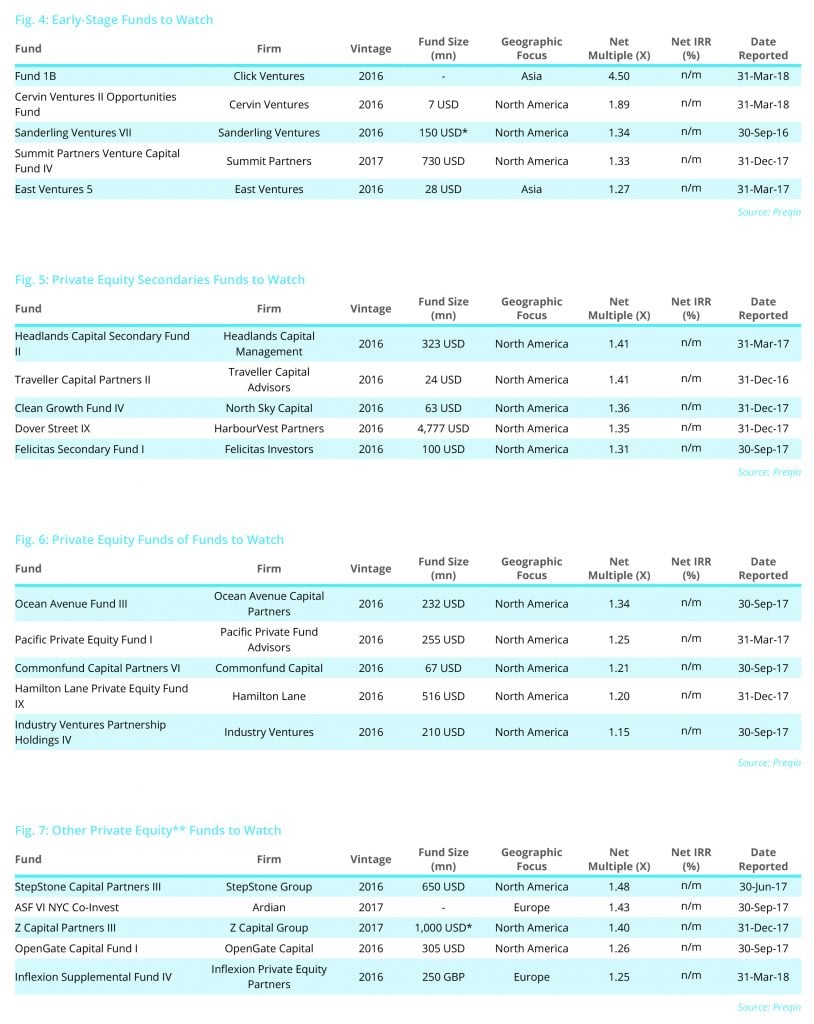

We provide an overview of private equity funds to watch in the near future using data from the newly launched 2018 Preqin Alternative Assets Performance Monitor.

In order to provide a list of funds that may potentially generate high returns, Preqin has examined returns information generated by funds with more recent vintages (2016-2018). As these funds are in the early part of their investment cycles, the IRR becomes less relevant; therefore, the multiple is used as the key measure of performance. The multiple provides a good indication of the value added to the unrealized investments within the fund portfolio, and takes into account any early distributions. These ‘funds to watch’ have the added stipulation that the fund must have called at least 20% of its committed capital.

Private Equity In The Northeast US

We examine the largest Northeast US-based private equity funds closed so far this year and those currently in market, as well as the largest investors in the region.

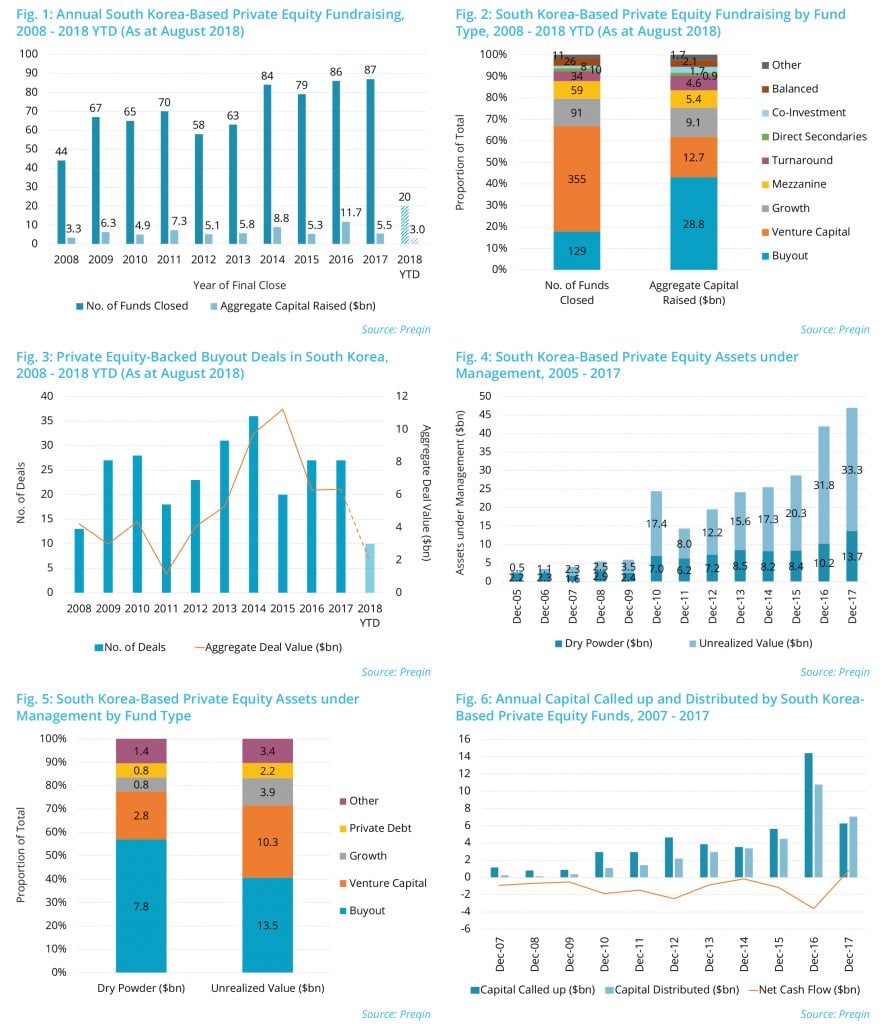

In Focus: South Korea

In this exclusive extract from our upcoming report focused on South Korea, we look at the private equity* industry in the region and how this has evolved over recent years.

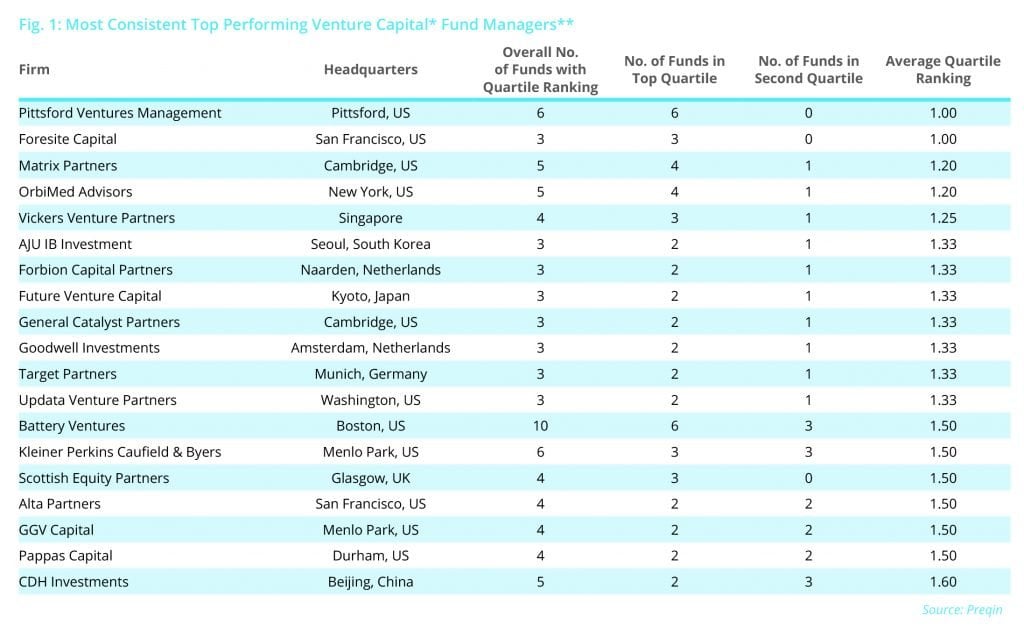

Most Consistent Top Performing Venture Capital Fund Managers

We take a look at the venture capital* fund managers that have performed consistently well over recent years.

Preqin generates quartile rankings for individual funds according to their investment strategy, geography and vintage. Each fund universe constitutes funds with similar fund types, geographies and vintage years, enabling the quartile rankings to be assigned using a combination of both the IRR and multiple rankings of each constituent fund, with equal weights placed on both the IRR and multiple. In instances where the sample size is small, the funds are assigned quartile rankings which are generated against the private capital industry in its entirety.

The tables are compiled using only funds for which Preqin assigns a quartile ranking, and so for this reason, funds with more recent vintages (2016-2018) have been excluded as these funds are too early in their lifecycles to generate meaningful IRRs. Furthermore, only fund managers that have raised at least three funds of a similar strategy are considered and further narrowed down to include only active fund managers (whereby the fund manager must have raised a similar strategy fund since 2010). The lower the average score, the more consistently the manager has performed. The scores are calculated by assigning top-quartile funds with a score of one, second-quartile funds a score of two and so on, and then an average of the scores is taken. Only firms with average quartile rankings below 2.00 are considered.