We are going to keep this week’s letter short and to the point. We are sick and tired of the political charade that is ongoing in DC with the tariffs and the SC vote. For us general Americans deserve better and we will just leave it at that. As for the markets, US Treasury yields have risen above the 3% threshold and in no doubt in further anticipation of next week’s FOMC 25bp hike. We aren’t a big fan of the FEDs slow drip process, we would rather they just hike the FED FUNDs above the 10yr rate and be done with it. With the ECB and BOJ firmly entrenched in continuing QE operations, the world will certainly absorb a relatively hawkish FED. Further evidence is mounting that the FED itself has become somewhat impotent and that these 25bp hikes amount to nothing more than buying time till the next crisis. Where they will most certainly peg long rates below 2.5%. Anyway, the global corporations have done their own fair share of monetary printing.

What do we mean? Well, take a look at their liability side of their balance sheets- chalk full of Trillions of debt. Although its a liability to them, its an asset to someone else, if they can continue to roll said debt and pay said interest. Have these liabilities and assets been used to secure further funding? No doubt. But that is a quant study for another day- though we are quite sure the data will point to such activity. We certainly know that the C-Suite is happy with all the debt, when all you have to do is issue stock option incentives, buy back said stock via debt issuance and voila, reap the benefits all the way to your nearest Nasdaq favorite tech company, or pot company. Speaking of has anyone heard of Tilray or seen their chart at least? We have, and we are sure the SEC might want to take a look at it as well.

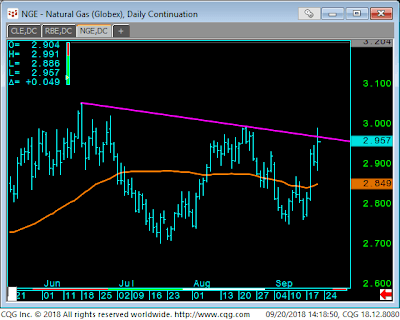

Ok here is just a sample of what has peaked our interest this week. Nat Gas is definitely on our radar and considering everyone in the global warming camp is forgetting that gigantic ball of hydrogen in the sky and the power to heat is just as powerful as the power to cool. Nobody and we mean nobody have looked at the Arctic Ice Mass Balance data, at least not like we have, its growing and its above multidecadal levels, what does that mean? It means snow in summer, just ask Canada, or are we just going to jump right from Summer and skip Fall altogether? Anyway, Nat Gas has perked up lately and we feel the chart is one to watch, shown here:

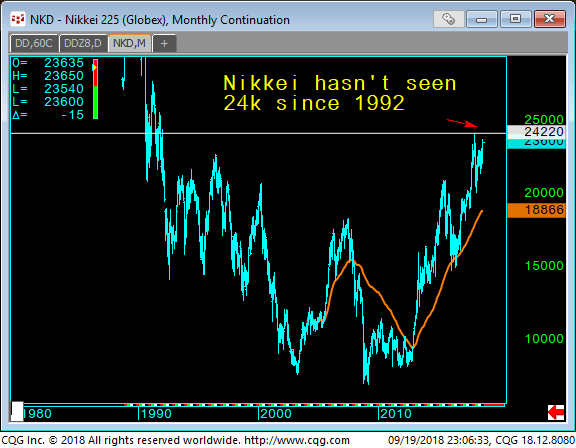

We are also closely monitoring global equities, they have jumped lately and even the Nikkei has shown signs of life, hitting levels not seen since, well 1992:

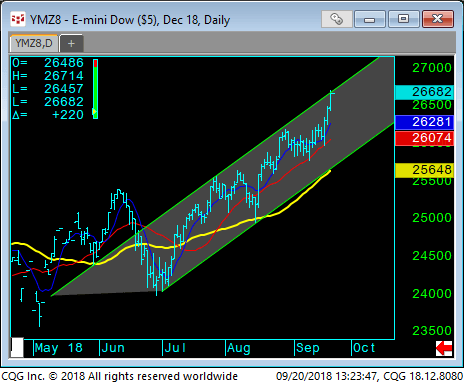

The Dow has even picked up some steam, although it seems to be running into a short-term channel top here:

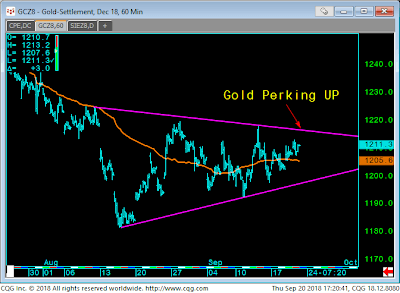

The Gold market has also shown some vigor as it has once again regained the $1200 level and seems to be looking toward the higher end of its base. The wedge pattern below gets interesting above $1217:

Our final chart is of the US Treasury 2s30 yield curve, which has steepened lately but looks as if resistance is dead ahead and considering the likely hood of another 25bp hike next week, we suspect a turn back to flat is in order:

Ok, folks that does it, we hope you are having a great week and we thank you for reading our work, we can't tell you how much we truly do appreciate it. As always, we hope you got something out of this and best of luck the rest of the week, Cheers!

If you enjoyed this newsletter, subscribe here: http://info.capitaltradinggroup.com/ctgs-weekly-unique-insights-newsletter-0-1

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.