From Crescat Capital’s latest update to investors

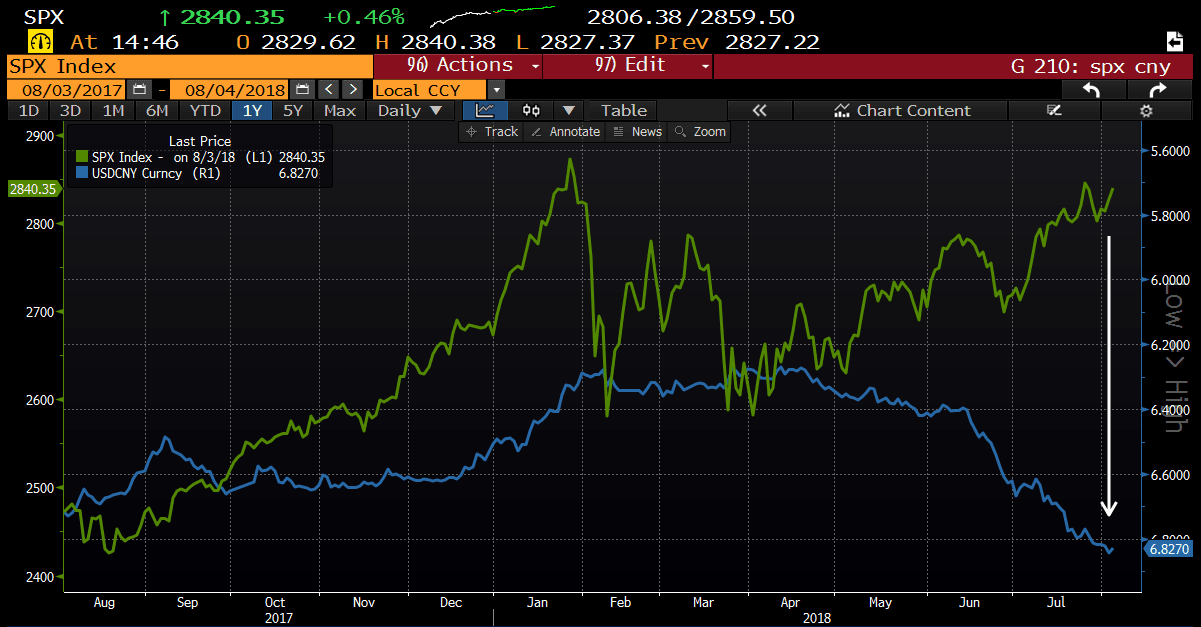

China equity and yuan shorts worked well for Crescat’s hedge funds in July although US equity shorts and the gold longs held back the performance. We expect US equity shorts and gold longs to be changing soon in our favor. The S&P 500 is re-testing its January 26 high, but there are many bearish divergences that indicate it will fail soon. Since the Chinese economy, currency, and stock market are crashing, it is doubtful the S&P 500 can break out to new highs now. With record valuations of US equities, peak earnings growth, peak margins, and peak US economic growth all hitting in the first half of 2018, what is left to drive the S&P 500 higher going forward? Nothing. We think China and our own looming deficits will drag it all down.

July estimates:

August estimates, off to a good start:

Sincerely,

Crescat Capital