PepsiCo announced plans to buy SodaStream for $3.2 billion and has already received public approval from activist investor Teleios Capital. The purchase price is a 32% premium to the company’s 30-day volume weighted average and a 420% premium to the share price at the date of Teleios’ initial 5.7% stake in November 2016.

Q2 hedge fund letters, conference, scoops etc

Teleios co-founder Adam Epstein spoke of the firm’s delight and praised PepsiCo for recognizing the value of SodaStream’s market domination in its attempts to reach customers in their homes as U.S. grocers transform with the times.

What we'll be watching for this week

- Will Malaysia-based APFT announce a special meeting date requisitioned by concerned shareholders?

- Will the Securities and Exchange Commission launch an investigation into Elon Musk’s tweets regarding taking Tesla private?

- Will Barclays bend to Ed Bramson’s Sherborne Investors and replace its chairman?

Activist shorts update

The Alberta Securities Commission (ASC) dismissed an application from staff to temporarily ban Marc Cohodes from trading in securities of Badger Daylighting. They claimed the short seller was disseminating misleading or untrue statements about the company.

Cohodes shorted the excavating services provider in May last year before accusing the firm of illegally dumping toxic and hazardous waste and claiming its numbers did not add up. The ASC conducted a probe into these allegations which it completed in May, “with no enforcement action taken.”

The ASC is currently investigating the short seller’s behavior regarding Badger. Cohodes has maintained that the allegations against Badger are true and are based on trustworthy sources.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

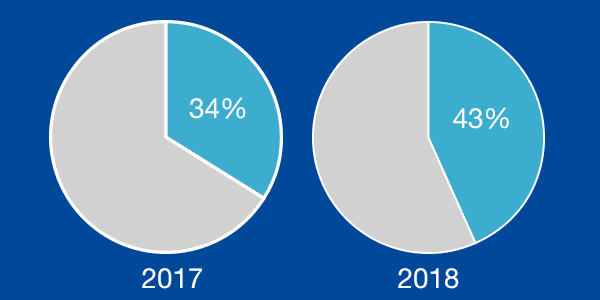

Chart of the week

The proportion of public activist demands made at consumer goods companies globally, that were board-related (between January 1 and August 17).