Incrementum recently had their quarterly advisory board discussion with special guest Kevin Duffy who is a principal of Bearing Asset Management. Kevin has been familiar with Austrian School investing for about 30 years. He was one of the few investors that warned about the housing bubble already in 2005-2007, successfully shorting stocks such as Bear Stearns, Citigroup and Countrywide Financial.

Which topics did they discuss during the call?

- What are the advantages and disadvantages of Austrian School Investing?

- Why relying on indicators that warned about previous crises won’t work this time.

- What is the connection between tatoos, flesh tunnels and time preference?

Q2 hedge fund letters, conference, scoops etc

Highlights of the conversation:

Special Guest - Kevin Duffy:

- A disadvantage of Austrian School investing is that one tends to focus on the negative, which can lead to ignoring positive trends.

- All bubbles are different, so relying on indicators that preceded previous bubbles will probably not work in predicting the next crash.

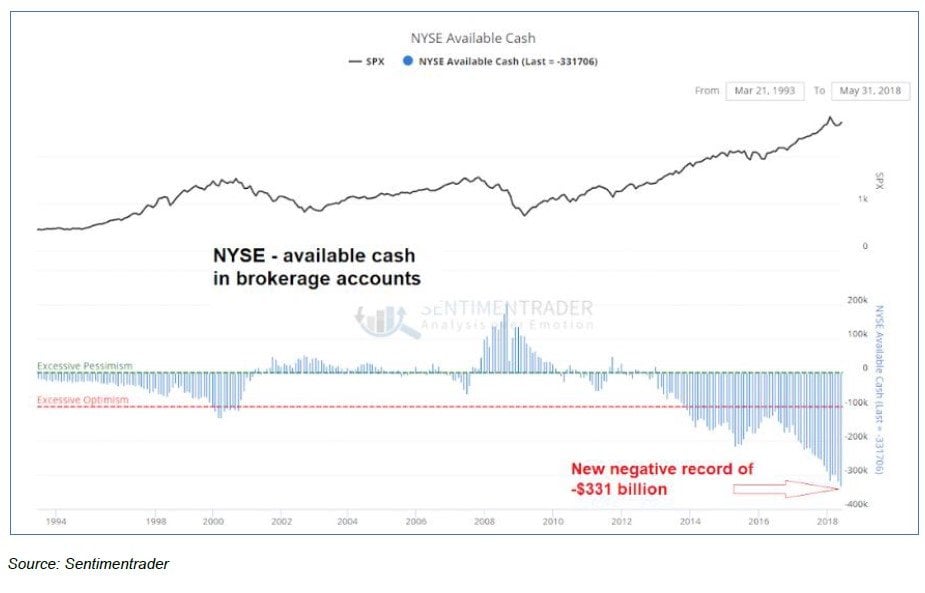

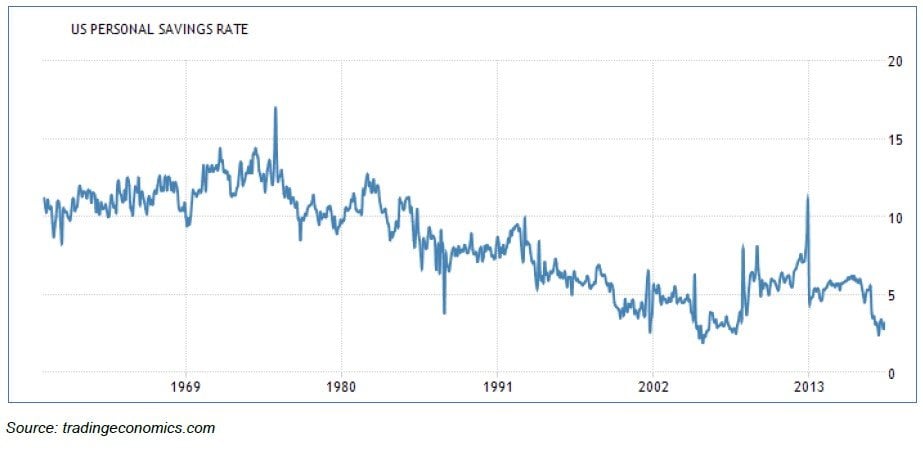

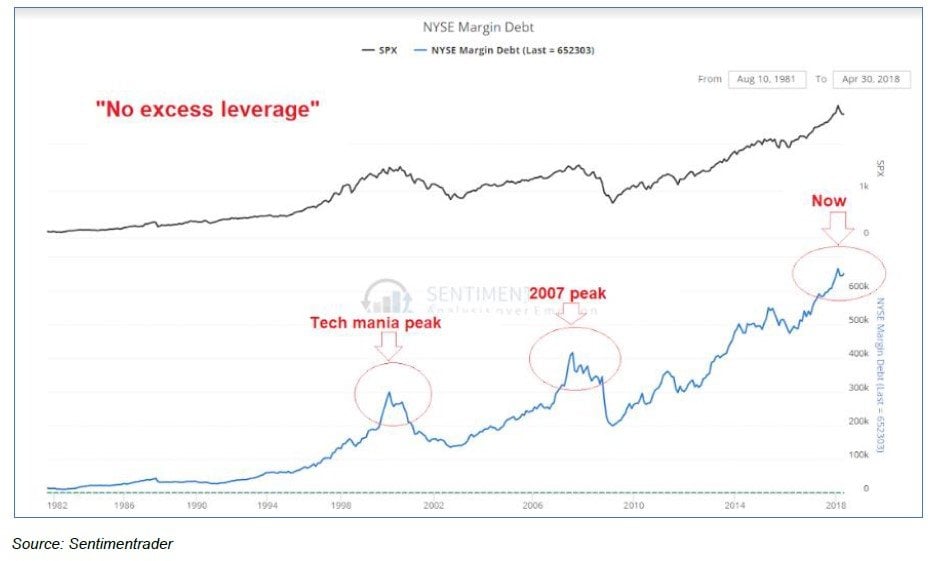

- At the end of bubbles people tend to save less, which is exactly what we are seeing today. Capital is becoming scarce, and margin debt keeps increasing.

- Moreover, markets have started to diverge (e.g. US is up year to date, but Europe and Asia are down), which is a sign that something is changing.

- When shorting we look for companies that can go down 75%-100%, and we use put options to implement the short. We are currently focusing on Chinese, Canadian and European banks (e.g. Deutsche Bank) and the passive investing bubble.

- Investing is about rewards that come from planting seeds and seeing them come to fruition over the long term.

Heinz Blasnik:

- A disadvantage of being an Austrian School investor is that you often miss out on the boom because you are focused too much on the flaws in the system.

- An example is China, we know there is a credit bubble and that the government controls large parts of the economy, but there is a lot of energy and a strong entrepreneurial spirit in China.

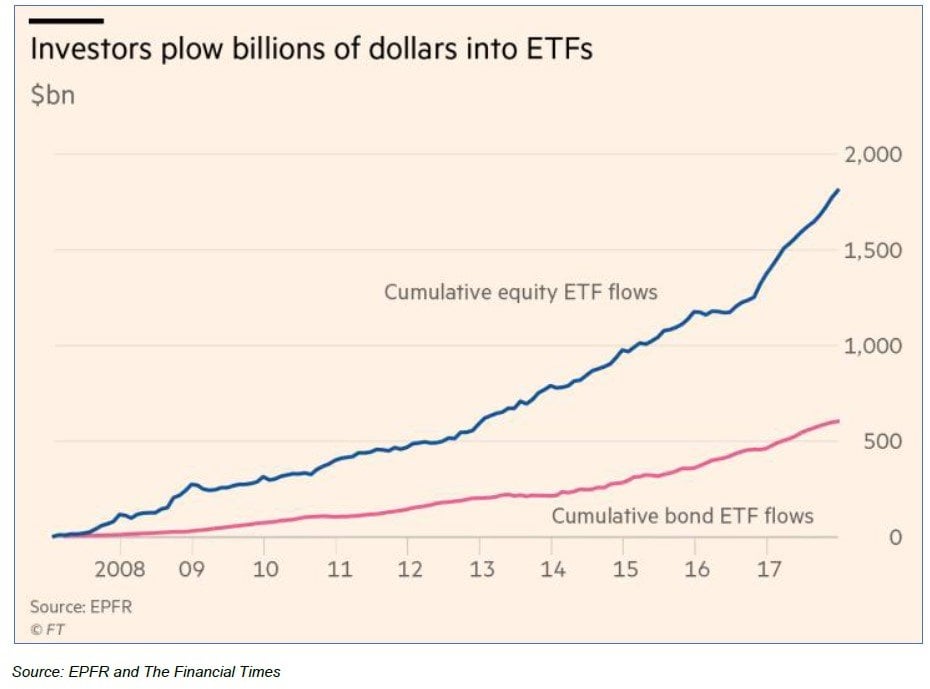

- I see the growth in systematic trading funds, as well as passive investing via ETFs as a risk, and these areas may exacerbate the next financial crisis or even become catalysts for it.

- Economic reality is starting to assert itself again. The Fed did not start the rate hike cycle, it followed it. The market, not the Fed, is setting the pace.

- The stock market peak in late January was quite possibly the top of the bubble in the major indexes.

Rahim Taghizadegan:

- In the long run Western states’ competitive advantages will diminish and the torch will be passed on to Asian societies.

- A disadvantage of Austrian School investing is that it’s difficult to make confident predictions because we don’t have a historical precedence for the current situation.

- I think negative interest rates on bank deposits are coming, and it will be a psychological breaking point for the market.

- In the next recession there will be an increased fight against cash, and some banks might be nationalized.

Ronald Stoferle:

- Our recently published “In Gold We Trust” report is our most successful to date. We also published a new “Crypto Research Report” recently.

- A disadvantage of Austrian School investing is that it often leads to bearish and dogmatic views.

- Austrian investors also tend to have extreme portfolios, leading to risk allocation problems.

- The Fed is tightening too aggressively, and the markets can’t handle it.

Mark Valek:

- As investors we need to have a broad scope, focusing only on markets is not enough, we have to also focus on the broader perspective (e.g. the interplay between politics and economics).

- Like Hayek said, nobody can be a great economist, who is only an economist

- In the next recession there may be a loss of trust in a lot of institutions of Western societies.

- The late January stock market peak may have been the top for Tech Stocks.

Biography of Our Special Guest - Kevin Duffy:

Kevin Duffy is a principal of Bearing Asset Management which he co-founded in 2002. The firm manages two long/short hedge funds with a flexible mandate.

Bearing warned about the housing and credit bubble of 2005-07, shorting stocks such as New Century Financial, Bear Stearns, Lehman Brothers, MBIA, Countrywide Financial, Wachovia, and Citigroup. Duffy wrote extensively on the subject, including articles, "Alan, We Have a Problem," "Mr. Mozilo Goes to Washington," and "Honey, I Shrunk the Net Worth." In May 2007 he gave a speech in NYC titled, "It's a Mad, Mad, Mad, Mad World," identifying root causes of the bubble.

Prior to Bearing, Duffy co-founded Lighthouse Capital Management and served as Director of Research from 1988 to 1999. He chronicled the excesses of the Japan and technology bubbles of the late 1980s and late 1990s respectively.

Transcript of the conversation:

Ronald Stoferle:

Welcome to this quarter’s advisory board meeting. Our special guest is Kevin Duffy who is a principal of Bearing Asset Management, which he co-founded in 2002. Bearing is famous for warning about the housing bubble of 2005-2007 and Kevin is definitely one of the most renowned “Austrian-minded” investors out there.

Kevin, thank you for being with us.

Kevin Duffy:

Thank you for having me.

Ronald Stoferle:

Let’s start off with some housekeeping. A few weeks ago we published our 12th annual “In Gold We Trust” report. It was the longest report to date and it contained some fascinating interviews, for example with Luke Gromen and with FA. Hayek’s nephew Dr. Richard Zundritsch about de- nationalization of money, crypto and what Hayek would have said about crypto. The report could be characterized by the change of the monetary tide; we are seeing the transition from QE to QT, de-dollarization, and cryptocurrencies and blockchain technology. Of course, we also wrote about inflation vs. deflation, mining stocks, and the technical view of the gold sector. So far, the success is overwhelming; the report was mentioned in almost 70 countries and we got fantastic feedback from the media and from readers. Moreover, a couple of days ago we published a new crypto research report and we are working on the “In Gold We Trust” chart book. We are also working on a new book and two new funds.

Now that we’ve covered the housekeeping let’s start the discussion. I want to start off by saying that having an Austrian School mindset has many advantages, but it also has disadvantages. Our opinion has always been that having an understanding of the monetary system and the interplay between inflation and deflation is a huge opportunity for investors. The Austrian mindset is often contrarian, which also gives you an edge. We understand gold and most importantly we understand the Austrian Business Cycle theory. But as I said there are also many disadvantages; Austrian School investors tend to be sensitive to flaws in the capital structure, often leading to a bearish bias, which is difficult when the economy is doing well. Austrian investors also tend to have extreme portfolios, leading to risk allocation problems, and they are often quite dogmatic. Lastly, there’s the timing problem; the Austrian School doesn’t make any timing calls. In our book, we have summarized the advantages and disadvantages:

Kevin, given your background, what do you believe are the biggest advantages and disadvantages of having an Austrian School mindset?

Kevin Duffy: I became familiar with Austrian School investing in the late 1980s. At the time I was a value investor with a strong contrarian streak. At the time everyone was bullish on Japan, but I thought it was a bubble. So, I had a contrarian opinion, but was not yet familiar with Austrian Economics. Then I read Murray Rothbard’s “America’s Great Depression” which I thought explained exactly what was going on in Japan. The unwind played out perfectly according to the script, but the problem was that it gave me overconfidence; I was very young and thought I knew much more than I actually did. This is one disadvantage of the Austrian School. The second disadvantage is that, as Austrians, we tend to focus on what is seen – the negatives of government intervention – and pay less attention to more hidden positives, especially market-driven deflation. For example, since the year 2000 bandwidth costs have gone down by 99%, which is a dramatic increase in productivity. Costs have also dropped in many other areas, e.g. the energy sector and genomic sequencing. My biggest mistake over the last ten years was to not pay enough attention to such positive developments.

Ronald Stoferle: Thank you for your views, Kevin. Heinz, what are your thoughts on this subject?

Heinz Blasnik: Speaking on the disadvantages of Austrian Investing, Austrian investors often focus on the actions of central bankers and credit expansion, which distort the capital structure. But booms will happen in the markets regardless or even because of flawed economic and monetary policies. And one can make money in such booms even though underneath the calm surface there is a lot of malinvestment going on, and eventually a price has to be paid. But in the meantime, asset prices will rise. And as Kevin mentioned, we shouldn’t lose sight of all the positive things going on. An example is China; everybody knows there is a big credit bubble and that the government is in control of important parts of the economy, as they basically control the banking system, but on the other hand there is a strong entrepreneurial spirit in China. There is a lot of energy and people are willing to take risks.

Ronald Stoferle: I just returned from Kazakhstan where I attended the World Mining Congress and held a keynote speech. The conference was a huge mining show with more than 3,000 delegates, and most of the participants were from China and they were extremely well organized and professional. It’s anecdotal evidence, but from my point of view the Chinese delegates seemed very entrepreneurial; they want to create value and build wealth.

Mark, I think you had a question?

Mark Valek:

Yes, thank you. Hayek once said that nobody can be a great economist, who is only an economist. Rahim, I know you have a very broad scope and I recently heard you speak about the loss of trust in some of the Western societies; how do you think this will play out?

Rahim Taghizadegan: Thanks for the question. I believe one of the main insights of the political branch of Austrian Economics is that society and the state are different, and therefore must be analyzed differently. This leads to paradoxical views, for example very burdensome states can reflect positive tendencies, society-wise. For example, the burdensome German and Scandinavian countries have high trust societies. High trust societies have a lot of economic advantages. They foster co- operation, and the Austrian School recognizes that the economy is about co-operation. In high- trust societies corporations tend to have a larger size, and more loyal and productive employees. But a lot of trust issues in society can be replaced by technological solutions. I think for example that blockchain can be one possible answer. But in the long run these burdensome Western states will see their competitive advantage diminished and it’s likely that the torch of economic progress will be passed on to Asian societies.

Mark Valek: Thanks a lot Rahim. What are your views about the disadvantages of Austrian School investing?

Rahim Taghizadegan: From a marketing perspective it pays to be overconfident, especially in the short term. The higher your conviction the easier it will be to market your investment ideas. I think the Austrian School is at a disadvantage here because it’s more difficult to be confident about your qualitative predictions and even in terms of investment advice it’s particularly difficult to be confident in these times because we don’t really have any historical precedents that we can analyze and draw conclusions from. And I’d actually be interested in hearing what Kevin has done differently from other Austrian School investors over the last few years when it has not paid off to be a bear.

Kevin Duffy: Unfortunately, we haven’t done a whole lot differently, and we paid a price for it. But I feel it has been a great learning experience, even if it was a very expensive one. One of the lessons I learned as a short seller is that you open yourself up to open-ended risk. Another, which I learned from Tony Deden of Edelweiss Holdings, is the importance of time preference, aligning yourself with investors who have the same long-term focus as you. They are willing to delay gratification and invest for the future. The problem with short selling is that you can get instant gratification if your thesis is proven correct, but it takes your focus away from the long term. Investing is about rewards that come from planting seeds and seeing them come to fruition over the long term.

Ronald Stoferle: That’s a great example. Tony Deden is a mutual friend and I hope he’ll read this transcript. We discussed this with Simon Mikhailovich and others at Tony’s Edelweiss shareholder meeting. An interesting example when it comes to the matter of time preference: We discussed why more people are getting tattoos and flesh tunnels these days (that they will

probably regret a few years after). We concluded that it’s mostly a matter of very high time preference.

Coming back to markets, it would be interesting to discuss what would pop the current “everything bubble”. Most major markets are distorted by central bank intervention, but we know that the bubble will eventually burst. But it hasn’t happened yet, which has been painful for Austrian Investors and people in the gold space. Incidentally, a trader once told Mark and me that the market is a maximizer of pain, and I think that is a good description of the current situation.

My question is what will pop this “everything bubble”? Will it be QT, or maybe rising interest rates?

Kevin Duffy: All bubbles are different. For example, the intervention by central banks in this bubble is different from anything we’ve seen before. But a lot of people rely on precise indicators that are based on previous bubbles, for example they think the yield curve will invert and the two-year yield will be half a percent above the ten year yield, and that’s going to be the indicator that will get them out before anybody else. But I don’t think this bubble will play out like previous bubbles.

However, one similarity that we see at the end of bubbles is the “brick pile” that Mises talked about. Central bankers can lower interest rates, but the problem is that they are sending mixed signals to the producers and consumers to keep producing and consuming, and you therefore don’t have a deferring of consumption, people don’t save. We can see this in the personal saving rate in the US; it was 8-10% in the beginning of the cycle, but the latest reading showed 3.2%. What’s happening now is that we are running out of bricks; we’re at the point in the cycle where there is scarcity of capital and interest rates are going up. It seems like economic law is starting to assert itself.

Moreover, in the first phase of bubbles everything is in synch to the upside, but in the second phase you start to see divergences, which we are seeing in markets today. The US market is up year to date, but Europe, Asia and Latin America are down. This trend is signaling to me that something is changing.

Finally, sentiment is strong. Every time there was a dip over the last nine years, it generated enough fear that the market recovered. There have been five corrections of 10% or more in this bull market and if you look at the margin debt during those early corrections it would go down around 20%. However, in the correction that began in late January this year it went down only 3%. Cash has gone down, and retail investors have bought the dip.

I think the above are potential signs of the end of the “everything bubble”.

Heinz Blasnik: I have thought about this a lot and have been writing about it over the last 2-3 years on my blog Acting-man.com. I have been thinking about what factors are similar, and what factors are different, in this bubble compared to previous bubbles. There are factors that didn’t exist back in 2000 or 2008, for instance the large increase in systematic trading strategies, including risk parity and volatility targeting strategies. And these funds use leverage to boost their returns. CTAs (commodity trading advisors) have grown in importance, and a lot of them are essentially technical trend followers.

The growth of ETFs is also an issue. A lot of the ETFs trade in relatively illiquid markets, for example corporate debt, and if investors want to redeem their investments, ETFs will have a problem selling the underlying assets.

I think the trigger of the next crisis will come from one of these corners of the market, and many of the traditional signals investors use to try to predict a crash will not work anymore. This is particularly true this time because we are in a historically unique situation due to QE and zero and negative interest rate policies.

There is no doubt in my mind that economic reality is starting to assert itself again, as Kevin said. The Fed didn’t start the rate hike cycle, it followed it. Interest rates on the short end of the curve

started rising before the Fed started raising rates. This is a sign to me that markets are setting the pace, and the problems in the capital structure is coming to the fore. People who invested in long term projects are starting to scramble for capital that is not available to the extent that they believed it would be. This is putting upward pressure on interest rates. We are also seeing CPI increase, which is a hint that relative prices in the economy are shifting, even though price inflation cannot be truly measured and CPI is a particularly flawed measure.

And I agree with Kevin that the last correction we saw, in February this year, was different from previous corrections. This time around the data showed that people were a lot less fearful.

Ronald Stoferle: Also, this time around the classic safe haven reaction, which is to buy US treasuries and the dollar, did not happen.

Heinz Blasnik: Lastly, the technical backdrop of the late January peak is strongly suggestive of a market top. For example, the weekly RSI of the Dow Jones was at 92 (purple line below), which has never been seen before. It may well be that this was the top.

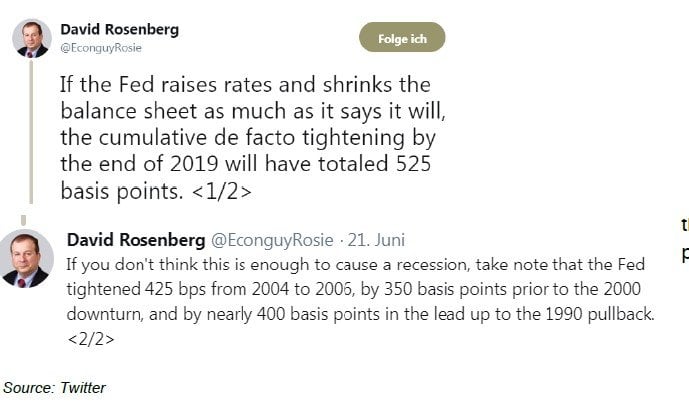

Ronald Stoferle: Dave Rosenberg, who is definitely one of my favourite economists out there, recently tweeted “if the Fed raises rates and shrinks the balance sheet as much as it says it will, the cumulative de facto tightening by the end of 2019 will sum up to 525 basis points in total. If you don’t think this is enough to cause a recession, take note that the Fed tightened 425 basis points from 2004 to 2006, by 350 basis points prior to the 2000 downturn, and nearly 400 basis points in the lead up to the 1990 pullback”.

There is already some pressure from the White House, for example Larry Kudlow, suggesting that the Fed is raising too aggressively. And James Bullard from the St. Louis Fed suggested they should maybe pause a bit. I think our system can’t afford such aggressive tightening.

Kevin, it would be interesting to hear from you about your investment process, and also about some of your current investment ideas.

Kevin Duffy: Austrian Economics is only one of the tools in the toolkit. We try to look at investing from many angles, including fundamentals, economics, and sentiment. We also look at many companies from a bottom-up perspective, to not only identify opportunities, but get a more complete picture of the business landscape. From that bottom-up view, we see a great deal of overconfidence in the U.S.,

e.g. excessive stock buybacks. We look at both longs and shorts. For the short positions we seek companies that will go down 75%-100% or else it’s not worth the risk of shorting. We short using put options because it limits our downside. Our shorts tend to be companies that are fragile and vulnerable to a downturn. They abuse easy credit in some way: have gotten wrapped up in the bubble, they confuse a rising market for their own genius, their business is overly reliant on credit, they’re in a highly cyclical industry, etc.

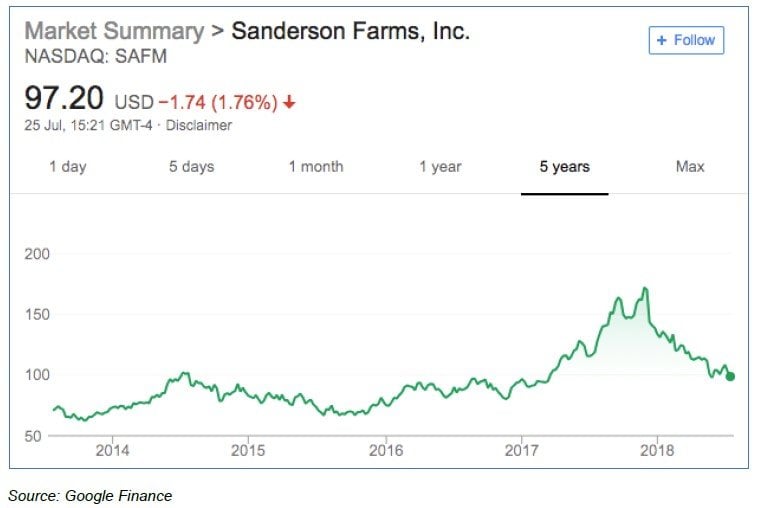

On the long side we look for the opposite; companies that are not reliant on credit, companies that are defensive, etc. An example is Sanderson Farms [a domestic poultry producer]; the stock went from a high of $170, which was too expensive, to below $100. A lot of the decline was due to trade war fears, but it’s a solid and defensive business. The balance sheet is in great shape, which matters a lot to us.

We learned from the last crash that the most fragile areas are typically the banking system and financial stocks. We are focused on Chinese financial stocks and banks. We’re also focused on some of the Eurozone banks. We own puts on Deutsche Bank. We also have exposure to Canadian banks because there seems to be a housing bubble in Canada. The leverage is about 25:1 in terms of total assets to tangible equity, which is what we saw in many US banks in the 2008 bubble.

We also believe there is a bubble in ETFs, which Heinz mentioned. The inflows to passive investments over the last three years have been $1.1 trillion, versus outflows from active investment funds of $700 billion. BlackRock, the biggest asset manager in the world, trades at an enterprise value to revenue of 6 versus a ratio of 3 for its active peers. There is a huge amount of competition in the industry and fees are being compressed. [On August 1, Fidelity Investments announced plans to launch a basket of no-fee ETFs.] This has become one of our favorite areas to short.

Mark Valek: What are your thoughts on Heinz’ statement that we may have already seen the top of the market?

Kevin Duffy: I agree. Every bubble is somewhat different from the last, and in the tech and housing bubbles the retail investors participated, however this time around it’s the professional investors, the elites, who are the biggest participants. The peak in January coincided perfectly with the Economic Forum in Davos, which is a meeting of the global elites. The commentary was very positive, which is normal to see at a market peak.

We will also start to see cracks, which we saw in the short volatility trade blowing up in early February. What should happen is that people will say it’s an isolated event, which is what happened in February and March 2007 when the subprime bubble burst and the cracks started to appear, and we got re-assurances from central bankers saying it was all contained. This sort of pattern is something we can look for this time around as a signal of the bubble popping.

Mark Valek: The market peak of late January this year might have been the top, at least for Tech Stocks. Even if it is not the top, and the market keeps rising, we know that a recession will come eventually. Rahim, what do you believe will be the consequences for western societies when the next recession hits?

Rahim Taghizadegan: I think that the trust will be shot. A psychological breaking point will be negative interest rates affecting people’s banking deposits. I think we’ll see an increased fight against cash and nationalization of banks of course, leading to further centralization. On the one side, we will probably have the elites trying to control the centralized system, which will be out of control. The enormous consumption of economic capital will become apparent, so I think that there will be opportunities for more entrepreneurial minded Westerners. There may also be a market economy emerging using modern technology, for example blockchain based alternatives.

Ronald Stoferle: I agree with Rahim that the opportunities for entrepreneurs will be huge, however they might be difficult to monetize. Heinz, any final thoughts from your side?

Heinz Blasnik: I think that when the next crisis arrives the problems in Europe on the political side will be driven by the lessons learned in the previous cycle. There are essentially two groups that have learned a lesson. The first group is the part of the citizenry that has paid attention to what has been going on; the government might tell them that their bank deposits are safe, but people won’t believe it, because they have already seen what can happen - Cyprus being a prime example, where people lost all their savings. So, when these people see a reason to panic, they will panic and act much quicker than before.

I think the other group that has learned something are the authorities. They learned that they can get away with anything. There was no violent uprising in Cyprus after basically all savers had their savings expropriated. Authorities probably already have a plan B in a drawer aiming to make it impossible for deposit holders to withdraw their money if push comes to shove. As a practical tip, if you have money in a European bank you should have a plan B yourself which you can implement if the situation threatens to become dicey.

Ronald Stoferle: Kevin, do you have any final thoughts?

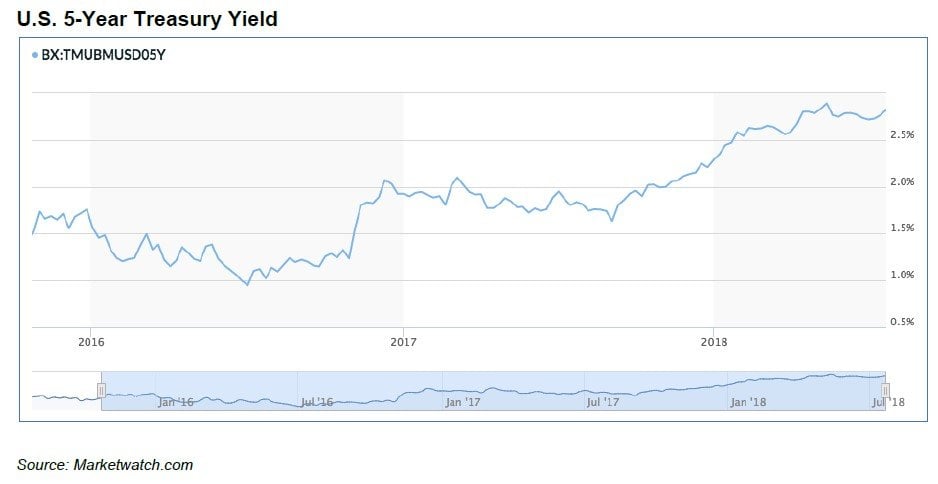

Kevin Duffy: What we have talked about is in some way like a Greek tragedy unfolding. There will be many twists and turns, and many acts. We might get hyperinflation, we might get a bursting of the asset bubble, we might see systematic trading strategies blowing up, etc. There are many different things that can happen. I think the idea of government bonds being a safe haven will be tested. Over the last two years budget deficits in the US have gone up during a rise in the stock market, which is very unusual. The borrowing cost for the US government, using the 5-year treasury yield as a proxy, has essentially doubled since the election.

Add to this that Social Security and Medicare trust funds will go cash flow negative in 2020. In some way it looks like all the stars are aligned for a crash. And I don’t think the elites really appreciate the situation they will be in; they will feel a lot of pain. It could lead to asset sales, privatizations,

i.e. things we haven’t seen for a long time. It will create a lot of problems for people who are invested in fragile areas, but it will also create some tremendous opportunities if you are prepared and you do your homework.

Ronald Stoferle: Thank you, Kevin, that was a very good summary. I want to end with a quote from Mises:

“All mankind's progress has been achieved as a result of the initiative of a small minority that began to deviate from the ideas and customs of the majority until their example finally moved the others to accept the innovation themselves.“

Gentlemen, thank you very much for joining the conversation. I look forward to talking to you again soon!

Article by Incrementum