Blackwells Capital entered into a settlement agreement with Supervalu after the food wholesaler agreed to sell itself to United Natural Foods (UNFI). The six-month-long proxy contest for six board seats came to a close when Blackwells agreed to a yearlong standstill.

Q2 hedge fund letters, conference, scoops etc

The activist had once claimed that management failed to entertain takeover offers and destroyed shareholder value. Chairman Donald Chappel expressed his happiness at the agreement, adding that the company would now be able to dedicate full attention to its transaction with UNFI.

What we'll be watching for this week

- Will shareholders take heed of Glass Lewis’ and activist investor Allan Gray’s advice to vote against the election of non-executive director Perry Crosthwaite as Investec board chairman on Wednesday?

- Will shareholders vote against the Rite Aid-Albertsons merger at a special meeting Thursday, as advised by Glass Lewis and activist investor Highfields Capital Management?

- Will a shareholder group, led by GTT Global Opportunities, be successful in its attempt to replace Baraka Energy & Resources’ entire board at a special meeting Friday?

Activist shorts update

Tesla recorded a seventh straight quarterly loss and a deficit that has more than doubled from last year’s second quarter in its earnings report Wednesday. However, with a combination of job cuts, a rush for Model 3s, and a fulfilled production goal of 5,000 cars a month, less cash was burned than expected.

Greenlight Capital took a short position last year, declaring the auto manufacturer’s stock should be performing much worse than it is. It claimed there is poor demand for Tesla’s vehicles and saw manufacturing challenges for its new Model 3, as well as criticizing its leadership. Many others have also been outspoken about the company, although most have since exited their short positions.

Earlier this month, CEO Elon Musk explained his intent to pay down the company’s debt instead of refinancing it, despite finishing the second quarter with only $2.2 billion in cash. Revenue rose 44% to $4 billion in the second quarter of this year, though, and the company reiterated its expectation of 6,000 Model 3s to be produced in a week at the end of August, and assured that it remains on target to make a total of 100,000 Model S sedans and Model X-sport-utility vehicles for the year.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

Chart of the week

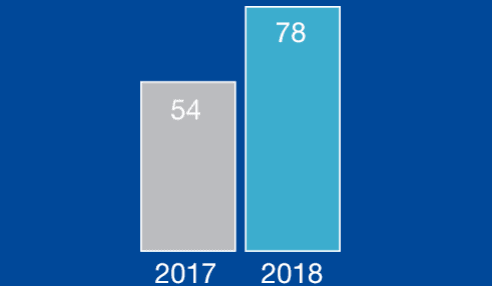

Number of Asia-headquartered companies publicly subjected to activist demands between January 1 and August 3.

Article by Activist Insight