Avenir Global Fund commentary for the second quarter ended June 30, 2018.

Q2 hedge fund letters, conference, scoops etc

Dear Partner:

The Avenir Global Fund – Class I units (the “Class I Fund”) increased 3.1%, net of fees, during the June 2018 quarter. The retail class of the Avenir Global Fund (“Avenir Global Fund”) increased 4.7%, net of fees, for the quarter and has returned 16.7% since inception on 25 August 2017. The MSCI ACWI index (in AUD) returned 4.4% for the June 2018 quarter while the S&P 500 returned 3.4%1.

After the volatility of the first quarter, the second quarter of 2018 was somewhat calmer. The mega-cap technology stocks, again, did most of the heavy lifting in terms of dragging major markets higher. According to GaveKal Capital (an economic consulting firm), during the first six months of 2018, just three companies – Amazon, Microsoft and Apple, accounted for 71% of the gain in the S&P 500. If you add Mastercard and four other tech stocks, the combined group accounted for 105% of the gain for the S&P 500 for the year-to-date. That, of course, means that the other 492 companies in the index declined in value as a group so far this year.

Despite the relative calm during the quarter and despite market confidence generally remaining high around the world, we sense an underlying fragility that may lead to increased volatility in the medium term. This, of course, would be wonderful news to us as we would welcome a more balanced view of the risks and opportunities facing equity investors than appears to have been the case over the past several years. While we have no view as to what the market will do over the near term, we can’t help but be aware of the longer-term headwinds that equity markets are likely to face over the next ten years.

The last 25 or so years have generally been very good for both equities and fixed income2. The period started with very high interest rates in the fixed income market and very low price-to-earnings ratios in the equity markets – both of which are good places to start. The period was then characterised by clear, and largely unchallenged, U.S. geopolitical strength, which provided global stability, and saw the rapid increase in globalisation along with all its benefits. These tailwinds were then overlaid by a massive increase in leverage throughout the economic system which helped to propel asset prices (including equity and fixed income) up dramatically.

If we look forward and try to guess what the next ten years might look like, however, we are starting from a point that is the opposite of what we have just described. We are now at high price-to-earnings multiples (and those earnings have been made at historically high margins3), interest rates are very low at 2-3% and there is already high leverage throughout the economic system including corporates, households and governments. Unemployment is about as low as it can go without leading to inflation and, unlike the relative stability brought about by the unparalleled global might of the U.S., we are now in a period where increasingly strong sovereign counterparties are jockeying for position and we are observing increasing protectionism, populism, nationalism and strongman politics.

Overall, things are unlikely to be as favourable over the next 10+ years and those focusing on passive or index driven investments may be disappointed with the results. We think that attractive equity returns can still be obtained, however, by searching off the beaten track, being very selective and investing only when we can do so with a large margin of safety to both protect and compound capital.

Our view of a margin of safety is not just based on price but extends to business quality, management capability and capital structure. Low price alone is not sufficient and neither is buying a high-quality business at any price. But the beauty of the public equity market is that there are always high-quality businesses going on sale for one reason or another and our job is to patiently and diligently find them. We continue to see a strong flow of interesting ideas amongst which to choose.

As summed up in a recent tweet by Jim O’Shaughnessy4:

New Investment - Charter Communications:

The Fund made one new investment in the second quarter of 2018, Charter Communications (CHTR:NYSE). We have been observing Charter for some time but felt the margin of safety was not adequate for our requirements. When the share price fell from a high of $408 per share to $260 during the June quarter we decided to act.

Our investment thesis for Charter was picked up by Barron’s magazine and published on 10 July 2018. While we provide a brief summary below, if you would like to read our investment thesis, as outlined by Christine Jurzenski, one of our Investment Analysts at Avenir, please see the article published in Barron’s here.

Charter is the second largest cable company in the U.S. providing 27 million households (out of the 50 million households ‘passed’) with broadband internet, television and telephone services. Charter is a toll-road on the internet highway and is the major broadband provider in most of the regions in which it operates giving the company a monopoly-like structure and ability to raise prices on average 5% per annum.

Charter is often classified as a television company, yet it should really be considered a broadband business. We estimate broadband makes +50% EBITDA margins compared to the 30% margin for the whole business. Television is less profitable due to high programming fees that have grown from 28% of cable TV revenues 20 years ago to almost 65% in 2017 with content providers demanding more of the pie every year.

The company trades cheaply due to negative views on the recent trend of ‘cord cutting’ whereby customers end their cable TV contract and rely on streaming content over the internet. However, in the US, television and internet travel over the same cord and this ‘television cutting’ can be advantageous to Charter. The company not only makes more money on internet-only packages, due to not having to pay the rising programming fees, customers also use twice as much internet data when they cancel their television package.

Charter has a material debt load which, we think, is appropriate for a company with recurring revenue streams and we view Charter as a ‘public LBO’. Charter has an effective duopoly with the largest cable business, Comcast, although the negligible footprint overlap between the two, means that they rarely compete directly. The development of 5G mobile wireless technology, however, is a potential future risk.

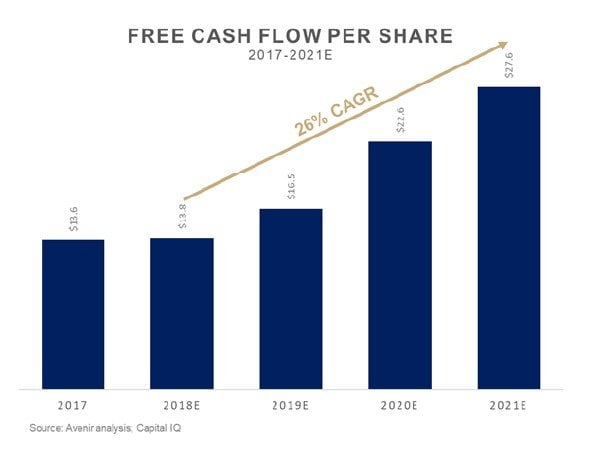

We expect capital expenditure to taper from 20% of revenue to closer to 15% as digital and cloud technology require less maintenance in the future. The increased free cash flow will be used to buy back shares at an aggressive rate. Over the past year, Charter has bought back $13 billion worth of shares, reducing share count by 12%. Ongoing buybacks can help drive a +20% per annum growth in free cash flow per share over the next several years. Assuming the company continues to trade on the current 5% free cash flow yield, Charter could be worth $575 per share, almost 100% above the current price, in three years’ time.

Select Portfolio Updates:

Our biggest gainer for the quarter was Adairs (ADH:ASX), the Australian specialty retailer, which gained in price by 16% ending the quarter at $2.23 per share continuing its long climb back from the $0.56 per share reached in mid-2017. During the quarter, Adairs provided a trading update which pointed to like for like (LFL) sales growth in the Australian financial year to date (1 July 2017 to 15 April 2018) of 16% with LFL sales in the fiscal second half to date (1 January 2018 to 15 April 2018) of 18%. Adairs online sales grew 99% and now represent almost 13% of sales. Illustrating the strong operating leverage obtained by such high LFL growth, the company revised guidance for operating income for the full year (to 30 June 2018) up by 8% (at the midpoint) and suggested that the company is likely to be in a position to consider capital management initiatives in FY2019.

The second biggest contributor for the quarter was Safran (SAF:PA) which increased in price by 21% to end the quarter at €104 per share. Saran has been a strong performer for the Fund having gained 44% since our initial purchase at roughly €72 per share in April 2017. 2018 is an important year in Safran’s transition from the legacy CFM56 engine to the next generation Leap engine and costs will be higher while this transition takes place. With 14,000 Leap engines on backlog (as at 1Q2018) and the company targeting annual production of 2,000 engines per year by 2020, there is plenty of growth ahead of Safran. An equally important driver of growth for Safran is the parts and service revenue to come from its 35,000+ engines sold over the past 35 years. In the first quarter of 2018, Safran’s civil aftermarkets business grew 16.4% in USD terms driven by spare parts sales.

Our biggest decliner for the quarter was KB Financial (105560:KOSE), the Korean bank. KB Financial declined by 16% to end the quarter at KRW52,800 per share. KB declined despite first quarter results being ahead of expectations with net income of KRW946bn beating consensus by 9% and representing growth of 11% year over year. KB currently trades at 0.6x book value, despite earning close to a 10% return on equity, which implies a 17% annual return on our investment, and roughly 6x forward earnings. KB is the largest commercial bank in Korea and has been solidly improving its profitability over the past several years and remains in our view, cheap.

We have confidence in the underlying stability of value in the companies in our portfolio and believe they are competitively well-positioned in their markets. In our view, they are also priced at attractive absolute levels with prices well below our estimates of underlying value, offering us what we believe to be an attractive margin of safety.

We do not have a crystal ball to determine what equity markets will do over the short to medium term or whether attractive market returns may be harder to come by over the next five to ten or more years. We believe, however, that our value-oriented and concentrated investment approach will continue to generate good investment outcomes for our investors over time, and the team at Avenir remain energised and focused in our search for the next great investment.

“Persistence is a secret weapon for everyone.” - Liu Wen

Best Regards,

Adrian Warner

Managing Director

Avenir Global Fund