Whitney Tilson’s email to investors in which he discusses Dolomites/Tyrolean Alps; London; webinar; Yield curve signal’s recession; Trump’s Taking Us From Temper Tantrum to Trade War; Bill Miller reveals the biggest mistake value investors are making; Mohnish Pabrai’s Advice for Value Investors; poker tourney.

To our readers Pease use “VW10” for a discount!

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

I hope you had a happy 4th of July! I’m on a Backroads trip with my wife in the Dolomites/Tyrolean Alps, which are spectacular! See pics and descriptions I’ve posted on Facebook at: Venice, hiking/climbing, and mountain biking.

1) Tomorrow afternoon I fly to London, where Glenn and I are looking forward to teaching our five-day program for the first time outside of NYC (our three-day Lessons from the Trenches investing bootcamp Sat.-Mon. July 7-9, a one-day seminar on How to Launch and Build an Investment Fund on Tuesday, and our new one-day program, an Advanced Seminar on Short Selling on Wednesday). We typically fill our last few seats at a steep discount for students and young/emerging investors, so if you or someone you know is available on short notice please email me and we’ll try to accommodate.

2) In less than four weeks, from July 23-August 1, we are going to teach via live webinar our Lessons from the Trenches investing bootcamp, followed by our seminar on How to Launch and Build an Investment Fund from August 2-4.

Rather than the full days we teach when we’re doing it in person, we’re breaking the two programs into 12 modules – 9 for the bootcamp and 3 for the seminar – that we will teach in 2½-hour sessions that will take place live every day from 7:00-9:30am NY time (no class Sunday, July 29).

The webinar offers big advantages for participants:

- No need to take time off of work: The webinar is only 2½ hours/day and takes place before work hours for those in the U.S., Canada & Latin America, and after work hours for most of Asia (India, China, Singapore, Australia). (Europeans will need to carve out time in the middle of the day.)

- No need to travel: Anyone, anywhere in the world, can take the webinar using a smartphone, tablet or computer

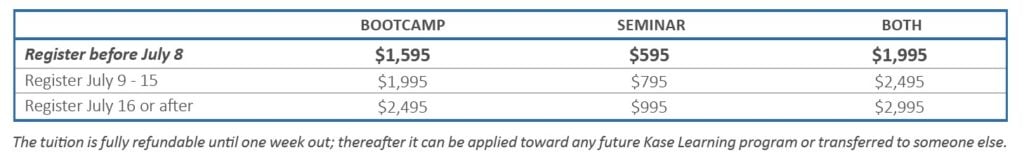

- More affordable: Participants won’t incur any travel or hotels costs and, because we don’t have to pay for renting a room, providing meals, etc., we’re pricing the webinar at less than half of our normal tuition, with an especially big discount for early registrants

You can register at: www.cvent.com/d/dgqdlz/4W. Don’t delay as the tuition goes up after Sunday!

To our readers Pease use “VW10” for a discount!

Please see attached for more details (also posted at: www.tilsonfunds.com/KaseWebinars.pdf) and let me know if you have any questions.

From July 23 - August 1, Kase Learning will teach via live webinar the Lessons from the Trenches investing bootcamp, followed by a seminar on How to Launch and Build an Investment Fund from August 2 - 4.

Rather than the full days we teach when we’re doing it in person, we’re breaking the two programs into 12 modules – 9 for the bootcamp and 3 for the seminar – that we will teach in 2½-hour sessions that will take place live every day from 7:00 - 9:30am NY time (no class Sunday, July 29).

WEBINAR BENEFITS

The webinar offers big advantages for participants:

- No need to take time off of work: The webinar is only 2½ hours/day and takes place before work hours for those in the U.S., Canada & Latin America, and after work hours for most of Asia (India, China, Singapore, Australia). (Europeans will need to carve out time in the middle of the day.)

- No need to travel: Anyone, anywhere in the world, can take the webinar using a smartphone, tablet or computer

- More affordable: Participants won’t incur any travel or hotels costs and, because we don’t have to pay for renting a room, providing meals, etc., we’re pricing the webinar at less than half of our normal tuition, with an especially big discount for early registrants

SCHEDULE

The webinar will be held daily 7:00 - 9:30am NY time:

- Lessons from the Trenches investing bootcamp July 23 - August 1 (no class Sunday, July 29).

- How to Launch and Build an Investment Fund August 2 - 4

TUITION

REGISTRATION

To register, go to www.kaselearning.com. Don’t delay as the prices go up soon!

To our readers Pease use “VW10” for a discount!

FURTHER INFORMATION

To learn more, call (212) 265-4510, email [email protected], or go to www.kaselearning.com.

FREQUENTLY ASKED QUESTIONS

Will the curriculum you teach during the webinar (including guest speakers) be the same as your in-person seminars?

Yes, it will be identical. We’ve posted a detailed agenda for both the bootcamp and seminar here: www.tilsonfunds.com/KaseWebinar.pdf and additional background material on Kase Learning here: www.tilsonfunds.com/

KaseLearning.pdf.

Won’t I miss out on the in-person interactions with you and my fellow participants?

Yes and no. While we won’t all be in the same room, each webinar session will be live, so participants will be able to ask questions via video, seen by all of the other students, just as if we were together.

In addition, as we do for every one of our programs, we’ll compile a bio package and share it among the participants so they can connect with each other.

Finally, we’re planning to launch the Kase Learning Network, a two-day program that we’ll host twice a year, to bring together everyone who’s ever taken any of our programs for additional learning, networking, and small-group sessions. The first one will take place in NYC on Friday and Saturday, November 2 - 3.

What happens if I miss one or more sessions?

No problem – every session will be recorded and made available immediately afterward (only to participants on a password-protected site).

If I’m not part of the live program July 23 - August 4, can I watch the videos afterward?

Likely yes, but we haven’t yet decided on the details or pricing.

If you have additional questions, please don’t hesitate to contact us at [email protected] or (212) 265-4510.

3) Interesting: What’s the Yield Curve? ‘A Powerful Signal of Recessions’ Has Wall Street’s Attention, https://www.nytimes.com/2018/06/25/business/what-is-yield-curve-recession-prediction.html. Excerpt:

You can try to play down a trade war with China. You can brush off the impact of rising oil prices on corporate earnings.

But if you’re in the business of making economic predictions, it has become very difficult to disregard an important signal from the bond market.

The so-called yield curve is perilously close to predicting a recession — something it has done before with surprising accuracy — and it’s become a big topic on Wall Street.

4) I think the greatest risk to stocks globally right now is a major trade war, which is outlined in this op ed by Paul Krugman: Trump’s Taking Us From Temper Tantrum to Trade War, https://nyti.ms/2KDx0tZ. Excerpt:

So we’re heading into a trade war, and it’s hard to see how the escalation ends. After all, foreign governments literally can’t give Trump what he wants, because he wants them to stop doing things they aren’t actually doing.

... For what it’s worth, I don’t think most businesses, or most investors in financial markets, are taking the threat of trade war seriously enough. They’re acting as if this is a passing phase, as if the grown-ups will step in and stop this downward spiral before it goes too far.

But there are no grown-ups in this administration, which basically makes policy by temper tantrum. A full-blown trade war looks all too possible; in fact, it may already have begun.

5) I’ve always really enjoyed hearing Bill Miller’s thinking – so outside the box. He was one of the first value investors to see that stocks like Amazon and Google were, in fact, incredible bargains. Legendary investor Bill Miller reveals the biggest mistake value investors are making now, https://www.cnbc.com/2018/06/22/investor-bill-miller-reveals-biggest-mistake-value-investors-make.html. Excerpt:

Blurring the line between growth and value isn't that uncommon — even Warren Buffett, as acclaimed a value investor as has ever lived, has taken a hugely profitable $46 billion position in Apple, the world's most valuable technology company and one trading at a relatively rich 18.5 times this year's estimated earnings. In the late-1990s bull market, Miller forged his streak by broadening the definition of value.

In an interview, Miller said the mistake critics make is to think value means nothing more than a low stock price. His focus on finding companies that were focused on high returns on invested capital and generating free-cash-flow growth helps distinguish stocks that are undervalued from those that are simply cheap.

Making a windfall

That's why Miller, like Oakmark, bought Facebook shares around $150 during the brouhaha over the social network's privacy practices, which have so far had little impact on the company's advertising sales or profits. At that price, Facebook was trading at just 14 times expected 2019 profits, Miller said — a bargain, unless the privacy controversy led to many more canceled user and advertiser accounts than early results suggested.

"To the extent that value is based on a simple calculation about ratios, that's a very simplistic definition of value. If people are buying things they haven't analyzed ... it's not likely to end well." -Bill Miller, legendary hedge fund investor who managed a fund at Legg Mason that beat the S&P 500 for 15 years straight through 2005

"Facebook at 14 times cash flow made no sense whatsoever unless you thought their entire business was in dire straits,'' Miller said.

6) A really interesting interview with Mohnish Pabrai as well. Mohnish Pabrai's Advice for Value Investors, https://sumzero.com/headlines/business_services/FCAU/411-pabrai-advice-for-value-investors. Excerpt:

Harris: What is your take on the current state of value investing? Where do you think that the most inefficiencies exist and why?

Pabrai: I think that in terms of value investing - the principles and the approach, there will never be any major change on that front. That said, there two types of adjustments that one has to make. One is that markets go through periods of euphoria and periods of pessimism. In general, when markets are pessimistic there are more fish in the ocean if you will. In pessimistic markets it is easier to find widely mispriced securities than in euphoric markets. The second is that from a geographic point of view, some parts of the world may be euphoric while at the same time other parts may be pessimistic or more mispriced. From that perspective, this is a very interesting time.

I find the USA a very difficult area to find mispriced securities, and I find that if you look at markets like South Korea or India or Japan there is a lot more mispricing to be found. The markets vacillate between fear and greed, and especially in Japa n and South Korea there has been a very long period where markets have flatlined or gone negative. Generally when you have multi-decade periods of that sort of activity then market participants throw in the towel and go on. That’s when you should be stepping in as an investor.

That’s the way I see the world right now. One thing interesting that I've found in the Pabrai Funds portfolio - despite my never approaching things from the top down, we have nothing in the US. Zero percent of our current assets are in the US. Which has never happened in the 19 years of running the fund. We always had a very large portion of assets in the US. I would have never guessed that we would get to the point where we would be at zero - but here I am. It’s the nature of the beast, I just can’t find much in US markets at this time.

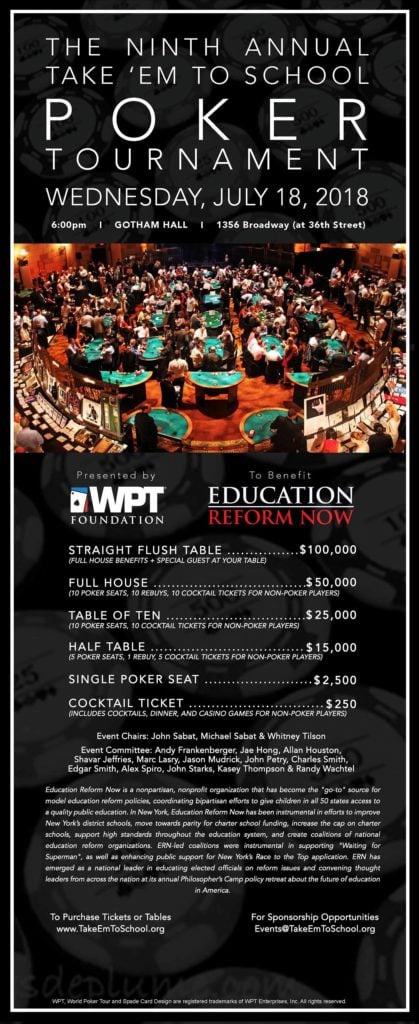

7) The 9th annual Take ‘Em to School Poker Tournament, which I’m co-chairing, is coming up on Wednesday, July 18th. It benefits Education Reform Now, a non-partisan, non-profit organization committed to ensuring that all children can access a high-quality public education regardless of race, gender, geography, or socioeconomic status.

It’s always a great night for players, spectators, and education reformers alike. The tournament will feature 250 poker players battling for prizes that in past years have included golf outings at exclusive clubs, a table at Rao's for 8, and power lunches with top investors. For those attending as cocktail guests there will be a variety of casino games and entertainment. The event also features a full swing golf simulator, which will host Long Drive and Closest to the Pin contests.

The event always includes specials guests and in the past has featured poker stars Phil Hellmuth, Erik Seidel, Sam Abernathy, and Layne Flack; sports icons James Blake, Alex Kovalev, Apolo Ohno, John Starks, Charles Smith and Allan Houston; America's Next Top Model contestant Jamie Rae; and award-winning actors Hank Azaria, Billy Crudup, Shannon Elizabeth and Seth Gilliam.

The event always sells out, so reserve your seat/table today by going to: www.TakeEmToSchool.org. I hope to see you there!