How much do Millionaires know about financial terms and concepts? How much do Millionaires NOT know? Do advisors mistakenly assume Millionaires are more financially literate than they actually are?

Q2 hedge fund letters, conference, scoops etc

These issues and more are analyzed in Spectrem's newest market research report: The Financial Literacy Gap Among Millionaires.

Here are some highlights of our findings:

- Although 84 percent of Millionaires believe they are very knowledgeable or fairly knowledgeable about investing, more than half failed a basic financial literacy quiz, with less than 70 percent correct responses.

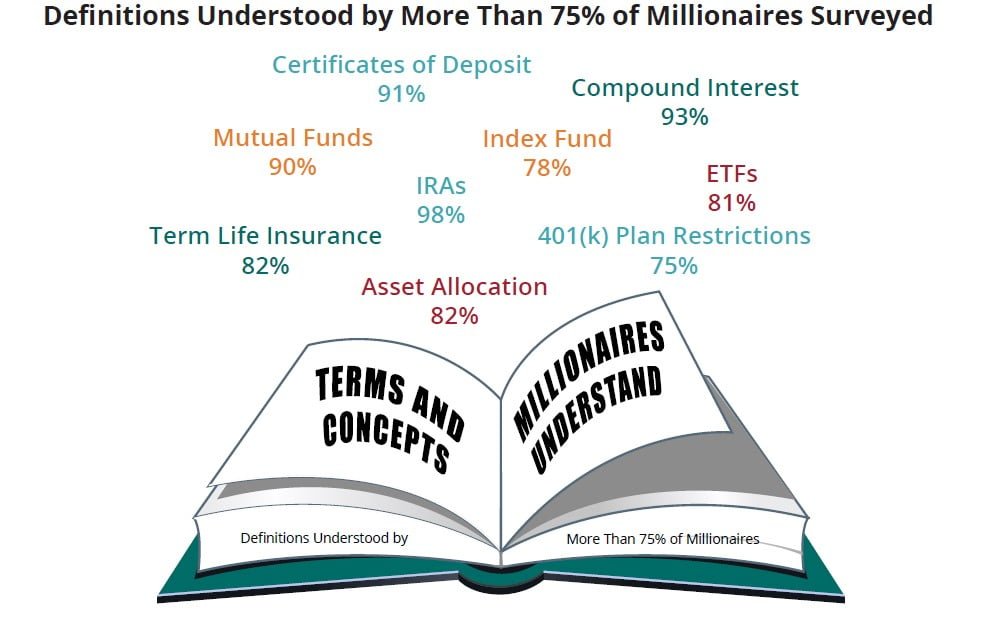

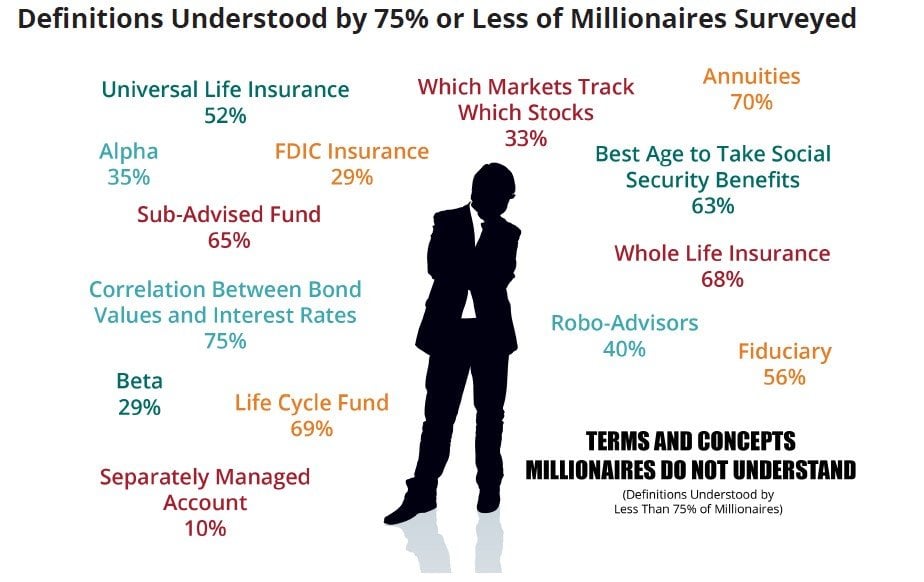

- Key literacy gaps found in the quiz:

- Just over half were able to identify the correct definition for "fiduciary."

- Almost 40 percent did not know they can maximize their Social Security benefits if they wait until age 70 to claim benefits.

- About one quarter did not know that bond values decrease when interest rates increase.

- Only 35 percent of Millionaire investors knew the definition of the investment term "alpha" and less than 30 percent knew the definition of the term "beta".

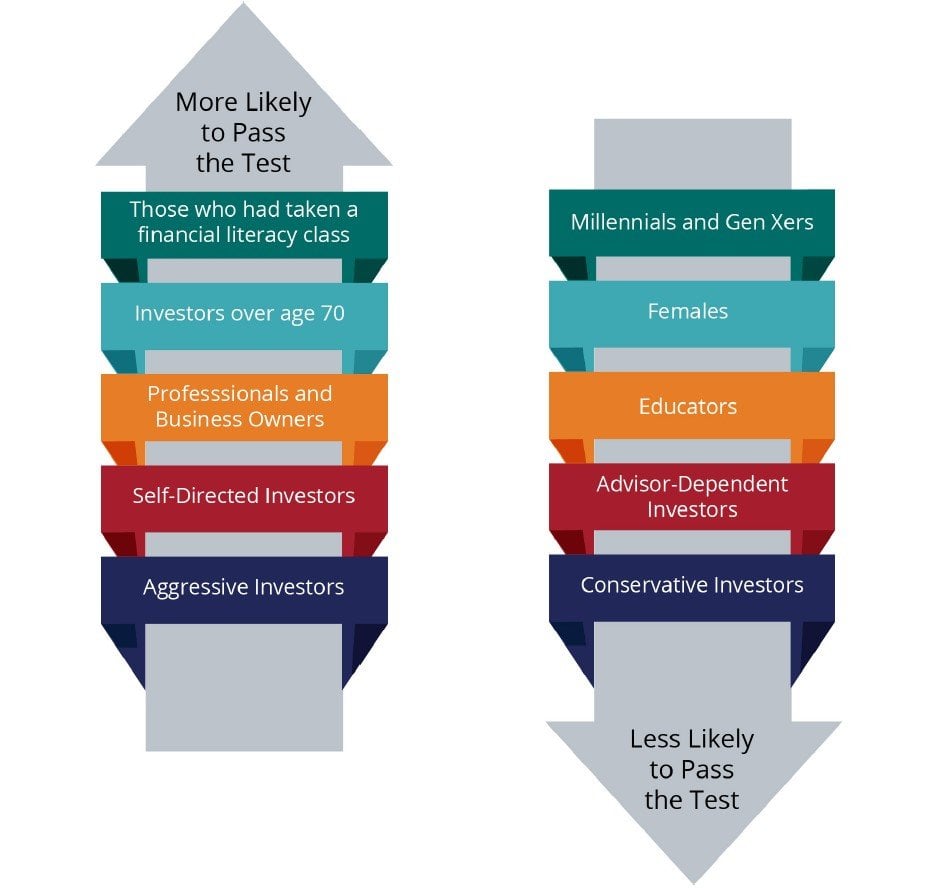

- Which investors performed the best on the quiz?

- Fifty-seven percent of WW II era investors scored a C or better, while only 38 percent of Millennials and Gen X investors got a passing grade.

- Millionaires who had taken a financial literacy class in their lifetime were more likely to pass the quiz, but only slightly more than one-third of Millionaire investors (37 percent) have ever taken such a course.

- More than half (53 percent) of Millionaire investors expect their financial advisor to educate them on topics they are unfamiliar with.

The Financial Literacy Gap Among Millionaires

Introduction

There is a problem with financial literacy in the United States of America. School districts throughout the country have eliminated consumer economic classes from their curricula, and teenagers often turn into young adults who get educated on matters of personal finance through the Internet, or in the School of Hard Knocks.

But certainly, once those young adults come into some money, they learn everything they need to know about finances, economics and investing, right? It’s not possible to become a millionaire without being fully informed in the ways of managing and making money, correct?

That turns out to be false. Many millionaires are woefully ignorant of financial terms, strategies and functions. They depend on the wisdom of financial advisors, lawyers and accountants to manage their assets. As long as their funds grow, they are willing to let smarter minds control their investable assets.

But there are also millionaires who are fully confident in their knowledge level. They believe they know what they need to know. They believe they understand how their financial advisors make decisions about their investments.

There may indeed be many millionaires who are wise in the ways of investing and finance, but there are many who are not, even among those who think they know what they are talking about. Financial advisors face all three types of investor sentiment: those who know what they are talking about, those who do not know much about investing, and those who think they know what they are talking about but do not actually know.

The purpose of this study is to determine the financial educational level of the nation’s growing population of millionaires. Investors with a net worth of $1 million or more were quizzed about their knowledge of financial and investment terms, and asked what role they believe their advisor should play in filling in the blanks. As you will see, most investors have relatively finite knowledge of investments, despite their success in other areas.

Executive Summary

How do investors educate themselves about finances? While just over half choose to be educated by their financial advisor, over a third also depend on other self-educating methods.

Fewer than 40 percent of Millionaires have taken a course (in high school, college or post-schooling) that could be described as instructional regarding finances, investing, budgeting or retirement planning. The percentage is higher for younger investors, while only 32 percent of millionaires over the age of 70 have taken such a course.

Males are more likely to have taken a financial literacy course than females (39 percent to 32 percent) and there appears to be a statistical correlation between those who have not taken such a course and their greater dependence upon a financial advisor.

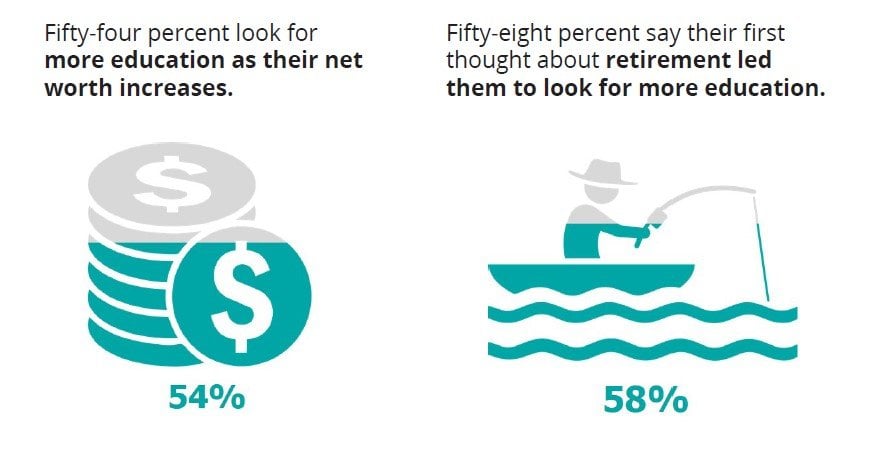

Investors look to further their financial education when life events dictate the need, such as nearing retirement or accumulating more money.

Life events like marriage and starting a family can prod investors into further personal education.

Investors who advanced further in their formal educational process (i.e. college, post-grade studies) are more likely to want additional education on subjects related to old age, such as retirement planning, estate planning and elder care. But investors who went no further academically than high school or undergraduate college are more likely to look to their financial advisor to further their financial education and knowledge as needed.

More than half of millionaires “failed” the financial literacy quiz, scoring less than a 70%.

Asked to place responsibility for education on a 0-to-100 scale, where “0” represented the investor and “100” represented the advisor, investors ranked the responsibility of the advisor at 35.14. However, investors who self-proclaim to be almost entirely dependent upon their advisor for investment information rated the responsibility of education at 68.44, meaning they have greater expectations of their advisor.

Those who scored poorly on the quiz are more likely to feel their advisor is responsible for educating them.

Implications and Conclusions

There are three types of Millionaire investors: those who believe they know enough about investments and finances to make wise decisions, those who want to learn more and are willing to educate themselves, and those who want to learn more and expect their financial advisor to provide the necessary education.

Advisors and providers need to have educational tools and programs available to assist investors who are uncomfortable with their knowledge level. These tools can be available online, but some investors want to have in-person educational sessions as well.

Firms should advertise their educational programs as a way to entice new investors and to make it easier for current clients to educate themselves.

There are Millionaire investors who feel the need to educate themselves only when outside factors require them to know more than they already do. Marriage, the birth of a child, impending retirement and wealth transfer plans are all events which can cause an investor to look for more education.

An educated Millionaire is more likely to be more aggressive in their investment decisions. Investors who worry that they do not understand what their investments do are less likely to invest in risky or alternative investments.

There are many terms related to banking, finance and investing which Millionaires cannot easily define. Advisors can decide which of those terms their investors need to understand and can provide instructional information to facilitate understanding.

College Educated Millionaires and higher are often still in pursuit of more knowledge. Advisors can provide different levels of educational materials for investors which are tailored to an investor’s academic background.

There are Millionaires who ceased seeking additional information after graduating from high school. It is possible these investors could be lacking in some financial knowledge that other investors have because they did not take economics or financially-oriented courses in college. Advisors should be prepared to assist those investors with a basic financial education when the opportunity presents itself.

Those investors who self-identify as not very knowledgeable require more education from their advisor. These investors rely far more on their advisor to educate them about financial information and they expect the advisor to own that process. Unfortunately our quiz results show that education is not currently taking place as more than three-quarters of those not knowledgeable failed our quiz.