Tab Williams, a research analyst at a multi-billion dollar value-oriented asset management company, conducted an insightful webinar yesterday about value investing. Since you were not able to attend the webinar, I’m sharing the webinar recording with you.

Q2 hedge fund letters, conference, scoops etc

Tab Williams: Value Investing Webinar - Columbia University

Transcript

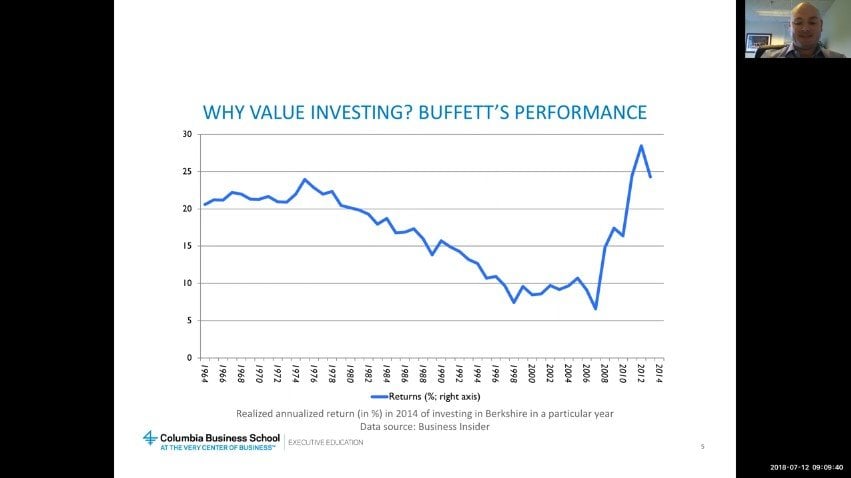

I'm no expert but I'm enough to be dangerous. But thank you for that. But you know why. Why value investing. In my opinion and in many other great investor's opinion it is the only way to invest it is the only way to take and look at a stock in a specific framework. Apply that framework to the stock and then make great investment decisions. And you know a lot of people define value investing as being you know one thing or another thing. But essentially what value investing is is it's looking at individual stocks evaluating their prospects evaluating their underlying business and then finding out what their intrinsic value is and then paying a price below that intrinsic value and countless investors have done this to you know great success. The most famous being Warren Buffett. And as we can see here here's Buffett's track record over his investing career. These are the annualized returns. And this is how you become a billionaire. In short I mean if you compound the capital at the rate that Warren Buffett has for the longevity of which he has you're going to be uber uber successful will have more money than you know what to do with AS's Warren's problem. And so what Warren does and many other great investors as they follow this value investing framework they look at stocks on an individual basis. They don't care about you know macros and stuff like that. They're looking in evaluating companies stock stock situation by situation and that's that's what we're going to learn you know to do in this course.

So Columbia Business School is kind of the leader in value investing. Warren Buffett is an alum. Mario Gabelli another well-known value investor is isn't alone. And even people that are not Alomes of Colombia become involved because they have such a strong value investing program and their foundation is really rooted in value investing and there the thought leaders they have a fantastic professor in Toronto who teaches this course. Bruce Greenwald another very famous professor come comes from Columbia. So really you are going to the one place that is that is the market leader in value investing. So moving on to Toronto Toronto is fantastic. Like I said I've worked with them now for a few years. He's the faculty director of the Hilborn center which is all things value investing at home. He is also a professor of value investing value investing with legends and modern value. You can see a theme there but he he really is a fantastic teacher. You're going to love him. He is from Spain. He has a wonderful accent. He's a pleasure to listen to any. He really boils this down on and makes this really approachable. And so it's an honor of mine too to be a part of this. So the little bit about yeah sorry go ahead please. You know it's just going to say I know that China has there's a number of well known her fast series at Columbia that they teach. I investing investing that technology has a unique take on it which is a little bit more analytical is that is that fair it's fair. Yeah.

See if there's anything else you could say his philosophy around violence that's saying it just it compared to what people might have heard about this scheme or others. Yes so that's fine. No. Bruce Bruce who who really revived the Value Investing program within Columbia he is a very very high level he likes to think of things kind of as an umbrella. Tonno likes to dig deep into things he likes to really get gritty into the numbers. He likes to look into you know annual reports and find that little tidbit that everybody else is missing. If you go into his office he has these obscure books about some of the companies that were going to learn about about you know he's very fascinated and John Deere and the equipment they were using 150 years ago he has books on that. He can talk about it you talk about all of that and he really you know melt this framework in with a certain level of detail that that will serve us all well throughout this course. Right. I think so yes so the learning journey this is this is the overview of what we're going to learn throughout this course. First woman started the foundation level. We're going to learn what is this value investing framework that you're going to be sick of hearing about. It applies to everything. Right. And then we're going to go and start to learn about how you actually value a company what methods we can use. Then we're going to talk a little bit about strategic analysis how you go and evaluate a company's strategy.