The January effect is one of the calendar anomalies in the stock prices. It indicates that the stock prices of small-capitalisation stocks go high in the month of January and outperform the larger stocks. The effect is very strong and it negates the efficient market hypothesis which states that there is no predictable pattern to the prices of the stocks.

Q2 hedge fund letters, conference, scoops etc

The January Effect is mostly attributed to the increase in buying in January, after the drop in December when the investors engage in selling-off their holdings for tax reasons to offset the capital gains. Another reason can be that the investors use their year-end bonuses to buy the stocks, thereby increasing the stock prices in January.

Overall, the January Effect is a hypothesis which confirms that the markets are inefficient. If the markets were efficient, they could make this effect nonexistent. In either case, for those who believe in the January Effect, it can be capitalised on. The believers can buy stocks of small cap and micro cap companies and reap the benefits. However, it is also a risky business, like the other forms and concepts of trading.

The January Effect is well explained by Jeremy Siegel in his book “Stocks for the Long Run”.

The book states,

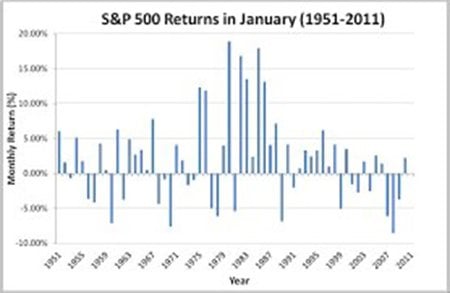

“Of all the calendar-related anomalies, the January effect has been the most publicised. From 1925 through 2012, the average arithmetic return on the S&P 500 Index in the month of January was 1.00 percent, while the average returns on the small stocks came to 5.36 percent. The 4.36-percentage point excess return of small stocks in January far exceeds the difference in annual returns between large and small stocks. In other words, from February through December, the average returns on small stocks have fallen short of the returns on large stocks. On the basis of history, the only advantageous time to hold small stocks is the month of January.

This explains why there is an increase in the volumes and transactions in the small cap company stocks. It is quite possible that the January effect exists because the traders act assuming that the January effect already exists!

A fascinating feature of the January effect is that you do not have to wait the entire month to see the big returns from small stocks roll in. Most of the buying in small stocks begins on the last trading day of December (often in the late afternoon), as some investors pick up the bargain stocks that are dumped by others on New Year’s Eve. Strong gains in small stocks continue on the first trading day of January and with declining force through the first week of trading. On the basis of research published in 1989, on the first trading day of January alone, small stocks earned nearly 4 percentage points more than large stocks. By the middle of the month, the January effect is largely exhausted.

When any anomaly such as the January effect is found, it is important to examine its international reach. When researchers turned to foreign markets, they found that the January effect was not just a U.S. phenomenon. In Japan, the world’s second-largest capital market, the excess returns on small stocks in January came to 7.2 percent per year, more than in the United States.4 As you shall see later in the chapter, January is the best month for both large and small stocks in many other countries of the world.

Thus, it is safe to assume that January effect is not localised to a country or an exchange, but it is an overall effect seen in all the markets and is caused by same or similar reasons.

How could such a phenomenon go unnoticed for so long by investors, portfolio managers, and financial economists? Because in the United States, the returns in January are nothing special for large stocks that form the bulk of those indexes that are analysed. That’s not to say that January is not a good month for large stocks, as large stocks do quite well in January, particularly in foreign markets. But in the United States, January is by no means the best month for stocks of large firms.”

Going by the facts and details mentioned in the book by Jeremy Siegel, January Effect is a seasonal worldwide phenomenon. Many studies have been done to analyse the effect. One study analysed the data from 1904 to 1974 and concluded that in the month of January, the average return for the stocks is five times more than any other month of the year. Another study on the stocks from 1972 to 2002 confirmed that the stocks in Russell 2000 Index (small-cap companies) outperformed those in Russell 1000 Index (large-cap companies) only in the month of January each year.

Although, since the January Effect is known by too many people now that the traders time their purchases and the effect is fading. For instance, the January of 2006 was specifically rough for the equity markets in the US and Europe and it was one of the worst starts of the year. Therefore, it is necessary to use your judgement professionally before getting pulled into the trends and chase of prices.