Open Square Capital commentary for the second quarter ended June 30, 2018.

Q2 hedge fund letters, conference, scoops etc

Dear Limited Partners,

Weightless. That’s what the world’s feeling right now. A moment in time when energy prices are just right, high enough to pull energy producers back to profitability, but not so high as to exacerbate global inflation. Astronauts have described weightlessness as calming, producing an almost euphoric effect. For those analyzing the oil market these past few years, we know better. For those who’ve bothered to look out the window, we know . . . we’re in free fall.

Despite more recent Wall Street attention, it’s still not obvious yet, and even if awareness is rising, the notion of higher oil prices is met with skepticism if not outright derision. Look no further than analysts’ oil price decks, albeit revised and elevated from before, still show average prices around $70/barrel. Many attribute the recent price curve to increasing geopolitical risks, of which there’s been no shortage to choose from (e.g., Iran nuclear deal, Middle East instability, Venezuelan sanctions). Delve further though and you’ll discover that disappointing non-OPEC/non-US production and lower inventory levels means that the margin for error has narrowed. Today, geopolitical risks, operational mishaps and episodic outages that would have caused nary a ripple a few months ago now exacerbate oil price swings. The current volatility is a symptom of increasingly tighter inventories and highlights the lack of spare capacity from producers willing or able to grow production.

Now surely the market knows this right? Something as ubiquitous and important as oil, must be well understood, examined and reexamined to the nth degree. Well, no. According to the Wall Street Journal “[s]ince March 2012 the number of commodity funds globally-which trade in oil and other commodities such as wheat or copper-has dropped from 368 to 130.” With few left 1 to understand the intricate dynamics of the market, and those remaining shunned because of lagging performance, the clarion calls of an impending shortage went unheeded.

Not that it mattered though because despite the forewarnings, personal incentives drove producers of all ilk towards the situation we find ourselves in today. It’s only now, when a confluence of factors have driven us to a supply shortage is the world beginning to stir, slowly waking to the realization that this is a shortage and it will continue unabated. As the energy crisis gathers momentum, it will have far ranging and wider repercussions than even we have ventured to anticipate. No matter because we’ve known all along that it will only matter when it matters. For now, enjoy this moment because heavy is the hand of gravity, and heavy is the other shoe that drops.

Our Quarter

As beneficial as it was to have our oil forecasts and prognostications come true, they mattered little if our investments failed to bridge our oil thesis and higher portfolio performance. We experienced a bit more symmetry this quarter as the maturing of the former led to the growth of the latter.

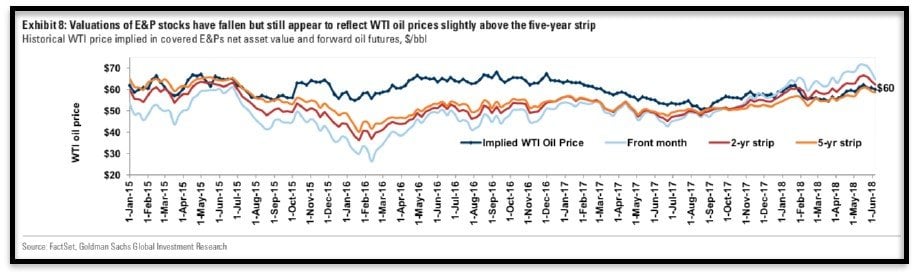

Although energy equities have started responding, we have barely begun. Energy stocks currently comprise just 6% of the value of the S&P 500 index when the long-term average is closer to 13%, and energy equities still do not reflect today’s oil prices, let alone where they are headed. According to a recent Goldman Sachs report, E&P stocks were valued as if oil was still $60/barrel, almost 20% lower than the WTI $73/barrel now.

Think about that for a moment. We’ve been calling for triple digit oil prices in the near future, but the market values energy equities at less than today’s depressed prices. So while the outperformance against the broader market this quarter is a pleasant surprise, it’s not entirely surprising, nor the end.

If we analogize our oil thesis to baseball, we’re in the third inning of a nine inning ball game. Oil stocks have recently only kept pace with the rise of oil prices since Q1. The gap has yet to close, but we believe it will eventually as oil prices lead the way. After rebasing during the seasonal lull (when refinery outages hit an annual high in May) and the uncertainty surrounding the recent OPEC meeting subsides, oil prices should regain their upward momentum in the coming months. Eventually as inventories draw further, prices will readjust. The entire curve will lift higher when the market understands and then believes that the oil shortage will be more acute and longer lasting than what the consensus believes today.

Cynically, we’d add that Wall Street’s oil price targets will lift only after it’s had its fill. To understand this, simply think about how Wall Street is compensated (i.e., by taking a fee when helping companies raise capital). So if it prematurely raises the “house view” on oil prices, it could hamper the business pipeline. Why raise capital now (i.e., sell stocks or bonds or enter into hedging contracts) when you’ll soon be flush with free cash flow? Even more cynically we’d suggest that oil price decks will move higher only after some of Wall Street’s proprietary trading desks have prepositioned for the upgrades. Regardless, if physical spreads continue to strengthen, analysts will be forced to lift their oil curves as their forecasts dislocates from reality. In turn, our equities should then rerate as they draw more investor interests. So once again we wait with preternatural patience, but like my son Mason says when lacing up his sneakers to venture outside . . . “les do dis.” Yeah buddy, we’re ready, let’s do this.

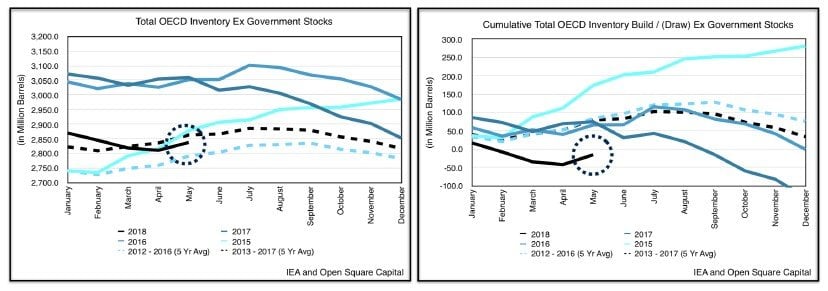

Lurching and Searching

We entered the year with a supply deficit of approximately 700K bpd, but that number is temporarily lower thanks to refinery maintenance season. Remember crude demand originates from refineries converting crude oil into products such as gasoline, so a seasonal outage means an immediate drop in demand and crude inventory builds. End user demand for products, however, continues to grow, supported by strong GDP growth overall. In short, this is entirely normal and similar to rush hour traffic, parts of the supply chain will move in an accordion like fashion. Even with tepid refinery demand, inventories fell in H1 2018, a counter-seasonal trend when measured against the 5-year averages.

So as we emerge from refinery turnaround season demand will return. The seasonal slump will abate and the backlog will clear, allowing oil prices to resume their upswing. Early indications from June data appear to corroborate the above.

Red Herrings

The recent rise in oil prices in H1 2018 have already started raising concerns. To see them, one only needs to check President Trump’s Twitter account, in which he recently tweeted:

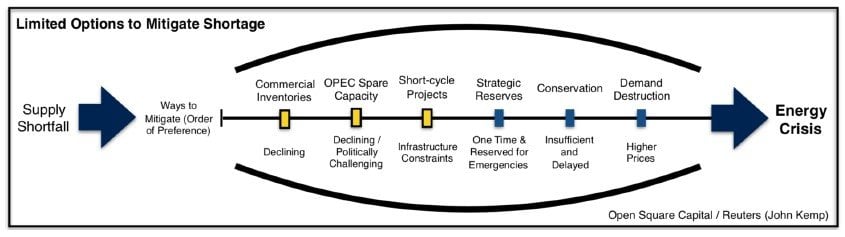

It’s not just the President, we’re at that stage of the oil cycle where a creeping shortage is becoming noticeable even for generalist investors, but most market watchers cling to the notion that help is on the way. We hate to disabuse you of that idea, but the reality is those who can’t, can’t, and those who can, won’t. As inventories tighten, the world will go through a series of stages to find an immediate salve.

First it will look to commercial inventories to serve as a buffer. As inventories run low, attention will shift to production, focusing on producers with spare capacity and short-cycle projects (i.e., shale projects that can be brought online within 6 months). We believe each option will prove insufficient and before long we’ll reach the point where lagging production leads to higher oil prices, demand destruction, and an energy crisis. We’ve already discussed commercial inventories, so let’s walk through OPEC’s production and then short-cycle projects.

OPEC+’s Vienna Waltz

As oil prices have increased, the search for reasons have followed. Thus far the consensus has settled on geopolitics as the main culprit. US sanctions on Iran, Venezuelan turmoil, and OPEC/Non-OPEC producers (“OPEC+”) manipulation now dominate the headlines; the media assuredly telling readers who’s to blame for rising fuel costs. The potential solutions offered vary, but all are equally simplistic (e.g., have OPEC+ increase production, lift bans on drilling in federal areas, or release oil from the Strategic Petroleum Reserve) and unsatisfying.

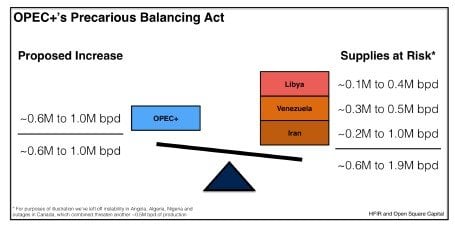

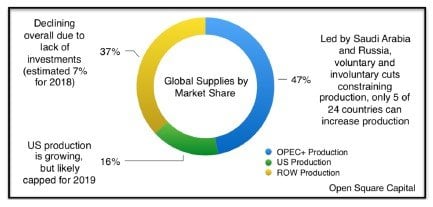

About the only thing most oil observers can agree on is who has spare capacity (i.e., who can actually increase production). The answer? Not many. IEA estimates that Russia, 2 Saudi Arabia, UAE and Kuwait are likely the only four producers that have spare capacity (around 3M bpd in total) with Russia and Saudi Arabia accounting for the large majority of that. We think the number is south of that, closer to 2M bpd given historical production figures, but either figure represents a very thin margin of safety. Recently OPEC+ agreed to make it even thinner.

On June 22/23, OPEC+ met in Vienna, Austria. This was the first of a regular bi-annual meeting for 2018, and the market was eagerly anticipating the event. As you may recall, OPEC+ had previously agreed to cut oil production by 1.8M beginning in January 2017, and have since extended those cuts to the end of 2018. As low oil prices have taken their toll, collective OPEC+ production has fallen by 2.8M bpd, 1M bpd more than what was agreed to. Much of the 1M bpd of “over compliance” was involuntary as Venezuelan decay has reduced production by ~800K bpd, and security challenges in Libya, Nigeria, and Angola have stifled production. Against this backdrop, the US also recently announced sanctions against Iran and Venezuela, which threatens to reduce production by another 0.5M to 1M bpd. So as the group gathered last week, a production increase may actually be prudent.

In the end, OPEC+ agreed to raise production by 1M bpd, effectively bringing compliance back to 100% (from the 2.8M bpd “over compliance” to the original 1.8M bpd agreed cut). Notably, this was a headline number. The reality is that apart from the four aforementioned producers, many countries are incapable of producing more oil due to years of underinvestment or deteriorating security situations. So the “real” increase will be somewhere around 600K to 700K bpd, a proverbial 0.6% drop in the world’s oil bucket.

Lost amidst all the headlines announcing the agreement is that this paltry increase effectively locks-in material draws for H2 2018 if demand stays high. At best the increase only mitigates the low-end of further anticipated declines from Libya, Venezuela, and Iran, and insures that whatever over compliance OPEC+ came into the the meeting with remains unchanged. In turn, this means that the current structural deficit also remains unaddressed. If our forecasts are correct, that deficit will soon accelerate beyond 1M bpd as we move into H2 2018.

Unfortunately for consumers, almost every oil producing country wants higher prices, so to ask them to increase production after three lean years runs counter to their vital interests. Add to this increasingly antagonistic US comments which undermined their sense of sovereignty, we can clearly see why OPEC+ producers weren’t keen to fully cooperate. For now, the nominal increase provides Saudi Arabia with political cover as it likely agreed to stabilize oil prices if the US were to impose sanctions on Iran. Saudi Arabia can now reclaim its title as a responsible producer; avoiding an price spike today, all the while crystallizing them for tomorrow.3

US Takeaway Constraints

Which brings us to our third mile-marker on our path to an energy crisis. Short-cycle projects. In our Q4 2017 letter we wrote the following:

“Today, increasing demand is almost wholly being met by US production increases. As we showed in our last letter, by the end of 2018, demand will have increased by 6.2M bpd in the last three years, which means the world will need as much oil as US shale producers can pump.”

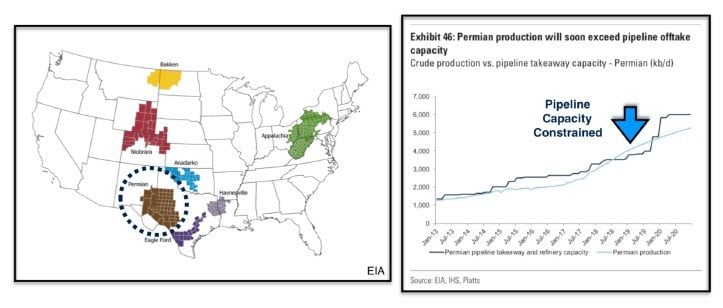

We had originally surmised that productivity challenges and a renewed focus on investor returns would restrain US producers from increasing production dramatically in 2018/2019. Thus far, it’s only partially worked as US producers have grown within cash flows, but overall production has increased markedly. The growth, however, looks increasingly capped by a new third factor, pipeline constraints.

The prolific Permian basin in Texas is singlehandedly responsible for the majority of higher US production today, but that growth has exceeded the ability of regional pipelines to transport the oil out of the basin. The lack of takeaway capacity means pipelines are filled, and the glut of oil is forced into storage tanks in the region. New pipelines won’t be available to clear the excess until later 2019. As Scott Sheffield, Chairman of Pioneer Natural Resources, one of the largest Permian producers recently stated

“We will reach capacity in the next 3 to 4 months . . . . Some companies will have to shut in production, some companies will move rigs away, and some companies will be able to continue growing because they have firm transportation.”

So unless you’ve already booked your ticket on a pipeline, consider yourself stuck. This isn’t merely an economic issue for oil producers, it’s a physical one. There are few alternatives for clearing the bottleneck, and a shortage of truck drivers and rail operators reluctant to invest in rail infrastructure when the demand is transitory means pipelines are the primary assets to move oil. Since you can’t simply cap a well and come back to it later, US producers will have to slow completions. Pipeline availability will remain challenged in the next 12-18 months, and eventually the constraint will slow shale growth, and in turn, overall growth in US/global oil production. It’s still early, but as we move into H2 2018, a key pillar for alleviating the global shortage is calling for a timeout. We’re waiting until the Q2/Q3 conference calls to determine how much production will be impacted, but needless to say, it will be material.

The Main Issue

In the end the arguments over “will they/won’t they” OPEC+ and “can it/can’t it” US shale growth are symptoms of a larger inconvenient truth. A supply shortage.

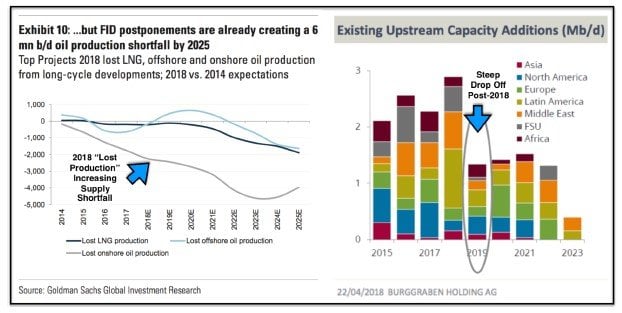

As producers shrug at the shortage in self-interest and short-cycle projects fail to produce the requisite supplies, oil inventories have steadily and unsympathetically revealed the truth. Oil supplies are insufficient to meet today’s level of demand. Even if producers were to immediately deploy capital, there would still be a multi-year lag between the spend and when oil actually enters the market.

Schlumberger recently showed that 15 regions accounting for approximately 27% of global production have decline rates that increased from 5% in 2015 to 7% in 2017. That may not sound like much, but that means older oil fields are producing 500K bpd less, and new fields have to come online to replace the lost supply. We can likely extrapolate that for the rest of the world. Excluding OPEC+ and the US, few countries can stem their declines let alone increase productions, which means overall global decline rates will continue to accelerate. In 2018, there were enough new projects coming online to keep the decline at bay, but in 2019, our shortfall will worsen because the repercussions from years of underinvestment will be increasingly visible as the absence of new developments translates to bigger draws.

The 3-5 year lag between energy investments and real world oil production means that 2019 will mark the beginning of a full blown supply shortfall. This explains in part why Mark 4 Papa, the CEO of Centennial Resource Development stated recently in a quarterly conference call

“. . . in 2018, 2019 will see a further constriction in global supply and demand even if you exclude the Iranian sanctions situation. So even at the current $70 WTI price level I see a strong possibility of further strengthening in WTI over the next couple of years . . . . and as far as the futures curve with the severe backwardation I would say it’s laughable that would be my term for it, it’s rediculous.”

As oil inventories free fall and asset prices rerate, the stark reality becomes clear. A historic inventory build followed by a historic draw will now usher in a period of historic price increase. When we embarked on our oil thesis two years ago, underinvestment in capex was always a future problem. Well guess what? 2019 is less than 6 months away. As they used to say in those old radio shows, welcome to the Future, future, future, future.

Parting Thoughts

“Establishing and maintaining an unconventional investment profile requires acceptance of uncomfortably idiosyncratic portfolios, which frequently appear downright imprudent in the eyes of conventional wisdom.” - David Swenson

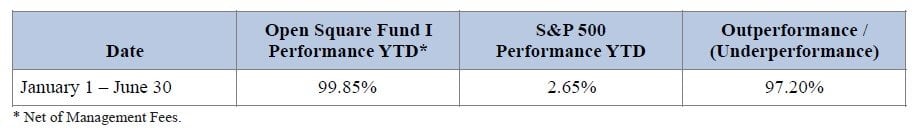

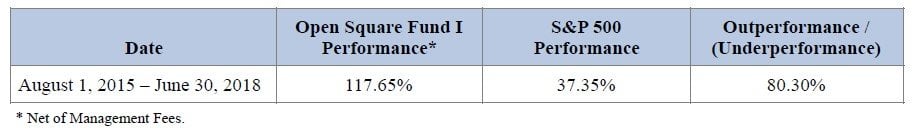

Uncomfortably idiosyncratic. It’s something we wrote about in one of our very first letter to investors and something we continue to bear in mind as we watch our oil thesis play out. When we began accumulating our energy positions a few years ago, those investments were certainly idiosyncratic as the market fully subscribed to the “lower for longer” thesis. A few years later we’d experience the uncomfortable part when the market tested our conviction and oil prices halved from $50/barrel. Yet through it all we stayed with it, and you stayed with us, and for that we are grateful and humbled. As we’re approaching the third anniversary of our fund (we started the fund on August 1, 2015), we wanted to reflect a bit on our results so far:

Although a large portion of those returns came in the second quarter, those returns were only possible because of the extensive research that preceded it. What mattered also was the patience displayed by our investor group. Even with the challenges, you’ve maintained the conviction that patience can payoff in investing, and it reminds us of something Howard Marks’, Co-Chairman of Oaktree Capital, once wrote:

“To be a successful investor, you have to have a philosophy and process you believe in and can stick to, even under pressure. Since no approach will allow you to profit from all types of opportunities or in all environments, you have to be willing to not participate in everything that goes up, only the things that fit your approach. To be a disciplined investor, you have to be able to stand by and watch as other people make money in things you passed on.”

We’ve written publicly on our website that “we believe there’s no safety in the unanimity of opinion, and that thoughtful contrarianism can lead to extraordinary returns,” and we continue to believe that. It hasn’t been easy though and it shouldn’t be, but if we’re to compound wealth with superior returns, why would it be? In the competition of ideas and returns, someone has to be on the other side of the trade, which means for us to outperform we need to think differently, act appropriately, and react judiciously.

As our energy investments gain in value, a few things to note. You can be sure that we won’t “protect the lead” to preserve our performance, meaning we will continue to take swings at the plate. We’re neither interested in performance on a short-term basis or “how we look.” If an asymmetric risk/reward opportunity presents itself, one where we have high confidence that the investment will work, your fund will almost certainly take the position even if it could detract near-term from our recent performance.

Ultimately, the returns-to-date are a direct byproduct of our core ethos, your patience, and most importantly your support. A fund and its managers cannot hope to take the path less traveled when its stakeholders fundamentally eschew that strategy. We greatly value our freedom to operate and we plan to zealously guard your trust in us by clearly communicating our strategy at all times. As always thank you for investing and please let us know if we can explain any of our ideas above in more detail.

Sincerely,

Nelson Wu

Managing Director

Open Square Capital